Research shows one in four applicants drops out while signing up for banking services. In fact, 90% of financial institutions report facing some form of digital abandonment, resulting in millions of dollars in lost business.

These insights come from a survey of IT decision-makers that Sapio Research conducted in October 2022 on behalf of ABBYY. About 12% of the more than 1,600 survey participants were in the banking sector, and they reported a higher level of abandonment than those in any of the other 11 sectors, which included retail, energy and insurance.

The good news is the dropout rate can be reduced, and the survey shows executives across all sectors believe doing so would improve key performance metrics: 26% say it would increase revenue, and 86% say it would improve brand reputation.

So, what is causing so many potential customers to drop out and how can financial institutions meet the demand for slicker and quicker digital services?

Let’s look at the digital onboarding pain points.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Not Enough of a Human Touch

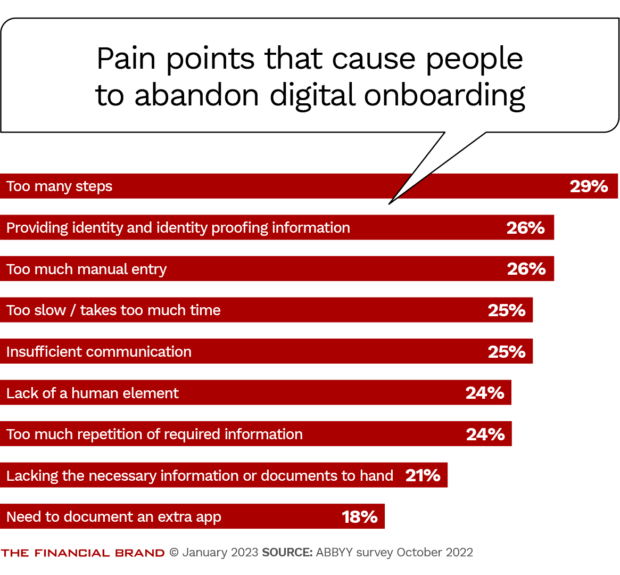

Perhaps counterintuitively, even a digital process benefits from a human element. Despite huge amounts of technology being thrown at onboarding to improve the user experience, the survey points to a “lack of human element” as one of the most common reasons people drop out; 24% of the executives in the broader cross-industry part of the survey cite this as a factor.

People still want a real-life person to talk to, whether to provide assistance or assure them they’re on the right track. They don’t want to spend time inputting data and being thrown from one automated process to another with no opportunity to speak to an expert.

That’s not to diminish the importance of automation: Of the survey participants who modified and streamlined their onboarding process through the use of technology, 43% say it improved overall customer experience and 37% say it increased customer retention.

Proof of Identity

Modern digital onboarding platforms often take a headshot of the applicant as one of the steps in the process. However, making sure this is taken in real-time goes one step further in improving security and increasing speed.

On a daily basis, 3.2 billion images are shared on the internet, and many are generated by artificial intelligence, so fake portraits can easily be used to populate a “selfie” screenshot. Having a selfie taken with real-time video or photo capture can help ensure the person is a live human being, and then the technology can compare that image with the submitted identity to ensure a match.

This type of facial-matching technology means the customer doesn’t have to wait around for their picture to be analyzed and compared — it’s all done on the spot using sophisticated intelligent automation software with high accuracy rates.

Read More:

- Improved Digital Account Opening Must Be a Top Priority for 2023

- What’s the Future for Checking Accounts?

- Dig Deeper into How Banks Can Improve Their Poor Digital Onboarding Experience

All The Toggling Between Screens

“Too many steps” (29%) and “too much manual entry” (26%) also are among the top reasons people abandon an application, according to the survey.

Much of the frustration lies with having to switch between screens to execute certain steps. For example, people may be asked to sign in via their email to change a password, go to their camera to take a selfie or open up a different app to scan a document. Having to flick to different screens is a big turnoff and adds time to the whole process.

Keep It as Simple as Possible:

Financial institutions should avoid adding too many steps and frustrating customers.

An onboarding app should provide an all-in-one solution. It also should offer the ability to complete applications on both mobile and laptop devices, as people will sometimes start it on the go and want to complete it when they get home and have access to the documents they need — which ties into the next challenge.

Providing Supporting Documents

Verifying identity often means requesting additional documents, such as a utility bill or income statement, to provide proof of address. But once again, applicants don’t want to wait for hours or days while validation takes place. Failure to meet real-time enrollment just leads to dropouts and lost business.

Using integrated document recognition and security detection software will allow this process to take place within minutes, notifying the applicant immediately if the submission is sufficient or if anything more is needed. This type of document-centric identity affirmation is expected to be used by an estimated 85% of financial institutions at onboarding by 2023, an increase from 30% in 2021, according to analysts at Gartner.

Overcoming key pain points like these ensures a better digital onboarding experience for bank and credit union customers. A good onboarding strategy strikes the right balance between human interaction and intelligent automation, and between minimizing security risk and not annoying customers. Implementing the right tools to help customers efficiently prove identity and submit supportive documents while incorporating a human element along the way is an investment that pays off — it saves time and increases sales. It also creates goodwill that, as survey respondents suggest, can give financial institutions a reputation boost.

About the author:

Brian Hettinger is senior director, mobility, at ABBYY, a firm that specializes in intelligent automation. He has been enhancing user experience in mobile banking for more than 20 years through spearheading initiatives to implement mobile capture, remote check deposit, identity proofing, mobile onboarding, bill pay and more.