The question that gets asked at almost every gathering of financial services executives is, “What institution is the best innovator in banking?” or “Where is most innovation in banking taking place?” Luckily there are trade organizations such as Efma (an association of 3,300 financial institutions in 130 countries) and the Bank Administration Institute (BAI) that have annual competitions to recognize the best in the financial services industry. While the specific innovations recognized may differ between these competitions, a relatively small number of organizations and geographic regions take home top awards year after year.

The Efma–Accenture Banking Innovation awards program is an initiative which aims to identify and award the most innovative projects in the retail banking sector at a global level. This program is in it’s fifth year, with the aim of sharing worldwide best practices in the retail banking distribution and marketing arena.

Innovations in ten categories are recognized, including two overarching awards for Global Innovator of the Year. The categories are:

- Best New Product or Service

- Phygital Distribution

- Digital Marketing

- Big Data, Analytics and AI

- Customer Experience & Engagement

- New Business Ecosystem

- Workforce Empowerment & Behavior

- Wallets & Payments

- Global Innovator of the Year (both Challenger and Established players)

A total of 183 financial institutions from 59 countries submitted 467 innovations for the 10 award categories in 2017. I was fortunate enough to be co-master of ceremonies for this year’s event, where bronze, silver and gold awards were presented. The winners were selected through a combination of votes by a panel of senior retail banking judges and by Efma members and non-members online. The three criteria used for evaluation included: originality; strategic capacity to generate long-term competitive edge and return on investment; and adaptability for use in other markets and countries.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Best New Product or Service

DenizBank (Turkey) won the Best New Product or Service award for their Augmented Agricultural Banking App. This award was the only one voted on at the awards ceremony, after six finalists pitched their innovations live to gain votes from attendees onsite and online.

The agricultural banking app from DenizBank shows the potential for banking to be at the center of a lifestyle ecosystem, going far beyond a traditional banking application. The app provides insight on crop rotations, planting, watering and fertilizing, and even integrates the ability to review and purchase farm machinery. These non-banking capabilities are brought to the app through strategic partnerships with regional experts who are available on call to provide assistance to farmers in need.

The benefit of this type of application is the ability to distribute expertise digitally, saving time for both the bank and the farmer. Instead of physical interactions, the mobile app leverages digital interaction on demand, personalized for each unique farm’s needs.

Phygital Distribution

Idea Bank (Poland) which focuses on entrepreneurs’ segment, won the Phygital Distribution category with “Idea Hub Express,” the first bank branch on tracks. It is a co-working space that allows train passengers, often traveling on business trips, to make better use of their time while in transit, while also benefitting from Idea Bank services.

Idea Hub Express train cars, adopted for office work, feature tables, comfortable chairs and a screen for presentations. Travelers can also use the available office equipment (printers and scanners), phone chargers, Wifi connections, as well as coffee makers, and read a selection of newspapers delivered every day. Cars are open to all passengers holding a valid ticket, but Idea Bank customers have priority in taking the available seats.

Idea Hub Express in aligned with Idea Bank’s corporate strategy of supporting SME owners in their daily chores, and it is a continuation of banking co-working project – Idea Hub. Idea Bank started its Idea Hub project in early 2015, with almost 30,000 visitors having stepped into these unique business banking centers.

The primary impact of this innovation has been on the overall Idea Bank brand, resulting in significant increases in visitors to the physical Idea Hubs. It has also served to position Idea Bank as the best banking solution for small businesses and entrepreneurs who need help starting their businesses.

Digital Marketing

DBS Bank (Singapore) won the Digital Marketing award for its very unique DBS Sparks mini-series, which was inspired by real client stories. DBS Sparks leverages digital content marketing instead of traditional advertisements to build trust and goodwill in the marketplace. The goal is to stand out from the competition in a highly commoditized industry and to challenge consumer’s perception of the value of DBS Bank.

By using real customer stories and DBS employees, there was authenticity that was not possible in a traditional ad. In addition, the longer format (YouTube platform) also helped convey the stories with more depth versus a 30 or 60 second television spot while still keeping audiences entertained.

The Sparks Episodes 1-7 and their trailers have amassed over 100 million views and over 11 million digital engagements across DBS markets (Singapore, Hong Kong, Taiwan, Indonesia and China). In breaking views and engagements down per country, the bank realized that using the mini-series as a vehicle to introduce DBS worked well in the bank’s developing markets (Indonesia, China, Taiwan), as evidenced by number of views and engagements in those countries. This may be an excellent vehicle for other banks fwith operations in higher unbanked and underbanked markets, where trust in banking is suspect.

