Over the years, Apple’s retail hubs have become more than just another store: It’s an experience so central to the brand that it is a product of its own. That modern aesthetic, intuitive technology and knowledgeable staff now influence consumer expectations at bank and credit union branches across the country. How should institutions respond?

It’s clear what made Apple stores successful, but it’s much harder to explain why they so outcompeted competitors. If you visited the Mall of America near Minneapolis in 2015, for example, you’d see a Microsoft store across the hall from an Apple store. Open spaces with glass walls, tables filled with state-of-the-art tech and staff standing ready to show it all to you.

Yet, we know Apple stores boomed and Microsoft permanently closed most of its retail locations in 2020. Both had a modern aesthetic, prime location, and the latest tech, but not the same outcome.

Apple’s success suggests people appreciate its stores. But the Apple-Microsoft faceoff suggests banking executives should look even deeper. What makes a modern branch filled with new technology (such as ITMs), or new design elements (such as teller pods) more successful than another?

Fortunately, institutions like ORNL Federal Credit Union have firsthand experience to share. The credit union, based in Oak Ridge, Tenn., has worked now for more than a decade to modernize its branches, notably moving out of grocery stores and into full-service branches equipped with the latest technology and design elements, such as interactive teller machines (ITMs) and teller pods.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

How ORNL Federal Credit Union Introduced Branch Technology

ORNL has been modernizing and consolidating its branch network since 2013, when Colin Anderson became president and CEO. That includes the acquisition of two new branches in new charter counties and remodeling 12 locations.

ITM installations were a key part of the credit union’s initiative. In fact, the $3.4 billion credit union was the first institution in its market to deploy interactive teller machines. It now has more than 50 ITMs spread across more than 12 of its 28 branches throughout its 19-county service area.

“People do not get out of their car to come into a lobby and use a machine,” Anderson tells The Financial Brand. “They’ll do it through the drive-up, but they won’t do it in the branch. When they come into a branch, they want to see a person.”

ORNL created processes to guide everyone, staff and members in using ITMs for the first time to provide the firsthand experience and the increased adoption that comes with it. When it added the machines to its drive-thru, ITM staff – those who would soon engage members through the ITM – traveled to the branch to train onsite teams and to guide members in their use in person.

Anytime ORNL opens a new branch with an ITM, it uses the same training process. “It really pays dividends,” says Anderson. “[Members] end up talking to those same agents, and they agents see common questions from the members’ perspective. It’s been really successful for us. Our members like the ease of use they get from ITMs.”

For ORNL, branch re-imagination did include closing six locations. “In the process, we ended up with fewer branches,” says Anderson, “But bigger branches, more progressive branches, and more full-service branches. We’re doing better actually; we’ve been able to invest back in our branch network.”

Designing Branch Upgrades for Success

ITMs upgrades are a strong example of a branch upgrade that provides compelling cost savings when they are used by customers or members. Through live video interactions with a teller available 24/7, institutions are using ITMs to reach new markets or infill others. Since the ITM tellers are staffed for transaction volume, institutions can provide branch services across a wide footprint even when the doors of the physical branch are closed.

The open question is: How does branch design help ensure they are used?

Institutions can step on their own toes when branch decisions focus too much on cutting expenses, says Neil Kool, CEO at Structure First. When Structure First consults to institutions, it becomes their branch project manager and looks at decisions with an eye for what creates return on investment.

ITMs can seem successful, even when they go unused. Kool has observed customers reporting high “efficiency,” when the data really indicates low account holder adoption. “I’ve seen institutions running 30 ITMs with one teller,” Kool shares. “We drove around to observe the branches and it became clear how that was possible. There were lines for the deal drawer, and no one was going to the ITMs.”

In-branch ITMs face the same challenge. “People will choose what they know if given the option,” Kool says. “The key is to provide a great experience as you familiarize them with the technology.”

Low adoption for ITMs in the branch can also mean the institution is missing a key role. Executives “might consider removing branch staff when [customers] go to an ITM teller line,” Kool observes, “but we find ITMs are most successful when someone, like a universal banker, walks visitors over and introduce them to the process.

You can sunset the greeter but don’t sunset the greeting. With that guidance from staff available, ITMs can – and should – become the only option for transactions at drive-throughs or in the branch.”

Managing Unknown Unknowns in Branch Projects

There’s always risk with major branch changes. Will the expenditure provide the desired ROI?

