Amazon is impossible to ignore. With its aggressive product pricing and right-now delivery model for everything from bath supplies to beehives, it controlled about 39% of all U.S. ecommerce in 2022, a figure that is expected to continue rising, according to data from Statista.

The company’s biggest sales event of the year — Prime Day — is happening October 10th and 11th, and many financial institutions have been ramping up their social media efforts in anticipation, with good reason.

During the Prime Day event in July, the retail giant sold more than 375 million items worldwide over two days for $12.9 billion in sales — record-breaking volume for Amazon. While the company boasted in a press release that shoppers “saved more than $2.5 billion on millions of deals,” the reality is that not every deal is as good as it seems. Some financial institutions are taking the opportunity to remind their social media followers of this with messaging that warns about the need for scrutiny. Others are using the widely publicized and highly anticipated sales event to tout their credit and debit cards, in some cases offering special promotions that increase rewards.

With 200 million Amazon Prime members worldwide, 167 million of which are in the United States, messaging tied to this sales event is well worth the effort. Prime membership costs $14.99 per month or $139 per year and brings with it free shipping on many items, as well as access to some content on Prime Video and other perks.

Below is a selection of Prime Day-focused social media posts from an assortment of banks, credit unions and fintechs. The posts in this gallery are organized into seven categories, with observations on the tactics used.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

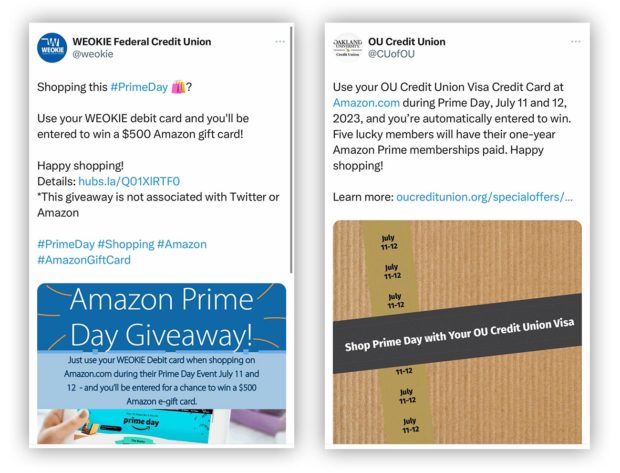

Have a Contest Tied to Credit and Debit Card Use

Sweepstakes and giveaways that give Prime Day shoppers a reason to choose a particular credit or debit card for making their purchases are popular with financial institutions.

This approach could pay dividends beyond just the two-day event, given that Amazon saves previously used cards in its system. This makes it easy to reuse a particular card for future purchases, as there is no need to input the information again.

Ahead of Prime Day in July, Oakland University Credit Union, based in Rochester, Mich., took to social media to let customers know that using their Visa credit card would automatically enter them to win a one-year Amazon Prime membership, with a total of five winners. The credit union shared the tweet, shown here, on what was then called Twitter, but later that month would be renamed X.

Meanwhile, Weokie Federal Credit Union in Oklahoma City offered customers a chance to win a $500 Amazon gift card for using its debit card on Prime Day purchases.

The rewards tied to Amazon are a good fit. Just remember that in the quick-scrolling world of social media, the less cluttered a post is, the better. Lean toward clean visuals and typefaces.

