For the seventh consecutive year, we have surveyed a panel of over 100 global financial services leaders for their thoughts on retail banking and credit union trends and predictions. The crowdsource panel includes bankers, credit union executives, industry analysts, advisors, authors and fintech followers from Asia, Africa, North America, South and Central America, Europe, the Middle East and Australia.

We used the findings from our panel as the foundation to develop a global survey of executives involved in the financial services industry which provided a prioritization of our trends. Our global survey also provided an opportunity to do an end-of-year review of last year’s projections. Finally, the survey collected insight into strategic priorities for 2018 and the fintech players that the industry believes will have the greatest impact in the upcoming year.

By collecting insights from leading influencers, ranking the trends using an industry survey, and including extensive analysis around each trend, we have developed the most comprehensive annual trend report in the banking industry. For the third consecutive year, the research, analysis and Digital Banking Report entitled, 2018 Retail Banking Trends and Predictions, are sponsored by Kony, Inc..

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Top 10 Retail Banking Trends for 2018

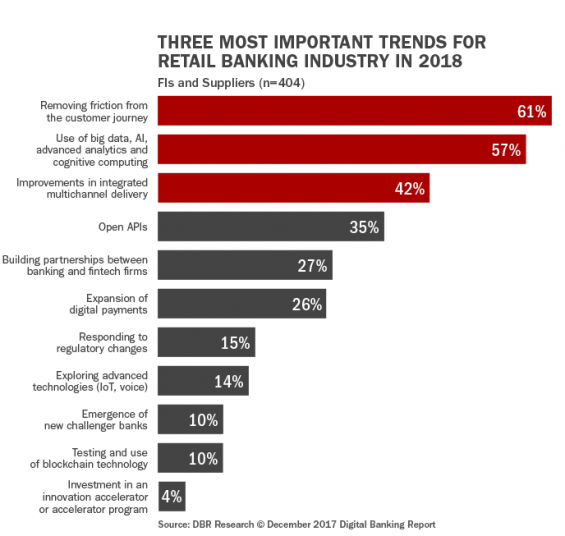

The ranking of the top 10 trends and predictions was done by providing a list of trends identified by our crowdsourced panel and asking banks, credit unions and the supplier community globally to provide their top 3 predictions for 2018. Of the organizations that provided their top 3 trends, the highest ranking prediction was that the industry was going to remove friction from the customer journey (61%). The next two most mentioned trends were the improved use of data and advanced analytics, and refinements in multichannel delivery (mentioned by 57% and 42% respectively).

Interestingly, with the exception of one trend (testing and use of blockchain technology), the trends and order of these trends were the same as last year. Last year’s trend of investment in innovation did not make the top 10 this year. The importance and underlying components of each trend differed in this year’s research compared to the predictions for 2017.

The fact that the list of trends identified by the financial services industry has remained relatively consistent could be a symptom of a greater problem. The banking industry is moving much too slow, and legacy firms are failing to differentiate themselves. According to Forrester, “In a market where one-third of all customers say ‘all banks are basically the same,’ it would make sense for executives and their teams to obsess over how to differentiate. Unfortunately, 2018 will look more like a digital arms race between warring incumbents than a year in which firms find new ways to specialize and create value for customers.”

Regarding changes in emphasis for this year’s trends, removing friction from the customer journey increased in importance from last year, with 61% of organizations placing this trend in the top three, compared to 54% last year. The trend around the use and application of data also increased in importance from last year, with 57% of those surveyed placing this in the top 3 for 2018, compared to 53% in predictions for 2017. Other notable shifts of importance included a greater belief that open banking APIs would be important, less emphasis on regulatory changes and a greater belief that advanced technology would have an impact in 2018.

Get the 2018 Retail Banking Trends Report

Top 10 Strategic Priorities for 2018

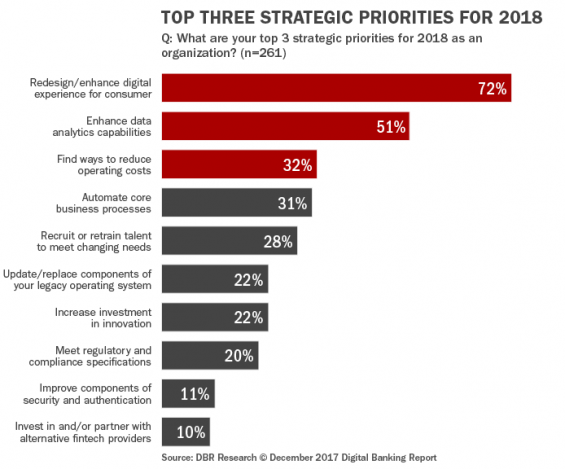

When we asked financial services organizations worldwide about their top three strategic priorities for 2018, there was a significant change in priorities compared to last year’s research. While the order of the top three priorities remained the same as last year, the priority of reducing operating costs dropped from 41% last year to only 32% for 2018. At the same time, the priority of investment in innovation dropped from the 4th position to 7th, with the number of firms mentioning innovation falling from 26% to 22%.

The biggest jumps in strategic priority in 2018 were seen with the emphasis on automating core business processes (up 13%) and recruiting talent (up 8%). These shifts illustrate the growing importance of becoming a digital bank and the impact of this transformation on the types of employees required to address new challenges.

Here is what some of our crowdsource panel had to say about 2018.

“2018 will see developments across the banking industry, including a more mature application of fintech solutions, greater use of digital payments, the opening up of banking thanks to API built architectures, the first significant progress with blockchain technology, and the harnessing of AI and RPA solutions. These changes will all occur as global tech giants (including those from China) change the financial services battleground.”

– Roberto Ferrari, Chief Digital and Innovation Officer at Mediobanca Group

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations. Read More about Navigating the Role of AI in Financial Institutions Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind. Read More about The Financial Brand Forum Kicks Off May 20th

Navigating the Role of AI in Financial Institutions

The Financial Brand Forum Kicks Off May 20th

“Financial institutions have spent the last few years painting the vision of what it means to be a digital bank. In 2018, we’ll see a significant shift from optimization streamlining and automation – to creating new revenue streams. This revenue may come from new business models or simply new products and services, but it signals a recognition that simply doing the same things better is no longer enough.”

– Nicole Sturgill, Principal Executive Advisor at CEB now Gartner

“Investing in new skill sets will be critical. The digital talent gap is only widening and organizations that can’t keep pace will be crippled by it. Now more than ever, the right talent is truly a competitive advantage.”

– Danielle Guzman, Global Head of Social Media and Distributed Content at Mercer

“2018 will see a radical change in how traditional financial institutions approach digital transformation. The Chief Digital Officer concept will be replaced as companies seek to embed digital transformation for both customer value proposition and business model transformation into the roles and expectations for every job in the organization and every initiative undertaken. Digital management, much like risk management in recent years, will become everyone¹s job. This will launch a wave of transformation, especially in traditional banking.”

– Mary Beth Sullivan, Managing Partner of Capital Performance Group

“2018 will be an amazing year in banking. The debate on cryptocurrencies will rage on, with jurisdictions legalizing and defining ICO token issuance and definitions around cryptocurrency use. Regulators will increasingly compete for dollars, talent and fintech innovation through more open banking and fintech licensing provisions, putting markets like the US further behind the eight ball on basic capabilities like payments and challenger models. Blockchain POCs will move to implementation, neobanks will start to go global, and global technology experiences surfacing bank and credit utility will start to emerge that undermine traditional charters.”

– Brett King, CEO and Founder of Moven and author of Bank 4.0

Regarding the use of an industry leading group of financial services industry influencers, Jay Palter, Chief Engagement Officer at Jay Palter Social Advisory, said:

“As technological innovation accelerates and financial systems globalize, social networks (such as LinkedIn, Twitter and Facebook) have emerged as indispensable and efficient tools for following key developments and insights from thought leaders. Knowing who you need to follow and pay attention to online is more important than ever.”

1. Removing Friction from the Customer Journey

While the banking industry has talked about ‘customer-centricity’ and ‘improving the customer experience’ for decades, most organizations have had difficulty breaking down product silos or leveraging internal data to deliver a contextual digital experience. “Long-term sustainable growth in the banking industry seems only possible with a radical departure from a sales- and product-obsessed mindset to one of genuine customer centricity, and further rationalization of strategies to target the right markets, customer segments, and solutions,” states Deloitte.

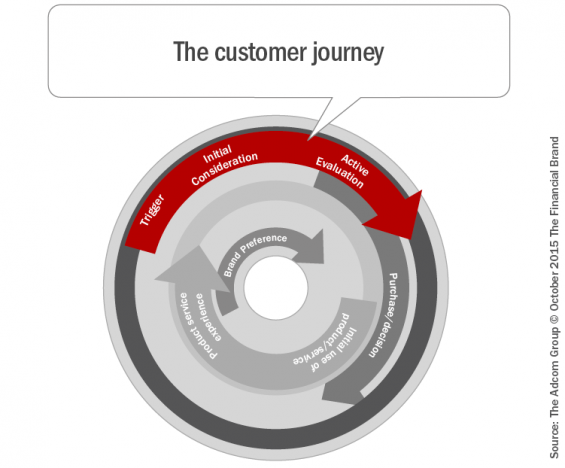

According to the 85-page report, Improving the Customer Experience in Banking, the objective of delivering a positive customer experience has become secondary to other bank priorities, resulting in a transactional banking relationship for the customer. For financial organizations to change this dynamic, and meet the evolving needs of today’s customers, there are five areas that have emerged as crucial priorities:

- Move focus of digital engagement from cost reduction to experience enhancement.

- Leverage advanced analytics, machine learning and contextual engagement to provide a highly personalized experience.

- Allow the consumer to engage with their bank on the channels they prefer at the times they want to engage.

- Transition advisory and sales activities from being reactive to being proactive.

- Engage end-to-end throughout the customer journey, from shopping to account opening, to onboarding and through relationship expansion.

