Back in the dark ages of financial marketing, “selling” was still a dirty word and a “data analyst” position would have been considered a strictly IT job.

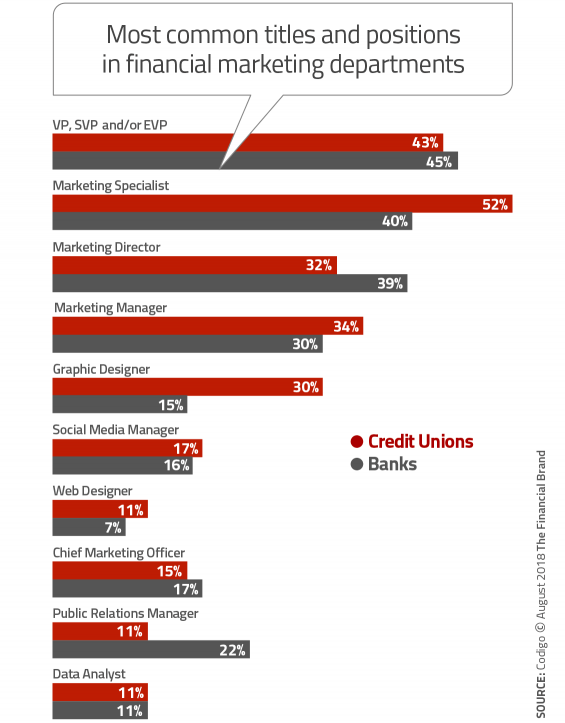

How things have changed. Now one in ten marketing departments include a data analyst position, according to Codigo’s report, Anatomy of the Marketing Department.

Codigo’s study looks at financial marketers’ top challenges, skillset priorities, hiring and employment trends, place in the food chain, and a sense of marketing department spending and structure in banks and credit unions.

Not long ago, you might have seen an ex-sportswriter, a schoolteacher, or even a former lender who “just had a way with words” wearing marketing hats at banks and credit unions. Back then, old school marketing tactics included a ton of print ads, buying billboards, and ordering toasters and teddy bears to help coax depositors.

“Everyone thinks they have a marketing degree.”

— Jeff McCarthy, First Bank Financial Centre

Codigo’s report details how bank and credit union marketing has grown to become a true craft and science. Some things never change though.

“Everyone thinks they have a marketing degree,” says Jeff McCarthy, VP/Marketing Director at Wisconsin’s $1.2 billion First Bank Financial Centre.

That’s understandable. Everyone — in all walks of life — is perpetually exposed to marketing from birth. Because we all have to see tens of thousands of ads every year, we all have opinions about what we like and don’t like, works and what doesn’t.

But McCarthy, who came to banking from an agency background, says there is nevertheless some level of recognition that financial marketing requires the right kind of expertise.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Teamwork, Tech, and Tweets

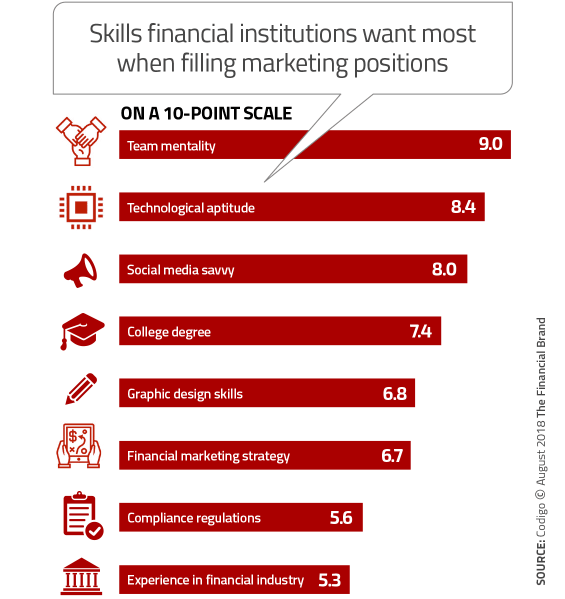

The leading skill sets that financial marketers hire for today are a team mentality, tech ability, and social media expertise. Graphic design skills rank below these, as does compliance knowledge.

