Marketing strategies are as varied as the financial institutions behind them.

For FVCbank, an emphasis on radio makes sense. The $2.4 billion-asset bank aims to attract business customers in the Baltimore and Washington, D.C., metro areas — where the competition is heavy, media is expensive and commuters are plentiful.

Bruce Gemmill, the chief marketing officer, says radio has proven effective at increasing brand awareness for FVCbank. Radio also gives other marketing efforts a boost, helping drive organic search results and supporting social media initiatives.

But State Bank of Southern Utah cut its budget for radio advertising in half and diverted that spending to video instead. “We’ve done this because we’ve been seeing good success in doing video ads on YouTube, Facebook and Instagram,” says Cordelle Morris, CMO for the $1.2 billion-asset bank.

The Financial Brand asked a handful of marketers around the country to share where they’re placing their bets in the effort to grow their institutions, whether they foresee cutting back on particular types of advertising, and what they’ve learned about making the most of their budgets. Here’s what they had to say.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

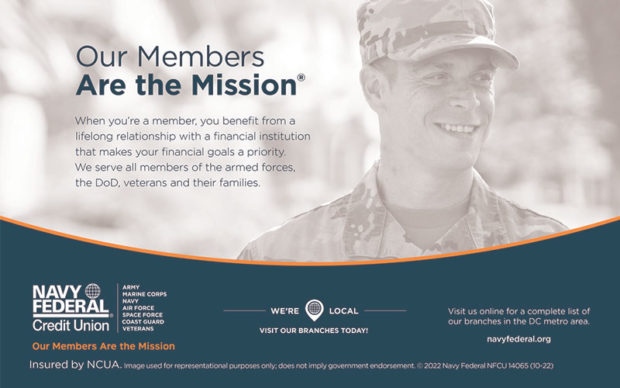

Video and Social Media Are Strongholds in Navy Federal’s Marketing

Pam Piligian

Chief Marketing Officer

Navy Federal Credit Union

Vienna, Va.

Asset Size: $156.6 billion

What type of marketing is getting the largest share of your budget?

Video, across digital and broadcast channels, continues to be an essential part of our media mix to drive awareness of the value we bring to our members and future members. Showing our support for the military community and its values helps support the other portions of our media mix, including our performance marketing and other related marketing efforts.

Which products are you emphasizing in the marketing lately? Can you tell us a little bit about the approach?

We own a unique space in the financial category in that we get the privilege of serving those who serve or have served. In the current economic environment, all our various services and products play a role in supporting the healthy financial lives of our membership base — active-duty military, veterans and their families.

We focus on highlighting messaging about our mission of financial wellness and the digital and service channels that provide award-winning member service, with deposit products, auto loans, credit cards and mortgage solutions. While we map out an annual plan, we adapt based on the current environment.

For example, the “Our Members are the Mission” campaign continues to entertain with a variety of scenarios about the financial challenges people face and how Navy Federal Credit Union’s breadth of services can help. The campaign also makes a powerful statement about the impact the credit union has on members’ day-to-day lives.

Our team also works with a military consultant, veterans at Navy Federal Credit Union, and Vets2Set to ensure the casting and tone resonates with our audiences.

How much effort do you put into social media? Is there a social media platform that you find particularly effective?

At Navy Federal Credit Union, social media is a key part of our service to members. In addition to more than 350 branches worldwide and robust digital banking platforms, our social media channels are another way for us to real-time respond to member needs.

For us, the effective social channels vary based on our objectives. For example, Meta channels are hard workers for us, both from a content and member experience standpoint. YouTube is the world’s second-largest search engine (behind Google) and a platform a majority of us use. It’s key to our financial education efforts. (Overall, Navy Federal has 340 videos posted on YouTube, many of them educational.)

Elsewhere, we have large communities on Twitter/X and LinkedIn, and emerging platforms are starting to demonstrate their value in our mix. Simultaneously, the results show paid social drives substantial traffic to our website, and when we bring the right ad to the right person at the right time, we know social helps us meet business goals.

