As 2021 shapes up increasingly as a year of expense challenges, marketers and management will be looking for ways to accomplish much more with less. Marketing technology in its many different guises will be part of that solution.

Scott Brinker, Editor at chiefmartec.com, in a webinar, identified five major trends marketers must be exploring sooner rather than later. The Financial Brand digests the martech expert’s points for bank and credit union marketers.

1. No-Code Development Will Empower ‘Citizen-Creator’ Financial Marketers

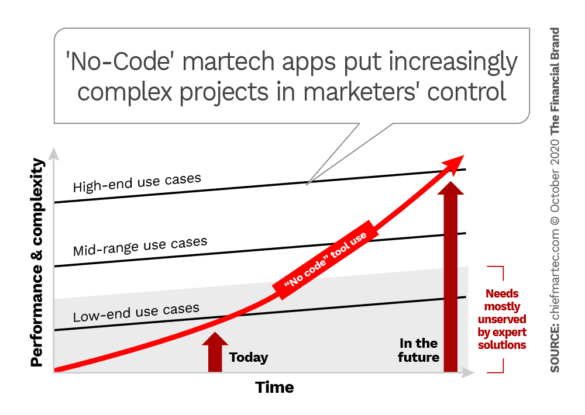

No-code development platforms allow non-programmers to manipulate blocks of functionality instead of literally writing computer code. This allows financial marketers to put together programs that they formerly had to rely on software developers to implement. This promises to unleash their creativity and to eliminate delays in working with experts outside of Marketing. The result will be increased agility.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Brinker draws a parallel between no-code and Microsoft PowerPoint, in that they both enabled what he calls the “democratization” of technology that used to require entire teams of people to produce. Brinker predicts that marketers will enjoy the same freedom in digital services.

“There’s a whole generation of software that lets non-technical people create cool apps,” says Brinker. He explains that this includes a wide variety of digital items, such as landing pages, website forms, interactive content like online quizzes and calculators, mobile apps and voice assistants.

“And this just scratches the surface of what these tools enable any general business user to do,” Brinker adds. He spoke during the MarTech Conference.

Putting this power into marketers’ hands enables them to operate on tighter timelines, with resources directly in their control. Truth be told, says Brinker, many of the tasks no-code programming enables generalists to tackle rank among those least-favorites that experienced web and mobile developers would rather not spend their time on anyway.

“No-code will enable more and more marketers to build things when they need them,” Brinker explains. He predicts that in time no-code will move beyond low-end work to more complex tasks.

Read More: Financial Institutions Must Clean Up Their Mobile Apps

2. Platforms, Networks and Marketplaces Will Unleash New Services

“Software is more than just the applications we install on our computers and smartphones,” Brinker wrote in his book Hacking Marketing: Agile Practices to Make Marketing Smarter, Faster and More Innovative. “Every website and online service we use, from Amazon.com to Yahoo!, is a software program — or, more accurately, usually a whole collection of software programs working together.”

A family of approaches Brinker spoke of during the webinar include these three, all of which create a common space and functionality:

- Platforms. These, as Brinker describes them, enable “specialization, innovation and variation of apps, campaigns, creative, workflow and more.” He says examples include Salesforce, HubSpot, Shopify, Xero, and iOS.

- Networks. These enable “connections, interactions and asset sharing” among people in online communities. Examples include Facebook, LinkedIn, Slack and Twitter.

- Marketplaces. These match producers and consumers, helping them find each other. Airbnb, AdWords, App Store, Etsy and Fiverr are examples.

“For some of us in marketing, this is the future of what we’ll be,” says Brinker, “but for some of us it’s [already] the present. These all represent new ways to engage with customers.”

In financial services Intuit’s growing QuickBooks universe, augmented recently by introduction of QuickBooks Cash, a deposit account provided in partnership with Green Dot, is an example of an online community. Another is BankMobile’s sale of virtual bank-at-work programs via the online benefits broker BenefitsHub. PwC has suggested that part of financial institutions’ recovery from the COVID-19 recession will entail formation of major financial and other platforms. Some will be operated by institutions and in other cases institutions will be participants in platforms operated by others.

These types of opportunities for marketers can be assisted by the increasing advent of open banking, which enables financial companies and qualified third parties to exchange data. One example is Plaid Portal, a platform which enables consumers to control how their personal financial data is shared among multiple financial apps and other providers.

Read More: New Tech Platforms Hold the Key to Retail Banking’s Future

3. The ‘Great App Explosion’ Is Bringing Martech to Every Corner of Marketing

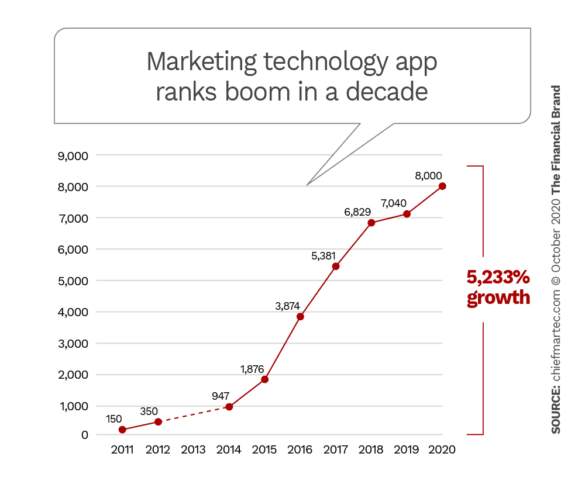

Brinker has become famous in martech circles for a graphic he puts together periodically showing all the types of martech available organized by type of application with the logos of every provider, The Marketing Technology Landscape. The supply and ubiquity of martech has made the graphic so dense that one wag recently sent Brinker a picture of himself using a microscope to pinpoint one particular supplier.

