In the wake of so much banking turbulence this spring, we watched with great interest as two major reputation trackers released their annual rankings, looking out for valuable insights.

We came away encouraged by both the Axios Harris Poll 100 and the Global RepTrak 100, as the results reaffirmed our belief in the power of effective branding.

The Axios Harris Poll found that financial services companies fared well reputationally with little lingering downside, at least among the most recognizable brands.

RepTrak determined that the reputation scores for companies across all industries in its 2023 ranking slipped an average of 1 point on its 100-point scale, which it attributes to the impact of inflation and supply-chain disruptions. The financial services category — in this case consisting mainly of payments companies such as Visa and Mastercard — slipped by less than 1 point, so fared slightly better than average in that regard. (RepTrak noted that its data came in before the implosion of Silicon Valley Bank in March, though it says consumers were not feeling optimistic even before that happened.)

What we appreciated most about RepTrak’s report, though, is the clear recognition of how branding contributes to reputation, which, in turn, impacts the likelihood of whether people will buy products from a company, recommend it to others or want to work there.

Improve Your Business Outcomes Through Data & Analytics

Gain centralized access to the credit bureaus and 20+ alternative data sources. Leverage advanced analytics to optimize marketing campaigns and loan decisions.

Read More about Improve Your Business Outcomes Through Data & Analytics

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

The Symbiotic Relationship Between Brand and Business Results

Data from these recent rankings align with what Adrenaline found when we surveyed hundreds of senior banking leaders, both online and in person at the Financial Brand Forum in the fall.

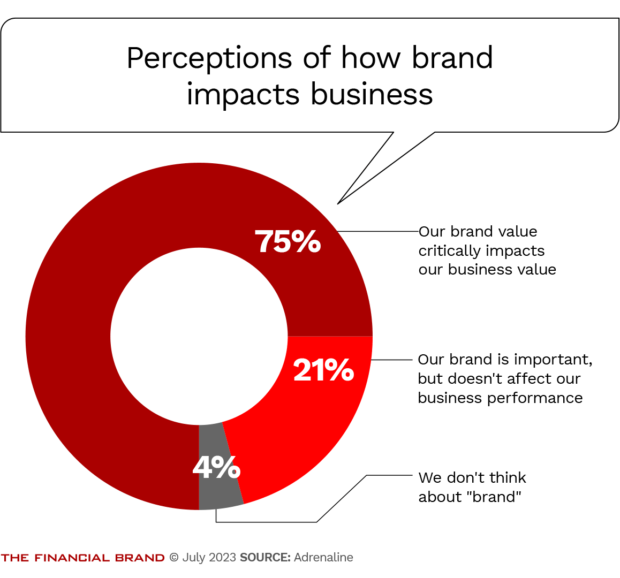

Asked how their financial institution views the role of brand, three out of four banking leaders said their brand critically impacts business value.

While a quarter hadn’t yet made this connection, the vast majority understand what two decades of research has clearly shown — that a strong brand experience helps boost the bottom line.

When a Banking Brand Needs to Take a Stand

So, what is a strong brand experience? What does this look like in the current environment?

Even if most banks and credit unions understand the importance of branding, they may not know that the way a brand shows up in the world speaks to their lived values and how tapping into those values can provide a way forward during turbulent times.

That’s what we saw VeraBank do in the immediate aftermath of the Silicon Valley Bank and Signature Bank failures. VeraBank’s president and chief executive, Brad Tidwell, was one of the first community bank leaders to speak out about the crisis, giving interviews to national media outlets such as CNN and The New York Times. His open approach resulted in not only reassuring customers at his $3.9 billion-asset Texas bank, but also helped calm a jittery public.

How do you ready your institution to respond like VeraBank did? What may not be the most intuitive for many banks or credit unions in the midst of a crisis (particularly one not of their own making) is the reality that their response to industry rumblings and consumer fear should flow from their brand values. Whether it’s trust and transparency or safety and security, the banks that have spent time building their brands to be relevant and relatable are best positioned to articulate their values at the moments that really count.

Many banks and credit unions haven’t done the requisite work to develop a truly authentic brand that is ready to take on industry challenges, whether in the case of bank failures or rising inflation.