An applicant’s previous experience in financial services ranks lowest of all among the points Codigo queried respondents about — not unimportant, but no longer essential. This likely suggests that financial institutions are savvy enough to realize and accept that the level of expertise they need in new areas like data analytics won’t come from inside the industry.

To McCarthy, the emphasis on “team” is not a “rah, rah” kind of thing. It means a willingness to step up when necessary and to backstop when someone is out. A couple of years ago his department added one more position, bringing the total to four marketing staffers including himself. “We need to cover for each other,” McCarthy explains.

Pamela Hatt, VP/Marketing at $1.4 billion Pen Air Federal Credit Union in Florida, says “team” implies a good cultural fit. Hatt has worked in both regional bank and credit union marketing positions. Yes, a person’s technical skills must be vetted, but more importantly, the new hire “must fit the parameters of our brand.”

At Pen Air, that means having “understanding of and believing in the credit union movement,” Hatt explains. One of the earmarks of this attitude, she continues, is Pen Air’s “Communerosity” theme, a blend of “community” and “generosity.”

While the individual skills reviewed in the survey were treated separately, increasingly practitioners recognize that they can overlap and complement each other in some roles.

“Creative folks have to be more technologically-oriented, and tech folks have to be more creatively inclined.”

— Brian Nutt, Codigo

One example concerns the intersection of social media savvy, graphic design skills, and technological aptitude, points out Brian Nutt, Founder and CEO at Codigo. Traditional graphic design has fallen off as a hiring criteria in one sense, he explains, because the traditional skills of handling print layouts have become much less necessary as traditional advertising channels fall out of favor.

However, Nutt says, what’s really been emerging is a fresh combination of skills for today’s marketing channels, especially digital design, which is more than simply placing graphic elements.

With social media demanding visuals, and websites and mobile apps needing to look lively, marketing departments need to produce “a beautiful design that’s also a ‘wow’ experience,” as Nutt puts it. For that to work “creative folks have to be more technologically oriented and tech folks have to be more creatively inclined.” This may sound like a “right-brain/left-brain” collision, but Nutt considers this imperative.

“We call them ‘creative programmers’,” Nutt says.

At Louisiana’s Home Bank, Natalie Lemoine, VP/Marketing, is recruiting for a fourth full-time post. Specifically the $2.2 billion bank wants to bring someone aboard with video experience. Lemoine explains that the bank always uses more and more video on its website and in its social media posts. She anticipates that there will be still more demand for video as the bank looks for ways to reach out to “folks who are not watching traditional TV.”

Lemoine’s being in the market for additional staff is a bit unusual, compared to the survey sample. 66% of banks and 61% of credit unions responding aren’t currently adding to staff. Codigo noted that this represents a significant rise in institutions not expanding staff, compared to the firm’s previous survey.

“When you do social media, you need graphics… We fully immerse our graphics interns so they are part of the team.”

— Pamela Hatt, Pen Air Federal Credit Union

At Pen Air Federal, the need for people who can blend technological and graphic skills has driven Marketing’s internship program in recent years. Hatt explains that the credit union’s demand for graphics keeps rising, as the nature of marketing communication becomes increasingly visual.

“When you do social media, you need graphics,” says Hatt — a post without at least a picture might as well be invisible. Pen Air partners with a local college to offer a hybrid graphic-marketing internship. So integral do the interns become, she adds, that the credit union lengthened the duration of the internships to six months from 12 weeks.

“We fully immerse our interns so they are part of the team,” says Hatt. She would have willingly hired the last few interns, had she had an open position.

