The proliferation of ads for higher CD rates is fomenting a fear of missing out.

Consumers are looking around at all the account offerings available and increasingly questioning whether they have the best mix of financial products, says Jennifer White, senior director of banking and payments intelligence at J.D. Power, citing findings from the 2023 U.S. Retail Banking Satisfaction Study.

Those questions could spur people to move deposits if their banks fall short on providing customer service and offering value, White says. Both areas are critically important to focus on at this point as the dynamics affecting customer retention are shifting.

Satisfaction with account offerings dropped by five points on J.D. Power’s 1000-point satisfaction scale, White says. The score this year was 622, down from 627 in 2022.

The annual J.D. Power survey, fielded from January 2022 to January 2023, gathered responses from 101,400 retail customers of U.S. banks, ranging from megabanks to midsize ones that had at least 45 branches. The survey measures satisfaction across seven factors, including trust, problem resolution and overall convenience. Account offerings showed the largest year-over-year decline in satisfaction.

White believes this arises from customers wondering if they should seek a better rate somewhere else. After the Federal Reserve began raising its benchmark rate last year, consumers began to see a flood of compelling offers for high-yield savings accounts and certificates of deposit.

“To use a colloquial term, it’s FOMO; it’s the fear of missing out,” White says. “Because all of this is happening around them, it leads to increased questioning about whether the account is right.”

Customers aren’t ready to leave their banks entirely, White says. However, they are willing to shift some of their deposits to other institutions.

The survey points to some strategies banks can use to counter this trend, though.

Accelerate Time-to-Market with Rapid Implementation

Create a sustainable competitive advantage with faster time to market by drastically reducing implementation time.

Read More about Accelerate Time-to-Market with Rapid Implementation

Community Bankers’ Top Priorities This Year

CSI surveyed community bankers nationwide to learn their investments and goals. Read the interactive research report for the trends and strategies for success in 2024.

Why Bank Customers Are Moving Deposits

J.D. Power tracks outflows on a monthly basis through a pulse survey gauging the share of customers and deposits that moved in the last 90 days. In April, 29% of customers said they had moved, on average, 39% of their deposits. In March, it was 30% of customers moving 40% of their deposits, according to the firm’s research.

For the April pulse survey, the top three reasons (not counting those who moved money to cover a bill or other payment) were: higher interest rate (29%), cash back or other rewards (20%) and a better savings program at the new bank (18%), White says.

“In order to combat deposit movement among rate chasers, banks must demonstrate and over-communicate their value proposition to customers,” she says.

Customers aren’t just thinking about rates, though. The comfort of a familiar brand and a better digital experience are also motivators. J.D. Power’s February pulse survey indicates nearly half of customers, or 48%, look for brands with which they are familiar, while just under a third, or 31%, look for good digital tools that help manage their spending. That is potentially good news for traditional banks and credit unions trying to match the rates dangled by their digital peers.

“There’s a few people who are really going to focus on rate-chasing,” she says. “But a lot of people are being more cautious.”

That’s not to say their expectations outside of rates are easily met. As in past surveys on satisfaction, J.D. Power found customers are looking closely at what financial institutions can do for them in the areas of customized advice and personal financial management. “Will you chase another half point in interest if your bank will help you with your financial life? Maybe not,” White says.

Still, when customers with deposits of at least $10,000 start to use more than one bank, they are more likely to be dissatisfied with their original bank, according to J.D. Power’s 2023 survey. The overall satisfaction score for those with savings at just their primary bank is 678, compared with 667 for those who also have savings with another provider.

Providing Support and Advice Matters to Bank Customers

In the past, the most important indicators for bank satisfaction were measures of convenience, such as wait times in branches and consistent availability of a mobile app, White says. “It’s now about how are you wrapping your arms around me and supporting me with some form of value beyond rate.”

However, banks in general do not appear to be doing a great job with this, or at least a memorable one. Only 21% of bank customers recalled receiving any advice or guidance from their banks in the last 12 months, White says.

Of those who recalled the advice, only 10% said the bank’s advice met their needs, defined as offering a clear call to action, being relevant and robust, and showing some sense of empathy, White says.

The top performers in the category for providing advice are Capital One and Bank of America, White says. BofA delivers advice through its virtual assistant, Erica, while Capital One stands out for using concise, easy-to-understand communications. “Their description of what something means is rarely more than a few sentences,” White says.

Customers also are more satisfied with a bank’s advice when they hear it from a branch employee, according to White. The satisfaction score for advice from a branch was 710, compared to 682 for advice delivered digitally, though digital advice was more common. Nearly two-thirds of those who received advice, or 63%, said it was through digital channels, such as email, mobile apps and virtual financial assistants, compared with 28% from a branch. Other channels they cited include phone calls and physical mail.

The findings suggest both a need to improve advice delivered digitally but also to remind customers that branches aren’t just for transactions, White says.

Dig Deeper:

In What Ways Do Customers Expect Banks to Help?

Customers don’t just want advice, however. They also want tools to act on what they learn.

