People sometimes refer to the “new normal” in the wake of the pandemic. But First Horizon’s Erin Pryor likes to joke that she hadn’t seen the supposed “normal” in the first place, let alone any “new normal.”

Here’s what she means.

Pryor is the chief marketing officer and head of client experience at the $85 billion-asset bank in Memphis, Tenn., the 33rd largest U.S. bank by assets. The veteran financial marketer joined in late December 2020 after serving as executive director of retail bank marketing at USAA. The pandemic was raging then, and many banks, First Horizon included, were doing little marketing other than promoting Paycheck Protection Program loans.

As it happened, First Horizon and IberiaBank had completed a merger of equals in July 2020, creating a combined branch network that spans 12 southern states and keeping the First Horizon brand for the larger company. The deal had been announced in late 2019, well before Covid began to wreak havoc on the economy.

Pryor went into this challenge knowingly, even eagerly.

“I took the role initially because of the opportunity,” she says. “There was a blank slate, and with the merger of equals, we could start flexing the marketing muscles in a way that neither institution had before.”

Considerable flexing went on in Pryor’s first year, but then another wrinkle happened. Canada’s TD Bank Group struck a deal to acquire First Horizon in late February 2022. It was a curious time, where Pryor became very busy even though her bank was slated for takeover. But then, after a 14-month wait for regulatory approval that never came, TD cancelled the deal in May 2023.

Suddenly First Horizon’s future morphed to independence again. And thus, Pryor found herself at a rapidly planned investor day just one month later.

“I can’t imagine anybody in the room who 45 days ago thought we’d be here doing this today,” Bryan Jordan, First Horizon’s chairman, president and chief executive, said as he opened the meeting.

Pryor is up for every twist.

“I was having a team meeting this morning,” she says in an interview with The Financial Brand, “and we were talking about how I have not been with First Horizon in what would be a normal year.”

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

A Year of Pursuing Growth for a Merger’s Sake

Pryor and her team never stopped marketing while waiting for the merger. “We actually continued to gain momentum,” she says.

In conversations with TD, it became clear there were areas where TD, which is traditionally more consumer oriented, was ahead of First Horizon, Pryor says. But in other areas, First Horizon, which is traditionally more business oriented, was leading. “So, it was beneficial to all if we continued to drive,” she says.

It was quite a drive.

First Horizon launched a new website, designed to accommodate the end of third-party cookies, in October 2022. This was part of a major initiative to improve digital marketing and put more emphasis on performance marketing. Pryor considers the latter — measurable, trackable marketing that demonstrates its worth — to be critical for financial institutions today. (The company says these moves have resulted in large increases in website visitors along with leads resulting from those visits.)

“We continued to build our franchise so we could deliver a valuable company,” Pryor says. “We didn’t know how long approval was going to take. You can’t lie dormant for two years and still deliver a valuable franchise.”

From early on, before the TD merger was announced, Pryor had a goal: “We needed to get ‘always-on’ marketing stood up,” on top of performance marketing.

Having come from USAA, a completely digital institution, she had strong feelings about the importance of this. “We needed to get our brand out there,” she says.

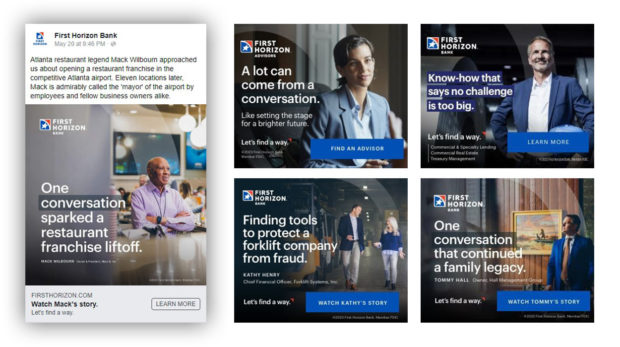

This focus on digital marketing led to the “Let’s Find a Way,” campaign, which featured real business customers. The brand awareness campaign has received eight marketing industry awards.

In the end, all the momentum paid off — but for First Horizon shareholders rather than TD’s.

Pryor says the whole period served as a reminder that constant change is a hallmark of the banking industry. “You’ve got to be pretty fluid today and be open to your strategies and even the tactics underneath your strategies changing pretty regularly. You can’t get too married to anything because you just don’t know.”

Read more: Tactics from a Nail-Biter Merger That Every Bank Marketer Can Use

‘Marketing Sits at the Table Now’

Pryor has spent 20 years as a marketer, most of it in the banking industry. Her first financial institution was the former Opus Bank, in Irvine, Calif., where she worked her way up to the top marketing post. (Opus is now part of Pacific Premier Bankcorp.)

She has seen a good deal of evolution, including the elevation of marketing across the industry. “Marketing sits at the table now,” Pryor says.

In her view, this is partly because as a function it has become more businesslike. Pryor says she can demonstrate the value of what her operation does and connect it to business results — which speaks the language of the CFO. Her budget has expanded in the two and a half years she’s been aboard, and she continues to look at where the marketing operation can be built out.

