Digital payments worldwide are predicted to reach 726 billion transactions by 2020, an increase of 10.9% CAGR, according to the World Payments Report 2017 (WPR) released by Capgemini and BNP Paribas. Emerging markets will lead this growth, with advanced technologies such as connected homes, contactless bank cards, wearable devices and augmented reality adding fuel to cashless transaction growth.

Contactless payments are becoming more commonplace, with this form of payment becoming the norm in many European countries. France saw the circulation of contactless cards double from 2014 to 2015, with the number of contactless cards in circulation in the U.K. reaching 106.9 million in 2015.

According to the study, debit cards accounted for the highest share of card transactions worldwide (70.5%), with credit card shard dropping from 30.1% in 2014 to 29.5% in 2015. Increases in electronic payments impacted the use of checks the most, with a decrease of 13.4% globally. It was noted that countries including the U.K. and Australia plan to phase out checks in the near future.

Despite increased adoption of digital payments, cash remains a primary form of payment for many, especially for low-value transactions and by certain demographic groups. Attributes of cash contributing to continued use include speed, universal acceptance, anonymity, lack of fees, etc. Some emerging markets also still lack a modern payments infrastructure while certain cultures don’t have trust in the banking system. In other words, the reports of the death of cash are still exaggerated.

By 2020, it is expected that emerging economies will be the backbone of non-cash transaction growth, with China challenging the U.S. as the leading market. While currently third in non-cash transactions, “China will benefit from multiple initiatives designed to create cashless economies, improve financial inclusion, and increase digital payment innovation,” stated the report.

Read More: Voice Payments Emerge as Tech Giants Compete for Voice-First Commerce

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Impact of Emerging Payment Technology

Emerging technologies such as the Internet of Things (IoT) and blockchain are beginning to disrupt the payments ecosystem at the same time as new competitors and new markets stimulate growth. “By 2021, more than 15 billion machine-to-machine (M2M) and consumer electronic devices are expected to be connected,” according to the WPR. Holding this growth back currently is the dual impact of scalability and security.

Much of this growth will result in high volumes of low dollar transactions. These transactions will also provide vast amounts of data, enabling banks to track preferences, behavior and overall activity which will lead to customized use cases.

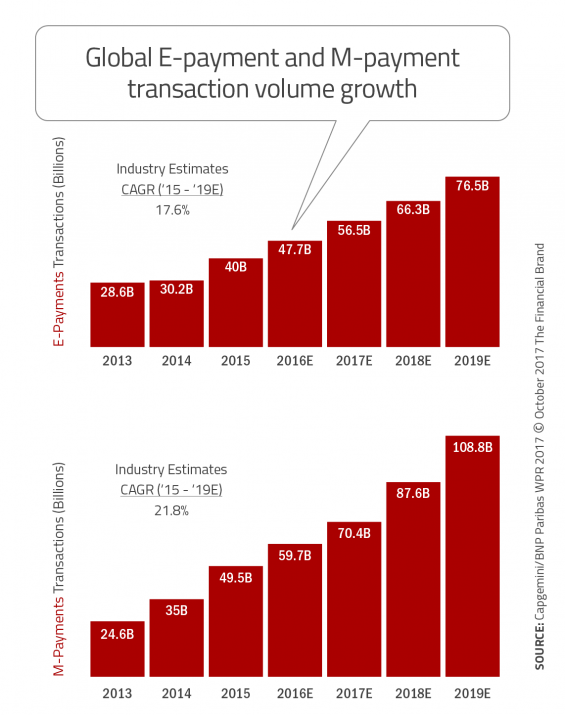

While e-payments are expected to grow at a CAGR of 17.6% from 2015 – 2019, the yearly growth rate is expected to decrease, as more transactions move to mobile payments (m-payments). Mobile payments are expected to have a CAGR of 21.8% from 2015 – 2019, helped by an increased proliferation of mobile devices. As with many of the payment trends, the impact of China on growth numbers is significant.

Read More: Digital Payments Approaching Universal Acceptance

Transformation of Payments Ecosystem

The intersection of new payments technology, emerging markets, increased consumer expectations, a new regulatory environment and greater impact of non-traditional players is transforming the payments ecosystem. This transformation demands that banks reassess the manner in which they will participate in this ecosystem.