No one likes paying foreign ATM fees, for example, even if they understand that those fees exist. But a bank’s mobile app ideally should make it easier to find fee-free ATMs, White says. “It’s a basic example, but it’s about this idea of, ‘I don’t expect to get everything for nothing. But make it easy for me to avoid the consequence.'”

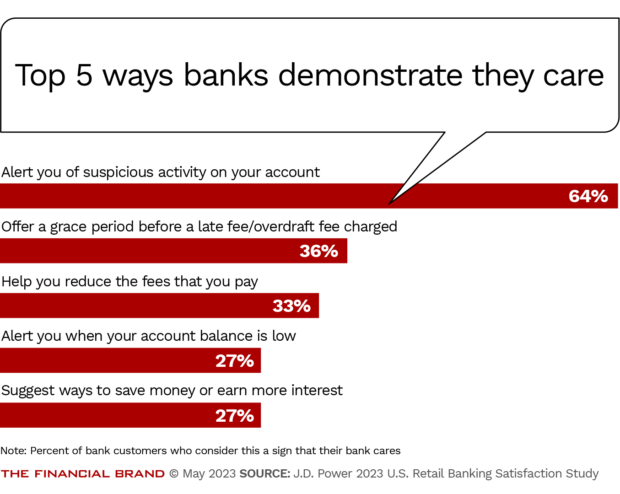

A similar logic applies to overdraft fees. Customers appreciate it when banks waive the fees. But customers are more satisfied with their banks when they learn how to dodge fees in the first place, such as through alerts that indicate an account balance is running low or through guidance on how to link accounts to avoid overdrafts. In those cases, customer satisfaction scores jump 166 points on J.D. Power’s 1000-point scale, while trust scores jump 172 points.

“It’s about knowing that you have a partner,” White says.

Read More:

Branch Use Up, Branch Experience Lacking

Banks have been trimming their branch networks for years. However, the J.D. Power survey shows customers still aren’t ready to abandon bricks and mortar. Overall, 43% said they prefer to use branches, though they occasionally use digital channels too.

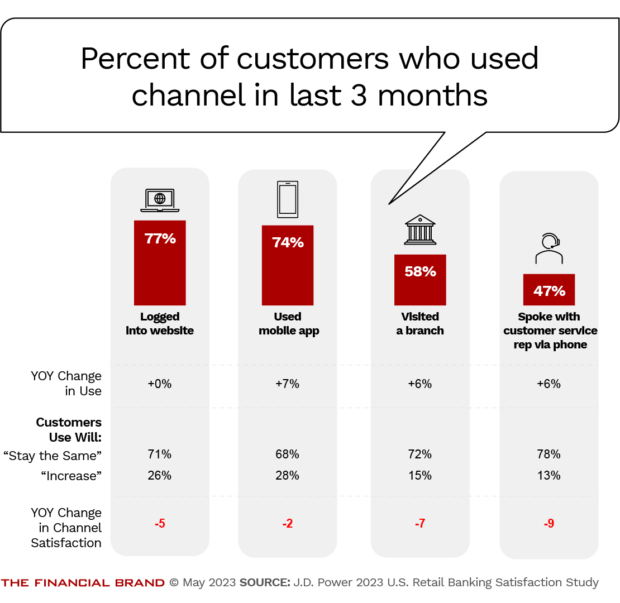

Among the bank customers surveyed in the November 2022 through January 2023 time period, 60% had used a branch in the last three months, slightly higher than the pre-pandemic average of 57% in 2019. Nearly three quarters of those surveyed, or 72%, said they expect no change in the frequency of their branch visits, while 15% expect an increase.

Just under two-thirds of customers visiting a branch did so to deposit money, withdraw cash or conduct other transactions, White says. A smaller portion, 14%, drops in to resolve problems, while 8% are there to open new accounts and 7% are seeking advice.

The number of advice-seekers ticks up slightly to 8% for people under 40, suggesting they are following up their digital research with in-person visits, White says. “For a very long time, our industry thought about in-branch versus digital almost combatively,” White says. “They really are complementary services.”

The challenge for banks is to create a seamless experience for customers that cross channels, she says. If a customer walks out of a branch with advice, they should be able to go online and act on it. If a customer starts a process online, they should be able to pick that up again at a branch without having to start all over again, White says.

Average wait times at branches edged up to 4.6 minutes, from 4.4 minutes a year earlier. But the survey shows some simple tactics — like branch staff calling customers by name and thanking them for their business — can dramatically improve satisfaction, with the impact being especially notable when the wait exceeds 4 minutes. Customers who received advice also rated their branch experiences more highly.

Read More:

The Remedy for Trouble Ahead: Exceed Expectations

At the same time, the J.D. Power retail banking survey points to some trouble. Customer satisfaction with banking convenience fell three points between 2022 and 2023.

White chalks it up to challenges posed by branch closures and staffing shortages. She also suggests inconsistent reliability of digital services — and technical glitches — may be a factor.

The danger is that hassles like standing in line, waiting on hold or failing to connect on a mobile app can be so much more consequential these days. They can prompt customers to look for another banking provider for at least some of their deposits, White says. “All of those foundational elements, in a rate-chaser environment, have a heightened possibility of a negative outcome when they go wrong.”

Now is the time to exceed expectations, she says.