Read More: Rethinking Innovation, Leadership and Marketing in Financial Services

Big Data, Analytics and AI

Sberbank (Russian Federation) took home the Big Data, Analytics & AI award for “Tips” in Sberbank Online, an artificial-intelligence-based tool that helps users change their financial habits for the better, saving them money, time and effort. Instead of looking at the past, the goal was to look forward and provide recommendations around what is expected to occur in the future.

Tips was created to leverage digital assistants such as Siri as well as financial services like Mint, providing the advantages of each: proactivity, analysis of financial behavior, machine learning, provision of recommendations for everyday tasks, etc. In comparison with similar services of financial recommendations, Tips in Sberbank Online also has features like collection of feedback, links that allow taking advantage of advice, and other tools.

The digital assistant accumulates feedback from clients and uses it for self-training. If a client says several times that he/she is not interested in the advice on a specific topic, the system decides if it is bad advice, or if the client is not interested in such advice. On the basis of this feedback, the digital assistant will continuously improve its advice targeting skills with respect to the broader audience. The objective is to make the digital assistant, at a certain abstract level, generate and provide clients with advice, without interference from content managers.

Read More: Banking Must Measure Customer Experiences Across Entire Journey

Customer Experience and Engagement

KBC Bank (Belgium) won the Customer Experience & Engagement award with “My car”, which uses blockchain technology to create a seamless experience in car loans, from the instant the customer signs the order to the moment they drive their car off the dealer’s lot. This includes the car loan, insurance, the acquisition of a license plate and even breakdown assistance.

The My Car program makes the actual payment of a car hassle-free while reducing fraud. Blockchain technology is used to ensure a shared source of truth and central place of workflow. Every participant in the ecosystem profits from a faster and more secure flow: the customer, the car dealer, the distributor, the government, the insurer, and the bank.

The initial assumptions about the poor customer experience around buying a car, fraud and rationale for the project were confirmed:

- One car dealer mentioned that up to 50% of his customers can’t pay their car on their first appointment.

- A very low interest rate is often approved when a loan is for a (new) car. The order serves as proof that there actually is a car to sell when the payback of the loan stalls.

- All involved parties are waiting for the customer to move the process forward. By centralizing and automating the process, all parties to the transaction benefit.

New Business Ecosystem

mBank (Poland) won the New Business Ecosystems award for “mPower Business Starter,” which integrates government, bank and accounting services to create an easy and intuitive new business customer (entrepreneur) user experience – reducing the new business establishment process from at least 10 days to less than 10 minutes.

Starting new business includes dramatic life changes and business issues that inexperienced entrepreneurs must solve, including challenges with both bank and legal forms that must be completed. In most cases, the process included at least 5 visits to financial institution, multiple forms and ~200 fields to be completed. The goal was to reduce the paperwork from dozens of forms to requiring only 6 fields to be filled in.

By using a state digital signature, opening a business bank account, signing up for accounting services and officially registering a new company could be streamlined for up to 90% of companies opening a new business. What was most important, mBank’s mPower Business Starter brought together two separate e-government services into a single client journey, eliminating the need for separate portals and logins. This implementation was developed in co-operation with Polish government.

Further developments planned for 2018 include:

-

- Robo-advisory calibration and further enhancements based on production data

- Collaborative browsing with accounting advisors

- Mobile application version

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Workforce Empowerment and Behavior

Intesa Sanpaolo (Italy) won the Workforce Empowerment & Behavior award with its Digital Learning portal and Smartphone app, which increases employee engagement and entices them to learn anytime, anywhere through a Netflix-inspired digital learning process

To improve the training and learning processes, combining customization and personalization with digital accessibility, ISP identified as essential to design a new learning service that was flexible, user friendly, easily accessible and more and more customized to individual needs.The bank followed a J3 approach: Just in time, Just for me and Just enough.

To increase employees’ engagement and improve the way training was developed, delivered and communicated, a digital portal was used. This was considered essential in reaching over 100,000 employees many of which were assigned to the more than 5,000 ISP branches. Learning is now available on smartphone and laptops, with employees able to access the tools with a non-mandatory approach and select digital contents based on digital self-planning and assessment of needs.

It is also the first time learning content is specifically created inside the Bank, with the set-up of the Learning Factory and Learning Media Lab – today run by 70+ digital learning specialists.

To deliver excellent content the bank created an ecosystem of institutions in partnership with ISP (top-ranked Universities, international Research Centers and top influencers), all collaborating to develop innovative content and knowledge to be used internally.