What comes under the banner of “marketing” also has changed tremendously over the past few decades.

“I believe marketing is about three things today. Data analytics, marketing technology and alignment to business units — being in lockstep with the business and the product.”

— Erin Pryor, First Horizon

When she arrived at First Horizon, Pryor says she had nearly 100 one-on-one meetings with key players in all areas, and even now she spends considerable time in the bank’s 417 banking centers to get feedback and a feel for the field.

Another critical purpose of all the visits: Establishing ongoing connection. That’s because Pryor has been in situations where bankers complained that they had no idea what marketing was up to.

She says her message is: “I’m going to report so much to you, you’re going to be like, ‘I don’t want to hear any more!'”

This means more than just face time. “You have to chain yourself to the business unit. You want to be their partner, go where they go, and you succeed and fail together,” she says. “It’s our job to help build the brand awareness that drives people in. We have to be driving quality into the funnel. But whichever way the client is coming in, we need the bankers in that channel to close the deal.”

Read more: Arvest’s Digital Transformation Focuses on Customer Pain Points

Data Analytics Answers the Key Question, ‘How Are We Doing?’

One of Pryor’s first major tasks was setting up a strong data analytics group.

“I was clear that not everything marketing was going to try would always work. Not all campaigns are created equal,” says Pryor. “But being able to show what you’re getting for your marketing spend is critical.”

A sampling of digital ads from First Horizon’s award-winning “Let’s find a way” campaign. (Selection courtesy of Mintel Comperemedia.)

Pryor expanded the data analytics team, adding functions such as awareness analytics and performance analytics. She also added a team to work with individual business lines.

The overall marketing and client experience team is up to about 60 people, according to Pryor. Nearly all of the marketing is run from the inside, but the bank works with its outside agency of record, Mindgruve, as well as various technology partners, she says.

Read more: Marketing in a World of ‘Infinite Data’

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

How Marketing Technology Fits into First Horizon’s Strategy

Pryor says her team consists right now of about 65% creatives and 35% technologists. She expects the share devoted to tech talent to grow, though she’s not sure it will rise to a 50-50 split.

Pryor says she’s not looking to build a software development shop in spite of her digital aims. So she collaborates on these types of tasks, working with the bank’s chief information officer, chief technology officer, the operations function and more.

First Horizon had a decent marketing technology stack when Pryor arrived, she says. But much of it wasn’t being used or at least not to its fullest extent: “I had the vehicle, but it had just been parked in the garage.”

More layers have been added to the stack since. The bank is building a voice of the customer function, to do more analysis of client satisfaction based on the channels they use. Pryor also wants the final system to be able to pull in user comments from such sources as the App Store and the Consumer Financial Protection Bureau complaints database. A more robust customer relationship management function is also being set up.

The cancellation of the TD merger resulted in a $200 million cash payment for First Horizon. At the investor day, executives said between $75 million and $100 million of that will go to new technology and recruitment of more tech talent. Pryor anticipates some of that will find its way to marketing.

Read more: Digital Transformation: Pursue Progress Now, Perfection Later

The Role of Artificial Intelligence at First Horizon

Pryor says she has a roster of marketing people she talks to, inside and outside of banking. Artificial intelligence in marketing nearly always comes up.

At First Horizon, AI plays multiple roles.

One is in data analytics. “AI has really changed marketing because it increases the speed at which we can ingest and use data,” says Pryor. “That can help us bring things to market faster.”

AI also facilitates more personalization in marketing. The bank’s new website incorporates some use of personalization, which has helped with sales.

Pryor says AI’s speed is becoming a must have, not a nice to have. “Clients’ lives are changing every day,” she says.

“Especially on the retail side, it’s a faster cycle now,” she adds. “If someone wants a checking account, they can go open it up anywhere they want. People have multiple accounts and they are increasingly moving their money around.”

Though she is worried about fintechs, Pryor believes human beings are a valuable differentiator for traditional financial institutions. “At the end of the day, when something is not going well or you need help, you want somebody to be on the other end of the line,” Pryor says.

Webinar alert: A Marketer’s Guide to AI and Banking

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Generative AI Not Quite Ready for Prime Time at First Horizon

While Pryor is a big believer in the power of AI to help financial institution marketers, she’s cautious about ChatGPT and other variations on the large language model theme. Too cautious to include any of this in her marketing strategy just yet.

“Banking is heavily regulated and there’s still a lot to be learned about ChatGPT-type AI,” she says.

The software’s proclivity to learn bias is one concern. But it’s not only downside risks that give Pryor pause. She also suspects the potential upside is less than some proponents promise.

At one point she and her staff considered using the software to produce a white paper, but abandoned the idea when they realized the human touch would still be needed.

If all institutions adopted this technology, would it start generating the same documents for the same purposes, especially if requests were worded similarly?

Pryor strongly favors personalization where possible, and she’s concerned generative AI won’t produce tailored content.

As long as she has more questions than answers, this technology is likely to remain on the sidelines. “We’re just kind of testing things right now,” says Pryor. “We’re not doing anything crazy.”

Are your thinking about adopting generative AI? Read more about it here: