Financial marketing is at an inflection point. Advances in technology have paved the way for an era characterized by personalized experiences.

In the past, most financial marketing relied on mass media to deliver messages to broad audiences. Precision was difficult to achieve, and success hinged on scaled communication. Even direct marketing used basic data elements to reach large segments of customers and prospects, with only minimal levels of personalization.

However, the digital landscape has changed everything. Financial marketers have the ability to better understand each consumer and tailor their communications accordingly. We have entered an era of “segment of one” marketing, where relevance is paramount.

So what does it take to succeed now?

A new report, “The State of Financial Marketing,” sponsored by Deluxe, and published by the Digital Banking Report, is meant to answer that question. Our survey of nearly 200 banks, credit unions, and fintech firms of all sizes assesses the changes sparked by heightened customer expectations and advances in technology.

Most financial marketers face challenges when it comes to turning their ambitions into actionable strategies. But as a new era unfolds, success will favor institutions that are willing to invest in both technological and human capabilities to gain deeper customer insights and to deploy personalized solutions that create value.

The good news is that the research shows that collaboration with third-party solution providers can help institutions succeed.

Read more: 2023 State of Financial Marketing

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Significant Shifts in Financial Marketing Priorities

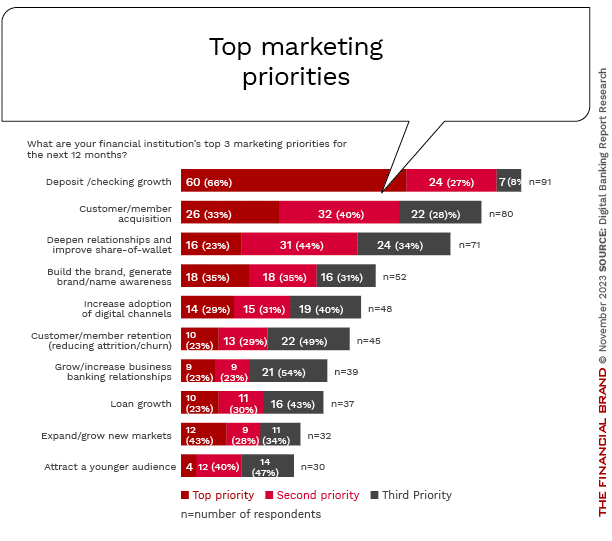

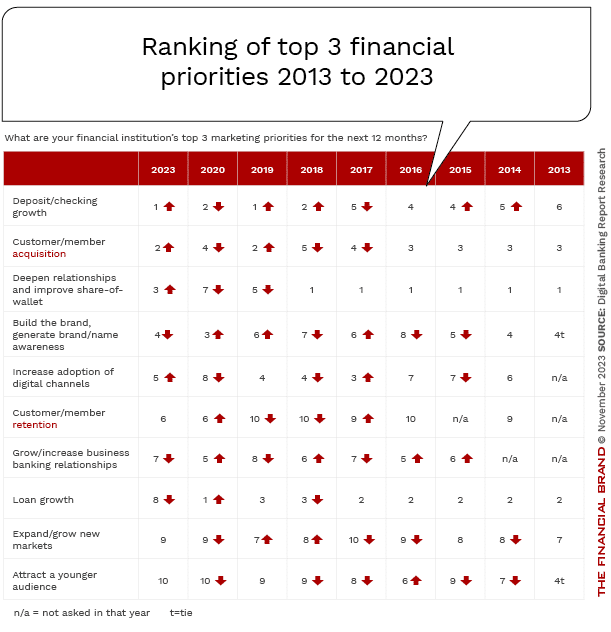

When asked about marketing priorities for the next 12 months, financial marketers showed a significant shift since the last report was published in 2020. While generating checking accounts and other deposits remained a high priority, new customer acquisition and deepening relationships surpassed priorities such as lending growth and brand building.

This shift in prioritization is a reflection of the impact that economic uncertainty has had on the banking industry. Challenges related to liquidity, rising interest rates, and intense competition for low-cost funding have pushed deposit acquisition to the forefront. In fact, 34% of all respondents ranked checking/deposit growth as their #1 priority, with 52% placing deposits as a top 3 priority.

Similarly, acquiring customers ranked as a top 3 priority for 46% of respondents, while 41% cited deepening relationships as a top 3 priority. No other priority received more that 30% of top 3 priority support. These trends likely reflect the response to silent attrition as more consumers splinter their financial relationships across multiple providers, particularly fintech alternatives.

This creates a pressing need to deliver more value to customers. It is crucial to prioritize building customer relationships and engagement as opposed to just focusing on increasing transactions or share of wallet. As digital consumers become more mature, loyalty will increasingly depend on conveying an understanding of a customer’s individual needs and providing timely, contextual advice.

