At JPMorgan Chase’s investor day, the outspoken banking analyst Mike Mayo scolded executives for their “love affair with branches.”

Chase executives had said 650 new branches were opened in the previous five years. “That’s almost equal to the total number of branches of Zions [417] and Capital One [296] combined,” Mayo, a managing director at Wells Fargo Securities, said during the Q&A period.

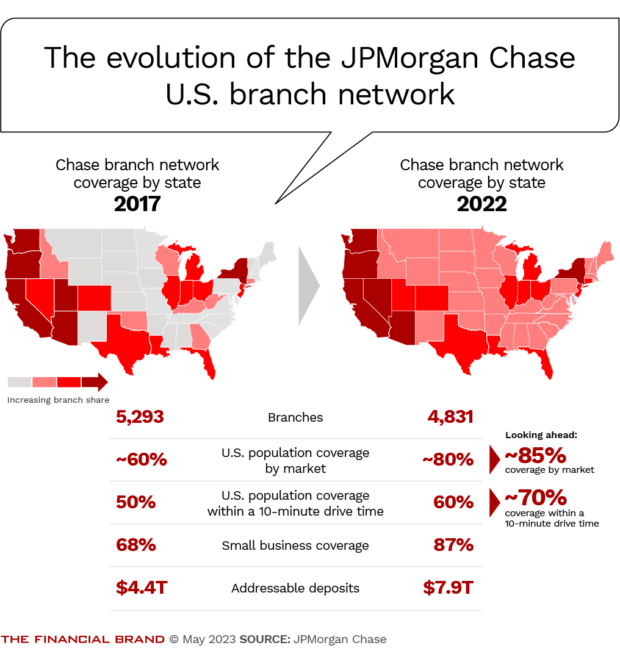

Jennifer Piepszak, co-chief executive of consumer and community banking, countered that Chase also closed 500 branches since 2017 — yet the bank now has locations in 25 states where it had no presence back then.

Going forward, Chase anticipates a small increase in its branch footprint.

“Just to be totally clear, it is a love affair with branches,” said Piepszak, “but that doesn’t mean that we can’t optimize the footprint over time.”

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Chase Branch Network Is a Deposit-Gathering Machine

The banking industry overall has become less branch heavy in response to consumers’ increasing willingness to bank digitally. But JPMorgan Chase’s retail banking unit has been dedicated to a contrarian approach. It opened 114 new branches in 2022.

Net, Chase has 4,831 branches across the 48 continental states, 15% of which opened in the last five years. (This figure does not include branches it gained by acquiring the failed First Republic Bank in San Francisco.)

Throughout the part of the investor day presentation focused on the consumer and community banking division, executives stressed how critical branches continue to be. As the team described it, digital channels and branches are intertwined, strengthening each other rather than one completely replacing the other.

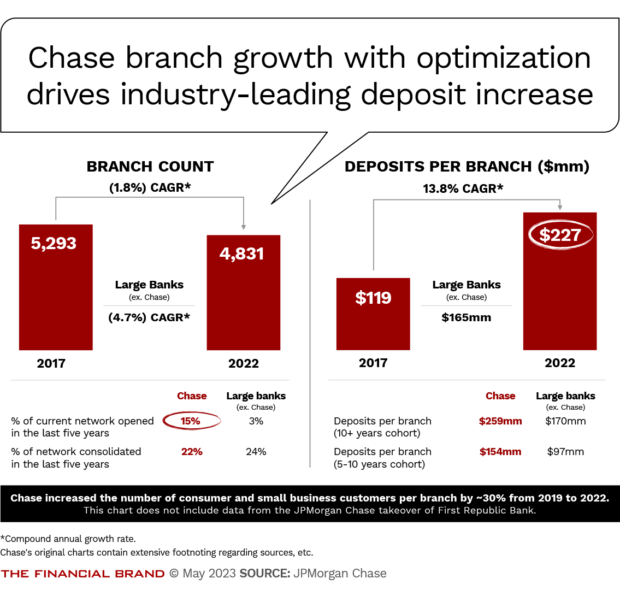

Between 2017 and 2022 the amount of deposits per branch has seen a compound annual growth rate of nearly 14%, according to Chase. As illustrated above, Chase branches outperform those of other large banks as a group in terms of deposit gathering, and the longer a branch operates, the greater its deposit-gathering potential.

