A perfect storm confronts legacy banks. Fee revenue and mortgage income are steadily eroding while acquisition costs mount amid fierce competition. Adding to these challenges, consumers are increasingly defecting from legacy financial institutions, enticed by simplified offerings from disruptive upstarts. Behind these marketplace realities looms an even bigger threat – the demotion of long-trusted institutions from primary financial status.

Not long ago, customers displayed enduring loyalty, with 40% sticking for life at their first bank. Yet today’s digitally savvy consumers hold 5-7 accounts on average, rapidly switching providers to optimize rates, rewards and experience. This unprecedented fragmentation signals the emergence of “super-consumers” adept at gaming the system for the hottest deals – not sustainable brand devotees.

Last year major banks trumpeted strong account growth. But lower income segments largely drove these gains, indicating higher credit risk and servicing costs that erode margins. Worse still, disruptors siphoned off 37% of new checking relationships as millennials and Gen Z flocked to digital-first challengers like Chime or used a legacy bank as a ‘deposit hotel’ while transacting with Venmo, PayPal or another non-traditional provider. Even cash-flush Boomers now divide loyalty across traditional and alternative apps.

“The primacy gap will continue to be exacerbated by younger generations, who have much lower brand loyalty than prior generations. To build stronger customer relationships, banks must recognize the need for a holistic customer engagement strategy focused on demonstrating and delivering value for customers. While the drivers of value may differ across segments, it’s about finding the right balance of convenience for common transactions and personalized service for problem resolution and financial guidance that will benefit customers in their daily lives, and ulti-mately anchor the banking relationship.”

— Chris Powell, Head of Deposits and Customer Engagement at Citizens

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

The Path from Acquisition to Primacy

Amid this turbulence, the central challenge becomes less about getting customers in the door than about converting them to primary status – occupying the coveted space as their main financial hub. Primacy signals engagement, larger balances, and expanded share of wallet. Yet complex definitions muddy the path.

For instance, fewer than 40% equate primacy with payroll deposits; most prioritize active usage and everyday spending. Nonetheless, a sizable 83% of consumers still claim one primary financial relationship, spanning both legacy institutions like Chase and Bank of America and disruptors like CashApp.

Achieving primacy requires a digital-first omnichannel strategy that blends AI insights, ubiquitous access and advisor partnerships. This starts with understanding intrinsic drivers of long-term loyalty. Ironically, longevity no longer guarantees primacy. But make no mistake, Boomers and women especially still reward empathetic accompaniment with enduring dedication spanning over 15 years. Forward-looking providers must demonstrate care by simplifying money management through personalized advice, anticipatory assistance and frictionless utility.

Crafting the Contextual Human+Digital Bank

To thrive amid unrelenting disruption, legacy institutions must now evolve into customer-obsessed enterprises constantly earning trust. Tactics demand transparency, ethical practices and financial operating systems that embed banking seamlessly into daily moments – not sales pitches.

The winning formula blends digital ubiquity with human utility to simplify money matters. Regional pioneer Citizens Bank has eased direct deposit switching via APIs. App leader Marcus preempts overdrafts through creative credit products. And wealth management disruptor Personal Capital delivers hyper-personalized insights.

Banks that realize this harmonious digital+human vision will lead the next era of consumer finance. Yet transformation requires courage to reconfigure cultures, an embracing of outside partnerships and the rethinking of metrics beyond short-term acquisition costs. With generative AI unlocking unprecedented agility, the moment to act is now. Lagards risk fading slowly into irrelevance.

Improving New Account Acquisition Strategies

The following are the findings from the proprietary research done by the Digital Banking Report on behalf of Pinwheel. The research was conducted in February 2024 and included responses from over 200 financial services institution executives globally.

The following are the findings from the proprietary research done by the Digital Banking Report on behalf of Pinwheel. The research was conducted in February 2024 and included responses from over 200 financial services institution executives globally.