Read more:

- How IP Targeting Gives Deposit Campaigns a Lift

- Bank Business Models Must Evolve to Regain Customers

New Customer Acquisition Seen as Biggest Opportunity

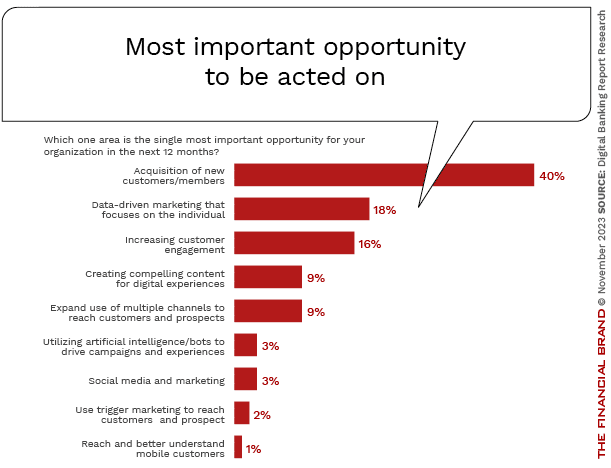

When we asked financial executives globally what they considered to be the biggest opportunity in the next 12 months, four in 10 respondents cited the acquisition of new customers. The importance of data-driven marketing and customer engagement also was clear, as these were designated as the most important opportunities by 18% and 16% of respondents, respectively.

Consumer research supports a major shift towards personalization. Surveys show that banking customers are willing to switch institutions for more tailored experiences. Fintech challengers have raised expectations in this regard as have consumers’ experiences with nonfinancial companies like Amazon, Hulu, Uber and others.

Given this, it is surprising that the potential of generative AI tools like ChatGPT to analyze data and drive hyper-personalization across marketing, sales and service has not yet taken center stage in the martech strategies of financial providers. According to the research, only 3% of marketers identified generative AI as a game-changing opportunity in banking.

That said, the ability to tailor experiences using data-driven insights has become crucial for standing out from competitors and securing existing customer relationships. In addition, the use of data and insights is increasingly being used for the development of new products and the selection of marketing communication channels, increasing the efficiency of marketing spend.

Read more:

- FAQ on Generative AI for Bank and Credit Union Leaders

- ChatGPT Will Become ‘ChatOMG!’ in 2024, Forrester Predicts

Challenges to Financial Marketing Success

Unfortunately, most financial institutions have significant challenges when trying to leverage data, technology and analytics to implement personalization strategies at scale. Reducing these challenges has become crucial.

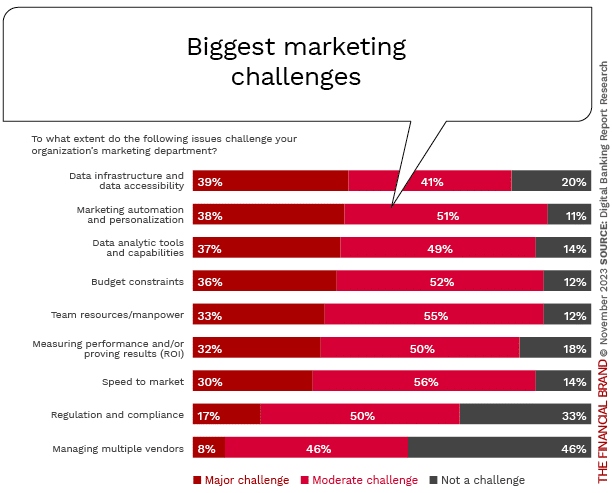

Most of the marketers rate themselves as simply adequate when it comes to leveraging data insights for crafting tailored recommendations and messages, and 80-90% of financial institutions find these core capabilities to be a major or moderate challenge.

Because of these shortfalls, many institutions are lagging behind in recognizing and adopting cutting-edge solutions that can deliver tailored experiences. By combining process automation with advanced analytics, smaller financial institutions can achieve interactions on a scale that would be impossible manually. In most cases, achieving this level of expertise requires rethinking existing business models and collaborating with third-party solution providers.

Beyond the technology and data processing challenges, financial marketers across all asset tiers mentioned budget constraints and lack of required human skillsets as major marketing challenges. This is especially true during times of economic uncertainty and when demand for qualified talent across all industries is high.

Finally, financial executives increasingly recognize the importance of agility and delivering innovative solutions with speed. At times of increasingly rapid change, speed to market is often a defining quality for success.

