Based on the sales results of the past 18 months, there appears to be an almost insatiable appetite for voice devices by consumers. The demand and utilization of these digital assistants, coupled with the significant advancements in the underlying technology, indicate that voice-first devices are on the cusp of transforming commerce and marketing in virtually every industry.

According to a recent study from CapGemini, “Voice assistants such as Google Assistant, Amazon’s Alexa, and Apple’s Siri, will revolutionize how consumers and brands interact in ways not witnessed since the dawn of e-Commerce. It is so much more than a new interface or an additional channel in an omni-channel world. It promises to be a curator of services and experiences that intelligently meet needs and engage consumers emotionally—anytime, anywhere.”

In fact, the research states that within 3 years 40% of consumers will use voice assistants rather than a website or app (compared to 24% today), and 31% will use a voice device instead of visiting a store or a branch (compared to 20% today). There is little doubt that voice-first devices will enable a new way to build and extend relationships. The question is whether marketers are prepared for this massive shift in how consumers interact with brands and how they want brands to interact with them?

Voice commerce (whether with a standalone device like an Amazon Echo or an integrated application like Siri) will allow marketers to extend relationships beyond a single device or a specific branch location. More importantly, each interaction will be based on dialogue that will create insight that can be used to develop highly personalized contextual engagement, building trust and loyalty.

What is unique about digital voice assistants is that the consumer is already embracing the potential of voice. They are buying devices and embracing voice interaction before most organizations have built the functionalities into their product delivery and marketing. As more devices and ‘skills’ are introduced for the home and within mobile devices, the demand and consumer expectation will only grow.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

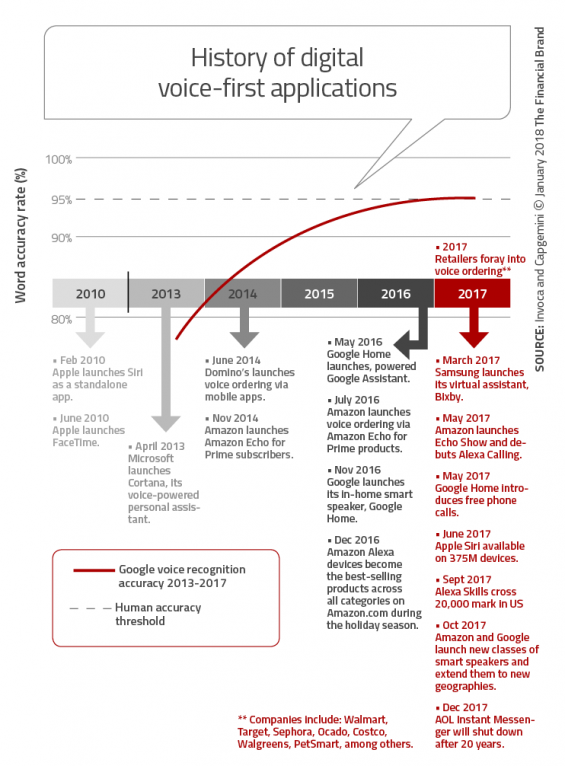

Why the Surge in Voice Technology?

One of the primary reasons consumers prefer voice to other forms of communications is that it is easier. According to Invoca, people generally can speak about 125-175 words per minute while most people can only type a little less than 40 words a minute (on a keyboard). With the accuracy of voice devices approaching the threshold desired by humans, it is no wonder why voice devices were center stage at CES 2018. According to a study by Invoca, the voice opportunity will see an annual growth rate close to 20% and be worth $18 billion by 2023.

