An onboarding process is really nothing more than a traditional CRM process implemented at the beginning of a consumer’s banking relationship. The difference is that, unlike a typical cross-sell program, there is normally less internal insight available on the new customer (especially behavioral and purchase data), and the focus is more on building engagement than selling new services.

According to the 59-page Digital Banking Report, Guide to Multichannel Onboarding in Banking, done early and often after the new account is opened, using various channels that leverage insight collected at account opening and thereafter.

By doing so, a bank or credit union is more likely to foster a positive consumer experience, differentiating your institution and building long lasting loyalty.

A successful onboarding program is not easy. “Onboarding requires a strategy that shows the customer you know them; that you will look out for their individual needs; and that you will ultimately reward them for their business,” says the inaugural Digital Banking Report (previously published as the Online Banking Report). Central to this effort is the collection of insight and the leveraging of insight to meet these objectives.

A successful onboarding program is not easy. “Onboarding requires a strategy that shows the customer you know them; that you will look out for their individual needs; and that you will ultimately reward them for their business,” says the inaugural Digital Banking Report (previously published as the Online Banking Report). Central to this effort is the collection of insight and the leveraging of insight to meet these objectives.

Unlike many traditional cross-sell programs, onboarding is an ongoing process. It is the communications gateway to what will hopefully become a long-term relationship with additional communication moving the customer from the ‘engagement’ stage to the ‘relationship’ stage and eventually to the ‘loyalty’ stage of the consumer life cycle.

As powerful as a good onboarding strategy can be, it can also destroy trust if not done correctly. The mission is to ensure that insight is collected whenever possible, delivering contextual communication that improves over time. This helps the communication be more relevant, reinforcing the decision the new household made to open an account at your institution.

As the old saying goes, “You never get a second chance to make a good first impression.” Onboarding is first way of illustrating the type of customer experience that can be expected at your organization. Done wrong … trust is broken. This usually leads to attrition … quickly.

Leveraging years of testing at financial institutions of all sizes, the Guide to Multichannel Onboarding in Banking provides a very in-depth review of each of the following 21 ‘rules’ that can help ensure success of an onboarding process.

Leveraging years of testing at financial institutions of all sizes, the Guide to Multichannel Onboarding in Banking provides a very in-depth review of each of the following 21 ‘rules’ that can help ensure success of an onboarding process.

According to this latest Digital Banking Report, financial institutions that follow these rules greatly increase their chances of success from both the financial institution and consumer perspective.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

1. Appoint a Program Leader

Since few institutions have a cross-departmental ‘owner’ of cross-selling or retention, a single point of contact for the onboarding process should be assigned. This person should manage the budget, goals and measurement of program success, and should be the liaison between product, channel and marketing departments. Without a strong leader, the onboarding process will lack focus and may never get initiated or be fully funded.

2. Include All New Account Openers

Onboarding is an ongoing process that should include both new households as well as current customers/members that open a new account. Ultimately, an onboarding process should be done for all account types including deposits (checking and savings), loans (consumer and mortgage), small business relationships and investment services. Some organizations even build an onboarding process for ancillary services such as online banking, mobile banking, billpay, P2P transfers and mobile deposit.

3. Acquire the ‘Right’ Households

A strong targeting strategy helps to acquire households willing to build a broader relationship than just one account. The more targeted the acquisition strategy, the greater the potential for onboarding success. In addition, if a significant financial or product incentive is used to acquire the new household, the ability to successfully onboard and ultimately retain the household is decreased as a percentage.

Another way to improve your acquisition results is to supplement your investment in offline channels like direct mail, and mass media with online tools that can optimize your overall investment. Due to the ability to target interested consumers as they proceed through the purchase funnel, financial marketers are increasingly leveraging digital retargeting to find interested digital shoppers.

