The ongoing debate over the future of branches in an increasingly digital banking world just got even more complex. Data from J.D. Power & Associates confirms that consumers that conduct their banking only by digital means are actually the least satisfied of all those surveyed. The most satisfied consumers are those who regularly use branches and also use digital channels.

The findings also reveal that although mid-size financial institutions trail the largest banks in overall satisfaction among consumers under 40, they have stronger branch-satisfaction scores than the largest institutions, which may provide them with an opportunity to improve their competitive position.

Two other findings illustrate the complex and sometimes seemingly contradictory state of retail banking today:

1. The percentage of consumers now banking digitally continues to rise — yet nearly three quarters continue to use branches along with digital channels.

2. The biggest banks have a higher percentage of digital-only customers and offer advanced online account opening where customer satisfaction is are improving. Yet they fall short in measures of in-person customer experience, where mid-size banks have an advantage.

These findings underscore that digital and branch capabilities are “still very much married,” stated Joe Wheeler, Senior Director, Mid-Size Bank Practice Lead at J.D. Power, during a presentation at The Financial Brand Forum. Wheeler’s presentation was based on data from three J.D. Power studies representing about a quarter million consumers.

Read More: Branches Still Dominate, But Banks Won’t Need as Many to Compete

Wheeler observes that mid-size banks and credit unions don’t lag that far behind the biggest institutions in certain digital capabilities, including mobile banking. (The research firm considers “Large” to be banking institutions above $250 billion in assets; “Regional” from $51 to $250 billion; and “Mid-size” from $2 to $50 billion.) Wheeler believes mid-size institutions should press the advantage they currently have in a superior in-person customer experience.

Customer experience demands much more than simply shorter wait times, Wheeler states. It must encompass understanding and explaining products and fees, clear and timely communications in consumers’ preferred channel, and relevant advice taking into account each consumer’s situation. While mid-size banks and credit unions have better branch-related satisfactions scores, they are far from where they need to be on many of these points.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Mobile Usage Up, Satisfaction Flat

During the period from April 2017 to July 2018, the level of satisfaction for the three primary banking channels — branch, online and mobile — held steady over the study period with a slight uptick for in-person. Wheeler notes that mobile satisfaction has been flat for the last six quarters despite a great deal of investment by the industry.

“The reason for that,” he says, “is that mobile banking — and digital banking in general — is considered table stakes now. People have come to expect it.”

Consumers who say they’ve used a particular channel in the previous three months breaks out this way:

- Used online banking 76%

- Visited a branch 66%

- Used mobile banking 52%

Overall consumer usage of online and branch channels was down slightly, while mobile banking usage increased four percentage points, during the study period.

Read More:

- Why Banks’ Digital Sales Efforts Still Aren’t Working

- Bank Branches: There’s No Going Back

- It’s Time for Banking Providers to Stop Faking Digital

Branch-Dependent Consumers Are The Sweet Spot

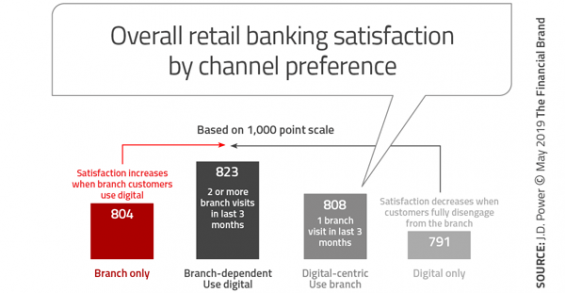

J.D. Power divides up U.S. banking consumers into four broad categories.

- Branch-only customers — 10%. No use of online or mobile banking in the last three months.

- Branch-dependent digital customers — 44%. Used branch two or three times in the past three months and also used online or mobile banking (10.2 digital interactions per month).

- Digital-centric branch-using customers — 13%. Use branch one time in the past three months and also used online or mobile banking (9.2 digital interactions per month).

