Given the economic downturn resulting from the country’s COVID-19 response and many consumers’ shift over to digital channels, it was widely expected that branch tallies coming out after the pandemic started would so show a significant decline in the number of retail bank branches — you know, the old-school brick and mortar locations you see across the country.

Boy, were we pundits wrong.

FDIC’s Summary of Deposits branch level data was released in late September 2020 and we had a surprise.

Everyone I know in the industry expected big declines in branch counts, but that’s not what the FDIC data indicate.

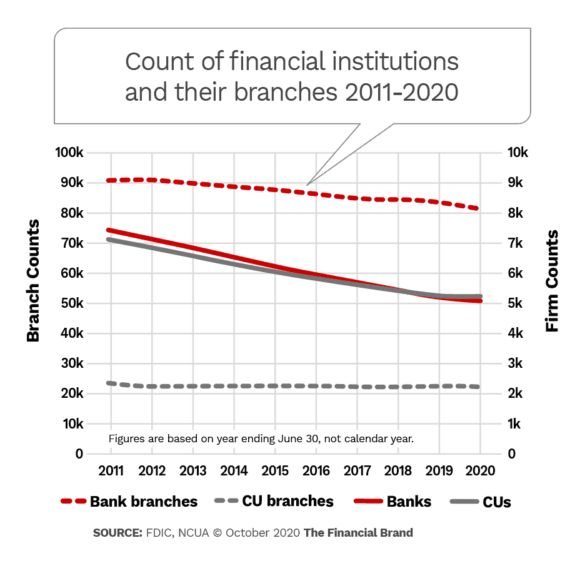

They show a net decline of 1,463 branches. That figure is only slightly up from the last year’s change (+12%). And more surprisingly, the data shows nearly 1,200 new branches, about 20% higher than the average of the last ten years. Credit union branch counts declined by about 400 branches during the last 12-month period, a reversal of the last few years’ trend of slight increases in branch counts. [To read the chart below, branch counts (dotted lines) are read off the left-hand axis and firm counts of banks and credit unions (solid lines) are read off the right-hand axis.]

Once a year FDIC releases deposit data for every bank branch in the U.S. The data is based on June 30 levels. It is the only source for this data point nationally. While it takes a while to clean up the file and get final counts of “real” branches (I mean deposit-taking non-cyber branches) the data provides some insights on the industry. (Credit unions do not report branch-level deposit data.)

Creating A Community with CQRC’s Branch Redesign

Find out how SLD helped CQRC Bank to create the perfect harmony of financial services, local culture, and the human touch in their branch transformation.

Read More about Creating A Community with CQRC’s Branch Redesign

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Why Branches Aren’t Dropping Away Quite So Fast as Predicted

Let’s explore the bank data in greater detail and speculate why there weren’t more closures. (The data as reported by credit unions at the branch level limits further examination there.)

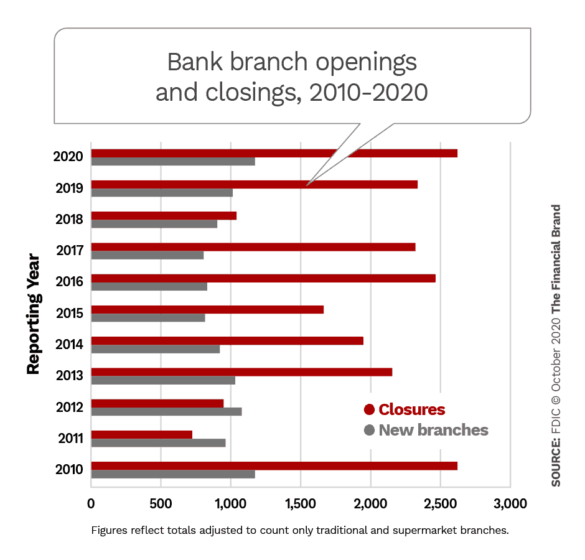

Between the June 30, 2019, report and the June 30, 2020, report, there were just over 2,642 bank branch closures and nearly 1,179 new branch openings for a net decline of 1,463 branches. Both the number of closures and the number of new branches are the highest in the last ten years of reporting (2011-2020). During this ten-year period, the industry has averaged 1,861 closures and 982 new branch openings annually, or about two closures for every new branch.

Branch openings have risen each year for the last three years. In a world where “branches are going away” seems the common refrain, this begs the question, Why are banks opening more branches each year?

