1. DBS Bank: DAX Innovation Lab

DBS Asia X (or “DAX” for short) is a space where DBS can “collaborate with start-ups and the broader fintech community to reimagine, inspire and create the future of innovation.”

DAX launched in late 2016 and provides 16,000 square feet of project pods, journey rooms, agile co-working spaces that can hold up to 100 people, innovation showcases, and recreational areas. At DAX the bank has run over 1,000 experiments.

“DAX is a space where we collaborate with start-ups and the broader fintech community to reimagine, inspire, and create the future of innovation,” says DBS Bank’s Bidyut Dumra, Executive Director of the DBS Transformation Group.

DBS has assigned a permanent team of about 25 innovators to its DAX facility, including design professionals and software engineers. At any given time between 60-80 other people will also be working in their innovation center, including bank employees and staffers from fintech firms partnering with the bank.

Among the results of DAX efforts that have been implemented are the DBS Developer Portal, which the bank describes as the banking world’s largest API portal, and their Jobs Intelligence Maestro (JIM), a custom-built employee screening application based on artificial intelligence.

Over 5,000 DBS employees have been exposed to agile and digital methodologies through DAX programs. Another 30,000 other visitors (including DBS employees) have passed through its doors.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

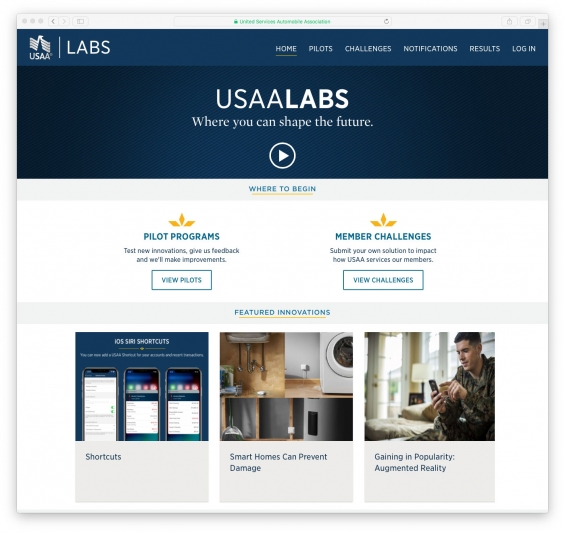

2. USAA Labs: Where Ideas Can Take Off (Literally)

The number of U.S. financial institutions that can boast of a fleet of drone pilots, you could count on one hand. USAA is one of them. During 2017’s Hurricane Harvey USAA’s insurance operation launched an aerial imagery tool that homeowner-members and staff could use to remotely search and view damage. USAA uses the drones to get remediation underway more quickly.

USAA has a long history of innovation. They established “innovation” as a formal function in 2009, and their current lab opened in early 2018. They even have a 1,288 square foot Innovation Showcase inside their 20,000 square foot USAA Labs facility in San Antonio.

USAA Labs includes dedicated staff, but there’s an emphasis on bringing in teams and individuals from elsewhere in the organization to work on fresh ideas. Typically lab staff partners with subject matter experts from specific areas of the company. The staff also manages a wider employee innovation program that includes a web-based “idea platform”, hackathons, competitions, and volunteer programs.

“Innovation is a team sport at USAA,” a spokesperson with USAA explained. “On any day, there will be team members from across the enterprise in the lab working to create new solutions. It is filled with collaboration space and new technology — and most of the surfaces can be written on— literally.”

A dedicated USAA Labs website gives its members opportunities to not only see some of the pending projects (you need a member login to get to the best stuff) but also a chance to volunteer to be part of member groups that pilot new ideas. This helps USAA test and improve fledgling innovation. Sometimes consumer feedback pushes an idea forward, sometimes it may terminate the project.

Over the past two years, USAA says, it has launched over 1,000 employee ideas, large and small. USAA and its employees hold many patents, as well.

See More: Peek Inside 7 More of The Banking World’s Coolest Innovation Labs

3. OZK Labs: Think Like a Fintech Startup

Bank OZK likes to think of itself — and its innovation group, OZK Labs, in particular — “more like a startup than a $22 billion bank.”

“We move fast, operate on a new tech stack, and have an extremely talented group of product and software engineers,” the lab team brags on its webpage. The lab organization functions like an internal fintech, with the engineering team presenting features to business areas of the bank at least weekly. OZK Labs has its own president, who reports to the bank’s COO.

The purpose of the OZK Lab is primarily about untethering bankers from branches. As many people working in creative fields like advertising will tell you, it’s hard coming up with fresh ideas when you have to sit in the same stale environment day after day. And if you wear yourself out coming up with new ideas, you can take a rest in the lab’s “Nap Pod.”

The 16,000 square foot lab has about three dozen staffers. About 60% of lab’s resources are devoted to digital channels and emerging technologies like machine learning. Another 20% is allocated to process transformation and efficiency improvement, with the rest going to the bank’s real estate specialties group.

OZK Labs has redesigned and launched an online portal for acquisition of new accounts. Less visibly, it has also implemented several enhanced tools for serving customers more efficiently, with greater accuracy and quality. One project in the pilot phase builds on the “shop local” concept. The bank created an application that fosters small business growth and rewards our retail customers for their local purchases. Thus far the organization has been awarded four patents, out of 10 patent applications.

A community event area within the lab can host meetings of up to 200. This allows the facility to provide a venue to monthly technology meetups pulling in many from the local tech community.

Read More: Does Your Bank Need an Innovation Lab?