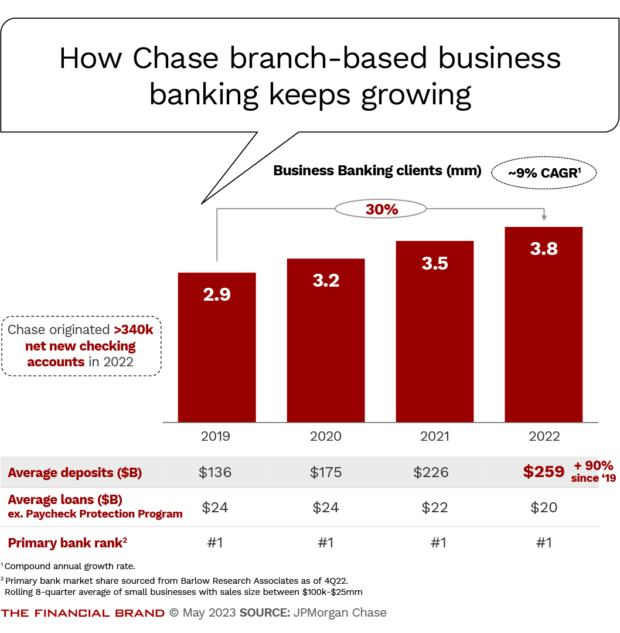

“We can reach more customers over time with the complement of both” digital and branch, said Piepszak, pointing out that the bank has grown its customer base by 8% over the last three years. The digital/physical combination has improved the reach of the branch network, enabling Chase to get better results with less branch density. Its branches serve 30% more customers than they did in 2019.

Chase executives dismissed any suggestions of an either/or proposition.

“We continue to engage customers in their channel of choice,” said Piepszak. “It’s not a binary choice between branch and digital. Most of our banking customers engage with both.”

She added that the two channels “cast halo effects on each other, as we see higher digital account production in markets where we have a branch presence.”

First Republic Acquisition Bulks Up the Branching Juggernaut

This philosophy influences how JPMorgan Chase will be weighing branch strategy in the wake of its May 1 government-assisted acquisition of First Republic. (Except for the data immediately following, charts and numbers from the investor day presentations don’t include First Republic.)

Chase took over 84 First Republic branches across multiple states, “and we’ve looked at every single one of them,” Piepszak said.

A small number will be closed soon because they are close to other First Republic branches. And some are likely to be closed because of their proximity to a Chase branch.

Others that have strong locations or better-than-average footprints will be converted to Chase branches. And some will become specialized Chase Private Client centers, reflecting the upscale clientele that First Republic specialized in. (The centers, an effort under development, give wealth management customers access to specialized advisors.)

Until backend conversions are completed, the acquired bank’s branches will retain First Republic branding, according to Piepszak. (Subsequent to the investor event, multiple publications reported the beginnings of a large layoff and reassignment of First Republic staff, which had been expected.)

Chase already uses some branch segmentation. It has been opening what it calls “community center” branches in historically underserved neighborhoods in various cities. These branches feature specialized staff, including dedicated community managers, small business consultants and home lending advisors.

Read More:

- Jamie Dimon’s 9-Point Plan for Making Banking Better

- 2022 Investor Day: Chase Reveals Its Strategy for Dominating Retail Banking

- How Chase, BofA & Citibank Got Speedier at Digital Transformation

How Branches Enhance Chase’s Sales Flywheel

More than one executive referred to the digital/physical blend at Chase as a “flywheel,” in which continuing to maintain, and even build out, a full-service branch network in 48 states pays off in all directions.

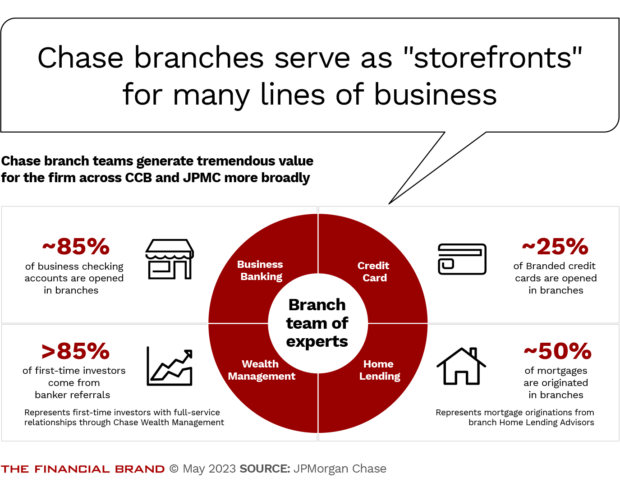

For example, half of new Chase-branded cardholders come from branch signups, as do 75% of mortgage referrals. And 50% of mortgages are originated in branches.

