Mobile technology has become more important than ever for financial institutions that are focused on digital banking transformation. Due to the significant shift from in-person to digital banking engagement, banks and credit unions need to arm their employees with access to the mobile tools that can increase everyday speed, efficiency, and convenience of daily activities and improve customer engagement.

To a degree, corporate mobility has mirrored the increased usage of mobile devices like smartphones and tablets by consumers, especially after the onset of the pandemic. With a focus on improving remote work-related activities, more banks and credit unions are embracing the BYOD (Bring Your Own Device) concept to mobilize their teams.

Future of Mobile Work:

A mobile workforce includes employees not bound to a physical location as well as office employees made more productive with mobile devices.

Beyond simply embracing use of mobile devices by employees, financial institutions are increasingly building new digital applications and tools for employees to use. New research has found that this commitment to mobile can improve both the customer as well as the employee experience.

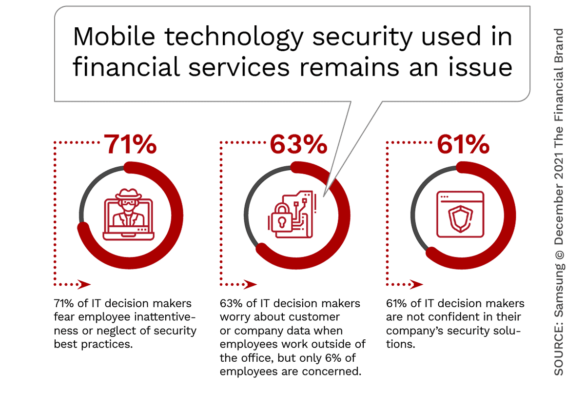

Despite these advantages, financial institutions must also understand the risks and challenges associated with mobile technology in the workplace. With cybersecurity threats increasing exponentially, banks and credit unions must continually improve internal security while educating employees on the risks associated with remote work and mobile device usage.

To better understand the benefits and risks associated with mobile technology, Samsung conducted an online survey of professionals from financial services and banking organizations across the U.S. The 2021 Future of Mobility: Finance and Banking Report provides guidance for organizations that want to expand digital banking transformation out of the back office and into the field.

Read More: Are Banking’s C-Suite Executives Prepared For The Digital Future?

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Benefits of Arming Employees with Mobile Tech

There are many benefits of providing mobile devices to employees across an organization. Some of the benefits are obvious, such productivity, employee engagement, and reduced costs, while some are more subtle, like the opportunity for improved process flow, talent recruitment and revenue enhancement.

Workplace Flexibility. The main benefit of using mobile technology is that it provides network access to employees that may not be at a company facility. With many employees still in either a hybrid or full at-home workplace scenario, mobile technology is essential. Mobile tools enable employees to stay always connected, increasing worker availability and generation of work.

This supports the desire for flexible working hours at a time when many employees are balancing work and home responsibilities. Providing a better work/life balance can translate into higher levels of productivity and fewer sick days.

Finally, employees can also leverage mobile devices for presentations in the office or on the road, accessing available data and resources without being tied down to a single location. This is especially helpful in small business banking, corporate banking, and wealth management customer interactions.

Reduced Overhead. When the pandemic hit, most workers were forced to work remotely. This provided financial institutions a better understanding of the requirement of brick-and-mortar facilities, from branches, to call centers, to headquarter buildings. By rethinking the importance of physical facilities, banks and credit unions can reduce overhead across the organization.

Improved Process Flow. A key component of digital banking transformation is the ability to rethink front- and back-office processes that can improve speed and simplicity of legacy operations. For instance, instead of rebuilding new account opening and loan application processes on legacy branch systems, many organizations have rethought these processes using in-branch mobile technology at the same time as rebuilding consumer mobile engagement processes. This improves in-branch customer and employee experiences while supporting overarching digital banking transformation.

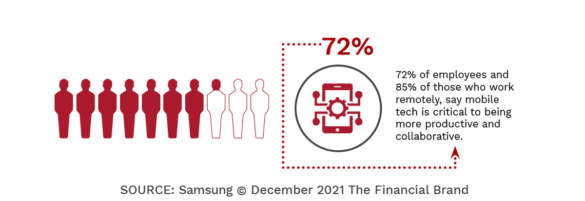

Additionally, 72% of employees and 85% of remote workers say mobile tech is critical to productivity, according to the research. This brings benefits to both the organization and the customer.

