The definition of bank marketing keeps expanding. Decades ago, the usual choices were newspaper advertising, outdoor, local radio and TV, and maybe some focus groups. Today financial marketers’ palette is far bigger with social media marketing, search engine marketing and optimization, and content marketing added to the traditional methods. And beyond that “martech,” big data and analytics are part of Marketing to varying degrees.

The chief marketing officer’s task — and talent — lies in finding the ideal blend of all of these options and tools to reach and sell the bank’s target audiences. The mix differs for every institution, but the question facing every marketing director remains: Is my marketing budget large enough?

Marketing spending is never in a vacuum. Not only does it need to take into account other banks’ and credit unions’ budgeting decisions, but spending by fintech players must increasingly be considered.

Benchmarks to Compare Where Your Bank Marketing Budget Stands

To help bank marketers gain some context as they evaluate their own budgeting decisions, The Financial Brand looked at FDIC call reports for banks ranging from about $250 million in assets up to about $50 billion in assets. We compared year-end totals for both 2015 and 2018, looking specifically at marketing and advertising expenditures. This database became the raw material for the calculations and analysis in this article.

Number of Banks in Study: 210

Largest Bank by Assets: First-Citizens Bank, Raleigh, NC ($35.3 billion)

Smallest Bank by Assets: Peoples Bank of Hazard, KY ($249.2 million)

Average Marketing Budget: $2,582,019

Median Marketing Budget: $921,000

Average Marketing Budget as a % of Assets: 0.068%

Median Marketing Budget as a % of Assets: 0.076%

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Breaking Down Bank Marketing Budgets

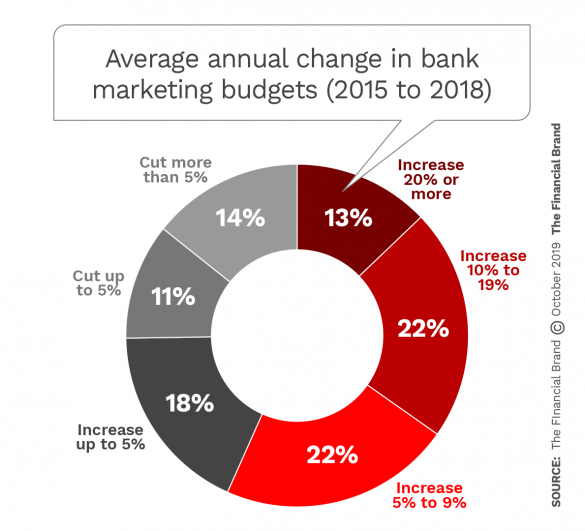

As illustrated in the pie chart below, three-quarters of banks in the sample increased annual marketing budgets between 2015 and 2018. More than one in ten increased marketing budgets by an average of 20% or more.

As a rule, the smaller the bank, the smaller the percentage increase in their marketing budget each year. Banks with over $10 billion in assets in our study tended to be much more aggressive. They increased their marketing budgets by an average of 10.6% every year between 2015 and 2018, and 40.3% over the study period. Banks with less than $500 million in assets, by contrast, increased their marketing budgets by half as much — only 5.0% over the same timeframe, and 21% over the study period.

Read More:

- The Financial Marketer’s Guide to Surviving Budgeting Season

- Financial Marketers See Pros and Cons in Marketing’s Changed Role

The Impact of Bank Marketing Investments

The table below, organized by asset tiers, includes budget figures for all asset ranges included in the study, along with other measures of profitability and their correlation with marketing budgets.