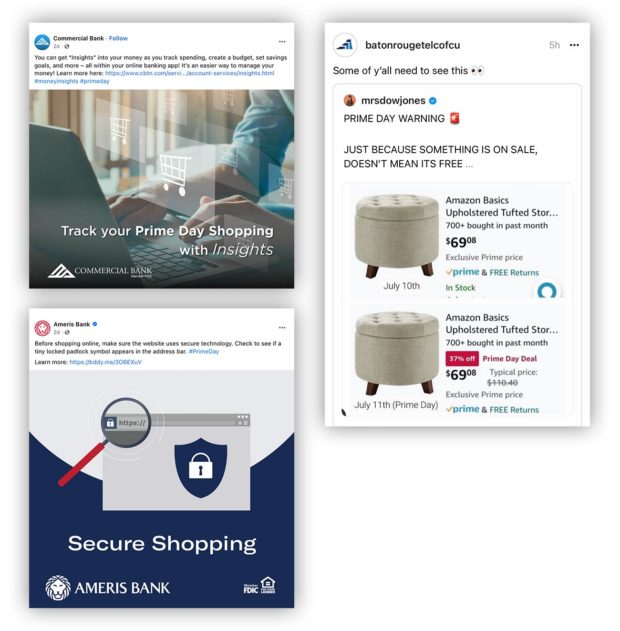

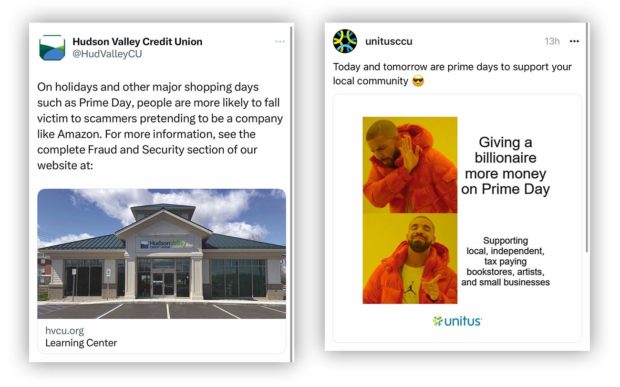

Try a ‘Public Service Announcement’ Type of Social Media Post

Rather than piling onto the Prime Day frenzy with more promotions, some financial institutions take the opportunity to warn their social media followers about scams or share a “buy local” message.

Ameris Bank in Atlanta showed people how to check whether a site they are shopping on is secure with a very effective image.

Baton Rouge Telco Federal Credit Union in Louisiana reposted a message from a financial influencer showing how “sales” are often not really sales. The post showed two identical Amazon products listed on different days for the same price, but the one advertised as a Prime Day deal claimed “37% off.”

The credit union’s comment was short and sweet and used the popular eyeballs emoji to good effect. Its post, shown below, appeared on Threads, the social media platform created to challenge the floundering former Twitter.

Unitus Community Credit Union in Portland, Ore., repurposed a popular meme featuring the rapper Drake to make a comment on consumerist culture. Its message on Threads encouraged people to consider the downstream effects of their dollars when they choose to buy from Amazon versus local businesses. It’s effective on many levels, putting a thought-provoking spin on a light-hearted meme.

Hudson Valley Credit Union in Poughkeepsie, N.Y., took a more straightforward approach. Its tweet warns customers of the increased potential for scams with a link to the fraud and security section of its website. This a basic social media post that could have used a more engaging image to draw attention. It also would have been helpful to include a tip for people in the messaging along with the link to click for more.

But riffing on timely events can heighten the impact of simple, low-effort posts. Not everything on social media needs to be zany or contrived.

Read more:

- How CMOs Can Maximize Their Marketing Budgets & Prevent Cuts

- Digital Marketing Tactics, Trends and Tips to Know About for 2024

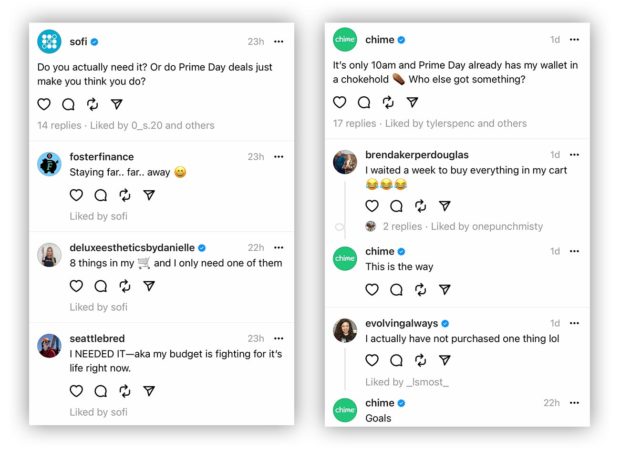

Spark Engagement with a Prime Day Conversation Starter

Chime asked its followers on Threads what they scored during Prime Day. It was a great strategy to spur genuine interaction, especially given that Chime quickly responded with comments like “This is the way” (a catchphrase from the popular Star Wars series “The Mandalorian”). The responses reflected the personality that the San Francisco-based fintech aims to project.

