Financial institution-owned innovation labs, accelerators, incubators and similar entities share the same feel but can have widely different philosophies. Some resemble the secretive “skunkworks” of the defense industry, developing a lot of proprietary technologies that will mostly be kept for its own development and use. Some pursue quite the opposite strategy, developing nothing proprietary and instead concentrating on evaluating, testing, adapting and curating their best picks from the plethora of fintech products out there, assembling the existing parts to provide their customers with digital services with best mix the experts in the lab can buy.

PNC Bank’s affiliate Numo — officially all lower case letters and from a Latin word, “nummus,” meaning “money” — is a very different creature. In some ways, according to David Passavant, CEO, its approach is “all of the above,” depending on the project. One way that Numo, founded in 2017, has been described is as a “build incubator,” versus organizations that bring in ideas from the outside and nurture them with advice, funding, and connections.

“From what I’ve seen out there, in different fintech labs, I believe Numo is a unique model,” says Passavant. “It’s different in that it exists to create startups, which will become spin-out companies.” Thus far most of what the lab has taken on has been conceived in-house and developed completely internally.

Indeed, Passavant says the argument for starting Numo was to prove that a large legacy financial institution could build fintech startups from scratch that would be successful enough to go independent, with PNC retaining partial ownership as an investor but the fledgling company attracting other capital and perhaps even taking some of the Numo staff with it. This is somewhat like the ways that bee hives divide under multiple queens and set up on their own.

Designing a Different Twist on the Fintech Lab

The startups’ apps, or what have you, would be available to other financial institutions as well as to fintechs themselves.

“It’s basically a way for a large bank to play in the fintech world versus letting things happen outside of its walls and later either competing with fintechs or acquiring fintech companies at what will by then be huge valuations,” Passavant explains.

Building to spin-out is very different. The ultimate goal, when an idea is first authorized for development, is to eventually achieve what Passavant calls “escape velocity.” By that he means sufficient momentum to leave Numo “and become its own thing.”

The journey at Numo begins with authorization that comes from a small board, including Passavant himself and three representatives of PNC’s executive committee. But the ideas can come from anyone on the lab staff. Numo’s operation includes technologists, entrepreneurs and venture capital experts.

“We have a small team that hunts for new ideas,” says Passavant. Concepts come from different places. Numo’s first consumer-oriented product is Indi — also officially lower-cased. Indi is an app developed to meet the needs of gig workers. The idea behind it, which we’ll explore, began in discussions with an outside organization that serves gig workers. A conversation on a different topic sparked the idea for the app.

“Ultimately, I want this lab model to be judged by the success of the companies that we spin out,” says Passavant. “Everything else is just talk.”

Read More:

- Do Banking Execs Have It All Wrong With Innovation Labs?

- Bank OZK Hones Edge with Innovation Lab Stressing Practical Change

- Transforming Banks and Credit Unions Without Blowing Them Up

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Life Inside a Big Bank’s ‘Build Incubator’

Passavant has extensive experience in the area of innovation. He headed PNC’s own innovation group for about six years, and spent the previous 14 years in tech development and tech consulting positions at nonbank companies. When asked if he considers himself a banker, at first Passavant says, “I’m a tech guy.”

He thinks a bit further and admits that he and others like him at Numo joke about being “bankers, but ultimately I’m a technologist, a tech entrepreneur. That’s what I do. I build things. They happen to be in banking right now, but ultimately what inspires me is creating things.” The young effort has no patents yet, but has filed for a number of them.

Because of Numo’s emphasis on producing not just the “things,” but the companies to run them, a wider net is cast for talent. Passavant won’t discuss the size of his staff in specifics, but says it can currently handle the coding on several products under development.

“From the beginning,” says Passavant, “the idea was not to go out and hire an army of folks, but to hire a very small, but talented, team and to scale up ideas as they find success. And that’s what we’ve been doing. I’m not at all fixated on growing big. I’m fixated on finding terrific ideas and bringing them to market.”

But he doesn’t seek only young technologists who can code innovatively and rapidly. He wants experience, too, specifically some experience in startups. Someone who has been through at least one startup’s lifecycle would make an ideal candidate, for example.

Numo’s CEO David Passavant confers with COO Laura Ritz at the PNC innovation operation’s new Pittsburgh center.

While Numo now has its own offices in a converted 1800s-era building in PNC’s Pittsburgh headquarters city, the incubator isn’t meant to be an ivory tower or an enclave cut off from the bank proper. Passavant say the bank’s staff and Numo’s intersect in multiple ways, beyond the approval function of the Numo board.

“We’ve looked at probably a dozen ideas that began as IT created by PNC or acquired by the bank in some way,” says Passavant. “None of those has yet become a springboard for creating a new company, but I expect something will in time.”

A key intersection lies in areas like compliance, risk management, cybersecurity and related disciplines.

“Any product that we take through our pipeline, at a certain point we interface with the proper teams inside the bank to make sure we’re complying with the regulations. As a sub-company, we are subject to the regulation and oversight that PNC is, as a bank, as well.”

Compliance, especially, “is a ton of work,” admits Passavant, but he believes in bringing compliance experts in early so the lab doesn’t go down a wrong road once an idea is being developed seriously.