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

4. Ally Bank: Tackling Banking’s Problems, Not Just ‘Brainstorming’

The basic strategy for innovation labs is typically to put a bunch of experts in a state-of-the-art facility where they can work undisturbed by the grind of daily worklife. Some institutions are concerned that this approach risks disconnecting innovators from the improvements that need to be made. Call it “ivory tower thinking.”

“You can leave people with too much open space — they’ll stare at the horizon and just ideate,” says Diane Morais, President of Consumer & Commercial Banking Products at Ally Bank. “If you take that approach, you can spend a lot of time, money, and effort without affecting your core business.”

Ally wants to see innovative thinking going on across the organization, not just in a dedicated facility.

“Innovation’s everyone’s job,” says Morais. “We encourage it very much as part of our culture.”

Nevertheless, Ally launched its own “TM Studio” innovation lab in early 2018 inside an old reclaimed industrial complex in Charlotte, N.C. About a half dozen dedicated staffers work in the lab. Their job is to work with rotating teams that Ally management sends to the lab to tackle specific projects — no open-ended “blue sky” spitballing here. These teams of employees — often mashed up from various departments — understand that they are there to develop a prototype that addresses a specific problem.

The lab is only about five minutes away from Ally’s headquarters. But Morais says this is just far enough to provide the isolation and focus that people working on such special projects require. “This removes them from the corporate workspace, and from the constant switching of thinking,” explains Morais.

In short, TM Studio is meant as a place to “go deep” — but not to go long.

Read More: Innovation in Banking: Killer Ideas? Or Idea Killers?

5. Eastern Labs: A Physical Space or a Mental State?

Eastern Bank was an early pioneer of innovation labs in the financial industry — lots of whiteboard surfaces to write on, long tables with huge Macintosh computers, and a casual dress code.

The original Eastern Labs opened in 2014, an unusual move at the time, especially for a smaller financial institution (Eastern now has $11 billion-assets). Back then, the lab might have had as many as 100 different technologists, designers, and others working on projects.

Since then, Eastern Labs has evolved. Instead of maintaining a large, separate team in the lab, the bank set out to create opportunities for the bank’s software developers, data engineers, and others to engage on projects with the remaining, smaller lab team.

Ashley Nagle Eknaian, who became Chief Digital Strategist and Head of Eastern Labs in early 2018, explains that they are now shooting for an “innovation-lab-as-attitude” mentality across the organization instead of just a strictly physical space.

“We don’t want to be seen as a separate entity,” Eknaian explains. The emphasis now is on collaboration.

The lab space still exists, but now there are seats reserved for employees visiting from other parts of the bank.

Another expanded emphasis is outreach and cooperation with the greater Boston area’s financial fintech community —”tapping into an ecosystem.” An example being Eastern’s decision to become a “Challenge Partner” for the MassChallenge fintech accelerator program.

“I like to think of our portfolio of projects as if it were an investment portfolio,” says Eknaian. Weighing the potential impact of a particular technology will help determine whether development is funded out of the Labs budget or through normal business channels.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

6. SunTrust: Accelerating Innovation By Fostering Collaboration

SunTrust opened its original Accelerator Studio in 2017, adding more space in 2018. Unlike some other labs, it wasn’t designed to maintain a large dedicated staff but to provide a place where teammates assigned to specific projects can meet conveniently to carry out their missions.

“The SunTrust Accelerator Studio was envisioned as a way to bring technology and business leaders together to enable increased communication and to develop more robust solutions, reducing time from idea to prototype as well as to uncover new opportunities,” says a SunTrust spokeswoman. “The Accelerator Studio is a testing ground that utilizes place, process, and collaboration to test and develop new capabilities needed to deliver client-centric solutions.”

Team makeup hinges on the project at hand. The space accommodates both core team members that work in the Studio full time as well as partners brought in for specialized expertise. Teams may also include compliance or other departmental staff when those skill sets prove necessary. On occasion vendors and academic have also had access to the Accelerator Studio.

Some of the results coming out of accelerator so far include efforts to improve customer experience and customer journeys. Projects can come from any part of the bank — one recent effort revamped the portal that the bank’s wholesale customers use.

Read More: Innovation in Banking Goes Beyond Open Spaces and Lattes

7. Wells Fargo: Blending Physical + Digital Product Testing

Innovation may require agility, but there comes a time when you have to stop and figure out if it works. That’s one of the key functions of Wells Fargo Digital Labs.

Digital Labs started out as a online-only function, but it now has physical space in San Francisco where its staff of 27 coordinates efforts such as pilot testing of new technology for consumers.

According to Shari Van Cleave, Head of Wells Fargo Digital Labs, the space is where the bank can research, develop, and test forward-thinking ideas that will benefit Wells customers. Coordinating with lines of business across the bank, Digital Labs conducts consumer research as well as proof-of-concept work.

“There’s a big funnel of ideas, there are things that are proved out, and then maybe five go into production annually” Van Cleave explains.

Some ideas are piloted with groups of Wells employees, some with members of the public, and some with both. Some of the innovations that either originated- or were tested in Wells Fargo’s lab include:

- Real-time credit card alerts via SMS text to better manage and track spending or potential fraud.

- Predictive Banking — generating insights and actions for a consumer within their online banking experience.

- Control Tower — a centralized way of controlling digital accounts with Wells.

Two ideas being considered are a program to help freelancers estimate their quarterly income tax payments and a plush Wells Fargo stagecoach horse with an embedded electronic function to help kids learn to save. A third was a means for consumers to access company ATMs without having their bank cards with them.