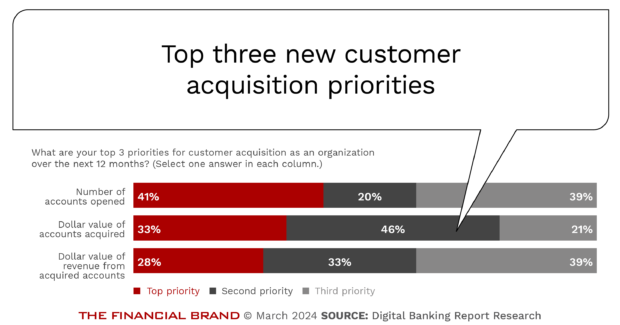

When asked about the top three priorities for customer acquisition over the next 12 months, over 40% of organizations mentioned number of accounts opened, with 33% mentioning that the dollar value of accounts opened was the top priority. The dollar revenue generated from accounts opened was the third highest priority (28%).

Interestingly, when primary and secondary priorities were combined, the dollar value of accounts opened had the highest percentage of respondents (79%).

The Cost of New Account Acquisition

As has been the case in banking for decades, the majority of banks and credit unions continue to measure acquisition costs using short-term metrics as opposed to lifetime value measurements that put an emphasis on customer primacy.

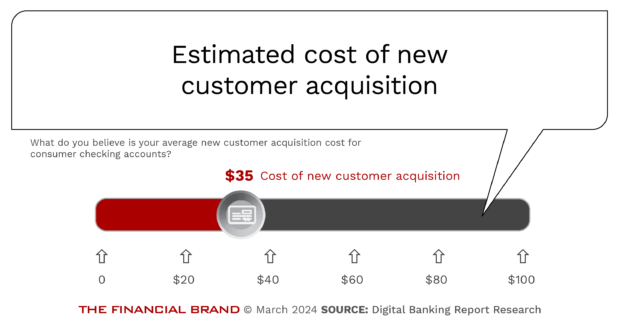

Respondents to our survey overwhelmingly stated that acquisition costs were measured on a ‘per account opened’ basis (46%), without considering relationship depth or engagement metrics of the account opened.

Banks and credit unions also do not measure the level of activation of new accounts, thereby assigning the same cost per acquisition for a strong relationship as they do an account that has never become active. The metrics used tend to significantly lower the perceived cost of acquisition, with no measurement of value or potential primacy considered.

When we asked financial institution executives the cost of acquiring new checking accounts, it is clear that the vast majority of financial institutions do not use a ‘fully loaded’ cost that would include any offers to prospects, the cost of general marketing geared to prospects, operational costs of account opening, etc. As a result, the perceived cost of a new checking customer is far lower than reality. Most consultancies estimate the cost of new account acquisition at well over $200.

Challenges to Relationship Primacy

The challenge of achieving relationship primacy extends beyond how an account is marketed, who opens an account and where it is opened. Much of the challenge is an inability to expand the relationship early in the onboarding process with digital services and tools that the customer values and that do not cause friction.

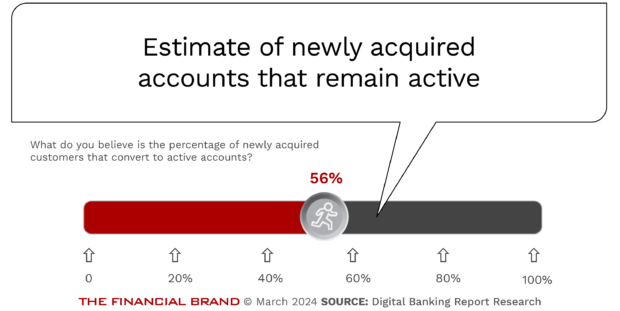

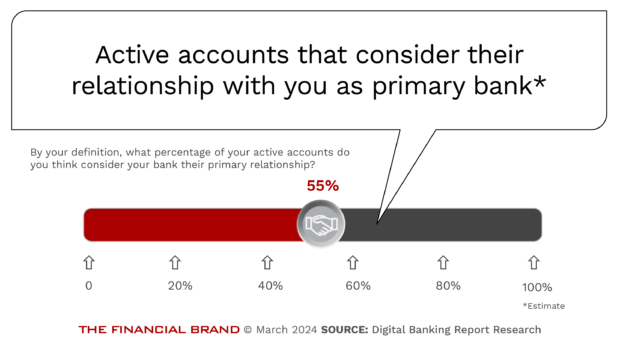

The impact of not deploying a well-structured digital onboarding process immediately impacts engagement levels, churn and revenues from the relationship. As shown below, organizations believe that only a bit more than half of new accounts acquired convert to active relationships.

