When it comes to building appeal to the next generations, banks and credit unions find themselves between two statistical poles. On one hand, studies show that over half of Gen Zers and millennials have accounts with nontraditional providers, such as fintechs. On the other hand, many young people choose the same bank that their parents use — but not as many as in the past. How can institutions improve the odds as they plant seeds for their future?

U.S. Bank thinks it has a key part of the answer, based on a fintech partnership.

The #5 bank recently partnered with Greenlight, a fintech that for about a decade has joined financial literacy education with practical experience for kids in using cashless payments, budgeting and learning to handle money while subject to parental spending control.

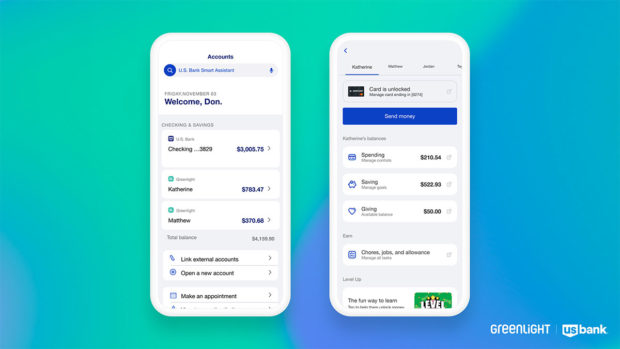

Greenlight Financial Technology has been striking partnerships with banks and credit unions since 2023, with about 50 institutions currently in the fold. Part of what sets the U.S. Bank relationship apart is that it is the first bank to adopt Greenlight’s accounts and services as an embedded feature of its own mobile banking app. There is liberal joint branding for the two companies inside the app, but the functionality is integrated using the fintech’s new software development kit. Indeed, once the bank decided not to try building such a service on its own, Greenlight’s SDK was one of the factors leading it to partner with the firm, according to Jennifer Miller, U.S. Bank’s SVP and head of strategic alliances.

The Greenlight services are available for free to customers who have U.S. Bank “Bank Smartly” accounts. The accounts, which feature overdraft benefits and a rewards program, debuted in 2022. Miller says that the bank estimates that 25% of its consumer customers have younger children and could take advantage of the new free service. Greenlight is designed for kids up to 18.

Register for Discovery2024 Conference

Join us August 8th for Discovery2024, your gateway to the strategic insights and human connections you may need to navigate the evolving financial landscape.

Improve Your Business Outcomes Through Data & Analytics

Gain centralized access to the credit bureaus and 20+ alternative data sources. Leverage advanced analytics to optimize marketing campaigns and loan decisions.

Read More about Improve Your Business Outcomes Through Data & Analytics

Building a Reason to Start Thinking of U.S. Bank as Home

Miller had personal experience with Greenlight prior to setting up the partnership after considering both the firm and competitors. Her 10-year-old daughter has used a Greenlight debit card and its money app, with related parental controls, for a couple of years. Miller says the account has helped inculcate her daughter in how to handle money and also in simply learning to transact cashlessly.

“As the world has moved towards a cashless society, there’s a need for kids to be able to transact with a payment card,” says Miller, “and that need comes up younger and younger.” (The card can also be loaded into the Apple Pay and Google Wallet digital wallets.)

Miller explains that, like other institutions, U.S. Bank doesn’t offer children transaction accounts. In fact, the earliest her daughter could open a joint checking account with her would be at 13.

So, in a sense, the Greenlight debit card is a set of training wheels.

But that’s actually a basic, functional need. More complicated is finding ways to give kids practical experience in handling money while providing them with parental guardrails. Greenlight’s debit card can receive funds from children’s allowance and payments for chores, drawn from the parents’ bank account. The bank permits up to five kids to be enrolled per parental relationship.

Greenlight functionality within the U.S. Bank mobile app permits parents to set rules for their kids’ spending and monitor how they are using their debit card.

The app — in U.S. Bank’s case, the Greenlight functionality within its app — enables parents to send funds to their children instantly and also set up automatic payments, such as for a weekly allowance. They can also set controls on where the debit card can be used and how much is spent. Parents are encouraged to work with their kids to establish those levels and to set savings goals. Greenlight also notifies parents about all transactions. The app also includes an interactive financial education game called Greenlight Level Up.

“Parents can say that their kid can spend money at the concession stand at the basketball game, but not too much on Roblox.”

