On the surface, the financial services industry appears to be in good shape, surviving the impact of the pandemic and moving forward with digital banking transformation initiatives. Offsetting that, an inverted yield curve, rising interest rates, high inflation and uncertainties surrounding Russia’s invasion of Ukraine threaten the industry’s stability and growth prospects. An extended downturn or recession could disrupt all sectors, including traditional banks, fintech firms, payment players and even big tech competitors.

When the economy faced headwinds in the past, the response across all industries was often to improve productivity, primarily by reducing costs. The question is whether this remains the best strategy at a time when the banking industry is in the middle of extensive digital banking transformation efforts.

During uncertain times, executives often make short-term decisions that negatively impact long-term strategy. This includes broad-based reductions in investments in technology, innovation, talent, back-office modernization, and customer experiences. With many financial institutions in the midst of major business model changes, cost cutting must be much more strategic – with some savings reinvested in areas of greatest long-term value. Below are five of the most important priorities.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

1. Double Down on Digital Banking Transformation

Financial institutions globally recognize that digital banking transformation must be an ongoing effort, impacting investments in technology, data, analytics, human resources and back-office automation. There is also the need to transform legacy culture, the structure of work, and existing business models to reflect a “new reality” in banking.

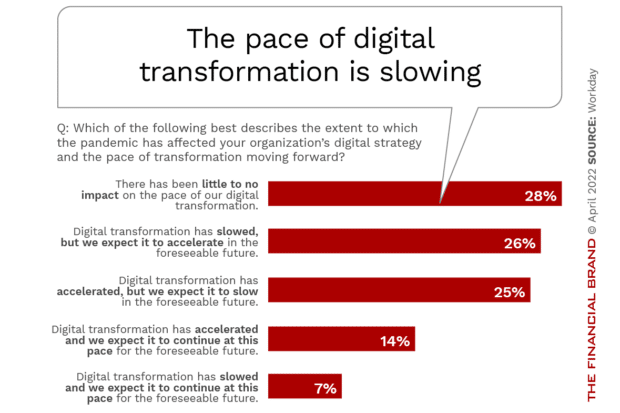

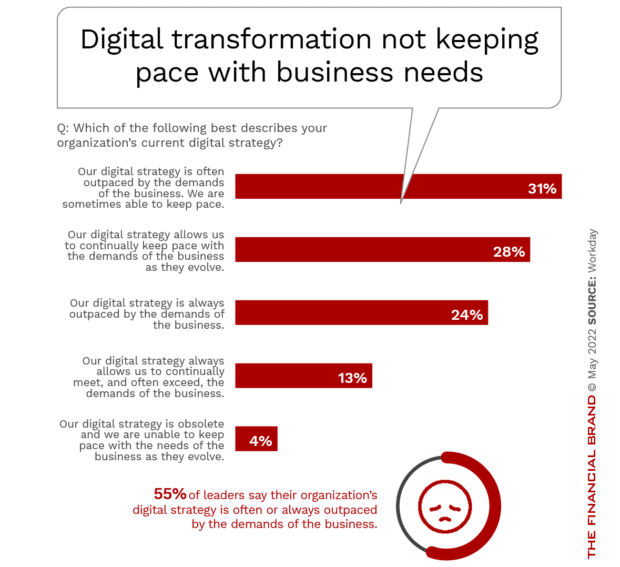

Despite this overarching need, a recent study from Workday found that digital transformation efforts are slowing compared with 2020, as leaders try to determine whether the rate of change during the pandemic is sustainable over the long-term. The research, which extended beyond financial services, found that nearly six in ten leaders (58%) said their digital transformation has already slowed or they expect it to slow in the future.

Even with the current economic downturn, this has created a widening gap between digital transformation leaders and followers. According to Workday, more than half (52%) of executives across various industries say there is a growing divide between where their business is and where it needs to be to compete.

To bridge this gap, and stop it from widening even more, organizations must take a proactive approach to the foundation of digital transformation. This includes data democratization, improved analytics, technology upgrades, back-office automation, employee re-skilling and transformation of existing cultures.

“Companies with fully accessible data are more likely to report strong transformation progress and be better equipped digitally to maintain business continuity in a crisis.”

— Workday

The ability to build digital transformation value will require financial institutions to move at a heightened speed or scale required to deliver the results companies need to see during an economic downturn. Institutions that are successful will need to identify the digital banking transformation opportunities with the highest value, and put the plans in place to implement change when other organizations are scaling back.

Read More:

- Fintechs Raise Digital Transformation Stakes, Many Banks Don’t Ante Up

- After 10 Years, Digital Transformation Still Eludes Most Banks

- Crisis as a Catalyst for Leadership, Digital Transformation & Cultural Growth

2. Increase Automation for Improved Operational Efficiency

Most back-office operations in banks and credit unions were created more than four decades ago. On top of that, initial efforts to modernize existing processes involved the digitizing of existing paper-based workflows as opposed to rethinking the back-office as needed to become a digital organization.

Improving operational efficiency is one of the best ways for financial institutions to invest now and see a payoff down the road. This is a great time to eliminate waste, use technology to automate the manual tasks that humans would typically perform, and free up capital.

Investment in robotic process automation (RPA) and other modern technologies can improve efficiency regardless of the economic conditions, delivering faster and more efficient outcomes at a lower cost than existing workflows or traditional outsourcing. In addition, reimagining back-office processes can significantly reduce errors, making the infrastructure of a bank or credit union more future-ready.

Looking forward, process automation allows employees to focus on higher value customer-centric tasks so they can deliver enhanced customer experiences. Well developed RPA systems also can provide insight into your customers’ needs and find additional opportunities for process improvement.