Whether it’s a technology investment such as an ITM or other branch modifications, there are a lot of unknowns — even with good underlying data, internal analysis, and assumptions. “There is a little bit of a leap of faith,” says Anderson. “For all the work that you do, you never know until you open whether you made the right decision.”

Part of the challenge for financial institutions is a lack of internal expertise. Few have “building experts” who can provide the necessary recommendations for a remodel, new build, branding, or technology investment. Because the branch projects can be very expensive, institutions feel the added pressure to be on time and on budget.

“There is a little bit of a leap of faith. For all the work that you do, you never know until you open whether you made the right decision.”

— Colin Anderson, ORNL FCU

ORNL partnered with Structure First to help with branch projects from site evaluation to architecture design to construction management. “They challenge our thinking,” says Anderson, “They challenge what we want to do with the branches. They’ve been a really good sounding board.”

Major changes may be required to upgrade branches. “If a location is very transactional, and not an advisory center, you probably only need to upgrade paint and carpet,” Kool says. “As someone with a banking background, I would prefer that the institution didn’t spend money. Whether ITMs, pods, or the latest technology, I always say… look in the mirror and understand whether you can operate this way.”

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Does Updated Branch Technology Pay for Itself?

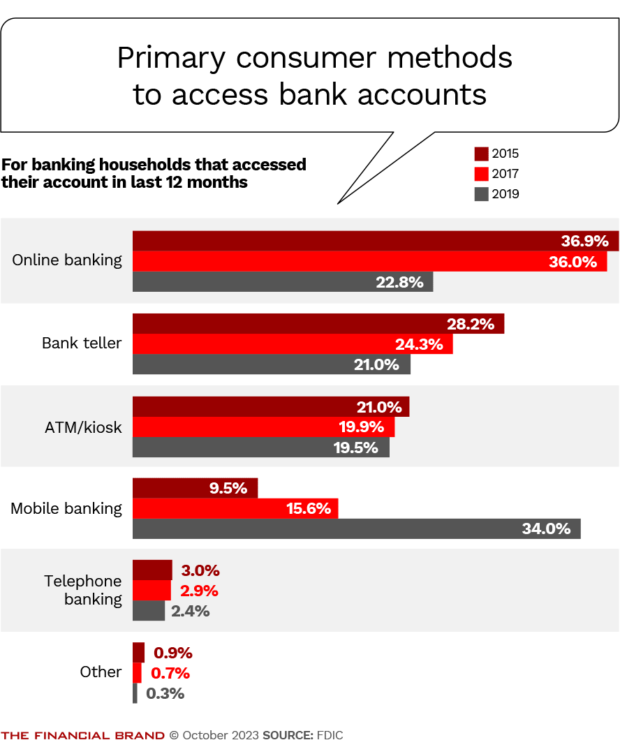

Foot traffic within the branches has undoubtedly changed, as reflected in the FDIC’s latest survey on household use of banking and financial services in 2019. The survey found mobile banking overtook online banking as the primary method of account access. (The agency conducts the study biennially with 2021 results yet unpublished.)

The popularity of digital baking options with customers and members has left many financial institutions shuttering low-transaction branches in the last decade. Some now find that the right design lowers costs associated with transactions while originating significant volumes in loans.

Five Star Credit Union, headquartered in Dothan, Ala, for example, found branches equipped with right technology, layout and processes delivered marked results, according to Tyler Beck, senior vice president and COO, in a recent interview with hardware provider QDS.

“We rolled out [ITM teller lines] and started focusing on member engagement and lending,” Beck said. “We went from one year of submitting $10 million in loan applications at the front line to $30 million the next year, because we were able to focus those on those conversations and engage with the members.”

The credit union started installing ITMs back in 2018. “We did this without fully understanding what we were jumping into,” Beck says.

“We rolled out [ITM teller lines] and went from one year of submitting $10 million in loan applications at the front line to $30 million the next year.

— Tyler Beck, Five Star Credit Union

At the time, the ITMs were rolled out in the branches, Five Star Credit Union had around $450 million in assets. Today, the credit union is $773 million in assets. Beck attributes some of this to the deeper relationships and better conversations that frontline employees were able to have with members.

“Technology is there to help people do the people part better,” asserts Farrell. “Strategically, you want to get the right staff. And the right staff, if given the right technology, don’t have to be the people that understand all of the balancing and compliance. You have tools that can do that for them so they can focus on the important stuff.”