Adding universal bankers to the branch staff is a trend that took off more than a decade ago. Yet banks and credit unions still struggle with limitations that keep them from making the most of the universal banker approach.

At its core, a universal banker combines a teller role with a sales role. This hybrid job suits the consultative approach that many financial institutions favor, but it is a poor fit for the teller line that still exists in many branches.

In a sense, the teller line has become something of an impediment to the ideal customer experience. If a customer waits in the teller line to do a transaction and then wants to open a CD or has questions about a loan, they often are asked to sit in the waiting area for the next available representative.

That’s hardly an outstanding experience for branch visitors.

Financial institutions recognize that they need to do better. The goal of branch transformation efforts is to maximize the increasingly rare opportunity to interact with customers in person — especially given that most sales still occur in a branch.

Here’s a look at how combining technology and training can help eliminate the shortcomings of the “please take a seat and wait” service that’s still far too prevalent in branches across the country.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Workstations for Universal Bankers? Pishposh

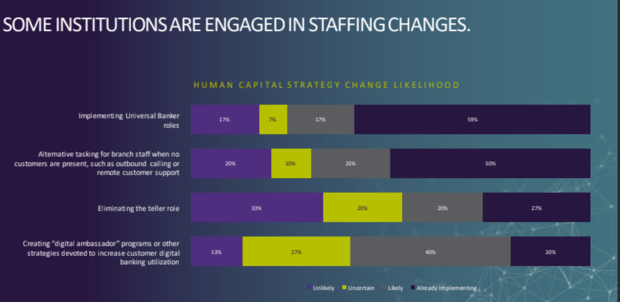

Recent polling shows expanding adoption of the universal banker role. A June 2022 survey of Celent’s branch transformation research panel found that 59% are implementing universal banker strategies or have already done so. Another 17% said they were planning to make such changes in the future. (The panel is a static group of 80 financial institutions that the research firm regularly polls.)

Some are supplementing teller positions; others are going so far as to eliminate tellers.

Universal bankers are, as the name implies, trained to help with whatever a customer needs. They are the ultimate problem-solvers and product salespeople.

But they need the right tools to be effective.

This brings up another hurdle many banks and credit unions encounter in trying to make the most of their universal bankers: like tellers, they need to be able to process transactions and have access to cash.

As a result, some financial institutions place them at workstations, but this also imposes limitations. It’s far more efficient — and it creates a far better customer experience — to equip universal bankers with a mobile device so they have the freedom to help people from anywhere in the branch. They can even greet people at the door.

In other words, universal bankers should be untethered. That’s the next significant shift in branch tech: to create solutions that allow them to use their laptops or tablets to do their jobs, with a much simpler interface.

How to ‘Untether’ Your Universal Bankers

At some banks and credit unions, a cash recycler at a workstation is considered a big win. But what happens when another employee occupies the workstation? Or when a conversation with a customer starts in an office and ends with a cash deposit?

Too many institutions still rely on humans to log into a specific workstation to complete transactions.

But think outside of that workstation box, and you’ll realize that having universal bankers is an opportunity to truly transform the branch experience.

In an untethered environment, cash recyclers, check scanners, printers, and other peripheral hardware are centralized so all universal bankers can share them. The cash recyclers must also be connected to the core accounting system, which might require an integration layer.

Then, universal bankers — properly trained to use the technology — can initiate transactions from wherever they are in the branch and go to the nearest cash recycler or kiosk to finish processing the transaction.

“That’s the next big shift in branch tech: to create solutions that allow universal bankers to use their laptops or tablets to do their jobs, with a much simpler interface.”

Over time, even more work can take place away from the workstation as more processes are modernized.

Financial institutions use a host of systems, from loan applications to CRM tools. To completely untether a universal banker, these must be easily accessible from a mobile device.

If universal bankers are going to do everything, they must have the technology and tools to do it. Ideally, institutions should be evaluating their entire tech stack and its ability to be web-friendly, tablet-friendly, and even touch-friendly.

Read more:

- What’s Eroding Customer Satisfaction & What to Do

- How to Find the Right CRM System and Make the Most of It

- See our latest coverage of bank branch strategies

The Branch Experience of the Future

Branches must change to stay relevant in the digital world, and increasingly that means engagement has to evolve from a transactional approach to a consultative one.

For financial institutions to stand out, they must not settle for incremental change by merely slotting their universal bankers into an outdated model that centers on traditional teller lines and workstations.

A far more transformative outcome is possible for those willing to go further.

With well-equipped and well-trained universal bankers on staff, financial institutions have an opportunity to think about how service in a branch can be redesigned from scratch.

If people sit down with a universal teller in the comfort of the lounge at the branch — even if it is to do a transaction — that is a much different interaction than one at a teller line. It feels personal and bespoke, like white-glove service. There’s a greater sense of warmth that lends itself to asking questions.

It isn’t just a matter of boosting sales, although that’s no small benefit. It’s a powerful way for banks and credit unions to foster deeper connections with customers and members, improving retention and generating coveted recommendations to friends and family.

About the author:

Nathan Moore is the SVP of Partner Alliances at Kinective.