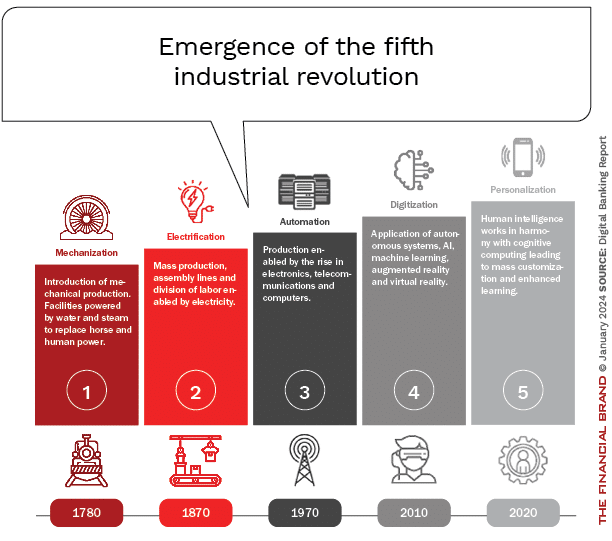

From steam engines spurring manufacturing to digital connectivity remaking commerce, previous economic revolutions shared technological catalysts and societal impacts. As retail banking stands amid the Fourth Industrial Revolution’s digital transformation, leaders now must prepare for an imminent Fifth Industrial Revolution poised to profoundly reshape markets and experiences.

Defined by extreme personalization, mass customization and precision augmentation, the emerging revolution’s exact disruptions remain somewhat undefined. Yet advancements in generative artificial intelligence, ambient interfaces and hyper-connectivity hint at consumer-in-command days ahead.

Incumbent financial institutions are mostly built on vast infrastructures to bygone eras focused on broad accessibility — not tailored personalization. Before personal preferences wholly displace generalized products and services, those banks and credit unions moving first to participatory engagement (combining human insight with synthesized AI) will gain first-mover advantage.

With non-traditional players vying more creatively for customer share of wallet using internal and external behavioral and transactional data, the banking industry should expect competition to emerge from beyond the players participating today.

As the convergence of new engagement options (glasses and wearables) reach mobile’s ubiquity over the next decade, continuous financial lifestyle augmentation will become integral. Banking as a Component (BaaC) experience serving episodic financial needs will fade against the rise of ambient money management, value assessment and decision support. Daily balances, cash flows and financial wellness opportunities will surround people and organization via persistent visuals delivered based on the customer’s choosing. Most disruptive may be that independent and instantly accessible DIY consumer financial guidance will become the norm.

More than ever, those organizations on the forefront of change will redefine revolutionary threats as opportunities through visionary collaboration with third-party providers that can deliver composable solutions. By partnering with those augmenting the fabric of finance and life itself, the most digitally mature organizations will reinvent value exchange beyond cost and experience for an intensely personalized solution.

Here are the foremost considerations for leaders readying to guide their organizations into the Fifth Industrial Revolution leveraging new AI tools and broadened data sources for an abundantly transformed banking future.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

The Years Ahead: Customers Control Their Own Connectivity

The specifics of a future where all businesses are enhanced by cognitive intelligence is still mostly undefined, but the foundation will be built around embedded interfaces, biometrically secure identity and anticipatory AI assistance. Gartner forecasts that organizations will move from building for efficiency to building for composable flexibility that is prepared for multiple futures and expanding customer expectations.

“The more these composable business ideas are integrated within your business model, the more flexibility and agility your organization will have. That means faster response time and more consistency in execution for this new type of business setup.”

— Gartner

Most of these Fifth Industrial Revolution financial applications seem unimaginable today. Imagine augmented live views layering physical surfaces like a retail store, billboard or car dealership with tailored offers based on persona identification and real-time transactional and behavioral data. Moving further, imagine a ‘digital twin agent’ seamlessly negotiating a personalized deal or pre-approved financing instantly. In this world, augmented and mixed reality interfaces, bridging physical and virtual worlds, will be able to move money experiences from transactions to value-based propositions based on where your eyes focus and engagements you have had in the past.

Advanced wearables will be able to expand the delivery of financial literacy from occasional monitoring to immersive education. For instance, financial market changes and portfolio fluctuations can be delivered with graphical surrounds providing investment recommendations instantly. Voice-based personal advisors will also be able to contextualize alerts, explaining concepts upon request and recommending helpful budget actions confidentially as you walk down the street, drive a car or when you are having lunch.

These scenarios may arrive in 3, 5 or 15 years, but all trends are moving towards consumers authoring their own interfaces through AI faster than traditional financial institutions can deliver them. Democratizing co-creation based on individual needs and terms will demand new business models, engagement redefinition, and agility that will require third-party collaboration and composable solutions.