“Our branches serve as the storefront for JPMorgan Chase,” said Jennifer Roberts, the CEO of consumer banking. “We have a saying across our company, ‘Everybody benefits from the branches.'”

“Banking is local,” Roberts said. “We are targeting covering 70% of the U.S. population within a 10-minute drive from our branches, up from 60% today.”

Roberts said that means “you will see us build more branches than we close, which will result in a modestly larger branch network over time.”

Read More: Shakeup in Retail Banking Strategy Spurs Product and Branch Innovation

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Chase Expects More Deposit Share Growth as Aggressive Branch Plan Continues

JPMorgan Chase serves 40 million customers, up 14% since 2019, according to Roberts.

“We are the number one retail bank, based on deposits, and we have extended our lead 60 basis points year over year and maintained primary bank relationships,” she said.

The bank gained 1.6 million net checking accounts in 2022. It’s clearly a bragging point that even in cases where Chase customers have opened accounts with competing online-only banks, management believes it continues to retain primary financial institution status.

“This year, our momentum has accelerated,” Roberts reported. Through the end of April, Chase added 600,000 net new checking accounts, which, with some rough figuring. would put the bank on pace for 1.8 million net new checking accounts in 2023.

Over the last three years, new checking account signups have substantially increased. This is the case for core mass-market checking accounts as well as checking accounts specifically designed for younger and lower-income customer segments.

“Our continued focus on customer growth has allowed us to grow consumer banking deposits by over $300 billion in the last three years — more than any other bank,” said Roberts.

The branch push enabled Chase to increase deposit share in 47 of the top 50 deposit markets in 2022, when compared with the previous year, she said. “We are now number one in 11 of those markets, including the three largest — New York, Chicago and, for the first time, Los Angeles.”

The First Republic acquisition should bolster this new status in L.A., she added.

Still, in 19 of the top 50 deposit markets, Chase has less than 5% share. Roberts put a positive spin on this, saying the bank sees “a $160 billion deposit upside” as its newer branches mature. This includes such markets as Washington, D.C., Boston and Philadelphia. Roberts said that Chase’s deposit production runs six times higher in its more mature markets.

Like the rest of the industry, Chase is seeing fewer transactions in its branches, so it has cut down on staffing to improve efficiency.

“While the value of the branches is clear, the role that they play continues to evolve. Customer adoption of self-serve and digital channels drove everyday branch transactions down by 25% and reduced our total head count in our legacy network by 10% since 2019.”

— Jennifer Roberts, JPMorgan Chase

However, “we have a conviction that people need people, and our branch teams of experts are there to help,” said Roberts. “Two-thirds of our customers visited a branch last year. This is consistent across generations as they seek advice or help with more complex transactions.”

(One point of perspective is that the bank’s consumer and community banking operation saw a 2% decline in deposits in the first quarter versus the fourth quarter of 2022 and a 4% decline versus the first quarter of 2022. Bankwide average deposits were down 8% year over year. During a wrap-up session for the entire investor day program, Jamie Dimon, chairman and CEO, spoke of the uncertainty of deposits in the midst of unfamiliar ground and Federal Reserve strategy: “We haven’t been through quantitative tightening, so we really don’t know what’s going to happen to deposits at all. And that’s why I’ve been quite concerned about that. I’m probably more concerned by quantitative tightening than almost anybody in this room. We’ve never had [quantitative easing] before. We’ve never had [quantitative tightening] before. It just started. And you see huge distortions in the marketplace already.”)

Read More: The Right Way to Balance Digital and Branch Banking

How Chase Credit Cards Benefit from Branches and Vice Versa

The flywheel effect of branches came up multiple times during the JPMorgan Chase investor day. A key benefit, according to Roberts, is the “lower cost to acquire” when an existing customer adds a product, compared with getting a noncustomer to sign up for that product.

