Digital marketers have been learning a key lesson over the course of Covid-19 (and what looks like a long-tail aftermath). As their role in their companies’ marketing continues to grow and as the digital channels they rely on multiply, they will succeed or fail in hitting their goals based on how well they can learn to work with other functions in their organization.

That’s a key conclusion from a massive study by Gartner — its three-part Digital Marketing Survey. 35% of digital marketers surveyed said they expect their greatest challenges for 2021 to come from inside their organizations, a worrisome trend when so much about banking and business in general will be in flux as economies attempt to reboot normality.

The project examined trends and attitudes in the field in the U.S. and the U.K., with additional sampling done in Canada, Germany and France. Banks and other financial services firms were among the 350 firms whose chief digital marketing officer responded to Gartner for Marketers’ queries.

Digital Marketers Head to Top Roles:

Testimony to the increasingly dominant role of digital marketing channels was Gartner’s finding that 36% of digital marketing leaders surveyed hold the CMO title. And 85% are VPs or higher.

As they rise in the hierarchy, digital marketers find that old-fashioned human cooperation makes a big difference in getting the job done. The year of Covid, 2020, was the subject of the study, but the findings will have longer-term significance.

Experiences differed from one organization to another, of course. But the ranking of other functions within the companies that helped respond to disruptive events and the ranking of functions that hindered response is instructive.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Where’s the Help, Where’s the Hurt

The greatest assistance came from IT departments, which the report indicates has been a growing trend seen in various Gartner surveys. “IT has emerged as a key partner to marketing,” it states. “A solid alliance with IT will be critical to elevating the role digital marketing technologies and data play as well as managing those technologies to maximum effect.”

The other functions identified in the top five were a tie among CEOs, Customer Experience and Communications; Operations; a tie between Loyalty Management and Finance; and a tie between Public Relations and, for firms that have the function, Supply Chain Management.

On the hindrance side — those functions that became roadblocks or at least brakes on progress — Sales/Business Development, Operations, R&D/Product Development and Supply Chain Management tied for the top barrier. Interestingly, IT was cited as a barrier almost as often as it was praised by those digital marketers who found it a helpful function. IT tied in this listing with Customer Experience and Finance. Filling out the top five positions that hindered progress were Communications, Loyalty Management and CEOs.

“A big theme in this survey was the interdependencies across organizations, and how Marketing and the digital marketing leader, specifically, succeeds in achieving marketing goals and contributing to their organization’s overall goals.”

— Noah Elkin, Gartner

Elkin, Vice-President and Analyst at Gartner for Marketers, believes digital marketers increasingly have to think beyond their growing specialty to behave more like managers. This means adding strategic, tactical and relationship-building skills to their technical abilities.

Second to the role of getting past roadblocks, 34% of the sample cites the need to elevate the role that digital marketing technology and data analytics play.

Elkin says that going forward digital marketers will not only need to strengthen their ties to cooperative functions, but to figure out how to improve relations with functions that have been barriers in the past.

Read More: Why Bankers Are Disappointed By The ROI of Marketing Data & Analytics

Cooperation Isn’t ‘Nice to Have’ — Without It You’re Crippled

“One of the takeaways of this research,” Elkin continues, in an interview with The Financial Brand, “is that to the extent that digital marketing is the bullhorn of your business and the primary customer-facing function, it demonstrates that the more organizations can align internally, the more they can have effective interactions with customers.”

In banking, he continues, coordination is critical the more messaging digital marketing does and more touchpoints the institution has. Beyond consistency, functions like the call center must be ready to engage with more people if digital marketing has issued messages that will drive call volume or chat traffic.

Beware the Fatal Disconnect:

When something gets lost between Marketing and the functions that make things happen, the public gets a message. And that’s not good.

“When you think about the totality of the customer experience and all of its different touchpoints, Marketing contributes to a lot of that,” says Elkin. “But there are many other functions that play a part, and all of that activity and engagement needs to be orchestrated so it produces the best customer experience.”

One thing that will help is more money. Elkin says the firm’s annual CMO Spend Survey indicated that many marketers face budget cuts for 2021 that will stifle some improvements that could have been made. But he expects budgets to bounce back in 2022.

Elkin says that he considers banks to be in the upper third of industries Gartner studies, in terms of digital marketing sophistication. Part of this comes from the relatively complex nature of banking products, and associated details like compliance.

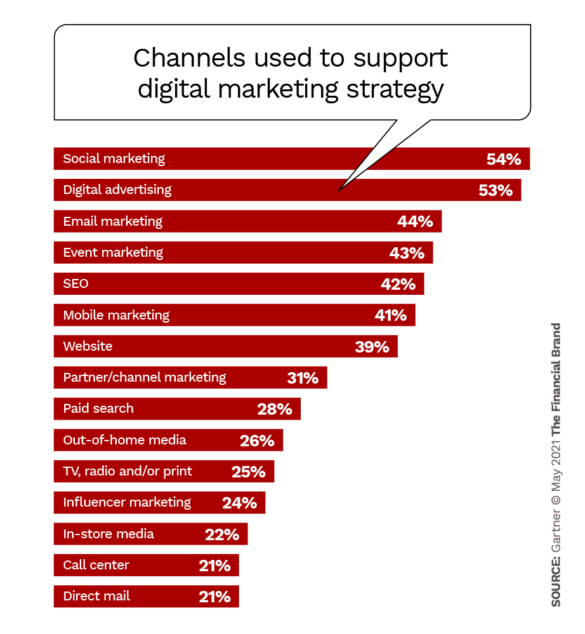

But Elkin says that very complexity also drives a challenging marketing task, figuring out how the customer journey now works, given the explosion in digital channels.

“It takes a fair amount of planning now to develop the sort of customer journey map that’s needed, and to align the right content and resources against that customer journey,” says Elkin. “And you have to have all of the assets in place to guide a consumer through that decision journey and beyond, to not only make the purchase decision, but then get them onboarded and then educating them to maximize the benefits of whatever product they’ve selected.”

Read More: Already Drowning in Data, Financial Marketers Ask for More

Where Digital Marketing and IT Intersect

The fatter the martech stack that a financial institution builds, the more of a role in the function’s success IT will play. Elkin points out that many institutions invest heavily in tools but they don’t go the next step.

“They need to surround the tools with robust processes and training for the people who are going to be using the tools,” says Elkin. “They need to do this to make sure they will reach full utilization of what they’ve bought.”

Let’s Be Honest About Tech Usage:

Anyone who has ever delved into their word processing software knows how much of even that relatively simple technology they are not using. Marketing chiefs have to squeeze more out of martech than the first drops.

“Getting from point A to point B with marketing technology doesn’t necessarily happen organically,” says Elkin. “There has to be a plan — and it has to be actively managed.”

A good example of this is in the use of artificial intelligence in marketing. The Gartner digital marketing research indicates that trust can be an issue when organizations add AI to the marketing mix. Elkin notes that to a degree this reflects fear of AI taking over.

However, experience changes this.

“The more marketing organizations use AI and the more widely they use it across the marketing function, the more progressive the acceptance curve becomes,” Elkin says. He suggests that fear and lack of trust is overcome as skills levels are developed. And that evolution requires the cooperation of IT.

“It’s a matter of having confidence in what machine learning is doing versus what human learning can achieve,” says Elkin.