SoFi also got its followers to engage. This fintech-turned-bank posted a Prime Day-related question on Threads asking people to consider whether they actually need that sale item. It got back several replies tinged with humor. Like Chime, SoFi is based in San Francisco with a widely dispersed national customer base.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Share a News Article About Prime Day as an FYI

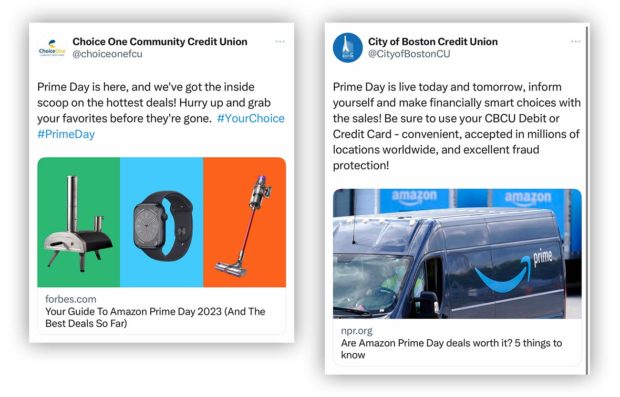

Linking to informative news articles is another option for financial institutions. The two examples below illustrate how social media can be used to offer some value to followers without a lot of effort. Both are posts that appeared on the social media platform formerly known as Twitter.

The City of Boston Credit Union posted a reminder about Prime Day and about using its debit or credit card (with its “excellent fraud protection”), while linking to a useful NPR article. The article advises shoppers to scrutinize deals, avoid impulse buying, and check with other retailers for coinciding deals, among other practical tips.

Choice One Community Credit Union, based in Wilkes-Barre, Pa., also linked to a useful article, but with a more upbeat tone. The Forbes article highlighted the best deals for Prime Day — an approach that offers a contrast to the other credit union and is still highly relevant to social media followers.

Relevance of content and the purpose it serves are important considerations with social media efforts, which can easily get caught up in the churn-and-burn approach of creating content for its own sake.

See all of our latest coverage of digital marketing strategies in banking.

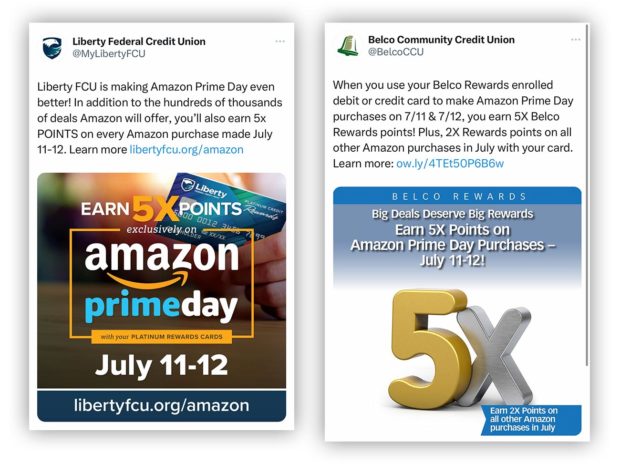

Offer Extra Rewards on Credit Cards for Prime Day

Contests that give cardholders a chance to win an Amazon Prime membership or an Amazon gift card aren’t the only way to drive usage. Offering extra rewards is also a popular tactic to prompt Prime Day shoppers to use a particular credit card, as the following social media posts illustrate.

With the proliferation of rewards in general, they have lost some of their luster as an incentive. But tying them to an event like Prime Day can help inject some excitement.

This example from HDFC Bank, based in Mumbai, India, illustrates how Prime Day is a worldwide phenomenon. This offer is for a whopping 15% cash back when using one of its credit or debit cards for Prime Day purchases. That’s a huge value, far above the typical cash-back reward.

Similarly, Belco Community Credit Union in Harrisburg, Pa., and Liberty Federal Credit Union in Evansville, Ind., amped up their rewards offers with five times the points on Prime Day purchases — also a big bump from the industry norm. The graphic Belco included on its tweet was eye-catching, with the headline “Big Deals Deserve Big Rewards” being both punchy and concise.

