Even with the number of branches nationwide on a declining trajectory, megabanks like Bank of America and JPMorgan Chase are investing in opening new ones.

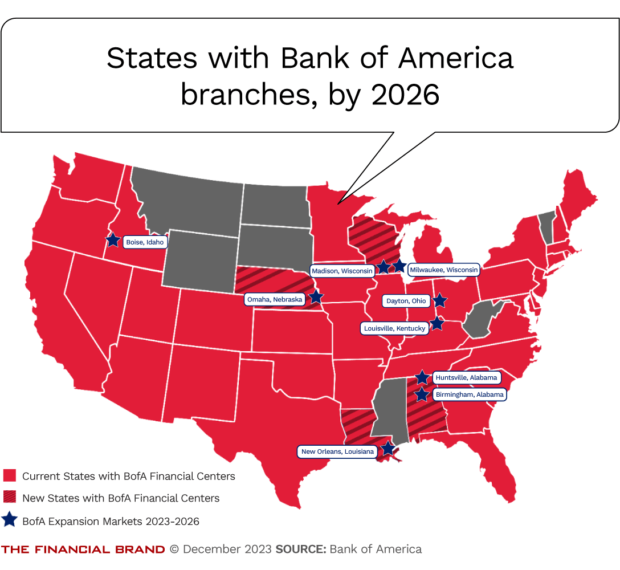

BofA added 55 branches in 34 markets in 2023, after having opened 58 branches just the year before. It also intends to expand into nine more markets where it lacks any physical retail banking presence.

Meanwhile, its rival, JPMorgan, has an aggressive push of its own to open Chase branches in new markets.

This could be a sign of things to come for the country’s big banks, says Steve Reider, president of Bancography, an industry consulting firm in Birmingham, Ala.

He expects others to follow Chase and BofA in staking out new markets, including Wells Fargo, PNC and U.S. Bank. “There’s probably half a dozen institutions that at least have a 10-year road map toward a nationwide presence,” he says.

A variety of business lines at the largest institutions increasingly operate on a national scale. This provides strong motivation for entering new markets with retail banking, as it allows the institution to make the most of its brand presence, Reider says.

One of the goals is to be in as many top media markets as possible to leverage the efficiency of national-level advertising, he says. “In that way, you’re no different than Pizza Hut or Taco Bell.”

But perhaps more importantly, branches also are vital to helping financial institutions stand out, says Michael Abbott, global banking lead for professional services and consulting firm Accenture.

When it comes to banking apps, he says, “it is literally a sea of sameness.” But branches are where banks can make deeper connections with customers. And, he says, customers are “desperate for conversation.”

He cites a March 2023 Accenture survey of about 49,000 bank customers worldwide that found six in 10 turn to branches to address complex financial challenges. “It is across all age groups and demographics,” Abbott says.

See: Stressed Millennials Could Use Some Advice on Managing Their Debt

The New AI: A Banker’s Guide to Automation Intelligence

Manual tasks across channels is costly. And while AI is hot, there’s a simpler way to bring efficiency that many bankers have overlooked.

Read More about The New AI: A Banker’s Guide to Automation Intelligence

Community Bankers’ Top Priorities This Year

CSI surveyed community bankers nationwide to learn their investments and goals. Read the interactive research report for the trends and strategies for success in 2024.

BofA’s Branch Strategy: Gathering Deposits and Giving Advice

When Bank of America mulls entry into a market, it evaluates a range of criteria, says Felicia Lewis, who is leading the branch initiative as a managing director and division executive.

Those factors include growth in population and households, as well as average median income. But one of the most important is whether BofA already has customers there for credit cards, mortgages and its Merrill Lynch wealth advisory business, among other lines of business, Lewis says, adding that there are no hard and fast numbers that trigger a decision to open branches. “Every market is slightly different,” she says.

Given BofA’s digital prowess, customers who want to expand their relationships can easily do so without a branch. Over the years, the megabank has made significant investments in improving its digital operations, which counted 57 million verified users at the end of the third quarter, up from 56 million a year earlier.

About 46 million digital users were considered “active,” meaning they had logged in at least once in the previous 90 days. BofA says the 46 million figure represents a household adoption rate of 74%.

In addition, Erica, the bank’s virtual financial assistant, had 18.7 million users in the third quarter, up from 16.1 million for the same period a year earlier.

So, why is there a need for new branches? “Deposit-gathering obviously is an important component of why we’re there,” Lewis says. “But clients need credit cards, clients need advice about their investments, clients need to purchase a home. Our goal is to make their financial life better, frankly.”

The new markets targeted by BofA are: Birmingham and Huntsville, Ala.; Boise, Idaho; Dayton, Ohio; Louisville, Ky.; Madison and Milwaukee, Wis.; New Orleans; and Omaha, Neb.

Tablets Replace Teller Lines at BofA’s Redesigned Branches

Besides adding new locations during 2023, Bank of America also completed a three-year project to redesign its existing locations to focus on financial advice. BofA says the new design is meant to make the branches feel more inviting and more comfortable.

The bank is doing away with teller lines, for instance, in favor of reception areas and offices where clients can meet with financial specialists. Branch employees are armed with tablets that help them serve clients regardless of their needs. It also frees the employees from having to be stationed at a desk.

“Even depositing a check doesn’t require a trip to a teller line,” Lewis says.

