“Focused on your financial health.” “Great rates, great service.” “Banking anytime, anywhere.” “Guiding you through your financial journey.” “Safe and reliable.”

How often does your bank or credit union use this kind of messaging? Many of these tired phrases have lost their impact, leaving institutions hard-pressed to stand out in a crowded marketplace.

Effective brand strategy goes beyond the simple refreshing of logos and taglines. It requires a comprehensive understanding of the institution’s growth strategy, organizational culture, and customers. Unfortunately, many brand messages are developed in isolation, and often reflect internal business goals rather than external customer needs.

Creating a brand that stands out requires both a clear vision and rigorous execution. Here are five financial brands that have successfully developed and executed brand strategies that are both unique and genuine.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

The Customer-Obsessed Brand: Ally

Ally launched its brand in the wake of the last financial crisis, at a time when faith in the banking system was at all-time low. That ultimately became the inspiration for the bank’s branding. “The premise and the phrase we used at the time was, ‘The world doesn’t need another bank, it needs a better bank,'” Diane Morais, Ally’s president of consumer and commercial banking, told Fortune in a September 2023 article.

Ally was rebranded from the century-old General Motors Acceptance Corp., which made car loans for its parent company. General Motors, and was also active in mortgages. It had faced bankruptcy during the global financial crisis.

The name “Ally” was intended to reflect one of the bank’s core pillars: Be customer-obsessed.

For example, below is an Instagram post in honor Veteran’s Day, highlighting a piece of art that Ally had commissioned. It was designed by a U.S. naval veteran (click on the image to see it larger).

Choosing a brand’s core values is one thing; solidifying it within your corporate culture is another. Morais said it took Ally years before its internal structure aligned with its values.

To track how well it’s doing in terms of “customer obsession,” the bank measures customer retention, customer acquisition, the number of products a customer has and each customer’s net promoter scores. Ally also consistently examines customer comments on its corporate sites to gauge sentiment, along with using audio analysis on customer complaint calls to identify and measure pain points in its service.

“We’ve invested very heavily in ensuring that we are on top of customer sentiment — registering customer needs both expressed and unexpressed,” Morais said. “It’s a powerful differentiator for us.”

A brand strategy is only as good as its ability to deliver on the promise it claims. Whether you’re challenged with a complete overhaul or refinement of an existing brand, the key is to not only deeply understand your audience and organizational growth strategy, but your institution’s culture as well. Otherwise, the brand will never come to life.

Read more about Ally:

- Ally Taking ChatGPT Slow, But Could Be Using It By Yearend

- How Innovation Itself Is Changing Inside U.S. Bank, Ally & More

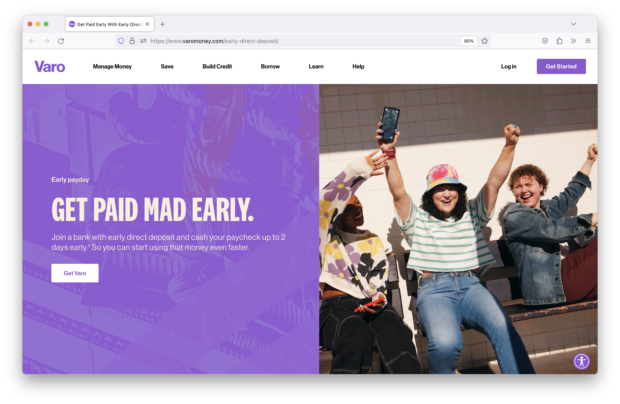

The Simple Brand: Varo

Even though San Francisco’s Varo is a digital bank with no physical branches, it boasts 3 million customers and 6.8 million accounts. It was the first fintech to be granted a full-service bank charter and, shortly afterward, launched a massive branding campaign that included a Super Bowl ad.

Varo’s brand is anchored in its lofty purpose: financial opportunity and inclusion for all. Its “bank for all of us” theme centers on the premise of embracing all types of consumers — even the underbanked.

Ignoring traditional bank marketing norms, Varo’s marketing strategy includes no direct mail, but instead leans on a fully digital, video and national TV approach to appeal to younger consumers. Today, all marketing spend for Varo is top-of-funnel, or general branding awareness spend.

