Off in the future, when someone writes the history of financial marketing, 2020 will go down as the Year of the Pivot. No matter where a bank or credit union is based, every marketer has had to make big pivots and little pivots all through the COVID-19 period in messaging, strategy, timing and priority.

In a very short amount of time financial marketers had to learn how to drop sales-oriented campaigns in favor of community-oriented communications and simple logistics, as everything from social media networks, websites and email to signage had to be updated frequently. Even as America attempts to reopen, flexibility and adaptability have become as important as creativity in marketing.

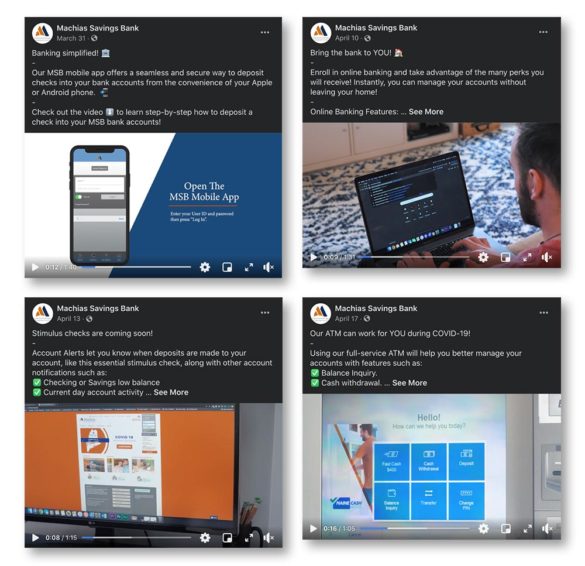

“This has been a pretty good stress test of what we can do if we have to,” says Yury Nabokov, AVP, Customer Experience Manager and Marketing Strategist at Maine’s Machias Savings Bank. Nabokov explains that in the first two months of the coronavirus crisis his institution had to be extremely reactive, not always knowing what was happening in the next week or the next day. As things settled into an odd routine, he adds, staff began to feel a “heightened sense of purpose,” as part of an essential business. More initiative became possible.

Within the first week of most Iowa companies shifting to work-from-home and social distancing, Des Moines’ Bankers Trust began promoting ways to bank remotely.

“Next time around we’ll be better prepared and less scared,” says David Patti, Director of Marketing and Communications at Customers Bank, Wyomissing, Pa. Patti likes to use the term “future normal” to describe the period ahead. What will that future normal look like when the industry and the nation get there?

“People are going to be climbing out of a deep hole, and that is the job of Marketing, to help them,” says Joe Sullivan, CEO, Market Insights. “People have been damaged a lot — their physical health, their credit and their financial health.” He says marketers need to help their institutions match their capabilities to what consumers and businesses need to bounce back.

“No one cares about tweets saying that so and so has been with your bank for three years or that you have hired on a bunch of new lenders,” says Sullivan.

As reopening runs what looks like a rocky course, marketers also must apportion their time more carefully than ever. “There is a risk that the urgent will choke out the important,” says Tim Pannell, CEO, Financial Marketing Solutions.

Being aware of the local picture as well as the bigger picture will be more important than ever, too. “You need to keep monitoring things,” says Laura Wiegert, SVP-Marketing, Investors Community Bank, Manitowoc, Wis. “Now, more than ever, we have to pay attention to what we’re saying, how we’re saying it, and when we’re saying it.”

If Year of the Pivot sounds too abstract, one can settle on another label: Year of the Mask. So much have face masks become part of the international wardrobe as societies open up again that O Bee Credit Union, Lacey, Wash., is using them as marketing tool. Founded as a brewery’s credit union and providing “pub-style banking,” O Bee is distributing masks that carry the names of three famous beers plus one featuring Mount Rainier.

“Many people are anti-mask,” explains Lee Wojnar, VP of Marketing. “Americans don’t like to be told what to do. Adding the beer brands made the masks cool, fun and hip.”