Wallets and Payments

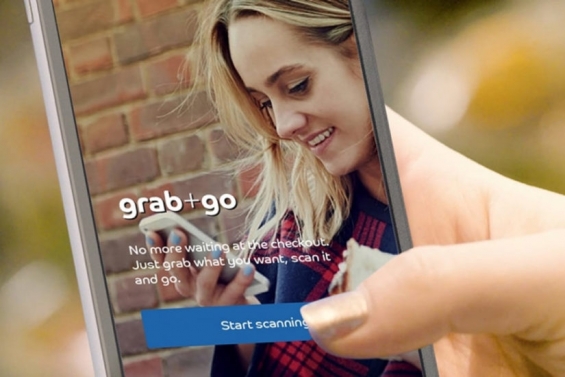

Barclaycard (UK) won the Wallets & Payments category with Barclaycard “Grab+Go”, which transforms a shopper’s smartphone into a ‘pocket checkout’ so the retail customer can scan the items they want to buy as they pick them off the store shelves, initiating a mobile payment and leaving the business without needing to go through a long check-out line.

One of the pain points of purchasing that consumers constantly cite is the need to queue to make a payment for something; they increasingly want speed and convenience when shopping. Centered around a proprietary “Grab+Go” app, it allows shoppers to simply scan the items they want to buy as they select them, click checkout when they’re done and walk out the store without visiting a cashier. Payment is taken seamlessly and invisibly in the background using pre-loaded card details.

Making ‘invisible payments’ is becoming increasingly commonplace in many of the mobile apps we buy goods and services through these days, including Uber, Deliveroo, Amazon’s 1-Click ordering service, etc. Instead of entering payment details every time, they are instead stored in an app or online interface, with the authorization for the merchant to process payments incorporated into the purchase journey, seamlessly and invisibly.

Grab+Go is the first use of this way of purchasing in the physical retail environment – combining it with the ability for the user to scan and ‘checkout’ their own shopping, it brings another brand new way of paying (and) shopping. This may be the key to moving usage from plastic to the mobile device since unique value is provided.

Global Innovator of the Year: Challenger Bank

N26 (Germany) was named Global Innovator of the Year for a Challenger Bank for bringing innovative services to market over the last year, including N26 Business, an account that enables freelancers and self-employed workers to navigate both their business and private finances, and a new digitized insurance service in partnership with insurtech provider, Clark.

As the largest challenger bank, N26 has expanded their digital-only banking offering to include more services and increased convenience for customers. It develops every product as a mobile-first application, as opposed to traditional banks who simply add on a mobile interface to their existing infrastructure. From the signup process to accessing account statistics, every function is just a single tap away.

Using open banking APIs, N6 has expanded their product line as well as their scope. They not only have expanded across Europe, but have intentions of expanding into the U.S. as well. The growth of N26 helped to get the digital-only bank named as the top innovator in the challenger bank category.

Global Innovator of the Year: Traditional Bank

BBVA (Spain) was named Global Innovator of the Year for an Established Player for the innovations it brought to market in 2017. These include the BBVA API Market open and global API platform, which enables companies of all sizes to access a secure and powerful set of financial tools to help them innovate.

With BBVA API Market, an organization can create new services and offer added value for theirclients, allowing the organization to improve their experience. The APIs manage, monitor and analyze payments, verify identity and notify clients, giving access to segmented purchasing patterns, and much more … with the support and assurance of BBVA.

Companies of any size and any industry can now easily integrate financial services into their product offerings. The educational and development platform provided by BBVA on their API site is unprecidented in the industry and shows the bank’s commitment to innovation beyond the traditional.

Innovation in banking is not universal, yet it is exciting when done well. The organizations that received awards this year (not just the top awards, but those who received silver and bronze recognition) are not unfamiliar with receiving kudos for their efforts. These firms are always named when we talk innovation in banking.

It all starts with culture and an enthusiasm to innovate.

“It’s exciting to see so much innovation from companies around the world,” said Vincent Bastid, Efma’s CEO. “The spectrum of innovations that we’ve seen this year has never been so diverse, with major developments in 2017 including blockchain progress, advances in personalization, encouragement of entrepreneurship, expansion of hubs, evolution of banks in motion, empowerment of customers through self-service and self-shopping, and the combination of AI and Big Data. As institutions push the boundaries, they are creating new and exciting ways to engage with customers and provide the products, services and experiences for a digital-first world. Congratulations to all of this year’s winners for their achievements.”

Piercarlo Gera, global managing director of Accenture Distribution and Marketing Services, said, “We continue to be impressed with how DMI Award winners leverage digital technologies to create innovations that generate value for clients—in terms of customer experience—and also for banks, to help gain market share, drive revenue growth and deepen client relationships, while reducing costs. Digital industrialization in managing the underlying processes in customer engagement is rapidly increasing year after year as customer experience is increasingly critical given the competition that retail banks are facing from non- traditional competitors. While the majority of this year’s winning banks are from Europe, they represent numerous countries, showing that innovation knows no boundaries.”