Enhanced Customer Experiences. As a result of the pandemic, consumers are increasingly looking for organizations and employees that are fluent in the latest digital technologies. More than ever, we need to provide employees access to the digital tools and instant insight that can help exceed customer expectation.

From the ability to engage in a video call, to being able access customer data at any time and place desired, mobile devices are central to customer engagement. In fact, according to the Samsung research, 78% of financial institution employees say inferior technology has hurt customer relationships.

Weapon in Fight for Talent. With the elimination of location as a constraint to hiring, financial institutions can focus on the talent needed … wherever they are located or desire to work. In fact, the research found that half of employees are unsatisfied with their companies’ mobile tech and 69% of employees would switch jobs for technology that would help them perform their jobs better. It was also found that 92% of financial IT professionals believed that advanced mobile technology helps in recruiting.

Access to an at-home workforce also allows financial institutions the ability to add and reduce staff quickly as needed, responding to changing demands for talent. At a time when more and more industries are experiencing the impact of The Great Resignation, investing in the right mobile technology will become more important to recruitment and retention efforts, while also improving collaboration, connection, and productivity.

Challenges to Mobile Workforce Transformation

While there are significant benefits to empowering a mobile workforce, there are also challenges to transforming a mobile workforce into secure, collaborative, and productive teams – especially as banks and credit unions open access to customer information and business applications.

According to Trend Micro, attacks on finance companies increased by a shocking 1,318% in the first half of 2021. As a result, IT leaders see cybersecurity threats/regulations as having the greatest impact on their organization’s digital transformation.

As employees either use their own devices or devices provided by their financial institution, safeguards must be put in place and education offered to employees that can prevent cyberattacks or other security breaches that can instantly impact financial results and brand trust.

With a younger workforce that already embraces mobile technology there will be added challenges if employees have non-essential applications on their devices that could create additional security vulnerabilities.

Focus on Mobile Security:

Financial institutions need to support an effective mobile workforce while putting security safeguards in place that will protect customer information and protect trust in the organization’s brand.

According to IBM, “Employees can be monitored to guard against safety hazards such as fall detection, location tracking, hazard zones, insurance and regulatory compliance.” This is only the start, however. There also needs to be a closing of the security perception gap of a mobile workforce.

According to the Samsung research, 63% of financial institution IT executives worry about company and customer data security due to remote work, yet only 6% of employees are concerned. In addition, 75% of IT executives at banks and credit unions worry about lost or misplaced devices, yet only 17% of employees are concerned.

Unfortunately, it is not enough for financial institutions to simply invest in security solutions – there is a need to provide comprehensive training to all employees on the potential risks and ways to identify vulnerabilities when using mobile devices.

While it may seem like common sense, employees must learn to take mobile security threats seriously. Financial institutions should make security part of the internal culture, making protection of data and assets everyone’s responsibility, not just the IT department.

The Samsung research found that 70% of IT executives worry there’s not enough security training, versus only 24% of employees. This gap must be closed. Employees must understand that company-owned devices can be compromised just like personal devices – even when they’re being used in the workplace.

Supporting a Mobile Workplace Infrastructure

Building mobile workforce functionality goes beyond simply distributing mobile devices to employees or allowing a BYOD capability. Empowering a mobile workforce requires the development of custom apps that can open the door for the benefits described while helping to close the door on security challenges.

As with almost all digital banking transformation initiatives, the support of mobile workforce platforms can be both costly and complex. The good news is that there are multiple third-party providers that can help in this process that can also assist with the integration of multiple platforms within a bank or credit union. IT decision makers in finance who were surveyed by Samsung agree. 79% say having a partner that provides strategic counsel is critical to their success.

Also good news is that there is agreement between IT executives and the employees of financial institutions. “86% of employees and 93% of IT managers agree that their organizations need to improve infrastructure over the next five years,” states the Samsung report.

Digital Transformation Includes a Mobile Workforce

The accelerated pace of change has required banking leaders to adapt workplace culture, support more agile communication internally and with customers, expand access to new digital tools and applications, while not compromising an organization’s security.

Simplicity for employees, IT staff and customers will be the key to success. Enabling increased productivity by providing new mobile resources has become a priority as work-from-everywhere is the new normal.

“The finance sector is at a crossroads right now. Many of the critical challenges illuminated by the pandemic are especially heightened for this industry,” states John Curtis, Vice President & General Manager of Samsung Mobile B2B at Samsung Electronics America. “Leaders in the space are under growing pressure to advance their company’s digital transformation and create a new value proposition. It’s no easy task, but there is a unique opportunity to define the future of the industry through strategic investments in mobile tech.”