Read more:

- Unlocking the Promise of AI for Loyalty in Banking

- Why the Power of GenAI Lies in the Augmentation, Not Automation (or Replacement), of Bankers

Four Forces of the Fifth Industrial Revolution

Underpinning the future of personal platforms within the Fifth Industrial Revolution are four interconnected technological and behavioral shifts gaining momentum in parallel:

- Generative AI — Language-focused models like ChatGPT and literally hundreds of even more advanced future releases will engage users conversationally to not just respond, but create engagement aligned with articulated preferences, contexts and modes. While there will still need to be human oversight regarding ethical concerns, the independence and articulation abilities will grow steadily more indistinguishable from our own. In short order, the value proposition of this technology will more than offset the perceived risk for many.

- Ambient Computing — Internet connectivity now extends nearly everywhere except isolated regions, but many interfaces still require smartphones as proxies. As augmented glasses and other wearables evolve, offering more user-friendly exchange of information, digital overlays onto the physical world will become commonplace through devices anticipating needs proactively.

- Quantum Infrastructure — Connecting embedded business capabilities at speed and scale — and doing so with flexibility for unique requirements and security — demands a computing architectures leveraging quantum’s exponential power for customized processing. These emerging stacks will be able to integrate market-ready innovations while allowing AI and distributed interfaces to interoperate adaptively – a ‘quantum leap’ in capabilities.

- Decentralized Identity — Establishing trusted identity that is not dependent on government documentation and that individuals can carry securely across contexts with total authority being in the hands of the individual is imperative. Distributed blockchain verification through encrypted biometrics with flexibility to adjust access to data based on a consumer’s desire is the future.

Allowing individuals to self-define experiences around their values and expression with AI co-creation, decentralized governance, and limitless infrastructure necessitates ceding institutional control while still creating mutual value.

Opportunities for Retail Banking

The centerpiece of the Fifth Industrial Revolution is a level of hyper-personalization powered by data-driven insights that has never been possible in the past. The combination of predictive insights delivered with immersive technology offers retail banking leaders three primary opportunities:

- Improved Engagement – Preventing loyalty and revenue attrition at a time of increased competition requires a consistency and cadence of usefulness demonstrating value through anticipation of needs. This mandates an engagement strategy that is defined by micro-segments in both digital and physical settings where financially impactful conversations already occur. Geo-located AI-powered banking assistants might soon prompt house hunting support for a recently married couple based on savings data, current salaries, housing features and external cost data. Or surprise rewards could spur loyalty where reward option prediction models indicate high engagement probability. These preemptive nudges support engagement during transactional ‘down times’.

- Enhanced Decision-Making – Integrating historically siloed legacy systems, relationship, and market data under singular models gives financial institutions uniquely comprehensive views. These in turn feed advanced analytics, revenue modeling and predictive personalization to enhance both operational and strategic decision making with democratized visibility across the organization. In the Fifth Industrial Revolution, virtual strategy rooms could simulate financial plan proposals with tailored visualizations responsive to executive requirement determinations.

- Innovative Offering Development – Embedding banking features where customers manage lifestyle needs positions banks and credit unions as digital money confidants through daily moments beyond transactions. Fintech and third-party co-creation can pilot new models while collaboration provides specialization at speed that no single institution can master alone today at scale.

Challenges and Threats

While the promise of the Fifth Industrial Revolution certainly excites many, such all-encompassing personalization and embedded engagement also spawns understandable skepticism, especially in an industry that is historically risk-adverse. Many question still-nascent capabilities, while consumer adoption and loyalty will definitely require real life demonstrations first. As with most innovations, legacy systems compound barriers between data sets, functions and channel experiences cultivated individually over decades without centralized orchestration.

Technical staff shortages, cultural aversion toward external partnerships in heavily regulated sectors, cybersecurity vulnerabilities from growing tech complexity, and the lack of big data governance will most certainly further delay modernization initiatives for most mid-size institutions. Finally, compliance risks around AI recommendations will emerge as guidance evolves from general to personalized. The speed at which these hurdles can be overcome will determine success and failure in the marketplace.

Preparing for the Future

Preparing for the personalization imperative that is part of the Fifth Industrial Revolution, banking and credit union leaders must focus investment on modern integrations, analytics teams and technical up-skilling, while reviewing existing business models and processes for automation opportunities. As needs emerge, specialized third-party partnerships can help bridge capability gaps faster and better than wholesale modernization with broad-based providers.

With customer centricity now an expectation and not a differentiator, the institutions that build a platform for embedding uniquely tailored financial empowerment into every environment where individuals express themselves both digitally and physically will earn relationships through relevance and value enhancement.