Anne Boden just doesn’t fit the profile — banker or startup leader.

When she started the creation of what became Starling Bank — at one point it was going to be known as “Bank Possible” — she had a long career as a commercial banker behind her. In fact, part of what motivated her to leave traditional banking was that coming out of the carnage of the financial crisis and the Great Recession, too much was reverting back to “normal.”

“We’d come through the worst banking crisis in living memory and everyone was pretending nothing had happened. Move along folks, nothing to see here,” she writes in her book, Banking on It: How I Disrupted an Industry.

Beyond that, Boden felt that financial technology was rapidly changing but that banks weren’t. In mid-2012 she took the job of COO at Allied Irish Bank but quickly became disillusioned. Even at the bank’s lab branch, “we were simply polishing up the old stuff with a few shiny new services.”

Boden couldn’t just suck it up and be bankerly any more. She felt the industry has ruined the Irish economy — “I was ashamed to be a banker” — and didn’t see it headed toward giving consumers a new square deal. She wanted to change things. She spent some time touring financial services in various parts of the world and found a lot not to like. Often institutions clung to old models that failed to address changing consumer preferences. Boden decided starting a fintech bank centered on mobile delivery could be a superior solution.

“I’m not a typical fintech founder. The majority of people in the fintech world don’t look and sound like me. I founded Starling because I felt I knew an awful lot about the industry, and I felt that the world needed a new bank. And I was very ambitious. I had this audacious plan of building a new bank with new technology with new ways of doing things and different propositions for customers.”

— Anne Boden, Starling Bank

Fast forward to the present for a moment and Starling Bank has passed £5.8 billion in deposits, has over two million customers of all types and represents 6% of the U.K. banking market by deposits. Its website crows that someone opens a Starling account every 38 seconds. (And explains where the figure comes from.)

Beyond that, in late 2020 Starling became profitable.

“People didn’t believe it was possible to reinvent the business, give customers a good deal and be profitable,” says Boden, 61, in an interview with The Financial Brand. “But it is possible, if you have new technology and focus on the right things.” Among those things are digital onboarding, no fees for consumer transaction accounts, a bevy of financial management tools, and 24/7 live customer service.

Read More: Neobank Tracker: Biggest Database of Digital-Only Banks

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

How Starling Gets Mainstream Banks’ Attention

Beyond growth, profitability and top rankings in banking quality surveys, Boden is convinced Starling is on the right track because big U.K. banking institutions are copying things that Starling does.

She says the impact of Starling and other new entrants in the U.K. market “is making people sharpen their pricing, improve their service levels and copy our features.”

Boden says she enjoys playing a major part in changing an industry.

“We are causing the industry to wake up, catch up and do a better job for customers,” she says. “Every time I drive down the highway and see an advert on the side of the road from a bank that’s been around for 200 years, promoting a feature that they’ve copied from Starling, that gives me a buzz.”

A point of pride for Boden is the rate of consumer switching from other institutions to Starling for their current (checking) accounts. In the U.K. the “Current Account Switch Service” enables consumers banking with participating institutions to seamlessly move their account relationship from one bank to another. In January-March 2021, the latest period tallied, Starling had a net gain of 17,769 accounts, the best showing of any U.K. institution. Virgin Money followed closely at 17,495 and Monzo Bank came in third at 7,744.

Boden points out that Starling took first even though other institutions were offering bonuses to switch, which she felt her bank didn’t have to rely on. “We offer banking with fantastic customer service and state of the art technology, and it’s free,” Boden says.

Popularity to Ponder:

Given that Starling only received its official approval as a bank, in mid-2016, and didn’t list on the App Store and Google Play until 2017, profitable operation and the public’s endorsement are notable.

“Starling is a fintech, but it’s breaking away from the pack because it’s achieved a business model which is sustainable,” says Boden, “while many fintechs have not achieved a sustainable business model.”