- Digital-only customers — 28%. Only used online or mobile banking (9.7 digital interactions per month).

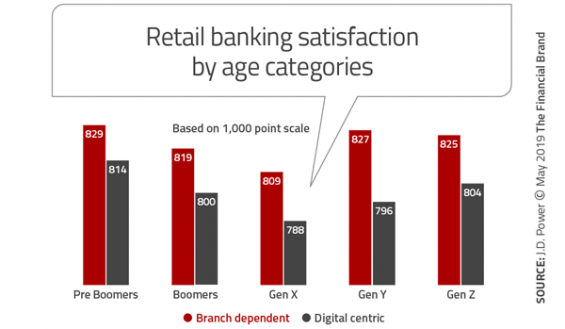

Wheeler says the branch-only crowd skews older, most typically what he calls “Pre-Boomers” (born roughly 1930-1945). The digital-only crowd, no surprise, are heavily Millennials. He considers the 44% branch-dependent-digitals to be the sweet spot for bank and credit union marketers. Remarkably, the data show that those customers do more digital transactions per month than the digital-only segment.

Mid-size banks have a greater percentage of branch-dependent-digital customers than the biggest banks (52% versus 41%), and double the percentage of branch-only customers (16% versus 8%). Regional banks fall between the two in both categories.

The largest U.S. banking companies, by contrast have almost double the percentage of digital-only customers than mid-size banking providers (32% versus 17%).

THE KICKER: Branch-using consumers are far more satisfied with their banking provider than digital-only consumers, based on J.D. Power’s customer satisfaction ranking. Further, that bias is seen in every age category. Branch-dependent Millennial and Gen Z consumers are only slightly less satisfied than Pre-Boomers.

“Retail banking is still very much a contact sport.”

— Joe Wheeler, J.D. Power

“The customers who are least happy with their institution are those who are digital only,” says Wheeler. “Retail banking is still very much a contact sport. The dissatisfaction from digital households tells us they do not feel they have a relationship with their primary financial institution.”

Explaining that further, Wheeler says, “They’re less likely to feel communications and interactions are consistent; less likely to believe that the information received during their most recent contact was tailored to their needs; and they don’t recall receiving advice or guidance.”

Where Mid-Size Banking Institutions Own An Edge

Millennials represent “money in motion,” as Wheeler puts it. They tend to switch financial institutions at about a 12% rate, the highest of any generation, according to J.D. Power data.

That would suggest that banks and credit unions overall must boost their digital banking game to a higher level to increase consumers’ — particularly Millennials’ — satisfaction with the digital banking experience. When comparing the industry’s offerings in general to those of the big tech companies or many fintech providers, many experts would agree with that conclusion.

Yet Wheeler looks at the data a little differently.

“I do not mean to diminish the importance of digital banking in any way,” he states. “It’s here and it’s growing.”

However, Wheeler contends, the way for mid-size institutions to move more consumers to a digital platform — and in a way that keeps them satisfied —ironically is through the branch. Why? Many people still visit branches. Three quarters of Millennials and the emerging affluent say they visited a branch in the last three months, according to the research. (“Emerging affluent” is defined by J.D. Power as under 40 years old making over $100,000, with $50,000 of investable assets.)

This behavior is an advantage for mid-size institutions. The researcher’s data show that these financial institutions strongly outperform big banks on all branch-related satisfaction factors, including courtesy, knowledge and range of services.

This is not a diminishing asset. Wheeler states that Millennials are coming back into the branches as they grow older and their financial needs become more sophisticated. Banks and credit unions need to be sure their staff has the training and knowledge to offer the quick tips that matter most to these important consumers — and, importantly, tips that focus on their life events. Milestones include marriage, buying a home, having a child, divorce, new business.

REALITY CHECK: The failure of their primary financial institution to recognize consumer life events and respond appropriately is the number one reason people leave their banking provider — it is doubly as important as digital capability.