Carrying inactive accounts has the impact of almost doubling the cost of account acquisition if an organization measures their account acquisition costs based only on the number of accounts opened.

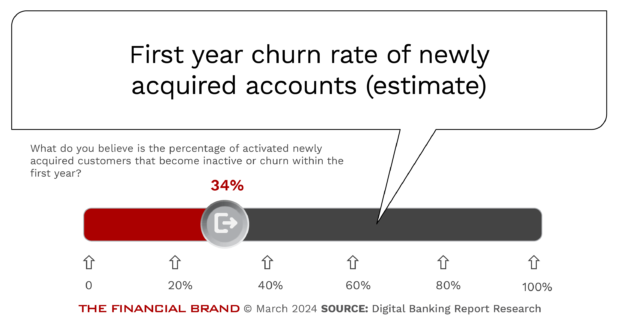

While mostly reflected in the measurement of inactivity shown in the previous chart, organizations that were surveyed stated that 34% of new accounts left the organization in the first year after opening a new account. Again, this increases the effective cost of a new account without any revenue being generated.

Finally, as would be expected, when there is a high churn rate as well as a high level of inactivity with new accounts, the potential for relationship primacy is foregone.

When we asked banks and credit unions globally for an estimate of the percentage of overall active accounts that would consider their financial institution as a primary bank, the number is far lower than it has been historically – at a rather dismal 55%. This is significantly lower than in the past, reflecting a heightened level of competition, the ease of digital account switching and opening, and the aggressiveness of offers for deposit customers.

The Power of Direct Deposit

As illustrated, legacy banks face an engagement crisis. Fintech apps and neobank challengers have raised switching costs, enticing digitally savvy customers with slick interfaces, creative rewards and simplified products. Defection risks are real, especially among millennials.

That said, direct deposit capture offers a pivotal opportunity for traditional institutions to construct durable relationships amid disruption. Unfortunately, according to our research, penetration of the direct deposit feature among new accounts is only 55% – far short of optimal, especially considering the fully loaded cost of acquisition.

Direct deposit signifies a customer’s paycheck landing in an account, establishing consistent cash flow. This drives a domino effect elevating the value exchange between financial institution and the customer. Customers access funds faster, grow balances and additional relationships larger through automated savings, and can borrow against payroll with attractive rates. Steady activity signals creditworthiness, unlocking more lending products. All this earns primacy as the core financial relationship.

The numbers reveal direct deposit’s adhesive power: Accounts with payroll deposits maintain 23% higher balances and remain open twice as long as non-payload accounts, proving significantly more profitable. These durable relationships also demonstrate higher satisfaction, loyalty and referrals.

That’s why securing direct deposit transfers early in onboarding is so vital, especially when competitors stand ready to poach customers. Yet cumbersome paperwork traditionally deterred small business owners and gig workers. New API solutions now automate switching quickly and seamlessly behind the scenes upon customer consent.

By smoothing this friction, more accounts turn active immediately, with foundational predictable cash flow powering fuller engagement. One regional bank using intelligent switching boosted new account balances over 50%, simultaneously increasing product usage.

The conclusion is clear: early direct deposit capture cements foundational customer relationships, seeding a chain reaction where steady payroll income escalates usage, trust and share of wallet. Legacy institutions must tap intelligent automation to plug this leaky revenue faucet before disruptors siphon too much value.

While direct deposit constitutes the cornerstone, integrated digital onboarding spanning full life-time journeys also proves foundational to securing primacy. Applying decision engines at the point of account opening can qualify customers for relevant cards, accounts and lending products upfront based on integrated data analytics. Instant issuance and fast funding empower new users to immediately access preferred payment types, money management tools and spending or borrowing optionality.

In an epoch of declining loyalty intensified by digital dis-intermediation, financial institutions lose ground by the day relying on aging metrics and narrowly functional capabilities. As disruptors redefine value chains through expanded utility, legacy organizations face a mandate to either adapt or fade.