“We’ve gotten to a place where we’ve figured out how to work together,” says Passavant. “They very intelligently give us the free space to create, while keeping us within the boundaries of what PNC’s comfortable with.”

But are Banks Innovating on Borrowed Time?

Passavant says it took time and effort to get to that point and that the balance between innovation and compliance is critical.

“If it’s not properly executed, any incumbent bank could risk-manage itself into extinction.”

— David Passavant, Numo

“If it’s not properly executed, any incumbent bank could risk-manage itself into extinction,” he explains. “But I think that over the last decade or so banks have come to realize that we are all evolving towards becoming technology companies.”

Banks need to think differently, says Passavant, and learn to experiment in a safe and compliant manner.

“My read is that banks are getting smarter and smarter at this, and are accepting it, more frequently,” he explains. “This is partly out of necessity, having to compete with not only fintech but also some of the large tech players out there who are infringing on our space. But it’s not like banks are stuck in a certain way of doing things. I think, in fact, that they are evolving.”

Evolving towards what, exactly? The theory of evolution is replete with dead ends, extinctions, and anomalies like the platypus. And there are innovation thinkers like Brett King who predict that banking as an institution, as an organization, will cease to exist and instead become an embedded function inside other processes. Who needs loan officers and classic lending institutions, this argument runs, if a purchase can have its financing going on in the background?

Passavant agrees, but while not endorsing precisely what King and others have predicted.

“I think both things are true,” Passavant explains. “Banks are already working on doing exactly what Brett King has said, providing ‘banking as a service’ infrastructure kinds of offerings. But does that mean that banks are just utilities? I think that is a long way from happening, and by that, I mean decades. There will be consolidation, and fewer banks as a result, because it’s very, very expensive to build technology at a pace to compete.”

Passavant adds this: “I think banks are smart, and they’re made up of smart people who are spending a lot of time thinking about how to evolve.”

Creating Indi, Attempted Solution to Gig Economy Pain Points

Indi is a banking product designed for gig workers, contractors, freelancers and other self-employed people. Indi’s story began after the conversation mentioned earlier. “We began researching the pain points of these people and our ideas took fire from there,” says Passavant.

One of the biggest difficulties for gig workers and others not in traditional jobs is managing their cash flow vis-à-vis their tax responsibilities. The self-employed are required to pay estimated tax, for example, but with fluctuating earnings and recordkeeping challenges, many gig workers wind up with nasty tax surprises.

Among the features of Indi are real-time income and expense tracking and a related automated savings function that includes a tax savings goal. Quarterly tax payment reminders are also included and the app’s software makes adjustments as needed when users fall behind or save ahead. The service also produces automatic yearend expense reports for tax purposes.

Currently the app is in beta testing, with about 100 users, most of them not affiliated with the lab nor the bank, using it. Meanwhile Numo is taking requests on its website to be invited to join future by-invitation groups.

Once Indi becomes available to the general public several marketing avenues will be tapped. Passavant says direct signups through the website will be one channel. Another will be promotions made through gig employers, such as ride-sharing services that employ gig drivers. And another channel will be associations of independent contractors, freelancers, and such.

Just when widespread usage comes is unclear at present. “I hope it would be by the end of the year that we could take the reins fully off,” says Passavant. “We’ll do it when we’re sure that the product is ready and we’ve tested all the operational controls.”

After that comes the waiting for Indi to reach “escape velocity.” Numo also has a commercial real estate analytics program in beta testing, and more offerings are in the pipeline.

Managing a Fintech Organization Inside a Bank

“When we began, we started in the equivalent of a garage,” says Passavant, which is an interesting twist since the traditional small-time inventor story often began with “two guys in a garage.”

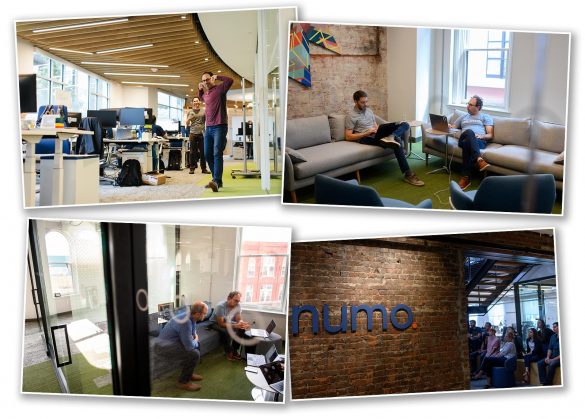

But nowadays Numo staff works in a converted building from the heyday of Pittsburgh, with an eclectic mixture of exposed brick, high-tech ceilings, glass-walled conference rooms, and office furniture punctuated by pieces in 1970s-toned greens and oranges.

There are no foosball tables at this time — they are a fixture in many financial innovation labs, for some reason — but Passavant admits that the lab does have a professional-looking conference table that converts into a ping pong table.

The veteran technologist chuckles a bit at the mention of a foosball table. He says that managing a staff of technologically creative people doesn’t really take toys and trappings, but understanding.

“Innovative people tend to have shorter attention spans,” says Passavant. “So you need to keep their attention, to keep them inspired by what they are working on and who they are working with. They want to feel like every day they are creating something, building something new. So when we hire, we look for creators, and we look to constantly move ideas through here at a pace that keeps the attention of the creative folks we have working here.”