A lighter touch will help, from time to time, as financial institutions begin rethinking the marketing function going forward. Bank and credit union marketers and marketing advisors spoke with The Financial Brand about the future of financial marketing from budgets to tools and techniques to the big question of whether institutions can “sell” again.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Budgets: Not Being Slashed (So Far) But Marketers Are Spending Cautiously

Traditionally, when the economy or a company’s results are down, Marketing gets gored. “Marketing’s always on the table bleeding,” says veteran marketer Tim Pannell.

“Marketing’s always on the table bleeding.”

— Tim Pannell, Financial Marketing Solutions

2020 is unusual in that banks and credit unions went into it as a year most expected to be strong, or at least decent. Managements set marketing budgets accordingly.

Nearly at the halfway point now, 2020 looks like a down year at this point but one unlike any marketer has seen before. There may be some hesitation to wield the ax too quickly or severely.

“Cutting marketing is not the way to go,” says Joe Sullivan. He believes the future of “sales” and “marketing” in financial institutions in the future won’t be the traditional meanings, but instead a depth of data analytics that will help institutions bring assistance to those who need it before they ask for it. This could take the form of putting them into a better type of savings for their circumstances or advising them that they could save by refinancing their mortgage. It takes money to develop marketing intelligence that can support that.

Most bank and credit union marketers interviewed say they haven’t lost any significant part of their budgets, but that they are spending what they have carefully.

“As things stand, we’re holding steady,” says Eric Nutter, “but we’re being a lot more cautious with our dollars. We’re holding back on ‘nice-to-haves’.” Nutter, VP and Director of Marketing at First United Bank & Trust, Oakland, Md., says his group has learned how to squeeze a lot out of a marketing buck.

In mid-March First United pivoted its “What Matter Most” podcast from investment trends to COVID-19 issues.

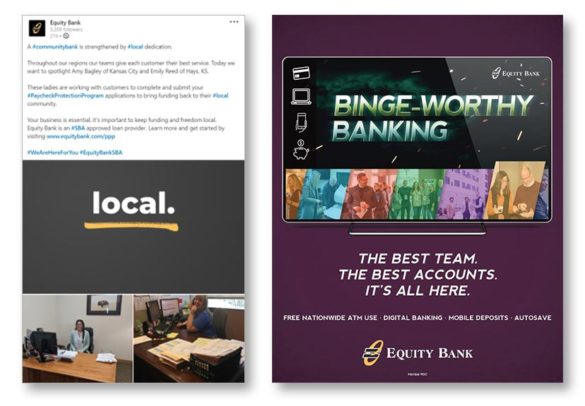

In some cases marketing officers reported the need to do some juggling to address current marketing spending needs versus matters than can be bumped forward without much harm. At Equity Bank, Wichita, Kan., John Hanley, SVP and Senior Director of Marketing, says a complete website rebuild originally planned for 2020 has been pushed into 2021 in the interests of funding beefed-up online account opening for businesses and consumers in 2020.

Isla Dickerson, SVP and Director of Marketing at Maine’s Bangor Savings Bank, says her department will hold the line in 2020 but anticipates steady spending in 2021. She says it’s important for a financial institution to project a sense of stability, so cutting back on the marketing front isn’t a good idea.

Maine’s Bangor Savings worked to bring out some of the better side of people’s behavior during lockdown.

In one case the pandemic’s impact will bring additional funds to a marketing director. Lee Wojnar of O Bee explains that 2020 originally called for a cutback because the credit union’s strong loan growth was outstripping deposit growth. However, strong deposit growth — most of it in the form of government stimulus checks — has flipped O Bee’s loan-to-deposit ratio from over 100% to the mid-80%s.

“We need to start pushing some loans out, due to having so much liquidity,” says Wojnar. Mortgages, notably refis, will come first, possibly followed by auto loans later in the year.

Read More:

- Ally CMO to Banks: ‘It’s Time to Get Rolling Again!’

