The phrase “coast-to-coast” frequently comes up when executives at PNC Financial Services Group talk about the super-regional bank’s reach. That kind of scope has been an ambition of Bill Demchak, chairman, president and CEO, as he seeks increasing scale to remain competitive. Today, the $562.3 billion bank operates in all 30 of the nation’s largest metropolitan areas and has branches in over half of the states. About 2,300 branches make up PNC’s network.

But in the company’s latest news, it is looking inward, rather than outward.

In mid-February, PNC announced that it will spend almost $1 billion between now and the end of 2028 on opening more than 100 new branches in certain existing markets and renovating more than 1,200 locations nationwide. It’s making this investment after having trimmed non-branch real estate by 17% during 2023.

Among the cities that PNC has slated for additional branches are Austin, Dallas, Denver, Houston, Miami and San Antonio.

The company is drilling down in territory it knows, rather than opening up branches in new cities or states. This is a matter of prioritizing the investment to best advantage, says Jeff Martinez, EVP and head of branch banking, in an interview with The Financial Brand.

“We’re not trying to spread our investment over more things, like peanut butter,” says Martinez. “We didn’t announce 100 new branches in 100 new areas. We announced 100 branches within our existing network, in places where we have been winning, and to build market share.”

In spite of its success in digital channels, PNC remains convinced that physical proximity can be essential to growth.

Read more: The Great M&A Debate: Regional Bankers Argue the Need to Buy Scale in 2024

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Martinez says that Texas is a good example of a market where branch share goes hand in hand with market share. Austin, Houston and Dallas are markets where San Antonio-based Frost Bank has been executing on aggressive branch plans. [Dig Deeper: “Touch of Frost Spreads Over Texas, with More Branching and Marketing in the Forecast”]

“We have a playbook that’s been vetted and has been executed with year-over-year success,” says Martinez. “That’s what enabled us to come out with this announcement.”

Some commentators have pointed out that the announcement by PNC — and the still-larger plans at JPMorgan Chase to open 500 new branches over the next three years — don’t mention that both institutions have also been closing branches. PNC filed over 80 applications to close branches with the Comptroller’s Office in 2023, for example, and reportedly shuttered 239 branches.

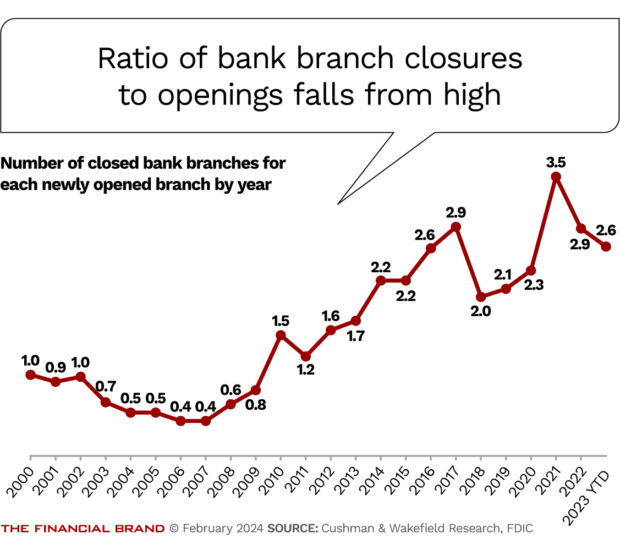

Recent research by Cushman & Wakefield, the commercial real estate services firm, suggests that a new balance is developing between closures and openings, as shown in the chart below. At the end of 2023 2.6 branches closed for every one that was opened. This is a shift from the 3.5 closure/opening ratio seen in 2021, but much stiffer than the 1 to 1 ratio seen in 2000.

What PNC Strives for with New and Renovated Locations

Martinez says PNC generally chooses markets where a new branch will be able to show a profit within three to five years. He says the timing of that threshold can vary depending on the size of the office built for that neighborhood and the costs of staffing. PNC attempts to project the volume of customers who will be seeking advice, based on community feedback and other market research. More demand means more advisor-bankers and thus somewhat more space.

PNC’s philosophy calls for branches to increasingly be “centers of advice,” rather than places for transactions. The bank’s standard today calls for a small number of tellers, ATMs and ITMs with remote tellers to handle routine matters.

Other institutions have attempted to downsize staff in newer concept branches by implementing “universal banker” programs that train branch bankers to be jacks of all trades. Martinez says management believes this dilutes the point of having trained advisors in the branches.

“We make the added investment to be sure that our bankers are bankers, really focused on financial wellness conversations, focused on advice, and not subject to a ton of distractions that may come with doing more cash handling,” says Martinez. The advisors book appointments with customers and also handle walk-ins.

Read more: Trends 2024: Is Record-Breaking Pace of Bank Branch Closures Easing?

What Makes a Likely Site for a PNC Branch

Martinez spoke with The Financial Brand from a new branch in Kendall, Fla., that had had a soft launch a few weeks beforehand and which was about to have grand opening. He said the office, part of the greater Miami market that the bank plans to expand with the 100-branch push, is a good example of what PNC looks for in a site today.

Some classic basics, like good parking, continue to be important, but the bank pays more attention than ever to environs. The Kendall location is part of shopping center that includes some restaurants and a Publix supermarket.

“These are destinations for our clients and so we want to be where our clients are today, to fall in with their natural current habits,” says Martinez.

Not all siting will be such a slam-dunk based on current traffic patterns. Martinez says in some cases PNC will be putting new offices in places where market research and community consultation suggest there will be substantial demand in a couple of years.

“There’s value in planting that first flag,” says Martinez.

Read more about branching issues:

- Why Bank of America Is Covering the Country with Branches

- JPMorgan Chase Defends Contrarian Branch Strategy as Deposit-Gathering Machine

- How to Downsize Branches Without Losing Prime Locations

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Renovations to Older Sites — and Massive ATM Network — Fills Out the Effort

Renovations for the existing 1,200 branch locations covered by the $1 billion plan will vary from office to office. Martinez says some newer locations won’t need as much — perhaps some paint — to fit PNC’s current retail banking approaches. But there are other, older parts of the branch system that may be as many as several decades old that will need much more work. (Martinez adds that about 800 locations have already been renovated ahead of the latest push.)

“We want to create a very similar PNC experience, whether you are in a branch that’s been renovated that’s been around for 10 years or one that was created 10 months ago,” says Martinez.

Outside of the branch network, PNC has a “fleet” of owned and branded ATMs in all 50 states and Washington, D.C., that help fill in the gaps where customers still need cash but don’t have branches available.

“It makes you feel like you’re in a place where PNC is, even though we may not have brick and mortar,” says Martinez. At the other end of channels, he points out, the bank’s digital outreach has had extensive investments to stay on the leading edge.

Read about the ripple effects of the big banks’ plans: Moves By Chase and PNC Re-ignite the Branch Versus Digital Debate