Neobanks and direct banks, domestic and foreign, have had notable success attracting customers. How do the new players — some with seemingly odd names like Chime and N26 — punch through today’s crowded media market?

This is a question that got Kantar Group digging into how these relative newcomers are promoting themselves. Jim Leichenko, Director of Marketing at Kantar, says he wanted to see how neobanks (also known as challenger banks) applied their disruptive business attitude to marketing.

Two areas where Leichenko found notable trends are in television advertising and in paid search.

These channels typically serve very different purposes. TV ads provide brand awareness, telling people what your brand offers in the most general terms, and giving viewers an opportunity to get the brand’s tone. Paid search, on the other hand, is by its nature more targeted, enabling brands to attempt to reach specific market segments and slices. Paid search helps with customer acquisition strategies, says Leichenko, useful to all brands but particularly for newer players who need to build up a customer base.

In looking at paid search, Leichenko reviewed both desktop and mobile click share. Increasingly the latter will be more important, he says.

“Consumers are doing everything on their mobile phones now, including their banking,” says Leichenko. “When I go to my own bank, it’s usually empty.”

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Standouts among Neobanks in TV Advertising

As Leichenko’s earlier comments illustrate, most neobanks have not been spending much on television, but two somewhat more seasoned players have been pouring dollars into TV marketing.

“Chime devoted $13.8 million to TV ads in the first half of 2019,” Leichenko says, “while Aspiration spent $12.7 million.”

Impressive, but these figures need some perspective. Kantar figures indicate that the major traditional banks spent much more on TV in the same period. For example, Wells Fargo spent $101 million, Chase spent $70 million, and Citi spent $30 million.

However, the two neobanks have consistently been promoting their contrarian images.

Chime offers banking services using the engine of two chartered institutions, and is targeted to younger consumers who live on their mobile devices. Among the pluses that Chime offers are early access to paychecks that are direct deposited — anyone who has lived on “fumes” the last couple of days before being paid gets that. Chime also promotes its being “fee free” and its feature of “spotting” consumers on debit card overdrafts.

Chime promotes early access to direct-deposited payroll. The woman in the top scene explains that this means she can go out instead of having nothing to do. In the third frame, a young office worker explains that the puppies are “a metaphor for the warm and fuzzy way that banking with Chime makes me feel.”

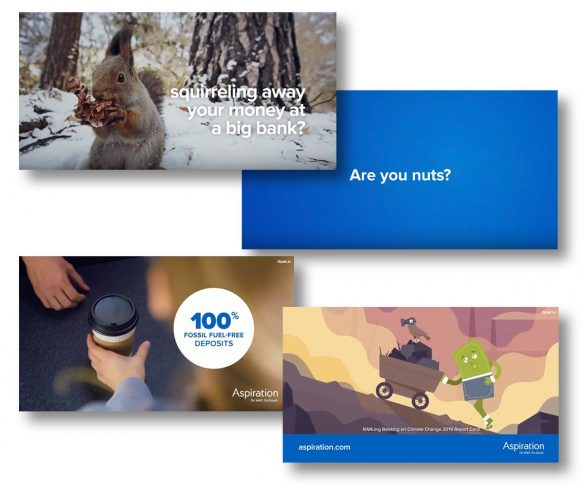

Aspiration has staked out socially responsible banking with decent returns as its niche. Another twist is that consumers can set the level of their fees — even 0 — based on what they can afford. Its TV ads emphasize these themes to stand out from traditional institutions who, the ads imply, may lack the social conscience that Aspiration prospects want to see in their financial institution.

Aspiration’s socially responsible banking theme goes hand in hand with ranking on big banks. The company’s ads emphasize its promise not to lend to businesses like the fossil-fuel industry.

In analyzing marketing spending Leichenko says he noted a pickup among direct banking programs connected to companies best known for their credit cards, such as Discover and American Express.

Read More:

- 3 Things Financial Marketers Must Know About Digital Video Now

- How Some Financial Brands May Be Shredding Search Marketing Money

Paid Search Attracts Newcomers to Make Their Marks

While Chime and Aspiration have devoted money to TV exposure, the neobank brands have more typically put major chips on paid search engine marketing. In order to gauge paid search performance, Kantar evaluated U.S. Google desktop and mobile clicks on 152 checking and savings-related keywords for the first six months of 2019. This did not include brand terms, but did include generic keywords like “bank account”, “open checking account online”, and “free checking account.”

Kantar’s analysis of financial advertisers’ share of total paid search clicks included this ranking of clicks over the entire 152-word grouping.

Top checking and savings advertisers by paid search clicks

| Desktop Click Share % | Mobile Click Share % | ||

|---|---|---|---|

| Bank of America | 16.9 | Bank of America | 16.9 |

| Chime | 8.3 | Chime | 11.3 |

| Citi | 8.1 | Discover | 8.2 |

| Discover | 7.4 | Citi | 6.5 |

| Simple | 5.0 | HSBC | 3.9 |

| SoFi | 3.9 | Chase | 3.3 |

| HSBC | 3.2 | SoFi | 3.1 |

| RatePro.co | 2.3 | Wells Fargo | 2.9 |

| American Express | 2.2 | Marcus.com | 2.8 |

| Capital One | 2.0 | PNC | 2.0 |

Source: Kantar – Kantar Media data based on US Google click share percentage for desktop and mobile text ads displaying on 152 checking and savings-related keywords, Jan-June 2019

Newcomers — including the likes of Marcus, the Goldman Sachs entry in direct banking — are well represented in both desktop and mobile click share.

“Neobanks are definitely making their presence felt,” says Leichenko. “Chime was the clear leader, ranking second among all advertisers in desktop search with an 8.3% click share as well as second among all advertisers in mobile search with an 11.3% click share.”

As a group, the newcomers slightly outpaced Bank of America.

Overall, Leichenko believes these trends underscore that traditional players’ ability to find more customers will be impacted as newcomers exploit newer channels like paid search.

Traditional financial institutions are now competing against both each other and new players that were not active in the space a decade or so ago, says Leichenko.