Financial institutions globally are redefining how customer experiences can be enhanced and channel engagement increased. The role of the branch is at the epicenter of this discussion, as organizations focus on creating tech-enabled, integrated ecosystems. Most importantly, banks and credit unions must support channel agnostic delivery where data and applied analytics allow a customer to determine when and where to engage without a change in service levels.

According to a report by the Economist Intelligence Unit (EIU), there may be a number of radical changes on the horizon around how products and services are delivered and how transactions are processed. In addition, there appears to be a commitment to integrating technology and humans for an enhanced experience.

The report incorporates data from over 300 senior global banking executives. Key findings include:

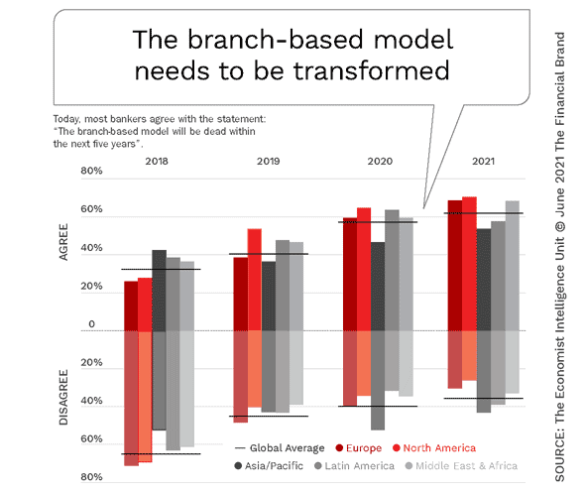

- 65% of bankers believe that the branch-based model will be “dead” within five years, up from 35% four years ago.

- 81% of bankers believe that banks will seek to differentiate on customer experience rather than products and location.

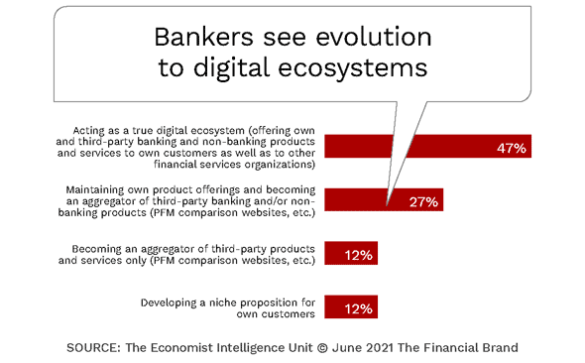

- 47% of financial institution executives expect their businesses to evolve into digital ecosystems over the next two years — partnering with both banking and non-banking third parties.

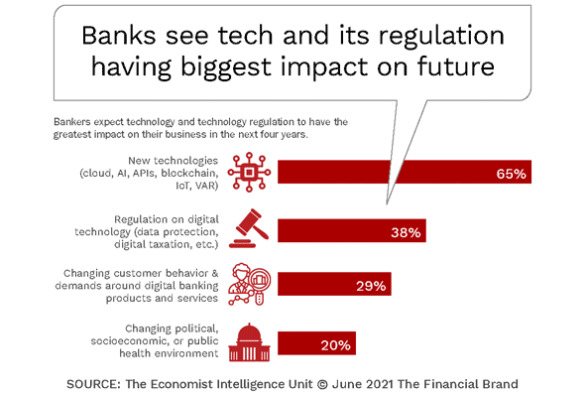

- 65% of financial institutions view new technologies as the biggest driver of change for the next four years, compared to 42% three years ago.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Has the Pandemic Doomed Legacy Branch-Based Banking Model?

The exodus of customers using physical branches started way before the pandemic, with consumers in all age categories embracing digital alternatives to save time. While not all digital experiences have been simplified to the degree needed to compete with fintech and big tech players, the pandemic accelerated the trend away from physical engagement.

In the survey, conducted in early 2021 by the Economist Intelligence Unit (EIU) on behalf of Temenos, just under two-thirds of banking executives agreed that the branch-based model will be “dead” within five years. This is a dramatic increase from the 59% last year and 35% in 2018. While a rethinking of the branch-based model does not necessarily mean all branches will be closed, this trend does reflect the impact of digital financial alternatives provided by both traditional and non-traditional competition.

Bankers’ belief that the traditional physical distribution model is at risk is a reflection on how the consumer responded to the pandemic across all industry sectors. As people have become more comfortable with intelligent digital engagement in retail, entertainment, hospitality, travel and even food services, the search for digital alternatives to traditional financial services expanded. The result has been an influx of fintech start-ups, new payment alternatives, improved delivery of deposit and lending products, and super app platforms from tech giants that are driving new business models from legacy banks.

The Future Includes Differentiating on Experiences

Traditionally, banks and credit unions have responded to the influx of new digital banking alternatives by trying to drive internal costs down. The reality was that these improved cost structures could only go so far, and would never match the low cost of operating a digital-first fintech operation.

Today, far more organizations have come to the realization that the consumer is looking for value in every commercial relationship. In other words, most are willing to pay a bit more for an exceptional experience (this is why Amazon is able to charge over $100 for Amazon Prime). This has resulted in more financial institutions prioritizing the delivery of exceptional experiences.

According to the EIU research, financial services executives globally stated their top priorities were improving the customer experience, mastering digital marketing, moving engagement to digital channels and improving product agility as the top priorities in the future.

Building Digital Ecosystem will Require Third Party Collaboration

Since the majority of legacy financial institutions are not structured to become nimble digital players, many have opted to collaborate with either established fintech providers and/or third-party solution providers that can accelerate the digital transformation process. By avoiding the ‘detours’ that can occur by building from scratch, banks and credit unions can become more agile and reduce costs as well. These collaborations can also help with the rethinking of back-office processes and operations that create barriers to delivering fast and easy digital solutions.

According to the report, 38% of banks are innovating through investing in (25%) or acquiring (13%) fintech startups, while 24% report participating in sandboxes to test new propositions. Far higher numbers are building improved experiences with the help of specialized solution providers.

The result of this focus on agility and expansion of digital capabilities is close to half of survey respondents expect their business to evolve into true “ecosystems” over the next two years. Beyond simply providing financial services, many organizations see themselves as part of a broader solution set — participating or leading in the development of a ‘super app’ platform. The research also found that 31% reported leveraging open banking initiatives, giving customers the ability to connect bank data with third-party providers.

Increasing the Focus on Technology

With the need to deliver an improved digital experience being at the forefront of priorities within legacy financial institutions, leveraging new technologies is viewed by 65% of respondents as the trend that will have the biggest impact on financial services for the next four years. This is an increase of more than 50% over the percentage of financial institutions who answered this way just three years ago. Executives also believe that regulations around new technologies will also have a major impact on business while changing customer behavior is expected to have a much less significant impact.

Interestingly, just over a quarter (27%) of survey respondents report focusing investment on cloud technology despite the fact that 59% believe bank-owned data centers may no longer be relevant. This is a paradox that is difficult to explain.

Technology, innovation, collaboration and a rethinking of legacy banking business models will all be required to achieve competitive differentiation in the future. There will be a continued (if not increased) threat of disruption from small fintech firms and the largest digital platform providers as the consumer demands even more from financial institutions. The question is: Will traditional financial institutions respond to these threats with the speed needed to succeed?