Read More: Moving From ‘Mad Men’ Era Advertising to True Digital Financial Marketing

In-House Data Analytics Now Mandatory

Banks and credit unions have the untapped advantage of lots and lots of customer data. There are plenty of needles, in all that hay, but they lack a magnet to help pull them out. Many institutions didn’t even think they needed such a tool. They thought they understood the consumers that they served pretty well.

That’s beginning to change, as the hiring of data analysts in marketing departments shows, according to Randy Schultz, Vice-President/Marketing at Weber Marketing Group. He has spent a career working with credit unions as well as some community banks, and finds that both are just beginning to understand the importance of data.

“The data analytics piece is getting to be a big part of financial marketing.”

— Randy Schultz, Weber Marketing Group

The trick now, he says, “is getting their arms around it.” Proper application of data analytics demands not only mining what the institution already has from its own customer interactions, but also picking, choosing, and correlating external data. The right combinations can drive good design and good decision-making.

“The data analytics piece is getting to be a big part of financial marketing,” says Schultz.

Schultz says building data analytics capabilities, or partnering with outsider expertise, isn’t solely about bringing in new business. In some ways, analytics can help financial institutions make sure they are bringing in, and capitalizing on, the right business. Often, Schultz explains, banks and credit unions assume that they are already optimizing their approach. They may be fooling themselves, and this can cost them money.

Read More: Data Speaks Volumes, But Are Financial Marketers Listening?

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Where Institutions Find New Marketing Staff

Codigo’s study determined that many financial institutions continue to hire people who have worked in financial services — 56% of credit unions said their marketing executives came from such firms, and 52% of bank respondents said the same.

To a degree, this reflects industry consolidation. Codigo’s Brian Nutt notes that the credit union industry continues to shrink, with smaller ones being assimilated into larger organizations. Frequently credit union marketers who lose their jobs through such transactions wind up working for other credit unions eventually, says Nutt.

However, the study found that both types of institution have been reaching out more broadly. 17% of credit unions and 25% of banks hired their marketing executive out of marketing and advertising agencies.

And 27% of credit unions and 23% of banks have hired from other industries altogether.

Home Bank’s Lemoine says she’s more interested in skills than where someone previously worked. “I can train them in our products and in the financial industry,” Lemoine explains.

Jeff McCarthy favors his old roots, advertising agencies, when considering a hire.

He has two reasons. First, “I’m looking for marketing expertise. Good marketing practices are consistent across all industries.” Second, he believes that agency staff bring the experience of serving multiple organizations, the ability to “change gears,” and fresh thinking to their new job.

McCarthy sees the relative longevity of bank employment as both a plus and a minus.

Institutions often brag about lack of staff turnover and smaller financial institutions thrive on the “family feel” that develops when many people work together over a long period.

“I wonder sometimes if that leads to some stagnation,” says McCarthy. “You can only come up with so many creative ideas. How are you going to come up with new ones?”

That’s why McCarthy likes to expose his staff to nonbanking companies’ way of doing things. He applies the same philosophy while attending business conferences. For example, McCarthy actually seeks out those sessions presented by nonbanking speakers The Financial Brand Forum, a conference he has attended for the past five years straight.

One of the most common non-financial sources of marketing talent may be surprising at first: the healthcare industry.

Weber Marketing Group’s Schultz believes the connection is almost a natural, especially for credit unions. Healthcare marketers strive to appeal to patients — selling services that often coincide with major life events — and financial marketers need to sell their brand to people who will face major personal economic events.