But for Boden, that’s not the destination, but only a way station on the road to what’s now on her mind.

Read More:

- CEO Reveals Plans for LendingClub’s Unique Fintech+Bank Model

- Community Bank Builds Future on ‘Banking as a Service’ & Google Plex

How High Can Starling Bank Fly?

In her book and in the interview, Boden demonstrates that she is creating for the long haul, and not interested in a skinny project that can be grown and quickly sold for a big gain. For example, she rejected the idea of founding Starling as a fintech operating on the “banking as a service” rails that a traditional bank might offer, for a price.

“We would have gotten to market quicker,” says Boden, “but we would not have become profitable. The thing about banking as a service, about using other people’s rails, is that there are too many people taking a cut of the revenues.”

Boden is now considering the series of next stages that could come. Sale is not on the table, but an initial public offering is contemplated at some future point.

“Starling is at a very transitory position at present,” says Boden. “We are no longer a startup. We are markedly profitable and growing very fast. We have a full banking license and we have really become members of ‘the establishment,’ really.”

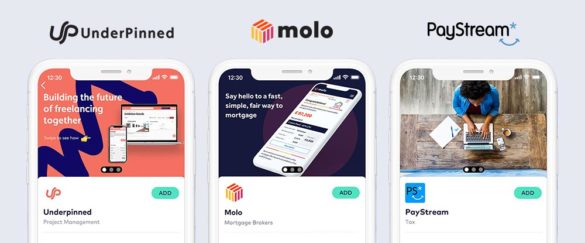

But Boden says that all-digital branchless Starling, with its low-cost model based on its proprietary home-grown core and customer-facing software, remains very different from much of the rest of the establishment. Factors like its Starling Marketplace, a selection of curated third-party apps that interface with Starling accounts, demonstrate the canvas Boden thinks on.

In her latest book, she discusses how the marketplace concept came early in her thinking about the bank: “We would be the central hub offering our customers and their financial partners data at their fingertips. Our understanding of spending patterns would help us give our customers better advice too. If, say, they had a large amount of cash to put on deposit, we’d be able to point them in the direction of the most convenient and profitable place to do so.”

Coming back to the matter of growth: “We have the ambition to be very big,” says Boden with a touch of British understatement. She says most of her career has been spent at very large institutions and that as Starling grows, it is actually rising into her personal comfort zone, quite a contrast for most startup chieftains. While she initially adapted to life in a startup —camped out with her team in warehouse space at one point — the veteran banker understands life in a large bank quite well.

“I’m not a typical startup CEO,” says Boden. “They normally know nothing at all, and think everything is simple and therefore say, ‘Let’s do something different’.”

When Boden says Starling has ambitions to grow very big, she means it.

“In five, ten, fifteen years, you might not be talking about JPMorgan Chase and Wells Fargo,” she explains. “You might be talking about Chase and Starling Bank.” She suggests that what people expect from banks will continue to evolve and that this plays into Starling’s accumulating strengths.

Read More:

- How Revolut’s ‘Super App’ Strategy Could Shake Up U.S. Banking

- What SoFi’s Rise From Niche Fintech to One-Stop-Shop Means for Banking

Starling Can Grow Beyond Anne Boden

Boden was the driving force that kept things going as the bank moved from concept to charter.

However, “the story of Starling is not just me,” she explains. Boden says succession management is no worry because she has a a dedicated team behind her. In the beginning many of them worked for a time without salary.

“I’m not on my own,” says Boden. “I have a group of people who are incredibly passionate, intellectual and detail-oriented. We’re not trivial, we’re deep thinkers. Those are the people who built Starling and who run Starling now.”

One example she gives is John Mountain, who is now Starling’s CIO. He wanted to work for one of the new banks that were gestating around the same time Starling was. He met someone in a pub who knew the players. The man told Mountain that Boden had the most ambitious and audacious plans but that she would probably not get them off the ground and that other newcomers were a better choice.