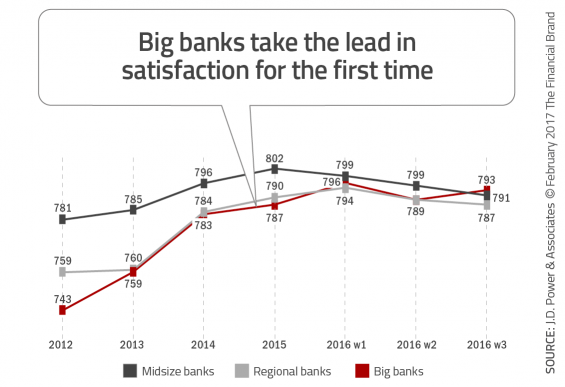

A positive customer experience is channel sensitive, with customers placing a higher weight on digital customer experiences more than physical or call center channels. In fact, in a recent J.D. Power, survey, the largest banking organizations improved in overall customer satisfaction, while midsize banks declined and regional banks plateaued. This was attributed primarily to improved mobile and online satisfaction.

As the banking industry responds to the “Age of the Individual”, big data and advanced analytics will define the winners from the losers. It is critical for banks and credit unions to deliver on the personalization promise to win the battle of having the best customer experience.

How customer insight is used can make a big difference to the customer experience – and ultimately to the profitability of the organization. The right information, analyzed in the right way, can ensure that the financial institution can provide the right offer at the right time – along with a seamless service at a lower cost. And that has to be good for everyone involved.

“Financial companies need to introduce experiences that are more like Tinder and Instagram rather than the traditional services they provide today. It’s not just digital innovation or transformation, where banks can compete for the future, it’s also about re-inventing dated policies, processes and products for new and more discerning generations of connected consumers. UX design strategies and principles and human-centered design belongs in the C-Suite now more than ever.”

– Brian Solis, Principal Analyst and Futurist at Altimeter Group, a Prophet company

“Most forward-looking banks have realized that a purely customer-oriented experience will never enable a really defensible differentiation towards competitors. Huge customer-driven programs have helped provide “error-free” transactional experiences to their customers, but this isn’t enough. Organizations must activate structured top-down initiatives to detail the brand promise across every touchpoint and front-line behavior, with the final goal to create a deep and durable alignment with the human side of their customers – moving from ‘customer experience’ to ‘human experience’.”

– Ambrogio Terrizzano, European Financial Services Lead at Accenture

“We are about to tear down product silos that confuse customers and get focused on being relevant, convenient and frictionless. Our new go-to-market will be driven by attention and engagement. The winners will be the most efficient at manufacturing and the most effective at engaging. Ecosystems will win beyond single individual providers.”

– Nigel Walsh, Partner at Deloitte UK

“Human first: The core of banking and insurance is social – not the abundant technology but understanding human behavior and decision making will be relevant to differentiate and design a superior value proposition.”

– Andreas Staub, Managing Partner at Fehr Advice

“2018 will bring more capabilities for shifting more control of one’s finances from banks, merchants, or processors to the end-user. These highly intuitive, trust-creating controls will ultimately drive higher spend, loyalty, and trust, with lower misuse.”

– Jim Van Dyke, Founder and CEO of Futurion.Digital

“The banks that have done the hard work of changing their internal culture in order to welcome and foster change and elevate the experience will retain the relationship with the consumer and will compete successfully with new entrants whether they are new challenger banks or the big tech firms (GAFA).”

– Duena Blomstrom, Chief Growth Officer, Marketplace at Temenos

“The great opportunity of 2018 will be to align cross-functional teams around an early stage adaptive and collaborative process (using agile and scrum road mapping). To move rapidly from a myopic operational and technology focus to working from the ‘outside-in’, letting targeted customer segments/persona needs, pain points and lifestyle triggers guide and inform strategy, experience design and personalized content and tailored new products.”

– Mark Weber, CEO of Weber Marketing Group

“Mobile will be at the center of the customer experience in 2018. Voice banking will become more prevalent, especially for customers of larger banks, while smaller community banks will continue to work to catch up, adding more mobile banking options that remove friction and improve functionality.”

– Lori Philo Cook, Owner of InnovoMarketing

“2018 will be the year of bringing human connection to the forefront of the customer experience. Whether through digital, voice or face to face, financial services firms will improve on the delivery of the most fundamental of human needs: to connect with customers, let them know they have been heard, acknowledged and understood.”

– Joe Sullivan, CEO of Market Insights, Inc.

“Mobile banking will continue to accelerate past standard banking in customer preference as their digital, user, and customer experiences become more enriched and data-informed. This will include consumer-to-business frictionless digital banking, consumer-to-consumer one-click payments, new cryptocurrency opportunities, password-free biometrics, locational services and offers, and conversational interfaces.”

– Kirk D. Borne, Principal Data Scientist and Executive Advisor at Booz Allen Hamilton

“Banks will increase experimentation with chatbots and interactive assistants to find ways to interact with customers in a more meaningful way and to provide a better customer experience. The focus will shift to evolving these experiences by integrating more sophisticated data to gain insight, using machine learning to understand and predict what a customer may need, and deploying bots that can help their agents do their jobs better.”

– Tiffani Montez, Senior Analyst at Aite Group