Attempting to establish a definitive relationship of marketing spending to any measure of results ignores the fact that a bank is a machine of many moving parts. Brilliant marketing could be undermined by a local economic downturn. Successful marketing that produces strong loan growth that ought to produce strong net income could be negated by a major loan loss. But with care a marketing officer can make a case for ensuring that in today’s competitive environment no brand need face the battle with inadequate ammunition and support.

| Key Marketing Metrics By Asset Tier |

Over $10 Billion |

$5 Billion up to $10 Billion |

$1 Billion up to $5 Billion |

$500 Million up to $1 Billion |

Less than $500 Million |

|---|---|---|---|---|---|

| Marketing as a % of Assets (2015) |

0.0678% | 0.0841% | 0.0742% | 0.0730% | 0.0736% |

| Marketing as a % of Assets (2018) |

0.0668% | 0.0772% | 0.0719% | 0.0730% | 0.0718% |

| Increase in Marketing Budget (2015-2018) |

40.3% | 33.7% | 38.0% | 31.7% | 21.0% |

| Average Annual Increase in Marketing Budget (2015-2018) |

10.6% | 9.1% | 8.8% | 6.9% | 5.0% |

| Profit Per $1 in Marketing Spent (2018) |

$26.74 | $18.30 | $24.89 | $41.68 | $18.83 |

| Change in Profit Per $1 in Marketing Spent (2015-2018) |

$7.93 | $0.03 | $4.98 | $12.49 | $1.55 |

| Asset Growth (2015-2018) | 38.1% | 37.4% | 30.0% | 26.4% | 18.8% |

| Increase in Net Income (2015-2018) |

97.0% | 90.7% | 73.3% | 60.8% | 66.3% |

| Profit Per $1 in Marketing Spent (2015) |

$18.80 | $18.27 | $19.91 | $29.19 | $17.28 |

| ROA (2018) | 1.34 | 1.26 | 1.21 | 1.19 | 1.11 |

| Change in ROA (2015-2018) | 0.34 | -0.05 | 0.20 | 0.17 | 0.21 |

| ROE (2018) | 11.00 | 10.96 | 11.63 | 11.59 | 10.25 |

| Change in ROE (2015-2018) | 2.69 | 0.47 | 1.71 | 1.75 | 1.69 |

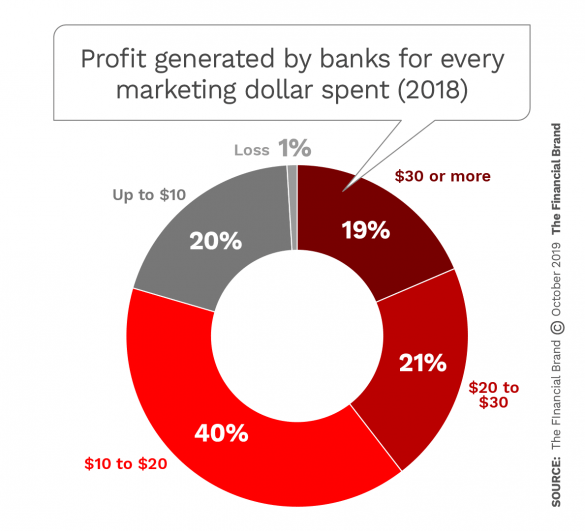

In 2018, banks generated, on average, $18.34 for every dollar spent on marketing, up from 2015’s average of $14.48. As a group, banks between $500 million and $1 billion averaged the highest profit per dollar spent on marketing, with the largest asset class, those over $10 billion, coming in behind that.

Looking at the above table based on asset tiers, it is notable that the three middle tiers, covering banks between $500 million and $10 billion, as a group spend more on marketing as a percentage of assets than the largest and smallest categories in the study sample, perhaps reflecting the urge to grow. In recent years, crossing the $1 billion mark and the $10 billion mark have become a priority.

Concerning the smallest institutions in the study, which spent less as a percentage of assets than the next three largest asset tiers in 2018, one factor may be a matter of banking specialty. In many ways bank marketing is more retail- than business-banking oriented. This has been changing over time, but, especially for community banks, which tend to be business-focused, marketing remains a more personal matter. These institutions still press the flesh with business leaders who want to deal with a human and not a Kabbage.