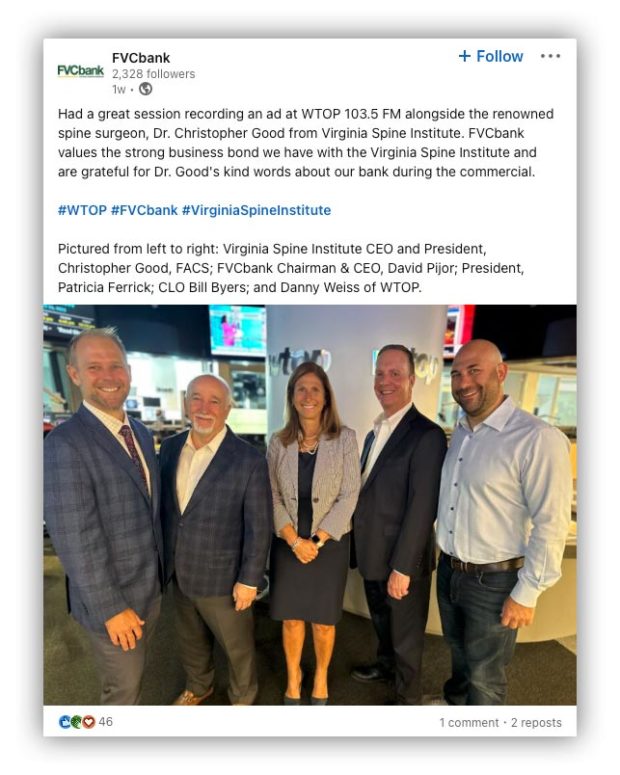

It’s Radio Days for a Community Bank in a Major Metro Area

Bruce Gemmill

Chief Marketing Officer

FVCbank

Fairfax, Va.

Asset Size: $2.4 billion

What type of marketing is getting the largest share of your budget?

A marketer’s approach is typically data-driven when allocating marketing budgets to different advertising channels. By analyzing historical performance metrics across various channels, considering conversion rates, customer acquisition costs, and overall return on investment, marketers can identify which channels have consistently delivered the best results, thus maximizing the budget’s capital.

We devote significant spend on radio advertising, an advertising medium proven to increase our brand awareness and convey the bank’s unique personality. In our Washington, D.C., and Baltimore metropolitan markets, radio blends perfectly with other media, helping to drive organic search results and supporting our social media initiatives.

We also recognize the importance of staying flexible and open to experimentation. A portion of our budget is dedicated to exploring a variety of channels and tactics. This allows us to adapt quickly and capitalize on new opportunities while optimizing our spending for the best possible outcomes.

Are there any types of marketing you expect to cut back on? If so, why?

Going into 2024, we will focus less on cold calling. Unsolicited phone calls can be intrusive and lead to a negative experience. People prefer a more personal and non-intrusive approach.

Traditional print advertising is another channel we will not be considering. Print advertising in the Washington, D.C., market is expensive and less effective due to the shift toward digital media.

Which products are you emphasizing in the marketing lately? Can you tell us a little bit about the approach?

No matter the size of the bank, products are generally the same. FVCbank focuses on enhancing the customer experience.  Most banks provide courteous and responsive customer service, but not all community banks have embraced financial technology. Combining traditional, friendly, and helpful customer service with financial technology dramatically improves the customer experience.

Most banks provide courteous and responsive customer service, but not all community banks have embraced financial technology. Combining traditional, friendly, and helpful customer service with financial technology dramatically improves the customer experience.

FVCbank recently introduced time-saving and easy onboarding platforms for mobile and online banking customers. For example, Lightning Lending, our digital origination system for business banking, pulls in data at each stage of origination. Existing customers will find applications are easily pre-filled with relevant information. Existing and new customers will experience the convenience of seamless AI technology — automated spreadsheets, aggregated data, scored applications, and document packages.

Lightning Lending meets business expectations for digital convenience and brings efficiency gains to our internal teams. The platform is unique in its use of data to streamline the origination of any business banking product, from application to decision to close. This program is helping meet the financial needs of small and underserved businesses with loans of up to $500,000.

Soon, we will be launching another new digital tool that will help business customers drive better insights and decision-making, such as the ability to forecast cashflows across accounts and the ability to do competitive benchmarking. FVCbank will continue to embrace fintech to enhance the customer experience with easy, convenient, and relevant platforms.

What is the focus of your radio campaign?

We have scheduled a series of :60 commercials recorded by eight of our largest customers.

To do this, I had to arrange studio days and times with the radio station, coordinate client calendar dates, write the script as an interview between our bank president, Patricia Ferrick, and the eight individual clients, and finalize broadcast on-air scheduling.

The eight client interviews rotate every day of the work week, mostly drive time to capture commuters, with a ninth :60 commercial tying into the campaign and voiced by our chairman and chief executive, David Pijor.

How much effort do you put into social media? Is there a social media platform that you find particularly effective?

We use Facebook and LinkedIn. We schedule three to four weekly posts covering our bank officers’ community engagements, new bank products or services, individual bank employee achievement highlights, customer relations and testimonials, and more. Our calling officers are effectively reposting our posts on their personal platforms. We also boost specific posts.

By posting engaging, relevant topics, our followers have increased by over 40% in the past six months.