“John decided he wanted to work for the one that had the biggest mission,” she says.

The Neobank that Came Close to Being a Neverbank

Boden’s book is actually her second while involved with Starling. Her first, The Money Revolution: Easy Ways to Manage Your Finances in a Digital World, could be read by both consumers and financial players. But Banking on It is a highly detailed guide to getting a neobank off the ground against tough odds. Even as an experienced banker, Boden had tough lessons ahead.For example, “I really needed to raise some money to make it all happen, and I didn’t realize that it’s quite difficult to raise money,” says Boden. She says she didn’t write the book specifically as a manual for would-be neobankers but for all entrepreneurs who want to make something happen. That said, anyone entertaining the idea of starting a fintech or a neobank ought to read it..

Boden loves reading business books herself but has been disappointed by a common characteristic: “We only ever hear the stories of the super successful with all the bad bits edited out. I decided I wanted to tell the story of what it’s really like to start a business.”

And Boden’s quest to build Starling is full of bad bits. Worst was when a dedicated team of skilled associates and coding experts broke away. Boden faced a choice: hand over the keys and leave Starling to her original team, or watch them leave, and become the firm’s only employee.

“I almost walked away from Starling, I almost gave Starling up,” says Boden. She had become so intent on Starling’s mission that she considered herself expendable. At the eleventh hour, Boden snapped to and refused to leave. The team then left, forming the core of what became competitor Monzo (originally Mondo).

Boden formed a complete second team and began again, in time bringing Starling to its launch … just a month ahead of Monzo.

Where Starling is Going — and Not Going

An ongoing challenge has been building Starling out from its original consumer base, accomplished with expansions into business accounts and loans and into mortgage lending and more.

Even Neobanking has Boundaries:

Boden sees some logical alternatives and limits on where and how Starling will expand in the future.

Consider product expansion, for example. Boden notes that Revolut announced that it will handle travel booking with a new feature called “Stays.”

Not for Starling. “There are lots of companies that are better at travel than banks, okay? That’s not our industry,” says Boden. “We are all about money and financial services. We need to utilize our balance sheet and we will use it in many different ways to obtain yield. But our core business is providing banking services to small and medium-sized firms and to individuals.” Starling Marketplace represents a much more logical stretch.

Podcast: Starling: Not Your Typical Challenger Bank

Geographic expansion will not take the form of establishing Starling as a bank in other regions. “In Europe, our strategy will be a banking as a service offering,” says Boden, “which we’ll sell to other banks and to retailers.”

“We have no intention of getting a banking license in the U.S. and no intention of getting one in Asia,” says Boden. “But if Asian banks or American banks want to buy our software, they can.”

Why no Starling U.S.A? Boden feels the U.S. market is too different. In addition, some of the new banks in Europe entered those markets by providing inexpensive foreign exchange service. “Cheap foreign exchange service is not an issue in the U.S.,” she explains.

“But there is a huge appetite, including from some of the biggest banks in the world, to buy Starling’s software,” she adds. “We built Starling with every line of code written from scratch.”

Starling continues to not have branches. However, in an accommodation to those customers who need to deposit or withdraw cash, the bank has an arrangement with the Royal Post Office for allowing cash transactions at no charge for consumers. Starling figures indicate most consumers in Britain live within three miles of a post office.

Boden began her career standing behind the teller counter at a branch, but sees branches as relics in the mobile age. There’s a nostalgia, as she terms it, for them, in the industry that is at least 30 years out of date.

In her latest book, Boden posits a reality check.

“[A] perhaps too little considered test that any entrepreneur should try is to ask themselves whether they are a potential user of the product or service they are intending to launch.”

Boden has dedicated a big chunk of her life to her idea. We asked what she’d ask to be put on her tombstone: “Anne Boden, Neobanker”? “Anne Boden, Banker”?

She ponders that a moment. “Anne Boden, a woman who thought customers deserved better.”