4. Collect Insights from Day One

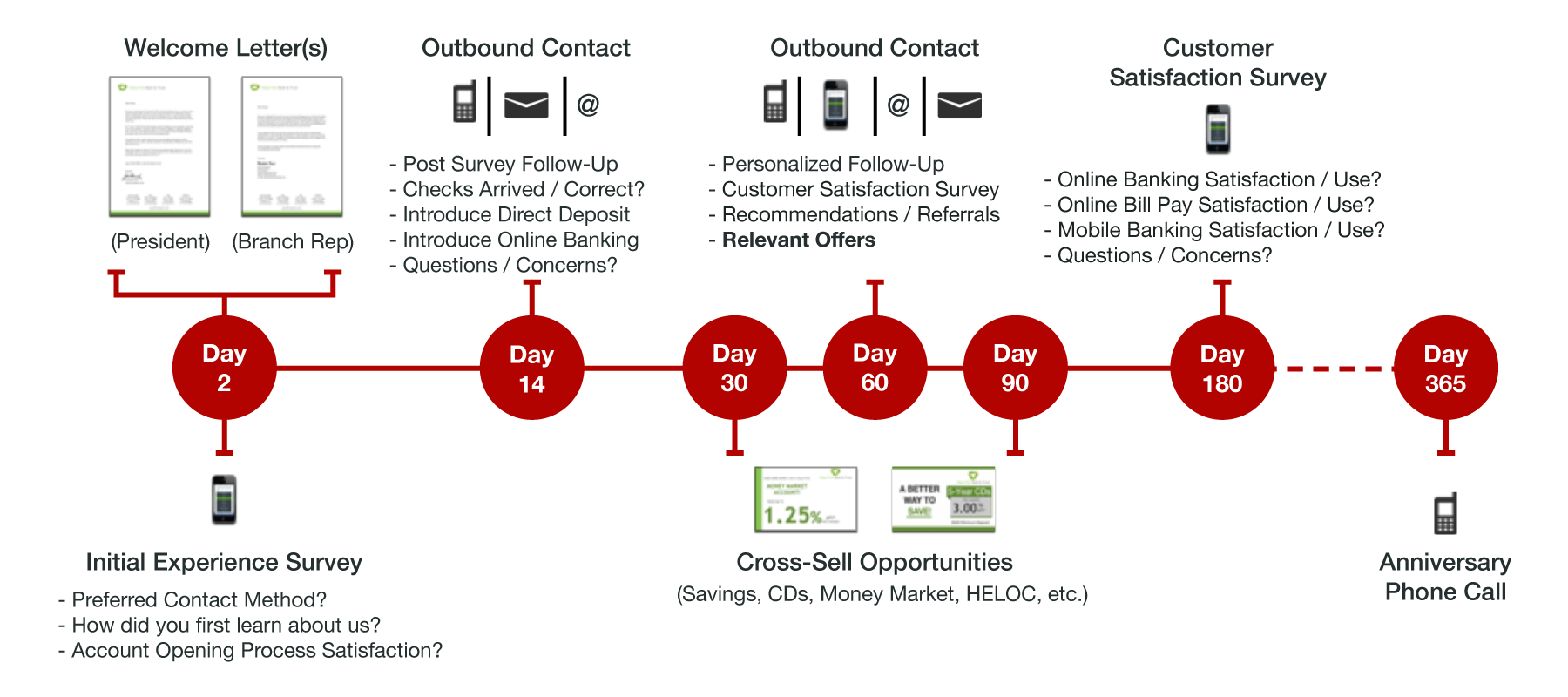

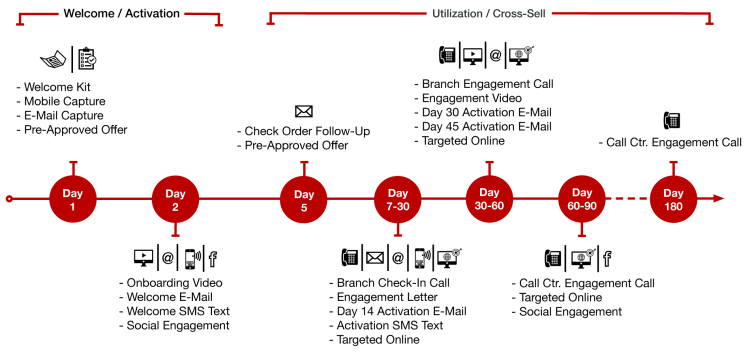

The ability to personalize communications and provide targeted solutions is based on the amount of demographic, behavioral and social insights you can collect. The collection of insight doesn’t stop at the new accounts desk, but should continue during the entire onboarding process using surveys and ongoing dialogue to build a robust customer profile as shown in the onboarding flowchart from Onovative below.

The challenge is to balance the desire for collecting more insight either in person or through digital channels with the need to simplify the account opening process for an enhanced customer experience. A simplification strategy that is proving effective for some organizations is the integration of smartphone/tablet camera functionality to capture primary data and insight both in the branch and as part of digital account opening.

5. Communicate With the New Accountholder Early

The sooner you can reconnect with the new accountholder, the more successful you will be in building dialogue and engagement. From a personalized, handwritten note sent to the consumer the same day they opened the account, to leveraging a cell phone number for an SMS text or email address for a simple email a few minutes after the new customer/member leaves the office, a quick ‘thank you’ is a great way to start an onboarding process.

For institutions just beginning an onboarding process, a one-touch ‘thank you’ communication may be all that is possible initially. But, it is a great place to start.

6. Connect With the New Accountholder Often

