More than ever, non-bank companies are providing embedded financial solutions such as deposit accounts, payments products and lending tools to increase customer engagement and provide additional revenue opportunities. Often, these services are supported by banking as a service (BaaS) offerings from traditional banks and credit unions, enabling virtually any company to become both a customer and a fintech competitor. In fact, according to a new Finastra research study, almost 85% of respondents are already implementing or planning to implement BaaS over the next 12-18 months.

While many banks and credit unions are justifiably concerned that becoming a ‘distributor’ of banking services could negatively impact their current client relationships, the potential for low-margin, high-volume partnerships can’t be completely ignored. But, the ability to become a distributor requires a cost structure that many traditional financial institutions still are failing to deliver. This requires an inside-out digital banking transformation.

According to Finastra, “BaaS is expected to reach a value of $7 trillion by 2030. Those that act fast and secure priority customer context will experience the greatest upside. Those that wait may very well be left outside looking in.”

The research finds that a successful playbook must include the following:

- Understand what use cases will deliver the most value to customers.

- Select monetization models that deliver required capabilities and enable profits.

- Be clear on how to take a BaaS solution to market, selecting partners with capabilities that accelerate delivery.

Read More: The Future of ‘Banking as a Service’

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Trends Impacting Banking-as-a-Service

The expansion of digital technology, and the increased focus on streamlining the operational underpinnings of products and services, has enabled the growth of the global banking-as-a-service market. The pandemic also had a positive impact on the future of BaaS, as consumers sought easier and contextual ways to complete transactions without changing applications or platforms. The origin of these financial engagements were less important than the value delivered in time savings.

As fintech organizations, big tech firms, retailers, and other non-financial organizations want to provide banking solutions to their customer bases, they require traditional financial institutions to provide the infrastructure, regulatory support and even funding. Utilization of APIs and the potential of data modernization is furthering the expansion of financial services providers.

Finally, the importance of new ways to generate revenues beyond fees and interest rate spreads is forcing traditional financial institutions to pursue scalable options such as BaaS. The outcome of these trends is that consumers are increasingly using alternative providers of financial services, trusting non-banks more than ever in the past.

Future BaaS Growth Opportunities

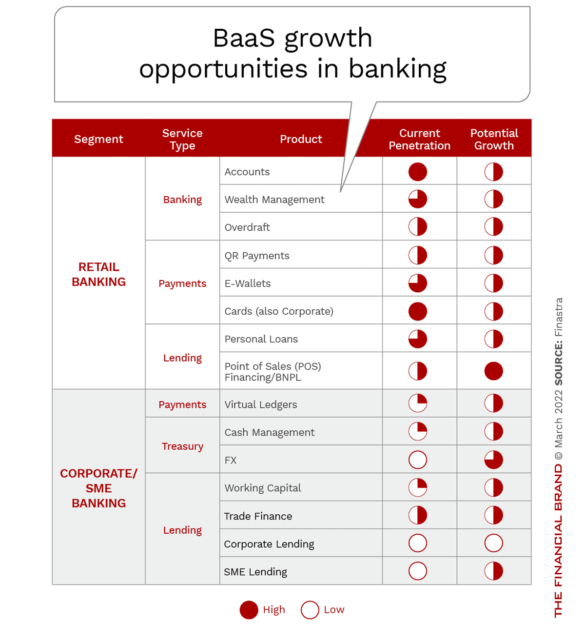

Opportunities associated with BaaS are exploding in the banking ecosystem as organizations not only search for new ways to improve customer engagement and enhance experiences, but also find new sources of revenues from inside and outside the financial services marketplace. Finastra compared current BaaS penetration of multiple banking products with their expected growth over the next three years. As can be seen, there was more current value with retail offerings. The future will see expansion in the corporate and small business areas as well.

Some of the largest areas of growth include:

- POS financing, including both BNPL (buy now, pay later) and other financing options (e.g., interest-bearing point of sale loans).

- SME lending, which is expected to deliver more revenue than POS financing, payments, or corporate lending.

- Corporate lending, with technology players and fintech firms delivering the most commercial lending growth over the next few years.

- Traditional deposit accounts and payment services, such as cards.

“As the banking world moves away from products to dynamic experiences embedded in the realtime world, BaaS will be the enabler of these experiences. It’s no longer your core system that informs your capability, but a technology stack that is always evolving.”

— Brett King, Bestselling author of the Rise of Technosocialism, founder of Moven, and radio host

Read More: How BaaS Turns Traditional Banks Into Digital Deposit & Loan Machines

Monetization Opportunities for BaaS

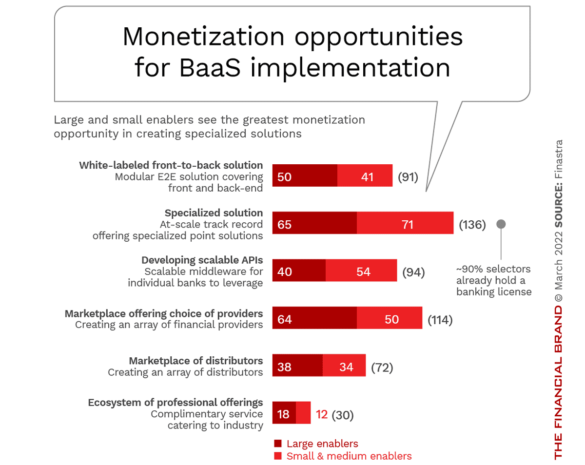

Traditional banks and credit unions that have progressed with their digital transformation efforts will be best positioned to create their own BaaS platforms. Not only will they be a forerunner in the open banking ecosystem, but will also be able to generate new streams of revenue by monetizing their platforms. Finastra research found several significant opportunities across solution sets and business models.

According to Finastra, “Providers will want to focus on offering a specialized solution, white labeling front‑to-back solutions, and securing access to a marketplace. And, in BaaS, competition will help establish markets and increase benefits for all as providers believe that a marketplace model will help boost revenue.”

To gain value, providers should focus on sector-specific products and services, enhancing data and analytics to enable better risk decisions, and specialized digital solutions.