Read more: Digital Marketing Tactics, Trends and Tips to Know About for 2024

Unable to Get the Basics Right

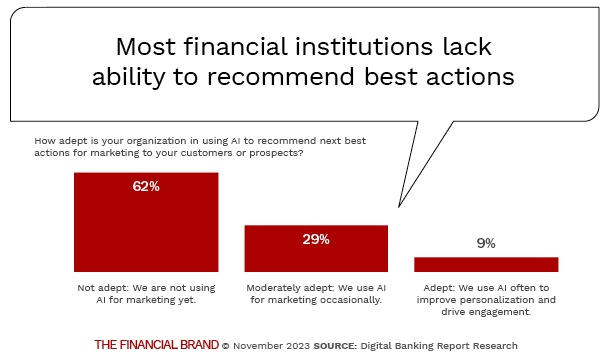

There is a noticeable gap between intentions and impact when it comes to generating personalized recommendations. The research found that 60% of institutions admitted that they are not adept at leveraging AI to deliver personalized recommendations. Only 9% believed they have truly mastered the utilization of data and AI to deliver tailored recommendations that match the needs and preferences of consumers.

At a time when customers are looking for guidance to achieve financial confidence and financial wellness, it becomes absolutely critical to bridge this capability gap to instill trust and to create the value proposition increasingly expected from customers. Insufficient investment in talent and marketing technology will jeopardize the ability to deliver on basic expectations across the customer journey.

Read more: Higher Pay Isn’t Enough to Stem Bank Employee Turnover: Study

The Data-Driven Marketing Paradox

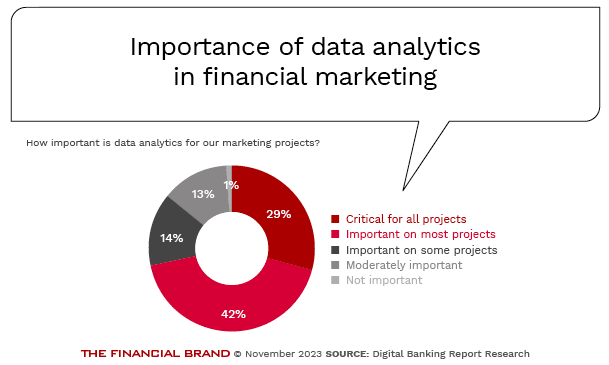

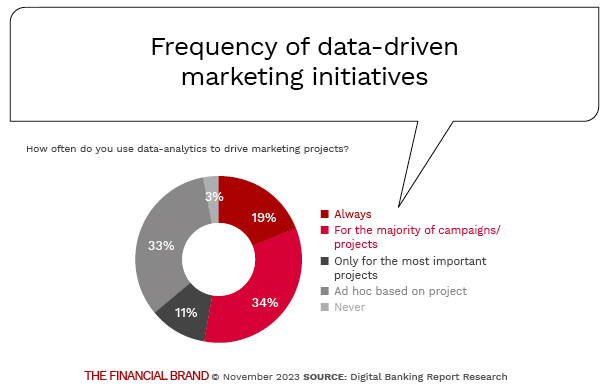

One of the more intriguing findings from the study highlights a disconnect between aspirations and implementation when it comes to data driven marketing. While over 70% of financial marketing leaders surveyed emphasized that leveraging data analytics to drive marketing initiatives is consistently important, only half of them currently apply data analytics with consistency.

This significant disparity reveals a gap between perceived potential and actual return on investment derived from customer data. The concept of using internal and external data to drive marketing initiatives has been discussed for decades; however, only a limited number of financial institutions possess both the expertise and technical maturity required to bring data-driven marketing to fruition.

The research found that the ability to “deliver on potential” increasingly resides in both the larger financial institutions (budget availability) and many of the smallest organizations where executive management has made a commitment to partnering with outside organizations that can build market-leading data capabilities. Many of these smaller banks and credit unions have built cultures that prioritize taking action. They recognize that in the digital age, marketing strategies must be guided by insights.

See all of our most recent coverage of marketing strategies.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Making Financial Marketing Future-Ready

Across the industry, there is a scarcity of roles like “marketing technologists” that can assist in implementing advanced marketing solutions. Moreover, transitioning from using analytics to improve financial performance to leveraging insights to drive predictive engagement becomes challenging without talent, budget and focus.

Achieving value-driven customer engagement at scale relies on unified customer data platforms, powerful analytics tools, and automated messaging capabilities — resources that many institutions lack. Outdated marketing technology hampers the activation and optimization of insights by making them slow or even impossible to deliver in real time.

Some progressive financial institutions have invested in strategies and talent to leverage the opportunities provided by an advanced digital marketplace. However, too many still rely on isolated datasets and manual processes that are ill suited for future-ready personalization efforts.