Building a robust cadence and sequence of communications based on new accountholder actions taken, engagement will occur and additional selling can begin. One of the biggest misconceptions by financial institutions is that new households don’t want to get a lot of messages after opening a new account. According to several research studies, satisfaction and cross-sell success both improve as the number of contacts are increased up to 4 times, and is still effective if the consumer is communicated with as many as seven times during the first 90 days.

7. Personalize Dialogue

Each communication must reflect where the new customer is in their financial lifecycle with your organization. Show the consumer you know them and understand their needs. Eventually, the goal is to mine the data on the customer to generate marketing messages that are customer (as opposed to profile) specific.

Just as important as remembering the demographics and product ownership of the customer, it is important to build a communication channel strategy for each consumer based on the channels they use and respond to best. By leveraging data from all sources, content can be developed based on needs, channels and devices.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

8. Start With a Simple ‘Thank You’

Don’t forget to thank the new customer for their business. This can be done by SMS or email immediately after the customer completes account opening. Some organizations have developed local ‘surprise and delight’ offers from local merchants to provide as a thank you.

9. Build Engagement Before Selling

Nobody likes sales messages before you have earned trust. Start your onboarding process with offers around ‘go with’ solutions (online banking, mobile banking, bill payment, mobile deposit, direct deposit, etc.) before trying to expand the relationship with savings or credit products. According to Novantas, the positive impact of direct deposit and bill pay alone can increase relationship value by more than $400.

