Research reveals that most banking providers will be using automated chatbots to handle a significant volume of customer conversations in the near future. Some are doing it already. Powered by chatbots, conversational commerce (Voice-First Banking) allows organizations to interact with customers over digital and messaging platforms, providing answers to questions, advice and offers in real-time.

A survey conducted by Personetics shows that over three quarters of financial institution respondents view chatbots as a viable commercial solution now or within the next 1-2 years, and almost half of the companies already have active chatbot projects in place. A majority of the respondents see a substantial share of customer conversations handled by bots within 3-5 years.

Chatbots are becoming more useful on a daily basis and are able to serve millions of customers 24/7 — a perfect fit for companies that want to deliver instant customer service while cutting costs. Bots can run on popular messaging platforms, with over 33,000 bots running in Facebook Messenger already.

“Banks and insurers are always keen to reduce costs whilst improving the customer experience. AI, and in particular, conversational commerce is a natural next step in that journey,” said Warren Mead, Global Co-Lead of Fintech, KPMG. “There is a strong incentive for businesses to enable such conversations across all digital channels, including existing mobile apps and web portals as well as highly popular messaging platforms such as Facebook Messenger, WhatsApp, and others.”

Making Chatbots Part of an Omnichannel Strategy

There was a great deal of buzz about chatbots in 2016, with players such as Facebook, Microsoft, Google, and Apple making news as they opened up their platforms for third party developers. According the the white paper by Personetics entitled, “How Chatbots Fit Into Your Omnichannel Strategy,” the rise of the bot was fueled by two key trends:

- App fatigue started setting in, where close to a quarter of downloaded apps were abandoned after just one use. Research shows that most users have just a few applications they use on a regular basis. These are usually the applications that save time or money (or both) and make life easier.

- Instant messaging apps took off exponentially, with the number of people installing messaging capabilities increasing at the same time that the amount of time spent on messaging apps also increased to hundreds of hours a week for the biggest users.

One of the primary benefits of chatbots is that there is no reason to download a new app for every service. A customer can chat with their friends, order food, get a ride with Uber, and transfer money, all without leaving their favorite messaging app.

Chatbots are also conversational, so a customer doesn’t have to learn a new interface or navigate hidden menus. The benefits of chatbots will increase as use of messaging apps increases and use of traditional apps go down.

“The true test for conversational commerce is in the ability to solve real problems and guide customers through meaningful and sometimes complex commercial and financial activities,” said David Sosna, Co-founder and CEO of Personetics. “Doing that requires the ability to analyze individual customer behavior and provide intelligent assistance that is truly personalized.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Financial Institutions Ready to Commit to Chatbots

The challenges and missteps suffered by early players in the chatbot space is not stopping banks and other financial institutions from moving forward with their plans to launch AI-powered bots according to research from Personetics. The results from a global survey of banks, credit unions and other financial institutions found that there is a groundswell of activity around chatbots, with the energy not expected to slow any time soon.

When asked about the overarching view of the state of chatbots in financial services today, 14.5% of the organizations surveyed said that chatbots are ‘Ready for primetime.” with 62% of those surveyed saying, “It’s an exciting opportunity that will become a reality in the next 1-2 years.” Only 2.5% said chatbots were all hype and will eventually die out.”

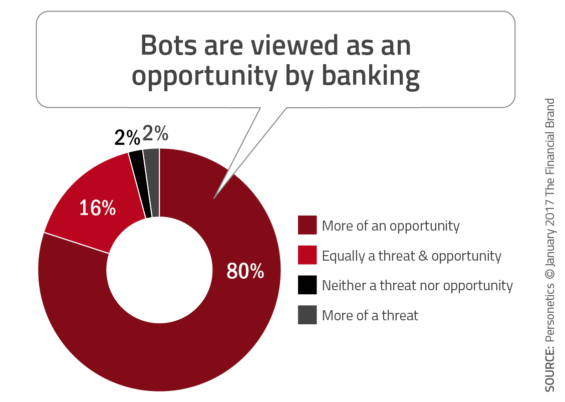

According to the research, 80% of financial institutions globally view chatbots as an opportunity. Only 16% view chatbots as both a threat and opportunity, with only 2% believing chatbots to be a threat.