3. Invest in Modern Technology

Investments in modern technology may seem risky for financial institutions at a time when it’s unclear what the future economic conditions may be. But when the economic downturn reverses (and even during the downturn), customers expect your organization to be ready with innovative products and services and engaging experiences that they see from competitors and from non-financial businesses.

It may not be the best time to embark on an overarching core banking transformation, but it could be the perfect time to upgrade specific modules of your operations that can provide a near immediate return on investment. For example, technology that can improve the new account opening or loan application process often results in significant increases in new business. Any technology that can improve efficiency also has an immediate and long-term payback.

Additionally, technology tends to be less expensive during an economic downturn as many solution providers are being impacted by organizations that are scaling back tech investments. Now may be a great time to lock-in lower technology costs with improved terms for important hardware and software purchases.

Beyond technology investments, financial institutions should consider maintaining or increasing investments in R&D during this economic downturn. This may be the best route to ensure your organization is ready when consumer and business confidence rebounds.

4. Pursue Fintech Acquisitions

The financial services industry is undergoing a dramatic shift in valuations, with legacy financial institutions experiencing significantly slower growth than fintech and big tech players that are built on digital technology infrastructure. More than ever, legacy financial institutions must rethink existing business models to provide customers with new, digital-focused solutions.

“The fastest growing financial institutions in the world are all fintechs today, and increasingly they are the amongst the largest market cap companies and the largest customer base institutions also. The market is recognizing this fundamental shift towards digital first.”

— Brett King

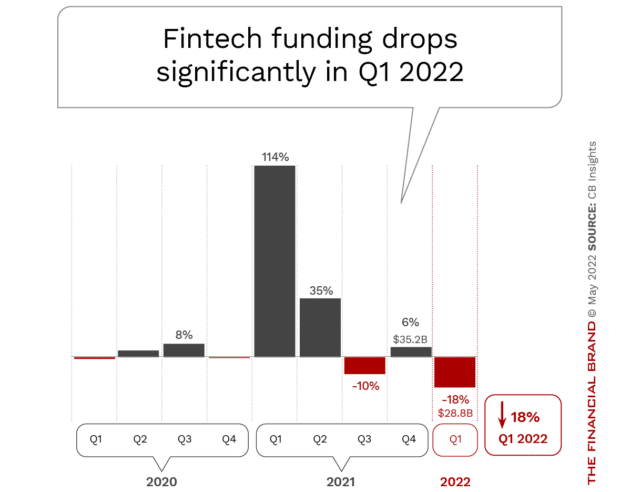

Despite the accelerated valuations of fintech firms over the past several years, the economic downturn is hitting this sector as hard as any. Investment in the sector has experienced the most significant drop in several years, there are recent announcements of mass layoffs, and some firms are embarking on significant restructuring with a heightened focus on revenue generation (as opposed to outside investment).

“An economic downtown will cause fintech firms to pull up the drawbridge and buckle in for the ride. Expect to see more focus on revenue and cost cutting, streamlining, and less geographic expansion or the addition of new products.”

— Chris Gledhill

Newer fintech companies are often especially vulnerable during an economic downturn, because most aren’t yet profitable, relying instead on venture capital investments to cover expenses while they focus on rapid growth. As consumer demand for some solutions slows, and investors become more selective, outside funding suffers.

Research firm CB Insights reports there was an 18% drop in fintech funding between the last quarter of 2021 and the first of 2022. That is the biggest percentage drop since 2018. The firm put the amount injected into the industry at $28.8 billion in Q1 2022.

As investor money dries up, fintech growth ambitions are directly impacted. For small fintech firms (or larger fintech firms that have yet to become profitable), many will need to seek alternative funding options. This could easily lead to consolidation across the industry in the form of acquisitions.

These changes in the dynamics of the fintech marketplace will provide opportunities for fintech acquisitions by larger fintech firms with available capital as well as by traditional financial institutions that want to quickly upgrade their digital capabilities. According to Cornerstone Advisors, 65% of banks and credit unions entered into at least one fintech partnership over the past three years, with 35% investing in a fintech startup.

Fintech partnerships by banks have also accelerated over the past three years. In 2019, banks that partnered with fintech firms averaged 1.3 partnerships per institution. That number grew to 2.5 partnerships in 2021. In other words, the economic downturn could create significant potential for legacy banks and credit unions to improve the speed and scale of digital innovation through fintech partnerships.

5. Upskilling, Reskilling and Strategic Hiring

According to Workday, nearly four in ten (38%) organizations across multiple industries say a lack of relevant workforce skills is their biggest barrier to achieving their digital transformation goals. The impact is that 68% of those organizations say that the pace of their digital transformation has slowed. Unfortunately, the existing talent pool for many positions is in high demand.

With labor shortages and skyrocketing labor costs, the first alternative during an economic downturn is to improve efficiency. Organizations must analyze what activities are being done and how those activities are being done, with a focus on automation and eliminating unnecessary steps. Talent upskilling activities like continuing education, skills development and cross-training must also be pursued.

The good news (for the bottom line) is that the current economic downturn could slow the rising compensation trend as many companies reduce staff and/or stop paying exorbitant salaries.

The biggest impact in financial services could be an influx of talent being released from fintech firms that aren’t getting the required outside funding to sustain an inflated cost of labor. This allows for banks and credit unions to pursue strategic hiring for high-impact positions to prepare for future growth.

Becoming Future-Ready During Economic Downturn

Financial institutions that make strategic investments during this economic downturn will emerge in a stronger position when markets normalize again. Banking leadership must determine what is needed to transform the core of the business for the future. Organizations must consider the cost of any investment, the difficulty of implementation, the potential level and timing of return on investment, the internal ability to advance the investment and the likelihood of success.

Remember, the value of any investment during a time of economic downturn is enhanced when your competition is standing still or retreating.