Read about marketing efforts from other community banks:

- Storytelling with a Twist Helps This Bank Connect with Small Businesses

- Funny ‘Bank of Joyce’ Ads Stand Out in Crowded Atlanta Market

A Brand Refresh, New Merch and Social Media Fun Are All in the Mix

Cordelle Morris

Chief Marketing Officer

State Bank of Southern Utah

Cedar City, Utah

Asset Size: $1.2 billion

What type of marketing is getting the largest share of your budget?

State Bank of Southern Utah has recently done a brand refresh with a new logo, so a large chunk of marketing spend for this year is going toward new promotional merchandise and signage. Our goal is to provide branded items that people hang onto, including hats and shirts that are trendy and customers enjoy wearing.

Are there any types of marketing you expect to cut back on? If so, why?

We’ve halved our spending on radio ads. We’ve done this because we’ve been seeing good success in doing video ads on YouTube, Facebook and Instagram. The marketing dollars that were being spent on radio have been shifted toward producing quality videos and putting additional video ads online.

Which products are you emphasizing in the marketing lately? Can you tell us a little bit about the approach?

Our approach is emphasizing what differentiates our bank, which comes down to personal relationships and our involvement in the communities we serve. We are trying to humanize our bank and make it feel more personal by regularly highlighting our employees and pushing these videos through ads on social media and YouTube.

How much effort do you put into social media? Is there a social media platform that you find particularly effective?

We find Facebook Pages very effective in the communities that we serve. We have a Facebook page for each branch promoting local content. The goal is to not focus on bank products, but focus on people by promoting “culture posts” (all about our bank employees) and “community posts” (all about our involvement in the community and anything happening in the community). We provide an award each month, called “The Social Media Butterfly,” to the branch that creates a post with the most reach.

We don’t have a quota for how many posts to do each month, but we are trying to create posts that generate engagement. We deem a post that has a reach of 500 or more to be successful. Each month, we put together some of our favorite posts to share with the other branches, to help them get ideas for posts they could possibly do.

Our TikTok account is new and growing. It is experimental at this point but focusing on creating fun, entertaining, or “edu-taining” videos. Our goal isn’t to be “funny” (humor can sometimes be offensive), but our goal is to create “fun.” For example, a video showing what it is like to go through the tube at our drive-up. We share our TikTok posts as reels on Instagram, and our successful Facebook posts on Instagram as well. I love our social media strategy.

Read more:

- The Fun Social Media Campaigns Keeping These Marketers Inspired

- See our most recent coverage of marketing strategies

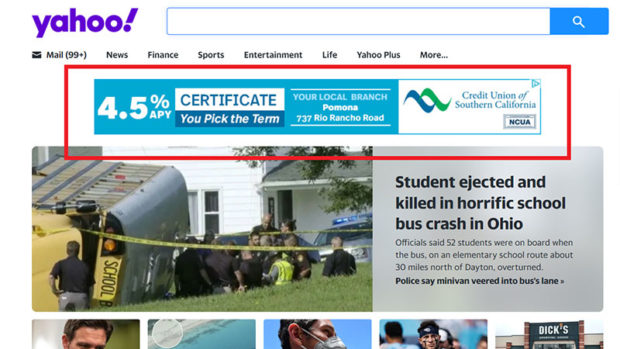

Focusing on Digital Ads to Bring in Deposits and on Social Media Engagement

Matt Tully

Vice President of Marketing

Credit Union of Southern California

Anaheim, Calif.

Asset Size: $2.6 billion

What type of marketing is getting the largest share of your budget?

We use a significant amount of our budget on programmatic digital display marketing because we get very good response from it for a variety of products. Ad respondents go directly to landing pages on our website, where they apply for products or membership directly. It’s been especially important this year for attracting deposits.

Are there any types of marketing you expect to cut back on? If so, why?

We’re not cutting back on any channels, but rather changing the product mix to meet the market. For example, we have reduced our marketing for loan products since rates are high and our bigger priority right now is deposits.

Which products are you emphasizing in the marketing lately? Can you tell us a little bit about the approach?

We are focused on deposits products — share certificates, checking, money market, and direct deposit. We market to both current members through our internal channels like email and digital banking, and to non-members through digital display and social media. Typically we are blanketing a five-mile radius around our branches with digital ads.

How much effort do you put into social media? Is there a social media platform that you find particularly effective?

We are very focused on social media and post frequently for both timeline content and advertisements. We always aim for high engagement with each post. We see really high engagement with community content, such as our donations to local charities.

We are mostly focused on Facebook because it matches our demographic, though we are putting more effort, time and budget into Instagram and Tik Tok in 2024. Our goal is to hit 20,000 followers on Facebook this year.

What banks and credit unions are the leaders on social media? See our top 100 list to find out!