— Jennifer Miller, U.S. Bank

The service also permits others to send funds to children enrolled in Greenlight, but only with parents’ approval.

Read more: The Big Potential of Banking Apps for Kids: Attract the Parents

.no webinar found.Serving Parents by Teaching the Kids, Attracting the Kids for the Future

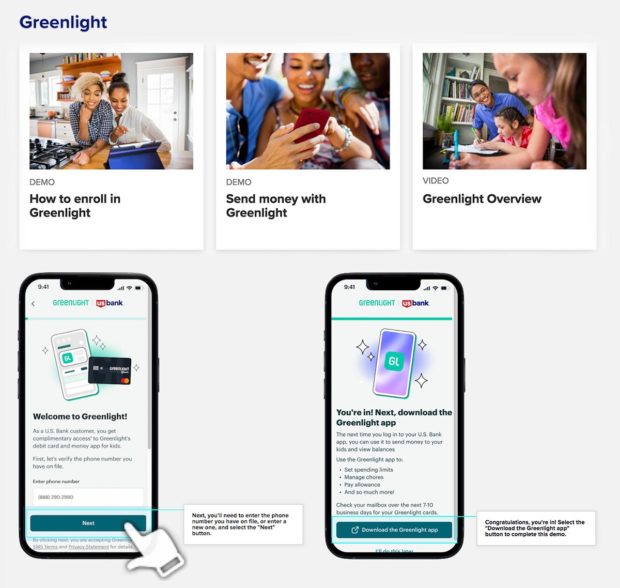

At the time of Miller’s interview with The Financial Brand the bank was still cranking up its promotional efforts, but something already in place was a trio of items on the U.S. Bank Digital Explorer page. Beyond Greenlight, this page features dozens of videos explaining various digital services as well as “test drives” enabling customers to walk through many of the bank’s offerings using simulated transactions. The selection below shows part of the interactive demo showing how to sign up for Greenlight through the bank’s mobile app.

U.S. Bank’s “Digital Explorer” page has dozens of videos and interactive walkthroughs for its online and mobile offerings. The sample screens above come from the enrollment demo.

Miller says the bank sees two competitive thrusts in the partnership. First, as a complimentary offering, it differentiates Bank Smartly accounts further from other products, possibly drawing or retaining depositors. Brandon Horne, Greenlight’s general manager of partnerships, says the service provides an alternative to offering debit rewards. (Greenlight’s basic service normally costs $4.99 a month.)

The second angle is that as kids grow older, “when they’re ready for their first checking account, they’ll look to U.S. Bank as the place for them to do that,” says Miller.

Read more:

- Bridging the Generational Gap: How Banks and CMOs Can Tackle Communication Challenges

- How to Navigate the Coming Storm of Demographic Disruption

- 12 Must-Have Mobile Banking Features Consumers Expect Now

Greenlight Keeps Widening its Waterfront

Greenlight launched in 2014. Horne says that 6.5 million parents and kids are using the service today. The company offers multiple levels of service on its own and has been pursuing partnership arrangements for a bit over five years.

Horne says the bank and credit union partnership programs aren’t a strategic shift for the company’s expansion but instead an additional channel.

“The ultimate goal is continued growth trajectory,” says Horne. “The ability to embed some of the parental experience in the bank’s app, as we’re offering with U.S. Bank, starts to become really interesting. We’re giving financial institutions a bit more ownership in the customer experience.”

Horne says a kid’s move from being under the parental umbrella via Greenlight and becoming a customer of the bank in their own right is more of an evolution than a sudden shift.

He explains that part of the company’s approach is to use promotions within Greenlight when a kid approaches various milestones based on age. The company uses popups to note, “It’s your birthday!” or “Graduation is coming!”

And then, he says, the message would be along the lines of “here are some products from this institutions that’s cared about your financial growth as you went from 9 to 16.” A segue to signup for an adult checking account could be used. Horne adds that the company tailors these approaches based on compliance rules that vary by state.

Like Miller, Horne is a Greenlight parent. He has two children, one of whom is beginning to understand money and another who has already been enrolled and has been asking about how to earn extra money.

“She’d been watching the Level Up videos on her iPad, and she pitched a business idea to me the other day,” says Horne. “She wants to make jewelry and sell it to classmates. So we’re, like, awesome. And we sat down to talk it through.”

From the archives: How Neobanks Cater to the Youngest Generation of Consumers