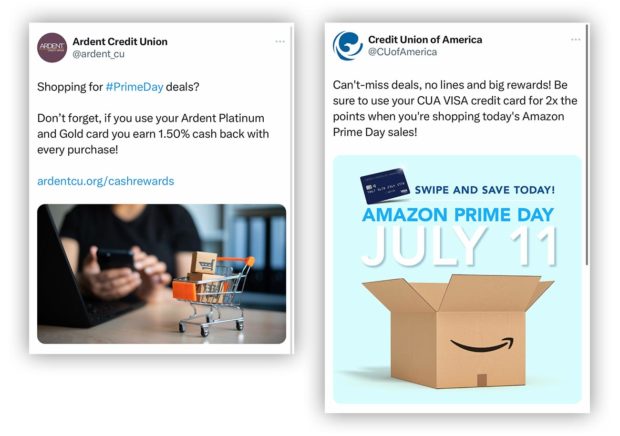

Taking a different tack, Ardent Credit Union in Philadelphia took the opportunity to remind followers of its 1.5% cash back rewards, which is its usual rate for gold and platinum credit cards. Though the rewards in this case aren’t boosted for Prime Day, it can’t hurt to remind customers that they’re there, seeing as the typical American has multiple credit cards to choose from.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance. This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team. Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

The unfair advantage for financial brands.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

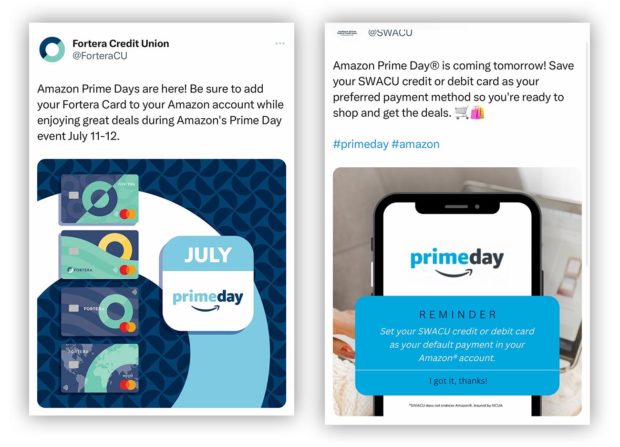

Aim for Preferred Credit Card Status

Piggybacking on Prime Day with social media messages about credit cards can be worthwhile, even without plugging rewards.

Both Fortera Credit Union of Clarksville, Tenn., and Southwest Airlines Federal Credit Union in Dallas tweeted ahead of last Prime Day encouraging customers to add their institution’s credit card to Amazon accounts to prepare for the big event. SWACU went a step further and asked users to make its card their preferred payment method.

This provides a benefit beyond isolated sales events, as noted earlier. It allows the card information to be autofilled during the check-out process in the future. Both tweets got straight to the point with pared-down text and simple graphics — no need to complicate it.

Read more:

- How to Supercharge Debit Card Marketing to Drive More Usage

- The Top U.S. Banks on Instagram for 2023

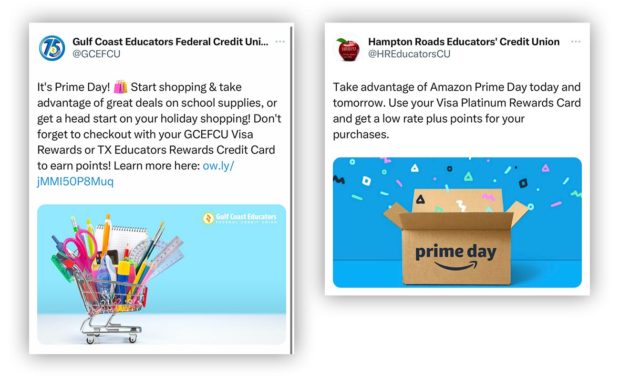

Target a Specific Audience with a Prime Day Message

Financial institutions also can capitalize on Prime Day buzz to share more targeted social media content that resonates with a specific audience.

Case in point is this tweet from Gulf Coast Educators Federal Credit Union with its eye-catching image. The credit union, which serves employees of school districts and colleges in Texas, suggests taking advantage of Prime Day to buy school supplies (specific to the customer base) or to get a head start on holiday shopping (more general messaging). There was even enough space remaining in the character count limit for a reminder about its credit card rewards.

Yet this multifunction message still holds fast to the golden rule of social media content: keeping it simple.