Over the last decade, banks and credit unions have needed to respond to the impact of the financial crisis, the digitalization of the industry and mobilization of the consumer, an influx of traditional and non-traditional competitors, new regulations, and continued pressures on margins. Despite these challenges — or maybe because of them — we have seen an increase in the commitment to innovation from institutions small and large. Innovation has also driven the fintech sector, with new entrants offering competitive alternatives focused on digital delivery and improved customer experience.

This increased commitment to innovation in response to consumer expectations and increased fear of non-traditional players are two of the primary findings of the 10th annual Innovation in Retail Banking report, sponsored by Efma and Infosys Finacle and published by the Digital Banking Report. The report includes a review of the previous nine years of the publication, providing a snapshot of the marketplace and innovation trends through the years. During this period, there was increasing investment in innovation, a shift from efficiency to experientially focused breakthroughs, evidence of continued strength of Eastern European and developing financial marketplace banks as innovators, and the integration of new technologies.

This increased commitment to innovation in response to consumer expectations and increased fear of non-traditional players are two of the primary findings of the 10th annual Innovation in Retail Banking report, sponsored by Efma and Infosys Finacle and published by the Digital Banking Report. The report includes a review of the previous nine years of the publication, providing a snapshot of the marketplace and innovation trends through the years. During this period, there was increasing investment in innovation, a shift from efficiency to experientially focused breakthroughs, evidence of continued strength of Eastern European and developing financial marketplace banks as innovators, and the integration of new technologies.

The key findings from this global survey of more than 300 financial institutions include:

- While fewer than half the organizations surveyed have a chief innovation officer, the presence of an innovation strategy increased by 6% since least year.

- 50% of organizations state that their primary area of innovation in the next four years is in product delivery channels.

- 74% of institutions increased innovation investment in technology, 73% increased investment in channels, and 69% increased investment for customer experience in the past year.

- The primary ways organizations are driving innovation is by partnering with business partners, large tech firms and start-ups.

- Open Banking APIs (5.68 on a 7-point scale) and advanced analytics (5.66) were the technologies thought to have the greatest impact over the next 12 months.

- In 2018, there was a significant shift to a longer-term perspective of ROI for innovation.

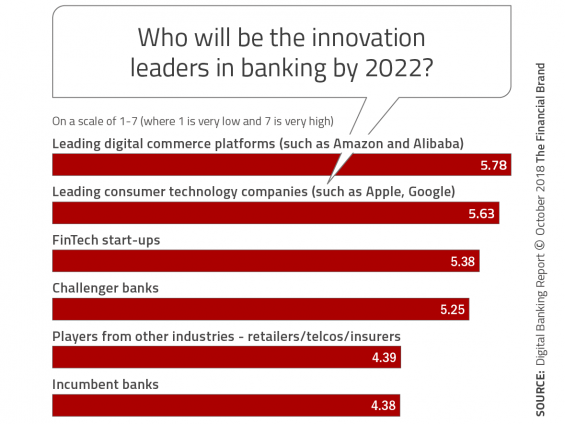

- Bankers surveyed believed big-tech firms, digital commerce platforms and fintech start-ups will be the most innovative competition in 2022.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Innovation Over the Past Decade

The success of smartphones and the digital convenience of applications have constantly changed consumer behaviors and expectations. New competitors have emerged that have found new ways to leverage digital technologies and customer insights. At the same time, financial institutions’ resources have been stretched, demanding efficiency and cost reduction. Regulatory systems have had a difficult time keeping pace.

As Innovation in Retail Banking 2018 looked back, it noted a transition from a time when product and service innovation was done behind closed doors, to a period when “Open Banking” provides the potential to co-create with non-financial entities for a competitive advantage.

The report finds a trend away from innovation to “save money” to an increasing focus on improving the consumer experience. With banks providing client access, industry expertise and ready-made infrastructure, fintech firms are bringing innovative solutions, new uses for technology and agility to the table.

Combining the power of traditional banks with the dynamic potential of fintech firms has changed the game in banking. More than ever, we are realizing that innovation in a digital world requires cultural change. Financial institutions must grow comfortable with new ways of delivering their services and organizing as a business.

“Today, innovations are being developed rapidly (from the user’s point of view), being released more quickly and continuously being improved,” the report states. “While a look back is insightful, it is the view of the next 10 years that will be the most exciting.”

2018 Innovation Trends

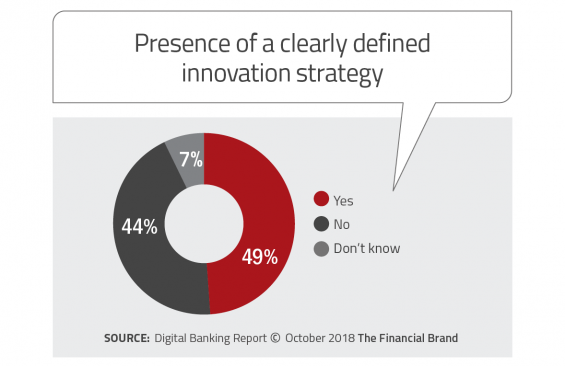

Digital Banking Report research found that the proportion of institutions with a defined innovation strategy rose 6% from 2017 — to 49%. In 2017, the percentage of firms with an innovation strategy was 43%, compared to only 37% in 2009 (when only larger firms were included in the study).