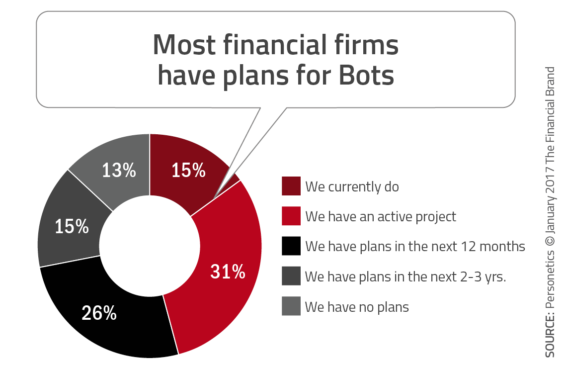

When asked whether financial firms had immediate plans for bots within their organization, 46% of organizations are either already using bots (15%) or have an active project in place (31%). While projections of any implementation are far from accurate, another 26% stated they have plans for bots in the next 12 months, with an additional 15% stating they have plans for the next 2-3 years.

Showing the level of commitment to the concept of chatbots, only 13% of financial services organizations surveyed said that they had no plans for chatbots at this time.

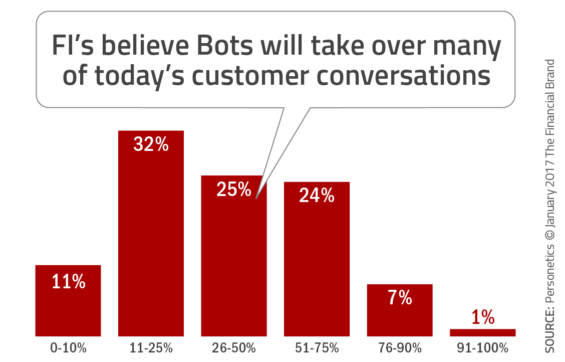

When asked what percentage of conversations would be handled by chatbots over the next 3-5 years, 34% of the organizations surveyed believe that over 50% of conversations would be handled by bots. Close to 60% believed that over 25% of all customer conversations would be handled by bots in the moderate future. While guessing the future in today’s dynamic and quickly moving environment is difficult at best, obviously the financial services industry believes that the use of bots will be an important component of tomorrow’s omnichannel strategy.

When organizations were asked about the role they expected chatbots to play in the future, the organizations surveyed were the most bullish on the ability for this technology to improve customer service (8.54 on a scale of 10 with a higher score indicating greater degrees of agreement). Interestingly, the ‘ability to engage Millennials’ was the second highest scoring purpose (8.12/10) with chatbots as a content distribution channel ranking 7.55 on the 10 point agreement scale. he potential for bots to completely replace apps only received a score of 6.08.

Chatbot Integration Requires Preparation

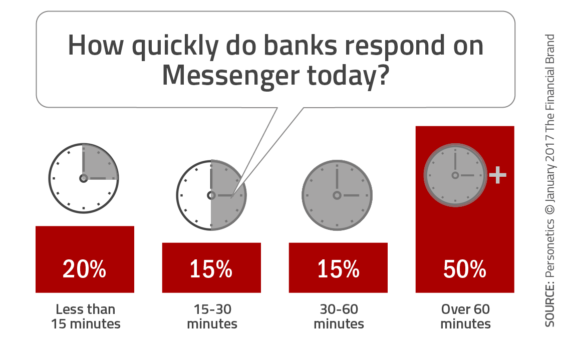

As attractive as chatbots may be for consumers, there is a significant risk of a bad customer experience if chatbots become another disconnected channel within the bank or credit union. “Customers that are currently attempting to communicate with their bank through Facebook Messenger all too often encounter responses that fall short of basic expectations,” states David Sosna. “Response time is less than adequate for many, and the quality of responses leaves a lot to be desired.”

In fact, research shows that the responsiveness on Facebook Messenger is far from satisfactory. With less than 20% of Messenger responses being in less than 15 minutes, and over 50% of responses being over an hour (if at all), the financial services industry has a LONG way to go.