During these last three years of reporting, there have been 3,108 new branches opened. So, who is opening all those branches?

Not surprisingly, JPMorgan Chase has opened the most, fully 11% of the total, as they continue to fill out some newer markets. Chase has also been closing lots of branches during this same period.

But besides Chase, over 1,200 banks — nearly one out of four — have opened new branches during this three-year period … that’s nearly ¼ of all banks. Let’s ponder that fact for a second. Nearly a quarter of banks have opened a new branch during the last three years. This attests to the fact that branches continue to play an important role in delivering services to your customers.

Read More: Branches Still Dominate, But Banks Won’t Need as Many to Compete

Among the other two top banks, Bank of America has been shrinking its branch footprint for many years, but in the last few years has also been entering multiple new markets. During this last three-year period, Bank of America has only opened 69 new branches. Remaining focused, though, 55% of the new branches have been in “new” states or markets it had previously not served with branches.

Wells Fargo has opened even fewer new branches the last three years — only 31 new branches, or about ten annually. Wells has been reeling from its new account scandal for several years now, and its focus has been on fixing those problems and reviving the brand, rather than expanding.

The complete list of big “builders” are, over the last three years:

Banks with 10 or more new branches

- JP Morgan Chase Bank 342

- Bank of America 69

- Regions Bank 67

- Woodforest National Bank 65

- Truist Bank 50

- First National Bank Texas 41

- TD Bank 38

- Wells Fargo Bank 31

- Frost Bank 24

- Fifth Third Bank 21

- Bancorpsouth Bank 19

- PNC Bank 18

- Pinnacle Bank 18

- First-Citizens Bank & Trust Company 18

- The Huntington National Bank 17

- HSBC Bank USA 17

- Citizens Bank 17

- Renasant Bank 16

- First Community Bank 14

- First State Bank 14

- Zions Bancorporation 11

- Republic Bank 11

- First Republic Bank 10

- Capital One 10

Yet the new branches that each of these 24 banks have built over the last three years represent only 31% of the total new branches built during this period. That speaks to the point that new branch building isn’t isolated to the biggest players. Branch building is still an important tool in growing your base and reaching more customers.

So Why Haven’t More Branch Networks Been Shrinking?

As I mentioned at the beginning, there has been much talk about massive branch closures tied to COVID-19, yet the market hasn’t seen that occur. Here are four possible reasons why there weren’t more closures:

Timing. The country shut down and workers moved to remote locations starting in mid-March this year. While banks and credit unions are considered “essential businesses,” most banks and credit unions scrambled to temporarily close some branches to protect their staff and customers so they could put new protocols in place. Nearly all the locations that closed temporarily have been re-opened by now.

This FDIC reporting is based on the structure of your firm’s branch network as of June 30, so that left only three months from the start of the COVID-19 restrictions until the end of June for banks to convert to a remote workforce, reassess customer behavior changes, put in place new health protocols, and create a new branch strategy. It’s doubtful that any firm could create a new strategy and execute tactical decisions in such a short time frame.

And recall that most banks need to give customers 90 days notice of permanent closures. This point suggests that we might see a spike in closures in the 2021 FDIC report.

Scale. The majority of banks and credit unions have less than five branches. In fact, nearly half of all credit unions are one-branch operations. For these organizations, closing a branch would prove extremely challenging. We’re more likely to see these smaller players acquired in the next year then see them close branches. It’s important to keep in mind that the number of banks has been declining by about 260 firms annually during the last ten years.

Big Players Mostly Done With Closures. The three biggest banks in the U.S. have been pruning their networks for years. Bank of America has reduced its branch count by nearly 2,000 branches at this point from its peak. Collectively, the Big Three still comprise about 14% of the industry. These facts suggest they may not have much more fat to cut without abandoning some markets, although I think Wells Fargo might close more.

Fear of Customer Losses. Closing branches comes with some risks. Those risks can be mitigated with the right customer and market analysis to identify a potential closure, and with enough time to stage the actual shutdown. I’ve completed more than 2,000 branch closures in my career, and I know you must be clear in your thinking before pulling the trigger.

Mobile banking has been touted as your new “branch in your pocket.” Chase and Capital One are even running new commercials with that specific messaging. Mobile banking may be the future, but branches continue to show resilience with only modest reductions in net branch counts, even after a dramatic event like the COVID-19 shutdowns.