In the past, the vast majority of organizations surveyed were larger financial institutions. In 2017, the scope of the research expanded significantly, including smaller firms that are less likely to have a mature innovation process. When a delineation of respondents was done by asset size, it was found that larger financial organizations are more likely to have a clear innovation strategy than smaller firms.

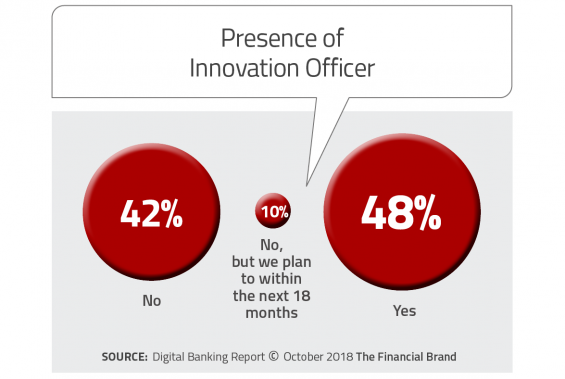

Presence of Innovation Officer. The primary driver of innovation, beyond budget and personnel, is the presence of an “innovation culture” and a focus on making innovation an integral part of the way an organization views itself. However, slightly fewer than 50% of organizations have a dedicated innovation officer within the organization according to the report.

The good news is that the presence of an innovation officer increased significantly over the past year — by six percentage points. In 2017, only 37% of the organizations surveyed had a dedicated person to lead the innovation process. This increase is one of the largest changes in this year’s survey.

When the report dug deeper into the responses, it was found that there was a definite delineation based on the size of organization. As expected, the presence of an executive for the innovation process is correlated with the size of the bank or credit union. It is assumed that as the size of the organization gets smaller, innovation becomes part of a broader role within the organization.

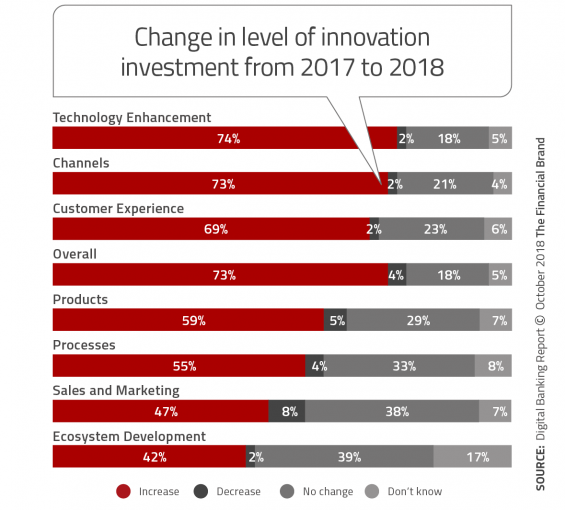

Areas of Innovation Investment. The percentage of firms increasing investment in innovation increased by only 3% this year, it is interesting to note that the number was relatively the same across all geographies and sizes of organizations. Supporting the focus on improving the digital delivery of financial services for the improvement of the customer experience, investment in channel innovation and customer experience were two of the top three areas of increased investment in 2018.

Not surprisingly, the top area of increased investment is in the area of “technology enhancement.” Based on other research done by Digital Banking Report, this focus is most likely to reduce costs, as opposed to improving the customer experience.

Measurement of Innovation Success. In a major shift from previous reports, far fewer organizations are taking a short-term view of innovation returns. In 2017, 31% of firms had a ROI perspective of one year, compared to only 17% this year. That said, while 54% of firms looked for an ROI in 1-3 years in 2017, this number increased to 63% this year.

This extended view of returns from investment in innovation is definitely welcome, since this indicates a separation between innovation and quarterly financial reports. This was considered a significant cultural change in the industry overall.

Increasing Fear of Non-Traditional Providers

To be competitive in the changing financial marketplace, banks and credit unions must provide mobile and online banking solutions that exceed peoples’ expectations. While consumers are increasingly satisfied with basic digital services provided by most traditional institutions, there are higher expectations around how institutions must help people reach their financial goals.

Meeting higher digital banking expectations could provide a way for banks and credit unions to monetize financial solutions, much as Amazon provides a higher, monetized option with Amazon Prime. The key will be to actually provide an enhanced level of value that digital consumers crave.

Unfortunately, while financial institutions hold a massive amount of consumer data, very few draw insights from that raw material — certainly not in a way that significantly improves the customer experience. Without a differentiated experience, the door is open for those organizations that can combine advanced technologies with real-time insights and contextual messaging and engagement.

In a continuation of findings from the past several Innovation in Retail Banking reports, platform-based competitors (Amazon), techfin firms and fintech organizations were the highest-ranked competitors. Much of this fear comes from the ability of these firms to provide payment capabilities and an exceptional digital experience.

In a shift from last year, challenger banks rose in perceived importance, reflecting the ongoing growth of firms like N26, Starling, and Monzo. The threat from non-fintech or banking firms and incumbent banks were seen as least threatening.

It is clear from this year’s Innovation in Retail Banking report, and the reports from the past, that great progress around innovation has been made Yet there is still much more ahead. The increasing demands of the consumer, fueled by digital experiences from technology leaders, relegates many traditional providers to playing a game of “catch up.” This is especially true with smaller organizations, which often lack the resources to deliver the digital functionality of larger peers.

To move forward at the speed of change will require a doubling down on providing a culture of innovation throughout organizations, combined with a willingness to embrace change, take appropriate risks and disrupt what has been the norm in the past. This requires getting out of our comfort zone and finding a way to serve the consumer in the way they are being served by big tech alternatives.