A Closer Look at the Banks Spending the Most on Marketing

26 institutions out of the 210-bank study universe devoted at least 0.12% of assets to marketing in 2015. This number dropped to 17 banks in 2018, but 11 of those banks appeared on both lists, suggesting a stronger-than-average commitment to investing in marketing.

Among the top spenders in 2018, ten had ROAs above 1.0% and seven had ROEs of at least 15%. On the other hand, six of the 2018 leaders had ROEs below 10%. (Among all banks in The Financial Brand study, both the average and median ROA were 1.21%. The average ROE was 11.24% and the median was 10.92%.)

Some interesting reasons for spending beyond average emerged among the institutions that were large spenders for 2018.

Take, for example, Axos Bank, which appeared on the 2018 ranking. The San Diego-based bank started in 2000 as Bank of Internet USA. It was one of the first internet-based financial institutions. Since then it has acquired several other institutions and its parent, Axos Financial, has moved into multiple financial businesses related to banking. In 2018, Axos, which topped $10 billion in assets in 2019, devoted $16.3 million to marketing. This represented 0.17% of assets, versus the average of 0.068% of assets among all banks in the study. 2018 marked the year of its rebrand, in October, to the radically different Axos name and look. The new brand’s tagline is “Banking, Evolved.”

One of the highest percentages seen among the study sample both years was that of FirstBank, Nashville, Tenn., which spent over $13 million on marketing in 2018, amounting to 0.26% of assets, nearly four times the study average. The institution has undergone three mergers since 2015 and went public in 2016, listing on the NYSE. It branched into Georgia and Alabama and has mortgage operations throughout the Southeast.

Meridian Bank, headquartered in Paoli, Pa., near Philadelphia, branched into the historic city in 2017, pursuing its mix of retail and commercial. It devoted 0.24% of assets to marketing in 2018, almost twice the level that put it among leaders in the 2015 tally.

Bank of Springfield, Ill., which put 0.17% of assets into marketing in 2018, typifies a number of institutions identified in this year’s study that pay for naming rights on public venues, such as sports stadiums, multi-purpose public spaces, and even museum exhibitions.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

How Marketing Correlates With Bank Growth

Does spending on marketing effectively help increase the size of the bank? One quarter of the banks in this study — 25.2% — increased assets by at least 40% over the three-year period reviewed. Of those 53 banks, 24 of them increased their marketing budget by an average of at least 15% year over year between 2015 and 2018.

| Marketing spending among banks with most asset growth | Assets in 2018 (in millions) |

