During the COVID-19 crisis, consumers became reliant on one-click ordering from Amazon, the ease of connecting with friends and co-workers on Zoom and the simplicity of watching personalized entertainment on Netflix. When the world became increasingly complex, the power of simplicity became a brand differentiator.

This in not a new phenomenon. Over the past decade, consumers have been overwhelmingly drawn to Google for search, Uber and Lyft for shared rides and Spotify for music. In financial services, some of the winners include Rocket Mortgage, PayPal, Ally Bank, Acorns, American Express and Apple Pay.

What the COVID-19 crisis did was make consumers increasingly aware of the digital solution providers that were empathetic to their need for simplicity and transparency. No longer will financial services firms be compared to other banks and credit unions. Instead, they will be compared to those companies that have removed friction and made life easier.

“It’s important to realize that customers aren’t measuring your experience against your competitors,” states Roger Dooley, author of the new book Friction: The Untapped Force That Can Be Your Most Powerful Advantage. “Rather, they are comparing your customer experience to what they find at Amazon, Uber, and other low-friction pioneers. If your website doesn’t work as well as Amazon’s, or if your app isn’t as easy as Uber’s, your customers won’t be happy.”

How easy is it for your customers or members to do business with you? How many steps or clicks are required to experience what the customer or member wants? Have you helped ‘carry the load’ to complete whatever the consumer wants?

Read More: How Banks & Credit Unions Can Fortify Stressed-Out Customer Support

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

The Value of Simplicity

According to brand consultancy Siegel+Gale, a stock portfolio comprised of the publicly traded simplest brands outperformed the major indexes by 679% between 2009 and 2019. In addition, consumers were willing to pay an average of 55% more for simpler experiences and were 64% more likely to recommend a brand if the experience was easier.

Bottom line, the world’s simplest brands were the ones that put clarity and ease at the heart of the customer experience. These brands don’t just simplify the sign-up process, but all stages of the customer journey, including onboarding, relationship expansion and loyalty. In other words, the value of removing friction is delivered throughout the customer lifecycle.

The holistic view of simplicity is important since it is well known that it costs a company five times more to acquire a new customer than it does to keep an existing one. Despite this, only 18% of companies focus on retention over the acquisition of customers.

Siegel+Gale also found a link between simplicity and trust. Complex is seen as deliberate, not by accident. A complicated experience in opening an account or applying for a loan is not seen as done for the consumer’s benefit, but rather as a way for the organization to ‘win’ if something goes wrong.

Read More: When Opening Accounts in Branches Becomes Impossible

Simplicity Requires More Than Being Digital

The importance of being able to deliver digital solutions was highlighted with the COVID-19 crisis. With stay-at-home orders, consumers were no longer able to visit retail establishments, were discouraged from visiting groceries, had limited options for home delivery of meals and couldn’t visit a bank branch. Many banks scurried to deliver end-to-end digital solutions.

But that wasn’t enough.

Converting a long, involved paper-based process to a long, involved digital process does not meet the consumer’s need for simplicity. Steps in the traditional process must be eliminated for the consumer to be satisfied. They want an experience that approximates Amazon’s one-click purchasing.

For instance:

- Do you require the consumer to complete an entire form even if they already have an account with you?

- Can consumers use mobile data pre-fill using a photo of an official ID?

- For extensive applications (such as mortgages), do you keep consumers proactively aware of each stage of the approval process?

Can Traditional Banks Replicate Fintech Firms?

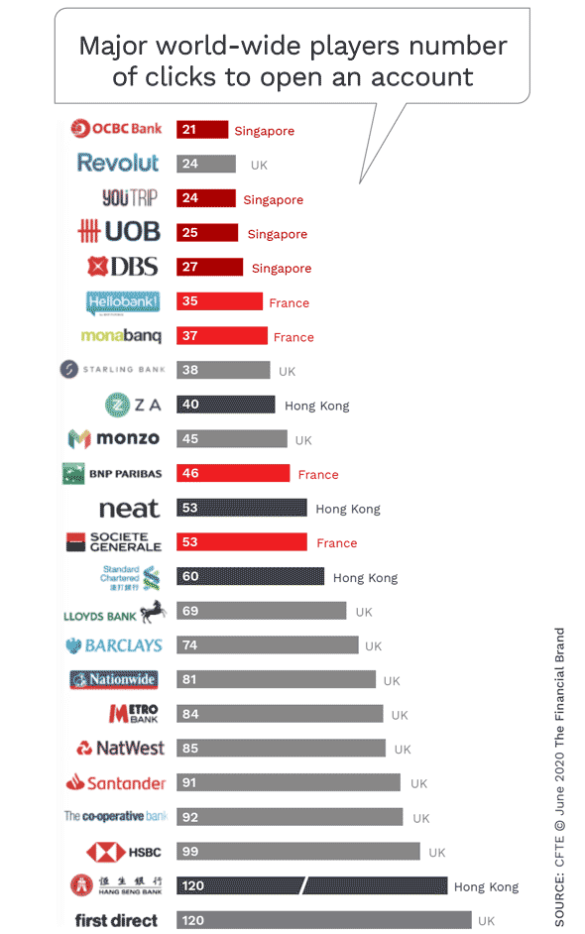

Recently, an analysis was completed by the research firm Built for Mars, determining the number of clicks it took to open an account at traditional banks and fintech firms in the UK. In many ways, this could approximate the amount of time and effort needed to finish the most important step of a new relationship … opening an account.

Since the initial report was published, an expanded analysis of financial services competitors was created by CFTE to further investigate the difference between traditional banks and fintech firms.

Two major findings can be gleaned from this analysis. First, the number of clicks needed to open an account at the top banks and fintech firms was exceedingly minimal. Secondly, while fintech firms are well represented, several traditional banks (mostly from Singapore) did quite well. It should not be surprising that these organization have long been recognized as digital banking leaders.

So, the answer to the question as to whether traditional banks can replicate (or do better than) fintech firms is “yes”. The real question may need to revolve around whether the majority of traditional banks can move beyond legacy back office processes to build a seamless, friction-free digital experience.

How many clicks does it take to open a new account, or apply for a consumer loan, or sign up for bill pay, or transfer funds at your organization?

Simplicity Beyond Clicks

All financial institutions need to remember that while clicks are a good way to start measuring the simplicity of a customer experience, digital transformation requires more. For instance:

- Seamless Multichannel Experience. Consumers expect to have the ability to use the channel they want at any time during the consumer journey seamlessly. A solid digital experience strategy focuses on optimizing for engagement across web, voice, and non-traditional digital.

- Mobile-First Design. Because a large majority of consumers engage with your site, your site should be optimized across all digital devices. Especially mobile.

- Immediate Customer Support. 90% of consumers rate an immediate response as important or very important when they have a customer service question.

- Personalization. Does each stage of your process leverage data, machine learning and AI to deliver a highly personalized experience?

- Clarity and Transparency. Most consumers view clarity of communication and simplicity of disclosures as part of the simplicity equation.

Friction, however it is defined, hinders your ability to build engagement with your customers or establish a relationship with your prospects. If the very first interaction with your bank or credit union is harder than the consumer wants it to be, they will abandon your site. By the time you follow-up on abandoned sales opportunities, they will have already established a relationship with your competitor.

Spend time to evaluate where your friction points exist. Eliminate or simplify every step of the process from the inside out, starting with each internal stakeholder. Without changing the way you process an account, you can’t adequately simplify a process.

Friction must be eliminated to serve the post COVID-19 customer.