How to Uncuff Budgetary Restraints

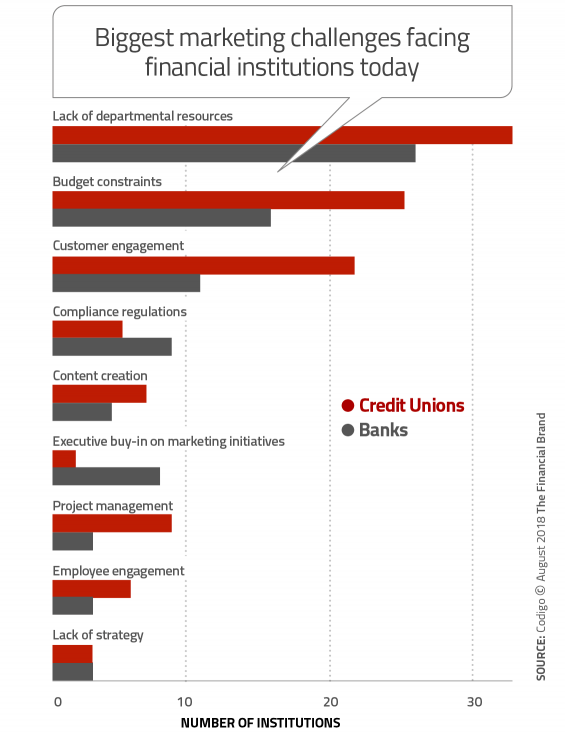

The top two challenges found through Codigo’s survey are intertwined: lack of departmental resources, and budget constraints.

“You can always argue that there’s a need for more resources,” says Codigo’s Nutt. In some ways, many of the other challenges relate to those first two, because the task of Marketing continues to broaden.

For example, Home Bank’s Natalie Lemoine notes how much brand marketing has grown for her institution, versus promotion of specific products and services. Presently Home Bank is at roughly 60% brand, 40% promotion.

A key difference between credit unions and banks, says Pen Air’s Pam Hatt, is the cooperative nature of the first and the stock ownership nature of the latter. Hatt says that she receives 1% of Pen Air’s asset size as her annual budget. In addition, she can make special requests for other matters that come up. The lack of stockholder pressure, and more emphasis on member service versus annual financial performance, allows Hatt a bit more budgetary muscle.

Marketers interviewed generally indicated their budgets and resources were adequate, but they allowed that they have sometimes heard complaints about marketing budgets from other financial marketers that they meet at industry peer groups and other events.

Hatt says that she often hears complaints about budgets from younger credit union marketing chiefs. As an experienced head, she says, her advice to them is: Sell it!

Instead of complaining, make a compelling case to management that the marketing department’s efforts are providing value.

“I don’t think marketers give management a clear idea of how they tie into their organizations’ strategic plans and goals,” says Randy Schultz. “If you have a good track record, you’ll get the resources to meet those goals. If you don’t show it, the first thing management will do is cut your budget.”

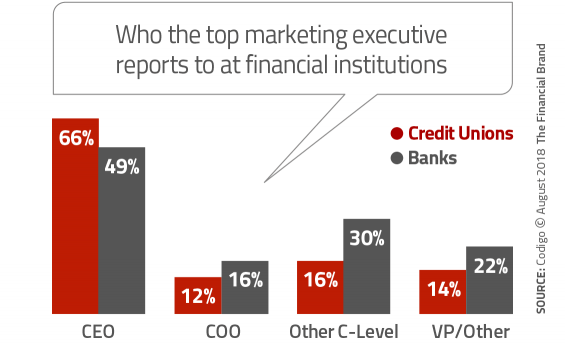

How marketing gets treated hinges as well on management’s perception of the department. First Bank Financial Centre’s Jeff McCarthy says he’s glad his CEO backs up Marketing. For example, he says, “I work for a CEO who see the value of social media. I talk to a lot of other marketing professionals and they say their CEOs and their IT teams won’t let them go on social.”

Making the ROI case to senior management is critical. This is easier, Lemoine points out, where you can establish a clear relationship between marketing expenditures and results. That’s easier with promotional spending than with branding, she acknowledges.

Schultz says sometimes the best solution is to develop some backbone and counter proposed cuts with pointed questions.

“Your response to them must be, ‘What goals do you not want me to reach, so I can cut my budget as you say?’,” says Schultz. “That will get the message across.”