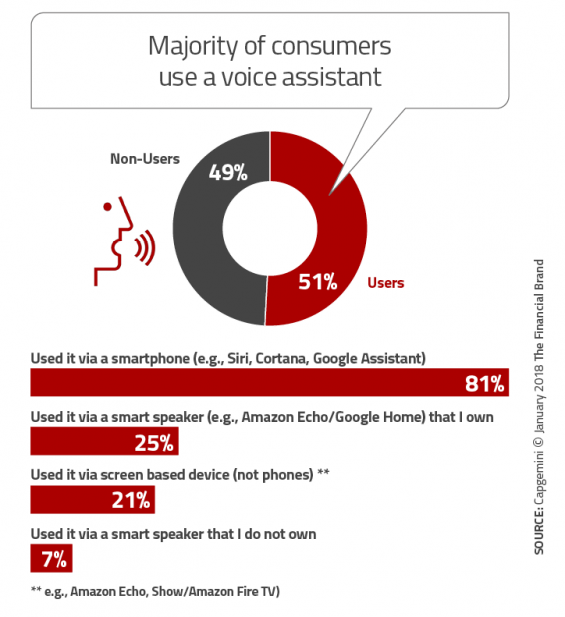

Voice engagement in not new. According to CapGemini, a majority of consumers (51%) are already users of voice assistants, and interacting with voice assistants via smartphones (81%) is the dominant mode of use. Twenty-one percent of consumers have been using voice assistants from devices other than phones or smart speakers (such as an Amazon Show or voice activated TV device).

CapGemini found that consumers who use voice assistants like their experience. It doesn’t matter what a digital assistant is used for, consumers like the interaction … from making payments to buying groceries. According to CapGemini, 71% of users are satisfied, with smartphone voice interactions scoring highest.

CapGemini found that consumers who use voice assistants like their experience. It doesn’t matter what a digital assistant is used for, consumers like the interaction … from making payments to buying groceries. According to CapGemini, 71% of users are satisfied, with smartphone voice interactions scoring highest.

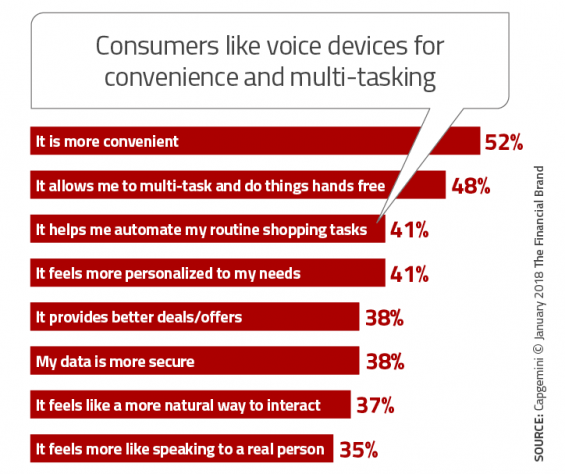

The major reasons why consumers like voice devices is because of the convenience (52%) and the ability to engage hands-free (48%). Many of the CapGemini respondents also said that a voice assistant helped them with routine tasks (41%). Consumers even preferred voice assistants over human interactions because they believed voice devices were faster (49%).

Read More:

- 5 Essential Tips For Building a Voice-First Strategy

- Should You Build Your Own Branded Voice Banking Solution?

- Voice Payments Emerge as Tech Giants Compete for Voice-First Commerce

Impact for Marketers: Unlike many new technologies where there may be a solution developed before consumers think they have a problem (digital payments and mobile wallets), voice digital assistants are being accepted by consumers who are looking for more ways to use their device. There are even those who prefer digital voice interactions over the human alternative. “If you build it, they will come.”

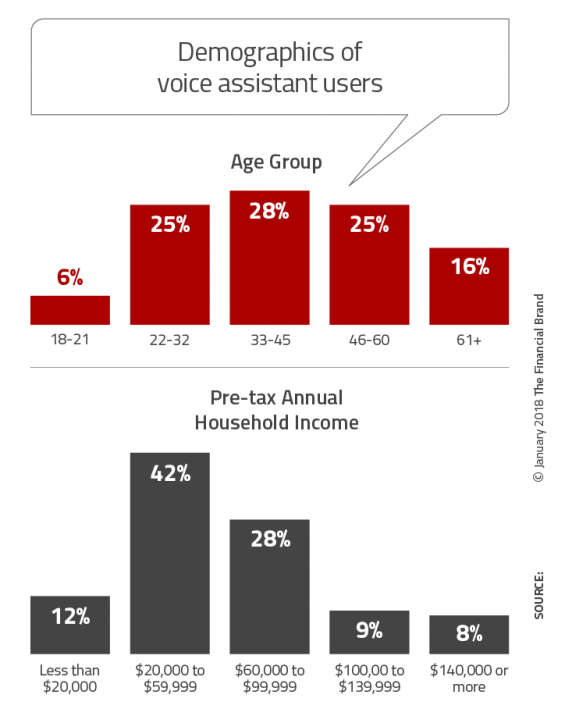

Who are Voice Device Users?