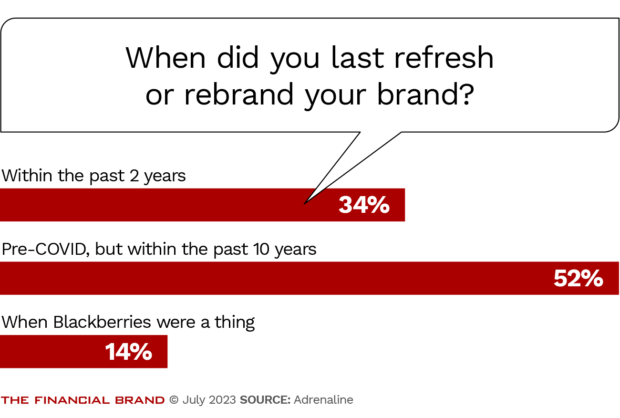

This assessment is borne out by the fact that the majority of institutions haven’t updated their brands any time recently. Our survey indicates that 66% haven’t touched their brand since before the Covid pandemic and, of those, 14% haven’t done any rebranding or refreshing in the last decade.

So here they are, three years and several crises later, with an out-of-date brand that isn’t well positioned to meet the moment.

Read more:

- Think Like a Brand, Not a Bank: Key Insights For Financial Marketers

- Five Brand Strategy Rules for Banks to Accelerate Growth

The Case for a Fresh Brand (and Not Just in Banking)

Every bit of research over the last three years shows us that the Covid pandemic was a threshold moment for everyone. During the lockdowns, the financial industry was a true champion, providing support that kept customers and communities going. Now, people’s experiences during the pandemic have shifted their priorities and expectations.

Across the board, Covid changed how consumers think about the way they want to buy from and relate to companies. Now more than ever, consumers need to feel connected to a company’s mission and the way it does business.

Our survey also found that just over one-third of banks and credit unions have rebranded or refreshed their brands since 2020. So, while not yet a majority, there is a significant rising tide of brands acknowledging the shift and embracing the need for change.

There has never been a better time to consider a brand’s story to solidify and future-proof its relevance, especially for those in financial services. If our current set of challenges in banking has taught us anything, it’s that a focus on brand is essential.

See The Financial Brand’s latest coverage of bank marketing strategies.

Banking Transformed Podcast with Jim Marous

Listen to the brightest minds in the banking and business world and get ready to embrace change, take risks and disrupt yourself and your organization.

Success Story — Driving Efficiency and Increasing Member Value

Discover how State Employees Credit Union maximized process efficiency, increased loan volumes, and enhanced member value by moving its indirect lending operations in-house with Origence.

Read More about Success Story — Driving Efficiency and Increasing Member Value

Storytelling Is a Best Practice in Branding

We recommend thinking about brand in terms of DNA — it’s enduring and it shapes “who” a brand is and will always be. Much of the work behind branding and brand strategy is uncovering that core truth, elevating it and telling the story behind it.

It’s critical to make sure the storytelling is matched to the needs of the people the brand wants to influence. In other words, a brand’s story should be meaningful to people, so that it will resonate with them on an emotional level. Brands should understand the bigger, broader picture of people’s lives and their role in it.

If a financial institution hasn’t looked at the story their brand is telling to the marketplace, then it is foregoing opportunities for connection and growth. The best brand stories are optimized for how organizations can authentically — based on their values — meet the needs of changing consumer expectations in our new era.

Without a strong strategy to shine a spotlight on their brand story and brand values, banks and credit unions are missing out on being able to ensure what they offer is more relevant to more people — which is, ultimately, the best way to win more business.

Read more:

- Why Strong Visual Branding and Communication Are Vital

- Inside the Rebranding of the Iconic Umpqua Bank

Brand Strategy for Meeting the Moment

The large regional bank failures in the spring have put all financial brands under a microscope to a degree not experienced since 2008. In moments like these, brand matters more than ever.

Don’t operate under the assumption that consumers (or small business owners) have moved on. Banks and credit unions should be executing on a communications plan.

Silence is not a strategy for meeting this moment. In fact, the strategy for times like these is to communicate clearly, communicate often and communicate with breadth and depth.

A brand’s purpose becomes the platform to create a very clear path forward for navigating issues that are external to the bank, like shifting market conditions and challenging conditions.

Branding Matters Even More in Tough Times:

The banking industry doesn't like change. Or the unknown. But, the right brand will guide a financial institution through it all.

If there’s one thing we know, it’s that unexpected things are going to happen. And that’s exactly the time for brand to become a beacon, a North Star to help organizations find the right way to respond.

While the organization’s response is coming from the top executives, it’s also a moment to shine a light on leadership at all levels. The very people that customers have come to trust as advisors and counselors should be the people they hear from now.

More fundamentally, times like these pull us back to the idea of brand purpose and why people get out of bed in the morning. A brand is never about making money — that’s an outcome or a result of their efforts. The real purpose is to help people and to help communities create economic prosperity.

When those values and that purpose are very clearly defined as part of your brand, it’s almost like a cheat sheet for how to respond to anything that the market throws at you.

About the author:

Juliet D’Ambrosio is the chief brand officer at Adrenaline, a branding and marketing agency that specializes in the financial services industry.