- Financial Institutions Should Be Getting Their Marketing Game On

Farewell to Event Marketing, from Branch Openings to Golf Tournaments

Social separation has become the rule of America’s reopening, with some notable exceptions, and this will have a decided impact on how financial institutions market their own significant events, like branch openings and customer and member appreciation days, and how they take part in golf tournaments and sports sponsorships. Other events that traditionally involved face-to-face engagement between the financial institution and someone else have become more virtual affairs.

“You may ask if sponsoring the big golf tournament still looks like a great idea when people in your community are hungry.”

— Joe Sullivan, Market Insights

Investors Community Bank does many events annually and cancelled everything through the summer, according to Laura Wiegert. The next event is scheduled for September and “I highly doubt we will hold it,” says Wiegert. The bank has honored its commitments for sponsorships of nonprofits’ events thus far, donating funds even for occasions that won’t take place. Just when people can assemble as of old is anyone’s guess.

Apple Federal Credit Union, Fairfax, Va., also faced widespread cancellations of community events. “All community events were cancelled mid-March, so we created our own virtual and remote events,” says Cynthia McAree, SVP, Marketing, Research & Member Engagement. “We did virtual/Skype check presentations to local charities with local media, delivered meals to frontline heroes, and leveraged Facebook Live video feeds.” Annually the credit union, with roots in education, hosts an onsite back-to-school drive called Backpacks 4 Kids with a local TV station. “We are looking to make this event virtual too,” says McAree.

Machias Savings has had an initiative called “Fast Forward Maine,” to bring experts before business owners to spark ideas and provide education in technology, marketing and other key skills. The effort includes both podcasts and related live workshops that have typically been taken on the road to spread the messages around the large state. Yury Nabokov says in April the bank pivoted, turning the workshops into a two-day virtual event.

Many institutions have made growing use of videos in conjunction with social media posts during the pandemic, such as Machias Savings.

Even if conditions improve so that events no longer cause health concerns, the hiatus may cause some institutions to reevaluate event sponsorships.

In some cases banks and credit unions have gotten into the habit of pretty much making donations to anyone who asks for one, according to Joe Sullivan, and the current pause is an opportunity to reexamine such generosity. Sullivan suggests institutions may decide to tighten the focus of their donations budgets.

“You may ask, for instance, if sponsoring the big golf tournament still looks like a great idea when people in your community are hungry,” says Sullivan. (Many of the institutions interviewed have made major extra contributions to local causes during the pandemic, one of them being community pantries.)

O Bee came up with a twofold “event” for charity. It engaged a noted artist to produce an adult coloring book featuring Washington State scenes. Part of the idea was that many adults find coloring therapeutic, helpful during lockdown. The credit union sold copies of the book and raised $9,000 for local causes. O Bee also held a contest for the coloring artists, giving away cash prizes.

Digital Marketing’s Share Grows Larger, But Needs Guidance

One of the effects of the pandemic period and its momentum towards more digital everything is greater spending on digital marketing compared to other channels.

Sarah Bacehowski, President at Mills Marketing, points out that COVID-19 and the recession have accelerated the move towards digital that was already taking place. “It’s become more important to reach people where they are,” according to Bacehowski. “If you are not using a mobile app, for example, as a marketing tool, then you are losing an opportunity to reach people.”

“If you are not using a mobile app as a marketing tool, then you are losing an opportunity to reach people”

— Sarah Bacehowski, Mills Marketing

That said, Bacehowski adds that many financial marketers are just throwing money at digital, not using any plan.

“Digital advertising should have a well-thought-out and purposeful strategy,” says Bacehowski. “They understand the power of digital, but it’s not magic.”

As an example of lack of strategy, Bacehowski says that during the pandemic period a major error she’s seen is the call to action that invites people to “give us a call or stop in.” During a period when many branches were open at best by appointment only, and call centers were often swamped, “that stops digital in its tracks.” Bacehowski adds that institutions should be using digital as part of a bigger marketing effort, not in place of everything else.

Pandemic Lockdown Adds to Video’s Continuing Momentum

Just about every institution contacted has been using video during the COVID crisis. Often this has been in conjunction with social media platforms or embedded in emails or on websites. Some institutions have tapped live video for meetings to keep staff in the loop.