Asset Growth (2015-18) |

Average YoY Increase in Marketing Budget (2015-18) |

Marketing as a % of Assets (2018) |

|---|---|---|---|---|

| Commercial Bank of California | $986,712,000 | 200.4% | 75.3% | 0.07% |

| Northpointe Bank | $1,279,654,000 | 178.7% | 46.1% | 0.20% |

| Bank OZK | $22,388,030,000 | 126.8% | 55.2% | 0.05% |

| Prudential Bank | $1,115,161,000 | 113.6% | 21.1% | 0.02% |

| Sterling Bank and Trust | $3,198,235,000 | 87.0% | 28.9% | 0.05% |

| Summit Bank | $416,468,000 | 76.2% | 32.4% | 0.09% |

| Legacy Bank | $252,063,000 | 75.1% | 48.1% | 0.05% |

| Spirit of Texas Bank | $1,465,892,000 | 73.2% | 73.4% | 0.06% |

| Old National Bank | $19,633,838,000 | 65.7% | 20.4% | 0.06% |

| Merchants Bank of Indiana | $3,710,275,000 | 63.5% | 41.5% | 0.01% |

| Wintrust Bank | $5,889,864,000 | 61.7% | 18.3% | 0.05% |

| Horizon Bank | $990,721,000 | 59.1% | 21.6% | 0.20% |

| Entegra Bank | $1,635,609,000 | 58.7% | 19.2% | 0.06% |

| Empire National Bank | $988,203,000 | 57.1% | 28.9% | 0.07% |

| First Reliance Bank | $583,054,000 | 56.1% | 21.6% | 0.10% |

| California Bank of Commerce | $1,005,544,000 | 54.0% | 25.6% | 0.05% |

| Level One Bank | $1,413,654,000 | 53.1% | 18.6% | 0.07% |

| Meridian Bank | $997,388,000 | 50.4% | 37.4% | 0.24% |

| North American Banking Co. | $582,603,000 | 47.8% | 50.6% | 0.10% |

| Axos Bank | $9,796,674,000 | 47.2% | 36.0% | 0.17% |

(09/22/2021 Editor’s Note: Empire National Bank has since been acquired by Flushing Bank, which took place in late 2020.)

(12/13/2021 Editor’s Note: Entegra Bank has since been acquired by First Citizens Bank.)

Topping the table is Irvine, Calif.’s Commercial Bank of California which grew assets by a whopping 200% over the three-year study period. That rapid growth had been a deliberate goal for Ash Patel, President and CEO, as was the strategy to move away from being a traditional bank into a diversified financial services and technology company. While the bank’s marketing budget-to-assets ratio of 0.07% is about average for the group, it has increased marketing spend by 75% over the three-year study period, to a total of $733,000 in 2018.

Another major growth story is seen in Bank OZK, which acquired 15 other banks from 2010 to present, two of them in the study period. In 2018 the institution, based in Little Rock, Ark., changed its name from Bank of the Ozarks to Bank OZK. In 2015-2018 the institution grew 127% in assets while upping its marketing investment to 55.2%. In 2018 it had a marketing spend of over $10 million, spread over a ten-state banking organization.

Four institutions identified as “big marketing spenders” also appear in the table above:

- Northpointe Bank (0.20% of assets on marketing in 2018)

- Horizon Bank (0.20% of assets on marketing in 2018)

- Meridian Bank (0.24% of assets on marketing in 2018)

- Axos Bank (0.17% of assets on marketing in 2018)

Bank Marketing ROI

More than half — 55.7% — of the 210 banks studied allocated at least 0.07% of their assets to marketing. Of these 117 banks, 39 were able to generate at least $15 profit for every dollar spent on marketing. The table below lists the top 20 of that number, as ranked by profit per $1 spent. A handful almost doubled that $15 figure.