Varo seeks to set itself apart from other banks with messaging strategies that leverage the power of simplicity. It also aims to build trust through transparency.

So when it talks about products, it uses language that’s simple and conversational. For example, Varo frames its cash advance feature as “early payday” and “spotting you cash.”

So when it talks about products, it uses language that’s simple and conversational. For example, Varo frames its cash advance feature as “early payday” and “spotting you cash.”

The Approachable Brand: Tucoemas Federal Credit Union

Tucoemas Federal Credit Union has been serving Tulare County in California since 1948. Tucoemas is tiny, with only 71 employees and just shy of 30,000 members at five locations. It ranks as the 107th largest credit union in the state and the 985th largest credit union in the nation.

“At Tucoemas, we believe in local. We get to know you and your family, provide solutions for your needs, and keep your money here in our community, doing good things for good people,” says Brice Yocum, the credit union’s the chief executive officer.

So how does Tucoemas punch above its weight?

It focuses on messaging that is tongue-in-cheek and light in tone. Tucoemas’ copy is consistently the focal point, addressing significant, systemic consumer financial issues while being humorous and congenial. Tucoemas believes that delivering solutions to serious problems doesn’t have to be so serious. For instance, the credit union says it would “even give a Rise Checking account to a T-Rex if they had a dollar.”

The Outside-the-Box Brand: Vibrant Credit Union

Amid an increasingly fragmented financial landscape, Vibrant Credit Union chose to focus on giving consumers what they want. So, naturally, they built a coffee shop.

“It is so individuals know our brand,” says Vibrant’s president and CEO, Matt McCombs, noting that the credit union employs a full-time coffee roaster and sells about $5,000 in merchandise each month. “They might not think about it as banking, but they’ll at least understand it.”

To Vibrant, a coffee shop plays an important role as a community pillar. “It’s a gathering point,” McCombs says. “Not only is it a central point, but it also has a low barrier of entry for someone to try. It has a unique value proposition from an engagement standpoint.”

The credit union’s goal is long-term engagement: When consumers walk in, there’s no pressure to join the credit union, take out a loan or open a checking account.

Prospective members can sign up for the credit union directly in the coffeehouse by scanning a QR code. The process takes less than two minutes. By the time they’re done with their coffee, or their socializing, their member information is ready to be taken home. Members can also use their Vibrant card for 20% off all coffeehouse purchases.

Read more:

- See all of our latest coverage of bank marketing strategies

- Throwback: Our take on Capital One’s coffee shop branches

The Targeted Brand: USAA

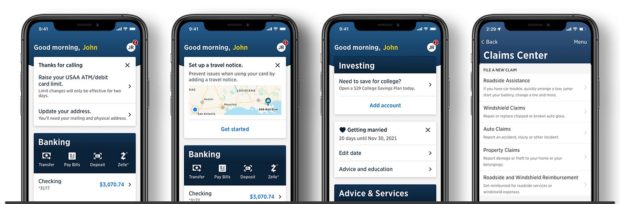

USAA caters to military members, veterans and their families. Because of the military service personnel it targets, the San Antonio, Texas-based bank is primarily mobile; it has only five branches in the U.S. Ameesh Vakharia, chief strategy and brand officer at USAA, said the bank brand is tailoring to an “audience of one.”

USAA’s close focus on a narrowly defined niche has helped it address very specific customer needs and goals, including the creation of highly relevant communications and deep personalization. Vakharia says this has been critical to their customer retention: starting with the customer, rather than with the organization’s products and services.

Learn more about USAA’s mobile app.

This includes utilizing a custom enterprise virtual assistant (EVA) to engage customers through delivering highly personalized alerts.

These alerts also have given USAA a competitive advantage, as most consumers are not happy with the level of personalization they’re receiving during interactions with their banks, per J.D. Power’s 2022 U.S. Retail Banking Satisfaction Study.

About the author:

Andrea Olson is the chief executive of Pragmadik, an agency that helps companies execute on strategic change. She is a TEDx presenter and TEDx speaker coach, a four-time ADDY award winner, and the author of “What to Ask: How to Learn What Customers Need but Don’t Tell You.” She also leads entrepreneurial programs at the University of Iowa. In addition to The Financial Brand, she has contributed to Harvard Business Review, Inc. magazine and Entrepreneur.