10. Don’t Forget Your Brand

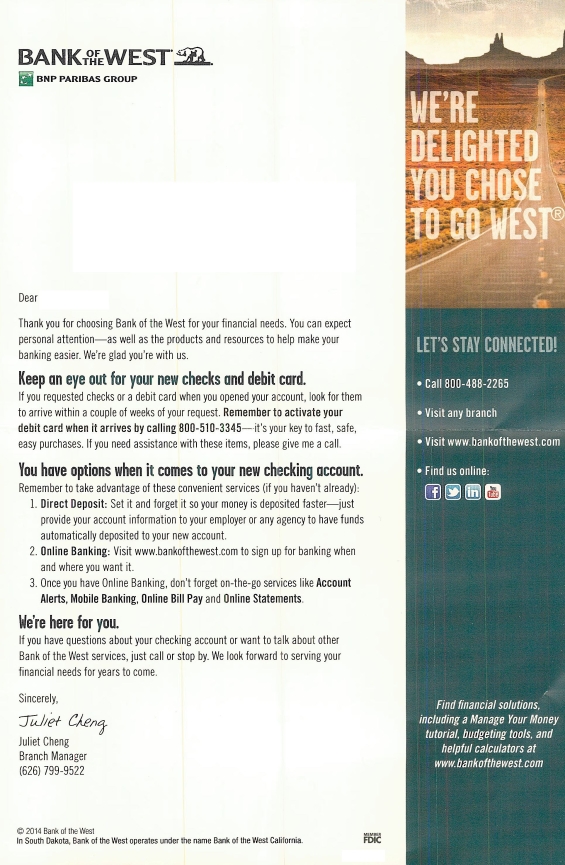

New customers and members are not necessarily familiar with your brand. Let them know what makes your organization ‘special.’ Make sure that all onboarding communication reinforces your brand and provides the new household with reasons to refer your institution to their friends.

11. Provide Personalized Offers

People respond to offers that relate to accounts they hold and their financial lifestyle. In other words, if a household has a checking account and you want them to sign up for direct deposit or bill pay, the offer will be stronger if you tie it to their checking account. If you have a rewards program, leverage this as part of your conversation.

12. Start Your Communication with ‘Snail Mail’ and Email

For onboarding, traditional direct mail and email is a great foundation for future communications. In combination, there is often a 1.5 – 2X lift in results. For financial communication, 38 percent of the U.S. households surveyed preferred receiving postal mail compared to 17 percent desiring information over digital channels.

13. Integrate All Possible Channels

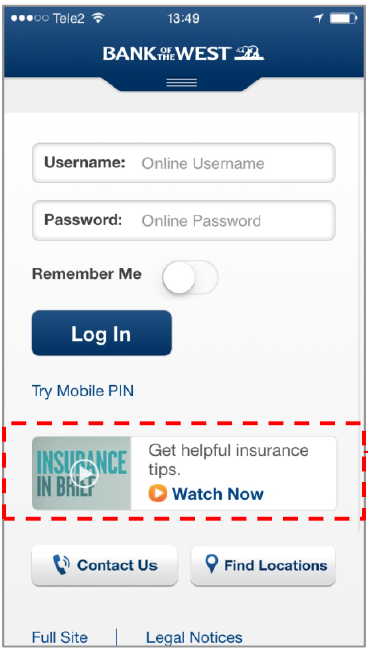

Today’s digital consumer is more likely to open your email on their phone than at their desk. They are also open to receiving SMS messages and targeted offers in their mobile banking app.

Leveraging multiple channels (1:1, direct mail, email, phone, SMS text, online, mobile banking, digital, video, ATM, social, etc.) allows you to appeal to a customer’s channel preferences while delivering a highly personalized message that will positively impact results. Many organizations have achieved a lift in results of 1.5-2X when combining multiple channels to reinforce an onboarding process.

14. Leverage Your Local Presence

Branch phone call follow-up can improve onboarding results significantly and is a great use of branch ‘down time.’ The use of new household welcome parties and partnering with local merchants for non-financial offers also is a great way to leverage your local presence.

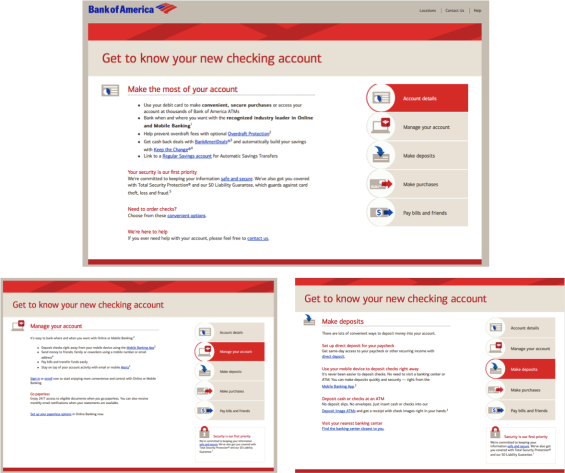

15. Build Custom Jump Pages

With email, online, mobile and web communication, it is best to use jump pages that identify the customer or member as being new to your institution. Several organizations have unique jump pages that are specifically designed for new customers, providing step-by-step instructions on how to take best advantage of services opened.