Unlike most new digital technologies, users of digital voice assistants are not dominated by younger and more affluent consumers. Potentially attributed to the very reasonable cost of standalone voice assistants, the integration into mobile devices and the ease of use, consumers from 33-45 are the highest user segment. In addition, households with pre-tax income of $20K – $60K are the highest users of voice assistants.

Impact for Marketers: From an age perspective, the strongest user groups of digital voice assistants correlate with the highest consuming consumer groups. While the income categories of users are a bit lower than many other digital technologies, this reflects the low cost of devices. Close to one-in-five users have incomes higher than $100K however.

Impact for Marketers: From an age perspective, the strongest user groups of digital voice assistants correlate with the highest consuming consumer groups. While the income categories of users are a bit lower than many other digital technologies, this reflects the low cost of devices. Close to one-in-five users have incomes higher than $100K however.

Voice Device Use: Becoming More Complex and More Frequent

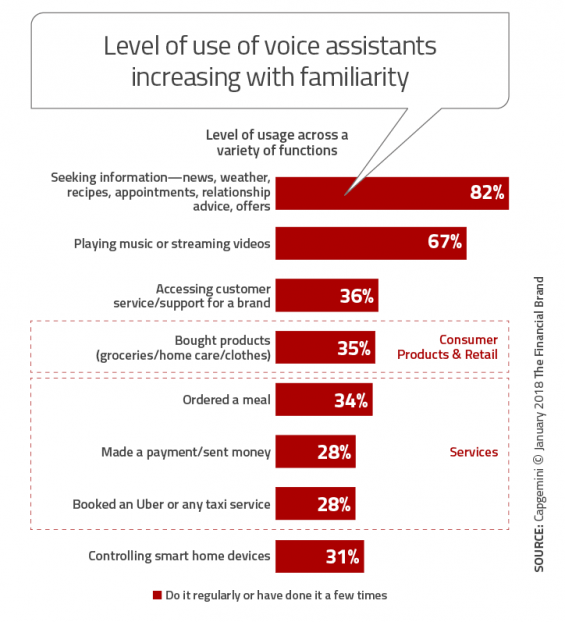

There are few people who have not said the words, “Hey Siri”, “OK Google”, or “Alexa”. While initially these prompts would be followed by a request for information such as news, weather, etc., it is becoming increasingly more commonplace to use digital voice assistants for initiating customer support, making purchases, ordering a meal, arranging transportation, or even doing banking.

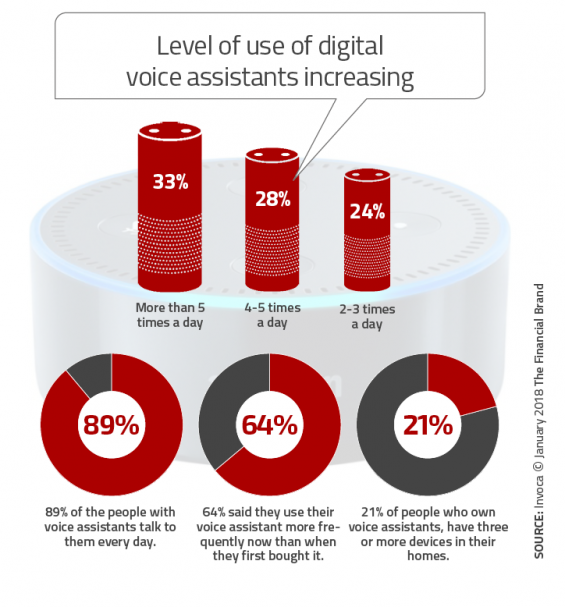

Beyond using voice devices for more complex tasks, consumers who own voice devices are using them more frequently. For those consumers who own a voice device, almost 9 in 10 use them daily, with 33% of users interacting more than 5 times a day with their device.