“If anything has been rising to the top,” Bacehowski says, “it’s absolutely been video. It’s probably the most effective and efficient way to message right now.”

Organizations from major networks down to community banks and credit unions have been using cruder video than might ordinarily have sufficed. At times the recording has been made on a smartphone. “I have never in my marketing career seen the forgiveness you see now among audiences,” says Bacehowski. “For now, much of what you see will continue to be pretty raw. But I think we will certainly get back to a time when professional videographers’ work will be valued and expected.”

Read More: 6 Ways to Integrate Video Into Bank & Credit Union Marketing Plans

Content consumption has gone ballistic during the COVID period. During the COVID crisis the consumption of content on financial websites has been increasing and financial marketers say they have increased their investment in this area. Concurrently with that, some are also investing in search engine optimization improvement for their websites in order to improve traffic and to better design blogs and other content to pull.

“We produced almost double our usual content in March and April, and sent additional articles out in a ‘Now Trending’ email that reached all subscribers,” says Emily Abbas, SVP and Chief Marketing and Communications Officer at Bankers Trust, Des Moines. “Those ‘Now Trending articles were some of the highest trafficked pages on the site in the last few months.” Much of the bank’s attention during COVID has been on its Bankers Trust Education Center and Abbas suggests that the results indicate that timely articles are a good draw. “This reminds us that we need to stay nimble as major news or events come out,” says Abbas.

Customers Bank’s David Patti says this only makes sense. If financial services officers will be physically meeting people less often in person and events will occur less frequently, if at all, then the likelihood of “meeting” the institution online must be improved via SEO.

“You need to meet them in the store they’re in,” says Patti, “and that’s Google.”

Will It Ever Be Okay to Actually Sell Again?

Much from this point on is going to be different for financial marketers. For one thing, competition will increase, and not just from fintechs. The starting gun for a true race to digital transformation among traditional players has been fired, suggests Becky Smith, EVP, Chief Strategy & Marketing Officer at SECU Credit Union. With many people having been forced by circumstances to try digital channels, the population that wants excellent digital service is growing. As institutions find their future normal, no one will accept jury-rigged digital for long. Further, now that so many more people are willing to use digital remote service, the number of challengers a bank or credit union may face is going to increase. Geographical location will mean even less, says Smith.

“Consumers will dictate what the need is, and as long as there is a need, there is an opportunity to sell”

— Becky Smith, SECU Credit Union

But what will institutions be doing with their marketing as they move away from informational messaging about branch access and the like? Can banks and credit unions resume product marketing?

Many of those interviewed think the time for this is coming. Others say they will be feeling their way carefully, sensitive to optics. And some institutions tend to promote relationships more than products in normal times.

Emily Abbas notes that Bankers Trust is one such example, explaining that brand marketing can play in more normal times and also in times of uncertainty. It also helps when marketing specific products and services.

That said, “we aren’t holding ourselves to a specific deadline to resume additional marketing efforts or expectation of what normal will be in coming weeks and months,” says Abbas. “As we’ve done throughout this pandemic, we’re continuously discussing options among our marketing and communications team and with our business-line partners to determine how our messaging should evolve.”

A common attitude is that as people continue to come out of figurative and literal lockdown, they will have needs that institutions can fill.

“Consumers will dictate what the need is, and as long as there is a need, there is an opportunity to sell,” says SECU’s Smith.

Joe Sullivan thinks it is time to uncouple Marketing from a product focus, using personalization to turn the function into more of a match-making service between an institution’s offerings and people’s needs. In a similar way, Machias Savings’ Nabokov thinks of financial wellbeing as what banking institutions should now be serving up to consumers — products and services just represent the tools.

As America’s reopening continues, busy marketers have to face reality and make time for something critical: Rethinking how they do their job going forward.

“Everybody came into the year with a strategic marketing plan. Given all that’s happened, that’s in the garbage,” says Tim Pannell. “The question is, will they have time to do a new plan? Or will they spend the rest of the year just reacting?”