Many of these specialized jump pages also have links to ‘go with’ service pages, providing easy applications and/or additional education on the service(s).

16. Integrate Video as Engagement Tool

Short form video that is built for mobile device viewing is a highly effective selling tool, especially when it includes links to open a new account/service. Differentiated from long-form commercials or YouTube links, these short form videos have large graphics, little if any captions and are focused on providing instruction around the use of digital services.

Highly sophisticated videos can also be produced that are personalized to the specific accountholder and the can even be used as a video receipt for the new account opened.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

17. Maximize Digital Retargeting

Retargeting is the practice of serving ads based on prior engagement. While there is more than one form of this technology, the most frequently used is site-based retargeting. (Other forms include search retargeting, email retargeting, Facebook retargeting, mobile, and CRM retargeting.) This entire process is automated and occurs within a fraction of a second. By the time the page loads, the ad space will have been purchased and your ad will appear alongside the page content.

Results vary, but many retargeting programs can generate lift in results of 2-3X use of a single communications channel.

18. Selling on Mobile

The use of alerts and sales messages within mobile banking reinforces other channels. Extremely effective as an engagement tool, opt-in push notifications are being used (and promoted) by more and more organizations.

Thinking outside the box, some organizations use behavioral insight to offer engagement and ‘next most likely’ products, while Bank of America has gone as far as prompting customers with merchant-funded offers through SMS texting.

19. Measure Results

While a common sense step for all marketing initiatives, measurement is the most often overlooked (or avoided) step. If in-depth analysis is not feasible, evaluate efforts on a go/no go tracking basis. While extraordinarily difficult, the objective is to find answers to the following questions:

- How did a particular sale happen?

- Who should get the credit for it?

- How much credit should be attributed to each consumer interaction across channels, and on what basis?

- How should the investment be apportioned across channels?

20. Test and Learn

Continue to test frequency, cadence, targeting, offers and other components of your multichannel onboarding process.

The key is to test messages, timing, offers and channels to optimize your specific program from both the customer and organization’s perspective. While multivariate testing may seem daunting to many, less scientific ‘thumbs up’/’thumbs-down’ directional insight many times is a better time/value trade-off.

21. Don’t Try to Boil an Ocean

One of the biggest impediments to onboarding success is not getting started. Instead of trying to build the ‘perfect’ onboarding process, start small and build layers on a strong foundation.

The good news is that virtually no financial institution has stopped an onboarding program once they have initiated the process. This is because the return on investment (even in the worst case scenario) is always positive, and many times has a return of 5:1, 10:1 and even 20:1 or higher.

If you don’t have a multichannel onboarding process in place already, start with the basics and move forward incrementally. The learnings along the way will serve you well as you build a more robust process.

About The Guide to Multichannel Onboarding in Banking

The Guide to Multichannel Onboarding in Banking is the first of the Digital Banking Reports to be published since the 20 year old Online Banking Report was rechristened back in July. Focused on digital, online and mobile innovations and strategies in financial services, the Digital Banking Report is a subscription-based publication distributed monthly.

Subscriptions to the Digital Banking Report are available to individuals and institutions, with the distribution of reports being done digitally. Subscribers not only receive a monthly report but also have free access to the 150+ report archive.

The Guide to Multichannel Onboarding in Banking is a 59-page report on the best-in-class strategies and tactics used by financial organizations globally to onboard new customers and members. With 20 charts/graphs, an onboarding business case and dozens of samples of onboarding communication, this Digital Banking Report is the ultimate guide for any organization wanting to start or improve an onboarding program.