“People are not looking for a certified financial planning discussion with you,” the analyst adds. “What they want you to portray is that you’re taking their situation into account.”

Read More: How to Avoid Sagging Satisfaction Scores As People Bank More Digitally

Big Benefits from Providing Relevant Advice

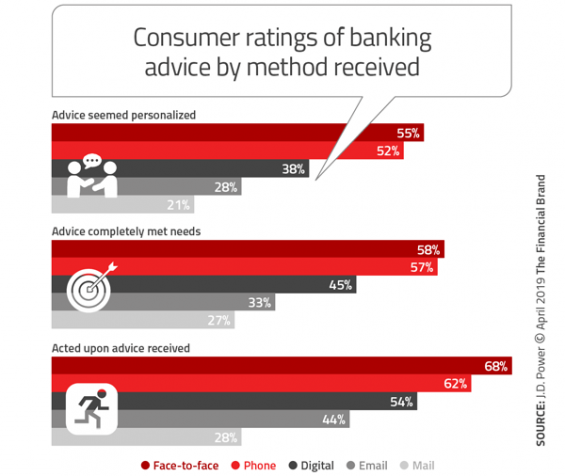

There’s a tendency for front-line banking staff to be focused on efficiency — the idea being that customers just want to get in and out of the branch or off the phone as quickly as possible. Sometimes that’s true, Wheeler observes, but the research shows that many people are interested in receiving advice relevant to their situation, and they will stay for it.

“They want to have a conversation,” he says.

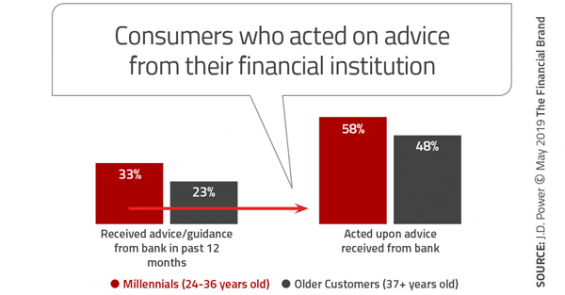

Overall more than three quarters of emerging affluent Millennials say they are interested (35%) or very interested (43%) in receiving advice from their bank or credit union. A third say they received advice or guidance in the last 12 months and, of those, more than half (58%) actually acted on it, according to J.D. Power’s data.

According to Wheeler, data show there’s a 17% positive impact on consumers’ willingness to use additional banking services if they think they’ve received relevant advice or guidance. This can include:

- Mentioning ways the institution can help with other financial needs.

- Communicating in the manner the consumer prefers (email versus phone or mail, for example).

- Identifying needs before offering a product.

- Educating the person about product features and benefits.

- Ensuring there is full understanding of the fee structure.

How to Overcome a Digital Deficiency

Despite the fact that mid-sized banks and credit unions depend on their core technology providers for their mobile apps — versus the biggest banks that often have proprietary solutions — the smaller institutions are “right in the thick of it,” according to Wheeler. He says J.D. Power’s research found the satisfaction scores for a range of mobile banking attributes including ease of navigation, appearance, and range of services scored only slightly below the largest institutions.

The analyst maintains that smaller financial institutions should take advantage in terms of closer personal relationships to close the gap further.

“How many of you do a demo of mobile apps?” Wheeler asked bank marketers attending his presentation at The Financial Brand Forum. “That one action will lift your overall satisfaction scores significantly. Even if you don’t have the slickest mobile app around, if Millennials know how to navigate it, they will be forgiving. Whereas if consumers have to figure it out on their own, that’s when they start talking to a friend who says ‘I don’t even have to swipe, I just do this.’ That’s when your customers start to move.”

Read More: Mobile Banking: Financial Institutions Must Clean Up Their Apps

“You don’t have to have the newest shiniest mobile app,” says Wheeler. “You’ve just got to present it the right way.” It would help, too, if a bank or credit union’s employees actually used their institutions’ mobile or online products.