Increasing bandwidth, rapid growth in mobile banking, and the desire to receive information in a short and fun format now make video one of the most powerful marketing mediums on the web. Banks and credit unions are increasingly taking advantage of the trend.

South Carolina State Credit Union has recently had great success with social media videos, Gina Finch, Vice President of Marketing, tells The Financial Brand. The credit union had its best year ever in 2021 and reached $1.28 billion in asset size, attracting an average of 600 new customers per month. Short web videos have been instrumental in attracting and retaining a younger demographic.

“We have an opportunity to put a 15- to 30-second streaming video out there to reach them on their mobile devices in a way that they want,” says Finch. “Younger consumers don’t want to read a 15-page dissertation about why your credit union is so great. They want things in a nutshell. And it really works.”

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Why Video Is the Medium of the Moment

86% of all businesses now use video marketing as a marketing tool, up from 61% in 2016, according to a video marketing survey by Wyzowl. Of those marketers that use video, 92% say it is an important part of their marketing strategy, and 87% say it offers a positive ROI.

Use of video is growing in all sectors for entertainment, education and marketing, with video content forecast to make up more than 80% of all online in 2022, according to Cisco. Marketers are using video in product knowledge campaigns, for social media content, to support direct sales, and in digital ads.

The best part is that consumers are highly responsive to the format, with approximately half of internet users consulting product videos before making a purchase, according to HubSpot.

Brenna Kelliher, Senior Digital Strategist at ZAG Interactive, says financial institutions can use video for product and service demos, financial education, branding, “meet the team,” testimonials, and product positioning. Because “people don’t always want to read,” video enables banks and credit unions to easily deliver information in an engaging and digestible format, she says.

Videos make it easy for consumers to understand important, yet complex financial topics, says Kelliher.

Read more:

- How This Small-Town Bank Boosted Its Video Views by 800%

- Go Beyond ROI With ‘Return on Experience’ in Banking

Video Excels at Educating and Tapping Emotions

Banks don’t necessarily need to invest a lot of time, effort, or money into web-based videos. The most important element is a “good story to tell,” Scott Hanson, CEO and Founder of ClickVue, says in an interview. ClickVue offers video marketing services for banks and credit unions.

Many financial institutions use standard customer profiles such as helping a consumer buy their first home, approving an entrepreneur for a business loan, or fulfilling a financial dream. “They all help position a bank or a credit union to be a hero, an educator, and a protector with all of these different messages that are much more impactful with video.”

“Video does emotion and storytelling better than any other medium. That is what financial marketers need to be thinking about.”

— Scott Hanson, ClickVue

Key to creating effective content is ensuring videos are educational, beneficial or entertaining to customers, not simply promoting the bank’s services. Hanson recommends an 80/20 mix with 80% being of value and interest to the customers, and 20% being “self-serving” for the bank.

Creating a video doesn’t have to be complicated, says Hanson. With decent lighting and sound, many banks and credit unions successfully shoot these videos on their phones and use Zoom interviews. As it all starts with a good story, the rest can often fall into place with graphics and other stock video clips to enable visual storytelling. “Video does emotion and storytelling better than any other medium. That is what they need to be thinking about.

Tips to Avoid Video Marketing Missteps

As a general rule of thumb, the shorter the video, the better, says Hanson. While three-minute videos were the norm a decade or two ago, most are now 30-seconds or less.

Banks can also host videos at several locations, from educational videos on YouTube to customer interviews on their website and live Q&As with mortgage managers on Facebook live.

One of the most effective strategies is to put things together in a themed week that focuses on a particular topic in different formats, then tie it all to interactive social media. “It’s a really interesting means of engagement,” says Hanson. “You are reaching people at the start of the week about a topic then showcasing your people at the end of the week.”

Don't Be Too Casual:

Just because you can shoot video on your phone and post it on the bank's Facebook page as is doesn't mean you should. Compliance is one reason.

South Carolina State Credit Union uses Facebook, Twitter and Instagram. Many of its videos are simple with titles like “5 Tips to Save Money” and “Financial New Year’s Resolutions.” Finch says small videos like these are great ways to stay relevant and top of consumers’ minds. Following these teasers, they can run other videos about the bank’s services.

Human interest also works. One of SCSCU’s most successful videos was when an employee brought her twin granddaughters into the credit union to open accounts for them. It landed more than 3,000 likes and forwards in only a couple of days. “These things grab people’s interest, make them smile and give them a short break from their day,” says Finch. “That’s what we shoot for in a lot of social media posts.”

Here’s what two other banks are doing:

Southern Bank (North Carolina) features a series of “Better Business Brief” videos which profile local businesses then lead into how Southern Bank helped them. Its “Money Matters” segments also educate consumers about personal finance basics.

First Bank (Colorado) has dozens of 15- to 30-second videos, many of which have earned hundreds of thousands of views. They include business profiles, educational videos, random segments about daily life as well as many of First Bank’s often humorous ad spots.

Read more:

- How the Best in Banking Are Marketing Their Mobile Apps

- Chatbots, Live Chat, Video, Virtual Assistants: Which One Wins?

Putting Video Marketing Into Action

While it may be fine to shoot videos on a phone, banks and credit unions still need to carefully edit their content, says Hanson. Editing software can help polish video and create a more professional experience, but banks must also edit content to ensure intended messaging and compliance. “Facebook has taught us we can just shoot and post, but bankers shouldn’t do that,” he says. “If something is spoken in that video, it needs to be captioned for ADA compliance.”

As video can take some time to gain traction, financial institutions should also establish a format and process that enables them to post at least once a week, preferably once a day, says Hanson. YouTube is filled with credit union and bank video channels that posted monthly videos for a year or so then went silent.

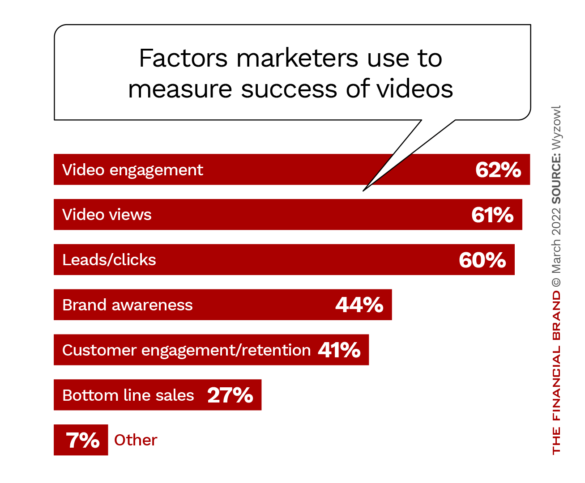

Marketers must also consider metrics and how they quantify success with video. According to the Wyzowl report, 62% of marketers noted their top metrics were engagement or views and displays. While only a quarter of video marketers considered sales a measurement of success, approximately 80% said it has improved their company’s bottom line.

SCSU uses a suite of tools to monitor statistics on social media pages. Going back over the past five to six years, Finch can see a strong uplift and increase in engagement in the “fun” type of videos. Whereas a direct advertisement for car loans or a mortgage may only get a couple hundred views, a fun and interactive video can gain thousands of viewers.

“Little things like that can really engage consumers beyond the banking basics,” says Finch. “Video can be a fast and easy way to do it.”

See all of our latest coverage of bank marketing strategies.