Beyond using voice devices for more complex tasks, consumers who own voice devices are using them more frequently. For those consumers who own a voice device, almost 9 in 10 use them daily, with 33% of users interacting more than 5 times a day with their device.

Use also increases the longer a consumer owns a device, according to Invoca. Almost two-thirds of voice device owners said they use their device more than they did when they first got the device. Interestingly, one-fifth of device owners own three or more devices.

In other words, those who have a voice-first device like the interaction, and are increasing the ways they use them. They are speaking more and clicking less.

Impact for Marketers: It is clear that, in the case of digital assistants, familiarity leads to higher levels of engagement. This is good news for developers of voice solutions. When new functionality is introduced to the marketplace, a very large segment of the population will be ready. Marketers will not need to educate consumers on how the technology is used … they will be there waiting for your application.

Impact for Marketers: It is clear that, in the case of digital assistants, familiarity leads to higher levels of engagement. This is good news for developers of voice solutions. When new functionality is introduced to the marketplace, a very large segment of the population will be ready. Marketers will not need to educate consumers on how the technology is used … they will be there waiting for your application.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Concerns of Non-Users … Desires of Users

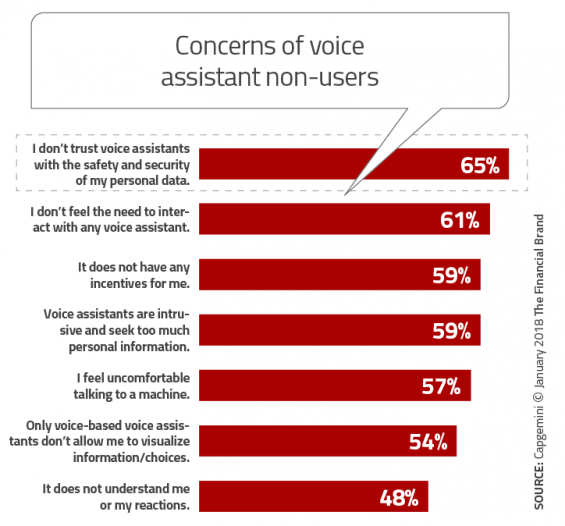

Despite the influx of devices and advancements in digital voice technology, not everyone prefers to use a digital assistant. Not surprisingly, security of personal data is a significant concern of consumers who do not use a device (65%). This finding is consistent with the challenges is use of other digital technologies. The fact that digital assistants are ‘always listening’ does not help with this concern.

As with mobile payments in the banking and commerce world, not every consumer believes that there is enough value with digital voice solutions. In other words, the ‘status quo’ is just fine for some. Since the voice-first revolution is still in a rather embryonic state, the value proposition will soon arrive as more companies develop new and exciting voice solutions.

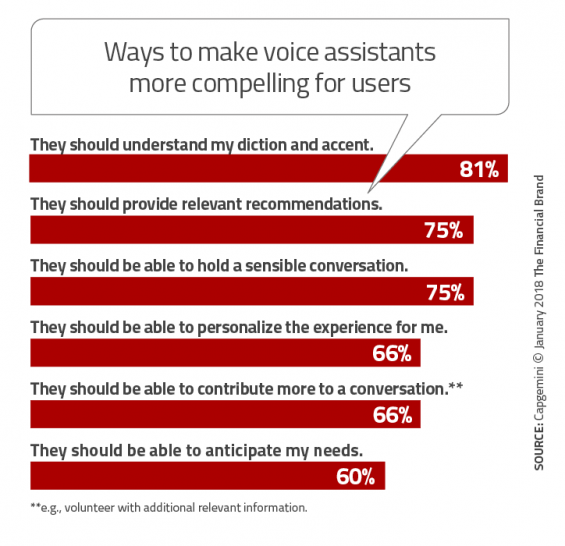

Understanding what current users would like to see in the future is a good way to plan for both increased usage and converting non-users. Beyond being cognizant of the reasons why non-users don’t find digital devices appealing, users told CapGemini that they would like the integration of AI and machine learning to enable relevant voice recommendations (75%) and personalized experiences (66%). There is also the desire for more human conversations.