| Top banks by profit per dollar of marketing spend | Assets (in millions) |

Marketing as a % of Assets |

Profit Per $1 in Marketing Spent |

ROA | ROE |

|---|---|---|---|---|---|

| Quantum National Bank | $489.8 | 0.07% | $36.92 | 2.79 | 24.87 |

| Citizens National Bank of Bluffton |

$858.4 | 0.07% | $28.12 | 1.95 | 20.90 |

| Rock Canyon Bank | $416.3 | 0.07% | $26.66 | 1.89 | 18.52 |

| Rockland Trust Company | $8,850.5 | 0.07% | $21.18 | 1.49 | 11.90 |

| Benchmark Bank | $582.8 | 0.11% | $20.93 | 2.30 | 22.81 |

| Frandsen Bank & Trust | $1,706.9 | 0.07% | $20.89 | 1.51 | 12.91 |

| Texas Bank | $2,528.0 | 0.07% | $20.83 | 1.49 | 13.49 |

| Glacier Bank | $12,102.8 | 0.08% | $20.39 | 1.71 | 12.81 |

| American Bank Center | $1,426.0 | 0.07% | $20.18 | 1.44 | 16.61 |

| ANB Bank | $2,567.1 | 0.07% | $19.93 | 1.34 | 17.33 |

| Bank of Odessa | $249.8 | 0.07% | $19.58 | 1.42 | 6.85 |

| First Financial Bank | $2,923.8 | 0.08% | $19.52 | 1.51 | 11.08 |

| Carrollton Bank | $1,637.6 | 0.07% | $19.41 | 1.30 | 15.90 |

| The Moody National Bank | $1,000.2 | 0.08% | $19.35 | 1.49 | 10.43 |

| Bank of Utah | $1,422.6 | 0.09% | $18.87 | 1.81 | 14.93 |

| Focus Bank | $738.4 | 0.07% | $18.28 | 1.32 | 12.70 |

| Farmers & Merchants Bank | $778.6 | 0.07% | $17.82 | 1.19 | 10.11 |

| Hancock Whitney Bank | $28,215.4 | 0.07% | $17.77 | 1.21 | 11.25 |

| Alpine Bank | $3,706.4 | 0.09% | $17.68 | 1.59 | 17.36 |

| First Bank and Trust | $923.8 | 0.10% | $17.62 | 1.73 | 17.84 |

Which Banks Get the Biggest Bang for Their Marketing Buck?

Here’s another way to look at the potential return on marketing expenditures. Out of the 210 banks in this study, 34.8%, increased their budgets by an average of at least 20% between 2015 and 2013. Among that group, 13 saw their net income increase by an average of at least 20% during that period, with their ROA improving by at least 0.5 points, and their ROE improving by at least 3.0 points.

| Correlation of marketing spend with return measures | Assets (in millions) |

Marketing as a % of Assets (2018) |

Average YoY Increase in Marketing Budget (2015-18) |

Average Increase in Net Income (2015-18) |

Change in ROA (2015-18) |

Change in ROE (2015-18) |

|---|---|---|---|---|---|---|

| North American Banking Co. | $582.6 | 0.10% | 50.6% | 34.8% | 0.85 | 10.79 |

| Pinnacle Bank | $359.9 | 0.10% | 15.1% | 73.3% | 1.07 | 10.22 |

| Rock Canyon Bank | $416.3 | 0.07% | 10.7% | 36.9% | 0.75 | 6.74 |

| Sterling Bank and Trust | $3,198.2 | 0.05% | 28.9% | 43.2% | 0.57 | 6.37 |

| Synovus Bank | $32,580.9 | 0.06% | 10.5% | 21.1% | 0.51 | 6.12 |

| Hancock Whitney Bank | $28,215.4 | 0.07% | 18.8% | 32.7% | 0.54 | 5.52 |

| California Bank of Commerce | $1,005.5 | 0.05% | 25.6% | 61.4% | 0.59 | 5.44 |

| Legacy Bank | $252.1 | 0.05% | 48.1% | 43.1% | 0.58 | 5.41 |

| First Bank and Trust | $923.8 | 0.10% | 11.5% | 22.9% | 0.59 | 5.28 |

| Wintrust Bank | $5,889.9 | 0.05% | 18.3% | 37.8% | 0.61 | 4.65 |

| Falcon International Bank | $1,150.7 | 0.09% | 16.2% | 21.6% | 0.54 | 4.08 |

| First Bank | $1,711.2 | 0.04% | 14.7% | 65.4% | 0.59 | 3.97 |

| Home Bank | $2,150.2 | 0.05% | 35.6% | 36.0% | 0.53 | 3.03 |

Download The Marketing Budget Data (Excel Spreadsheet)

You can have your own copy of the data assembled and analyzed by The Financial Brand by providing the information in the form below. You will receive two spreadsheets — one for banks and one for credit unions. Here is just a sample of the datapoints these spreadsheets contain:

- Marketing budgets as a percentage of assets

- Breakdown of marketing budgets by asset tier

- Marketing budget increases

- Correlations between marketing budgets and profitability

- Profit per $1 in marketing spent

- Correlations between marketing budgets and asset growth

- And much, much more!

The ways in which you could slice and cross-tab the data are almost endless.

To receive the data, you must provide a valid email address. A link to the spreadsheet will be emailed to you.