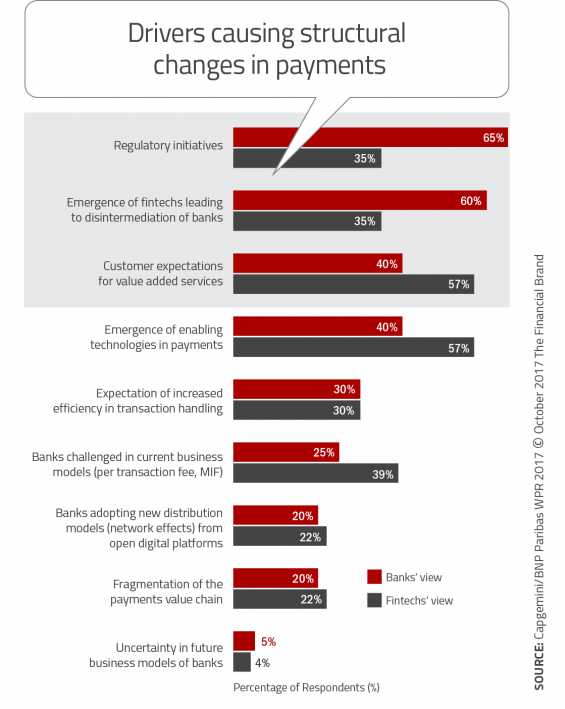

The proliferation of new technologies will dramatically change both security and regulatory components, while the increase of data from these transactions will impact the value propositions possible. The WPR 2017 study found that regulations, competition, customer expectations and emerging technologies were thought to be the primary drivers of change in the future.

Fintech executives and traditional bankers differed in their view of what would impact the marketplace the most. Not surprisingly, the responses from fintech firms revolved around the customer experience and technology, while traditional banks thought regulations and non-traditional firms would have the greatest impact.

The integration of customer analytics, improved fraud management, dynamic wallet solutions and other value-added services will have a positive impact on both the consumer and the merchant. It is expected that ongoing improvement in biometrics and secure payments will become mandatory in the future, while integration real-time financial management solutions will become commonplace.

The integration of customer analytics, improved fraud management, dynamic wallet solutions and other value-added services will have a positive impact on both the consumer and the merchant. It is expected that ongoing improvement in biometrics and secure payments will become mandatory in the future, while integration real-time financial management solutions will become commonplace.

Finally, as fintech firms continue to bypass traditional value chain components, traditional financial services organizations will need to determine if they should partner with, buy or ignore these new competitors. Given that most of the fintech activity in the payments space has targeted the most lucrative components of the payment value chain, significant decisions are necessary.

This urgency becomes apparent when taken in context of the potential for new payment solutions made possible by open APIs, blockchain, AI and big data. With the expansion of solutions beyond traditional banking services and the aggregation of data for added consumer value, there is significant potential for growth (or loss) of market share.

Challenges of New Payments Ecosystem

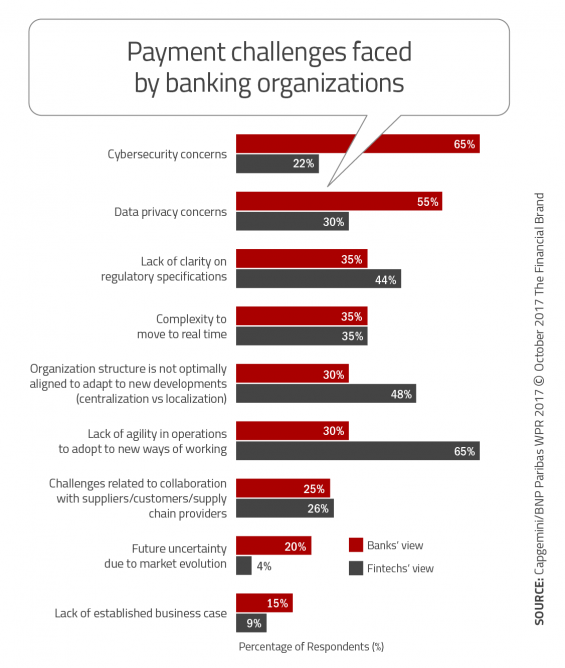

The opportunities of the new digital payment ecosystem comes with risks. From cybersecurity and privacy to the impact of legacy technology and new competitors, it is far from clear sailing for organizations wanting to be a player in the future payments marketplace.

The survey done by CapGemini and BNP Paribas found that banking executives were most concerned about cybersecurity (65%) and data privacy (55%), with a lack of clarity around regulations also being a concern (35%). Again, there was a significant disparity between the reponses from traditional bankers and fintech players.

The Importance of Collaboration

There is no clear path to success in the new payments ecosystem, with many variables, opportunities and challenges still in an embryonic state. It does seem to be clear that success will require collaboration between players and markets. Especially as new technologies and new structures of solutions emerge in connection with open banking APIs, AI and big data, organizations will need to determine their best role in the new ecosystem.

In the end, the consumer and commercial marketplace will determine the winners, but there are tremendous opportunities for firms that embrace collaboration of insight and solutions to develop an improved value-added proposition that can address the need for speed, insight and security.