The footprint of the average BofA branch is down about 500 square feet, to around 3,500 to 4,000 square feet. New branches have drive-up ATMs, but not the traditional drive-thru lanes staffed by employees, Lewis says.

For siting, the bank eyes locations that people frequent, Lewis says. Today, that means locations closer to where people live and shop, rather than where they work.

Does that mean less need for branches in downtown areas? “It just depends on the market,” Lewis says. “I would just say we’re really selective with downtown locations.”

Read more about Bank of America:

- Bank of America CEO Brian Moynihan: ‘We Won’t Have a Recession’

- BofA Ups Digital Prowess with Marketing & Digital Banking Combo

BofA Aims for Top Deposit Market Share

Bank of America generally aims to open multiple branches when it enters a new territory, because it wants to capture top market share, Lewis says.

The magic number for BofA, at least initially, often seems to be five branches or less. In Omaha, for example, the bank opened its first two branches in 2023, but plans to have an additional three branches there by 2025, for a total of five. It also plans to have five branches in New Orleans and Milwaukee by 2025. And Birmingham will get a branch in 2024, the first of five BofA plans to open in that city by 2026.

Felicia Lewis leads Bank of America’s branch initiative as a managing director and division executive.

Lewis declined to share specific targets for branch deposits and profitability. But a glimpse of BofA’s track record shows that it has surpassed $5 billion in deposits in Columbus, Ohio, after starting from zero in 2019, according to data from the Federal Deposit Insurance Corp. As of June 30, the bank had 14 branches in the Columbus metro area, where it now ranks as No. 5 in deposit market share.

“That’s a pretty efficient system,” BofA Chairman and Chief Executive Brian Moynihan said of the results during a June 1 Q&A at the Bernstein Strategic Decisions Conference.

Nonetheless, it is not exactly easy for national banks to gain share in new markets. Some customers, such as small-business owners, prefer going to a community bank, even if its pricing is not as good as national competitor’s, Reider says, citing their desire for “better, quicker service.”

And even if BofA or Chase swoop in and open 15 branches in a market, the existing banks may still have 30, he says. “You can still win the convenience proposition in your specific market.”

Community banks also are likely to lean on their existing relationships. That’s been the approach taken by Mid Penn Bank, a $5 billion-asset bank based in Harrisburg, Pa., a smaller metro market where Chase started opening branches this year.

“I don’t take any competitor lightly, and when someone that is as big and powerful as Chase moves into a market, do I notice it? Absolutely,” says Rory Ritrievi, Mid Penn’s president and CEO.

Chase may attract depositors looking for higher rates, Ritrievi says. But he questions whether the megabank can match Mid Penn’s deeper connections to its customers and communities. “We’re not just opening checking accounts and making loans here and there. We’re developing full relationships that are really based on a consultative approach.”

Read more:

- Are Your Customers Moving Deposits? Here’s What to Do

- Bankers Are Dangerously Underestimating Consumers’ Growing Comfort with Fintechs

Optimizing the Branch Network at JPMorgan Chase Too

At the same time the megabanks are adding branches, they also are eliminating some in areas where they feel they have too many, Reider points out. They are still working through what Reider describes as “residual overlap” from past mergers, and the mix of openings and closings is meant to optimize their branch network.

JPMorgan Chase opened 114 branches in 2022, bringing the total number of branches opened since 2017 to 650. But it also closed hundreds of others in that same five-year period.

Still, the megabank now has locations in 25 states where it had no presence back in 2017, Jennifer Piepszak, JPMorgan’s co-chief executive of consumer and community banking, said at its 2023 Investor Day.

Taking It to the Bank:

How much of the U.S. population is within a 10-minute drive of a Chase branch?60%

The combination of digital channels and physical presence has improved the reach of the branch network, enabling better results with less branch density, Piepszak said. Chase branches averaged $227 million of deposits in 2022, compared with $119 million in 2017. The bank also gained 1.6 million net checking accounts in 2022. (See “JPMorgan Chase Defends Its Contrarian Branch Strategy as a Deposit-Gathering Machine” for more detail.)

All told, there were 4,831 Chase branches in 48 states as of the end of 2022, and 60% of the U.S. population was within a 10-minute drive of one of those branches. The bank aims to get to 70% and, going forward, executives expect a small increase in the branch footprint as they work toward that goal.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Improve Your Business Outcomes Through Data & Analytics

Gain centralized access to the credit bureaus and 20+ alternative data sources. Leverage advanced analytics to optimize marketing campaigns and loan decisions.

Read More about Improve Your Business Outcomes Through Data & Analytics

Moynihan: BofA’s Branch Total ‘Starting to Flatten Out’

The high-profile branch openings belie the trend for the industry generally. The overall number of bank branches nationwide shrunk 12.8% between 2019 and 2022, to 79,186, according to data from the Federal Deposit Insurance Corp.

“We are actively seeing banks, without a doubt, adjust their branch networks,” Abbott, the Accenture executive, says.

Statistical research from Bancography shows that banks accept a greater distance between branches than they used to. In 2010, 56% of Atlanta households lived within two miles of a Bank of America branch, according to the consulting firm. By 2022, the figure had slipped to 47%.

But in a second-quarter conference call with analysts, Moynihan suggested that BofA may be reaching a plateau with cuts to its branch network. It has 3,800 branches, compared with 4,300 at the onset of the pandemic and 6,100 in 2010. “It’s come down a slope, and that slope is starting to flatten out,” Moynihan said.