Actually, that’s not really an exaggeration of how martech sector continues to expand.

As shown in the chart, the quantity of apps available to marketers has risen by over 5,000% in the course of a decade. Brinker divides them into six broad categories: advertising and promotion, content and experience, social and relationships, commerce and sales, data, and management.

In his April 2020 count, there were over 8,000 apps. This is just the beginning: Brinker says that researchers at International Data Corp. IT (IDCIT) estimate there will be over 500 million digital apps and services developed and deployed using cloud-native approaches by 2023. IDCIT notes that COVID-19 has served as a catalyst for use of cloud processing and predicts that most enterprises will double the rate at which they move applications to the cloud by the end of 2021.

Brinker notes that the cloud will continue to encompass both general purpose infrastructure software as well as very specific apps. Some will be platforms that enable marketers to find specific apps that suit their needs.

One example he cited was Twilio, which is a platform that specializes in customer communication, bridging between companies like banks and their customers on a multitude of communications vehicles from phone to social media.

“Application platforms make it possible for marketers to discover the right sort of apps to plug into,” explains Brinker.

4. Marketers Will Journey from Big Data to Big Ops

Unravel any marketing cliché and you will determine what is really there versus the hype. Brinker’s personal peeve remains a popular one.

“People love to say, ‘Data is the new oil’,” says Brinker. “I’m not really overjoyed with that. I would rather say, ‘Data is the new oil paint’.”

To Brinker, data by itself is just data, raw and unrefined. Even a supply of oil paint, he says, is just goo in a tube until it is applied to canvas with some creativity. Only when effort is added to “data oil,” then, does it become valuable to marketers.

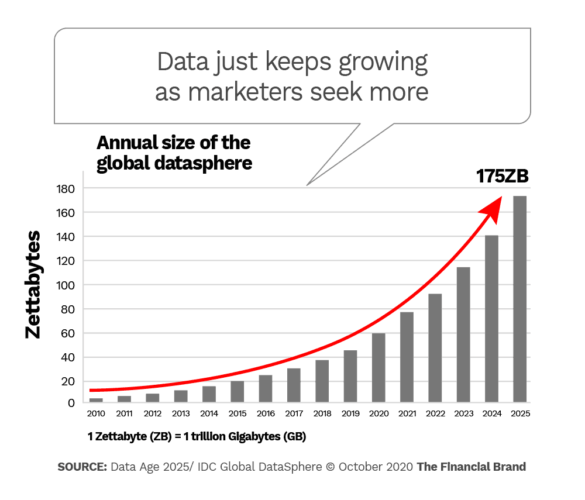

He believes this is important to understand because while people keep parroting the oil cliché, most data in most organizations never gets put to work.

This is happening at the same time that the supply of data is growing by leaps because as more and more activities are performed digitally, they become more easily measured and tracked — in theory. Indeed, “44% of the data that goes through organizations doesn’t even get captured,” says Brinker.

Brinker explains that only distillation of raw data to make sense of it and relate it with other data makes it useful — the process turns data into information, in other words.

So, when people speak of Big Data, Brinker tends to consider that as last-decade thinking. Now instead of gushing about the quantity of data, he says, organizations should be asking how they are using it to assist in making decisions and how they are using it to execute on business goals.

“That is how we get value out of data,” says Brinker. “That is how marketers take our oil paints and turn them into Leonardo DaVinci masterpieces.”

That “painting” takes the form of a group of activities that Brinker calls “Big Ops.” These are all ways that marketers turn Big Data into results, from data that goes into designing products and services through to what results in revenue for the organization.

Read More: Data + AI Must Play Bigger Role in Financial Marketers’ Growth Strategies

5. Beyond Artificial Intelligence: Harmonizing Human and Machine Thinking

So far, many of the tasks that AI has been doing in marketing are those that aren’t worth a human doing, according to Brinker. By this, he explains, they are jobs that serve helpful purposes but which no organization could afford to pay humans to do. One example would be optimizing the time of day when a email will most likely be opened by a specific individual. Handy information to have before doing a major email promotion, but at human speed and cost a virtual impossibility at any scale.

Brinker says the future dividing line between human tasks and AI tasks will ideally include a “line” less and less and, instead, more of a decision of which aspects of a task require human judgment and which ones can be safely trusted to AI. In time, Brinker predicts, AI will be making more decisions, but they will still be subject to human override, leading to what he calls “The Age of the Augmented Marketer.” In some areas this may produce multiple options from AI, which human marketers will choose from. In this way, AI becomes a coach to the humans.

But technology, even in ecommerce and digital bank marketing, is not a one-way street. People use bots and related services to help them shop for their best options. Brinker suggests that a time will come when there will be “machine-to-machine” marketing, in which a marketing bot talks to consumer’s shopping bot.

There will still be human participation on both sides, but in a supporting role.

On the seller side, a human will set pricing and other points requiring an overall decision and set parameters that will enable competitive bidding. On the buyer side there will likewise be preferences and requirements set.

Brinker suggests that consumers will also be able to set rules for their bots to follow regarding the ethics of the sellers. Given current trends, especially among Millennials and Gen Z, it’s plausible that they may want sellers to be screened not only for the quality of their specific offers, but also for their policies on various social issues, sustainability and more. Seller apps might be configured to present such information or bots could interface with independent rating services. Such services have existed for years for the investment community.