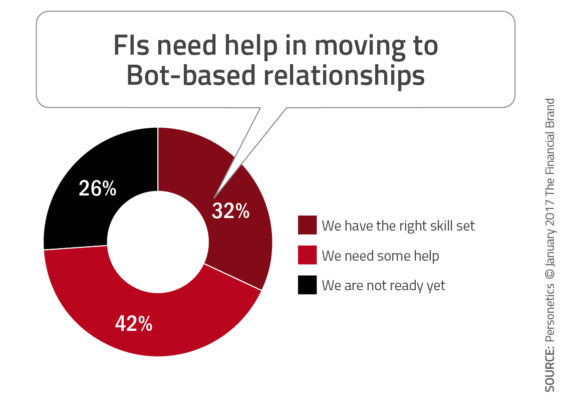

To help address this apparent shortfall when it comes to implementing a chatbot strategy close to half (42%) of organizations believe they will need outside help to move forward with chatbots. And while 32% believe they have the right skill set internally already, 26% are just not ready.

8 Requirements of Intelligent Bots

While bots are new and will take time to mature, there are several 8 requirements they should be able to do in order to improve the customer experience, according to the white paper ‘8 Things Your Bot Should Do to Make Customers Smile‘ from Personetics.

1. Carry an Intelligent Conversation. Natural Language Processing (NLP) is one of the coolest technologies being tested in the marketplace today. Done well, the bot will be able to maintain the context of a conversation as opposed to being limited to simple, disconnected requests. The bot should also be able to process an unexpected reply and adapt to changes in the course of the conversation. For financial services, we’re not there yet, but the technology is advancing very fast.

2. Build Contextual Engagement. A smart bot can understand each individual customer’s financial situation, including current account holdings, recent and projected behaviors, etc. in order to provide advice and offers that are personalized in real time. This moves the conversation from a ‘financial rear-view mirror’ perspective to a ‘financial GPS’ perspective.

3. Leveraging Real-Time Transaction Data. Connected with the need for contextual engagement, an intelligent bot must be able to access real-time insights on transactions. Without real-time data access and analytics, the power of artificial intelligence (AI) and contextual advice (either human-based or with chatbots) is limited.

4. Reuse Existing Content. To have an impact, it is crucial for the bot to be able to access content created and maintained in digital repositories across all channels. From digital ‘brochureware’ to FAQs, rules and regulations, and rate information, bots must be able to access and leverage this insight in real-time.

5. Build Deep Knowledge. To build engagement, a bot needs to be able to provide advice, not just balances. Personetics believes bots need to be purpose-built – with deep knowledge on issues important to the customer. With PayPal supporting payments through Facebook Messenger, the bar transactions through the bot channel has been set and is being raised.

6. Work Seamlessly Across Channels. Customers expect a consistent experience across the digital landscape – online, mobile app, Facebook Messenger, Amazon’s Alexa, etc. A bot can not be a silo, but should be able to traverse across and between multiple channels. This may be a challenge for organizations who still can not achieve this within internal channels (mobile, branch, online, call center).

7. Get Smarter Over Time. An intelligent bot must get to know customers better through over time as more conversations and transactions take place. It must improve based on how a customer reacts to information and advice provided by the bot over time.

8. Anticipate Customer Needs. According to Personetics, almost half of all bots are only used once. This happens when a bot experience does not meet of exceed expectations as set out above. “To get customers in the habit of conversing with your bot, it needs to proactively reach out to customers with information, insight, and advice – presented at the right time and place based on predictive analysis of individual customer needs,” states David Sosna.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

The Future of Chatbots

Artificial-intelligence-powered chatbots work in real-time and provide personalized and contextual answers to customer questions. It can tell your current account balance, transfer money to a friend, pay a bill, and report recent spending activity.

It will eventually be more equipped to provide know you, look out for you and reward you with the benefits of deeper learning and timely advice. Last but not least, the bot will work on the messaging services and integrate with the personal assistants that customers are already using. Facebook Messenger, Amazon’s Echo as well as WeChat, Siri, Cortana, Slack, Line, Kik, and other platforms will all be supported.