Impact for Marketers: As organizations develop voice-first solutions, it will be important to plan for tomorrow as opposed to reacting to today. This includes building biomentric security into the use of the device, increasing the value proposition around voice solutions and integrating advanced analytics into the delivery of voice-first products and services. Marketers have an obligation to lobby for voice solutions that maintain ease of use, while adding advanced functionality, personalization and contextual recommendations.

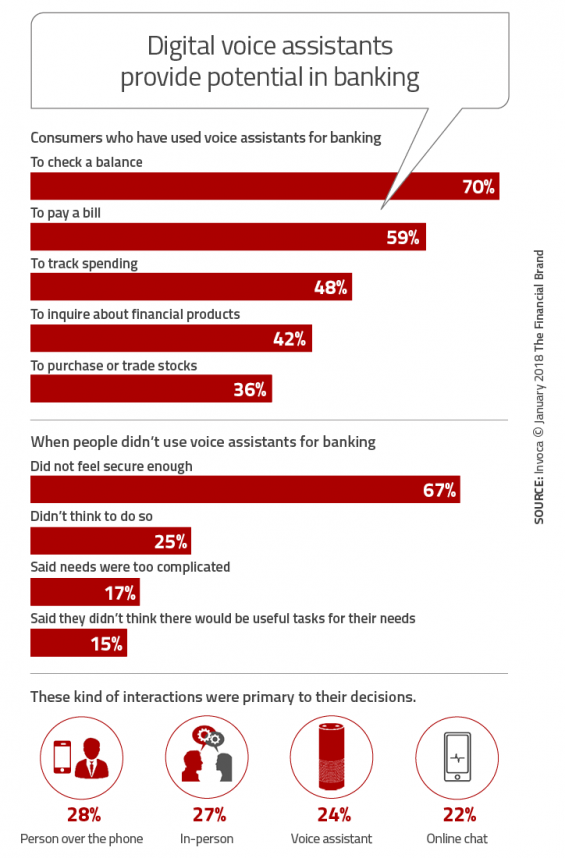

Voice-First Banking

CapGemini found that 28% of users have already used a voice assistant to make a payment or send money, and that interest in this voice banking is increasing (44% expressed an interest in using voice assistants for bank transactions in the future). While the sample of users of voice banking is still rather small (especially with devices like Echo and Google Home), a large number of banking organizations plan to introduce voice capabilities in the near future.

As with the overall voice device marketplace, the use of digital assistants for banking is focused on basic banking interactions (checking a balance, paying a bill, tracking spending, etc.) with security of information being the primary reason for not using a voice device for banking.

Impact for Marketers: Financial marketers will need to continue to move consumers along the acceptance curve, from basic interactions to more complex engagement. The key will be the introduction of advisory solutions that can proactively engage with a consumer, helping them to make the right financial decisions. The acceptance curve will most likely mirror the ability for a financial institution to apply advanced analytics and personalized solutions in a voice environment. The benefit of these interactions will be the ability to sell additional services with a voice device. This is the ROI component of voice banking.

The Power of Voice-First Marketing

The voice-first revolution could change the dynamics (and results) from marketing dramatically. As consumers move from one channel to another, voice devices can monitor this movement and provide recommendations by voice (instead of email or other less engaging channels).

Voice devices will have the ability to assist in opening new accounts, guiding a prospect through all of the steps and answering questions. Voice devices could also be the ultimate retargeting device when a prospect disengages from a potential purchase. The immediacy and scalability of re-engagement could be invaluable.

Probably the greatest potential for voice-first engagement is the ability to mine conversations, in real time to deliver improved solutions. According to Invoca, “New technology can identify language patterns associated with specific intents and outcomes. Marketers can use these insights to optimize their digital investments, improve offline conversations, increase ad spend efficiency and drive revenue.”

The time to build a voice strategy is NOW.