For example, applicants for Chase credit cards have an approval rate that turns out to be 17 percentage points higher when they are existing customers with deposit accounts. Likewise, two out of five business owners who carry a Chase business credit card also have a business banking relationship with the company, according to Allison Beer, the CEO of card services and connected commerce.

Beer said that Chase is expanding its Freedom line of credit cards in 2023 with Freedom Rise, a credit card designed for younger consumers just starting out with credit. She said the bank estimates the potential market at 25 million people for the features it will be rolling out selectively in 2023. Distribution through branches will be a key element in the promotion strategy.

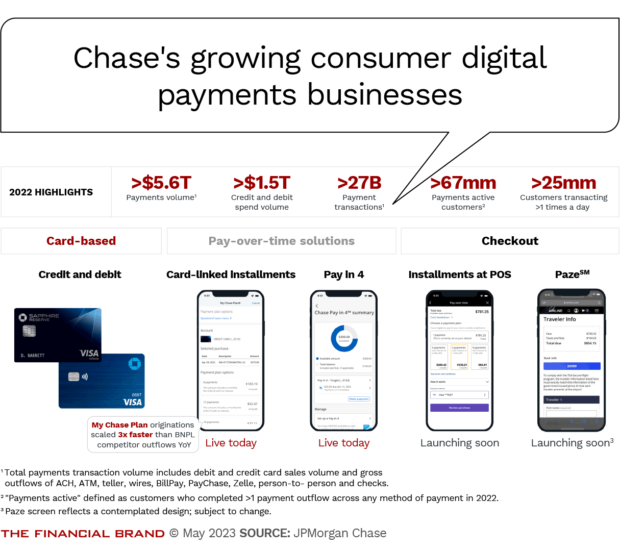

This is a small part of JPMorgan Chase’s continuing rollout of payment products. The bank already offers a buy now, pay later option tied to its credit cards, which it calls Chase My Plan. It has also selectively offered debit card customers its fledgling Pay in 4 BNPL option. Coming soon is a Chase version of BNPL offered at the point of sale, likely similar to offerings by Klarna and other fintechs.

This fall, Chase will also be joining six other major banks in launching the ecommerce-only Paze digital wallet.

All told, Chase’s owned channels, including branches, its website and its mobile app drove 85% of its 2022 acquisition of new Chase-branded card accounts, according to Beer. “And that’s at a materially lower cost per acquisition than available through third-party channels,” she said.

On the flip side, Beer also pointed out that the card operation brings in approximately half of new-to-Chase consumer relationships.

Once they know the bank, she said, “they open consumer bank accounts, they deepen into wealth management, and they deepen into business banking.”

Read More: What Bankers Need to Know About Higher Credit Card Spending & Consumer Debt

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Small Business Relationships Flourish in Chase Branches

The pandemic caused many people to start their own businesses, for various reasons. This trend had been expected to slow down as the pandemic shadow lifted, but Ben Waller, CEO of business banking within the consumer and community banking division, said it has had staying power.

“There are now over 40 million small businesses in America, a new record high,” said Waller.

Branches are important to this customer segment, as evidenced by the fact that nearly 6 million small business owners already use Chase branches to do their banking, he said.

A key advantage of growing this customer segment is deposits, due to the need small businesses have for operating accounts.

“Eighty percent of those balances are held in noninterest-bearing checking accounts,” Waller said. “Many of those deposits stay with us through the rate cycle because clients are using them to run their businesses.”

Offering small businesses something beyond the same old, same old business checking is critical as fintechs on the prowl are becoming specialists in this area. One wrinkle that fintechs have been adding to business accounts is built-in invoicing features. This ranges from simple add-ons for business banking apps to more sophisticated accounting systems that hook into bank accounts.

“Later this year we’ll embed invoicing capabilities directly into our core account functionality,” said Waller, “so our business clients can collect revenue right from their banking experience.”

Of course, that feeds the flywheel too, bringing more deposits directly into Chase.

More from JPMorgan Chase Investor Day: JPMorgan Chase’s Jamie Dimon: What It Takes to Be an Effective Banking Leader

For interested readers: Since the event, the company has set up a JPMorgan Chase Investor Day page with highlights videos and full videos of each major section, along with transcripts and presentation materials.

From the archive: Why Chase Bank’s CEO Loves Branches, Admires Bezos & Questions Facebook