The more things changed in 2021, the more things seemed to stay the same. Whenever the banking industry thought it would see the end of the impact of the pandemic that began in 2020, a new variant of Covid sent the industry’s collective mindset backwards. Despite these setbacks, banks and credit unions continued to transform the way they delivered services and sought to improve efficiency and customer experiences. The single constant was that change continued unabated and with increased speed.

As we proceeded through 2021, the most successful retail banks exhibited leadership that was not going to depend on successes of the past to drive their business models for the future. The gap in success between the organizations that embraced digital transformation and those that were laggards was evident in the way new customers were acquired and onboarded, the deployment of back-office automation, improvement in customer experience, and commitment to innovation. The urgency of digital transformation increased as consumers continued to test alternative banking options.

Digital banking leaders realized the importance of data, real-time analytics, deployment of insights and restructuring delivery networks to favor digital over physical. For fintech firms, venture capital investment values skyrocketed, with many fintech organizations looking to partner with traditional financial institutions that needed to jump-start product innovation initiatives.

Below we reflect on some of the most popular trends from 2021 with keys to success for 2022.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Success Story — Driving Efficiency and Increasing Member Value

Discover how State Employees Credit Union maximized process efficiency, increased loan volumes, and enhanced member value by moving its indirect lending operations in-house with Origence.

Read More about Success Story — Driving Efficiency and Increasing Member Value

1. Digital Customer Value Requires Onboarding Success

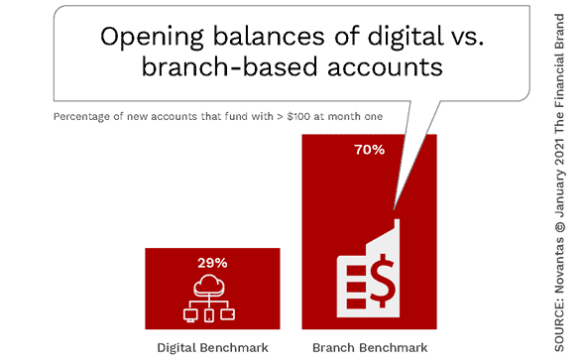

Curinos research found the long-term value of a digital customer relationship hinged on the success of post-opening onboarding more than for branch-originated accounts. For brand new accounts, Novantas found that only 30% of digital accounts were funded with more than $100, compared to 70% of branch-originated accounts. After four months, the new-to-bank balances originated in branches were up to ten times higher than those accounts originated digitally at some organizations.

This value gap was not because less valuable customers were opening digital accounts. Instead, the gap in value was caused by the lack of digital onboarding that could replicate the in-person cross-selling done in the branch at account opening. Bottom line, without an aggressive multi-channel onboarding process, the value of new digital accounts opened were less likely to reach value potential.

2022 Action Item: Banks and credit unions need to completely revamp onboarding processes that lack depth of communication, personalized recommendations, timely engagement, and multichannel integration. A solution is to re-engage existing branch personnel to assist in the digital onboarding process, armed with insights that can empower teams to provide valuable contextual recommendations.

2. The Future of Customer Engagement Became More Personalized

Consumers increasingly connected with their bank or credit union across channels in 2021, interacting with many touch points before opening an account, expanding a relationship, or even doing a simple transaction. The most successful organizations had a holistic data and technology strategy that could individualize at scale, with customer journey capabilities that could adapt in real-time, and intelligent decisioning to automate the self–reinforcing cycle of tailored experiences.

The real payoff occurred when data was leveraged to deploy highly personalized content at scale … in real-time. Without great content that could reflect the components of personalization possible, banks and credit unions were not able to obtain the levels of engagement desired.

Shift in Data Purpose:

Financial institutions must move from using data and analytics for great internal reports to using data, analytics and content for exceptional experiences.

Consumers expect content and offers that appeal to them personally, based on both their past interactions as well as anticipated future actions. They no longer want their financial institution to tell them what has already occurred … they want a “GPS of financial services” that will communicate shortcuts to financial wellness and warnings about pitfalls to avoid.

2022 Action Item: Financial institutions must merge offline and online data sources. Until this is done, the ability to adjust channel strategies during the customer journey is virtually impossible. If your customer profile includes hybrid customer channel information, the potential for personalization of both content and channel will be optimized.

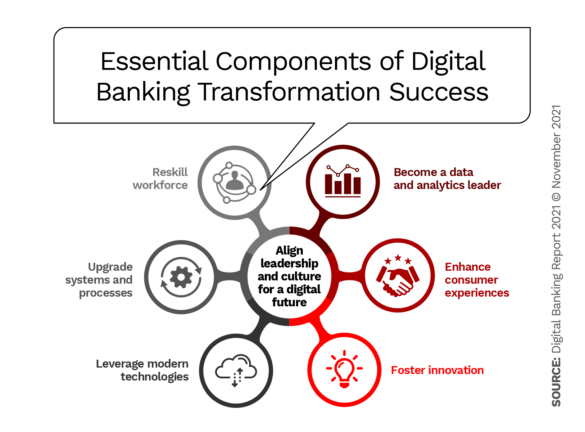

3. Digital Banking Transformation Never Stopped

In 2021, financial institutions began to realize that digital banking transformation is a journey as opposed to a destination. Banks and credit unions also realized that there are benefits to breaking down digital transformation into different components and assessing the maturity of an organization within these components.

Organizations realized that the maturity level in any area differed based on business objectives, investments made, and marketplace dynamics. For instance, while a financial institution may have been a leader in leveraging data and advanced analytics, they may still have had an outdated core system or lacked an innovation spirit within the organization.

The Digital Banking Report found that there was a direct link between greater digital banking maturity and superior financial performance. The research also found a correlation between digital transformation maturity, innovation maturity and data maturity within financial institutions. In other words, when the leadership and culture of an organization illustrated commitment to digital maturity, all components of digital transformation improved.

2022 Action Item: In the report, Using Data to Drive Improved Customer Experiences, it is clear that investments in digital banking transformation must continue to increase. The benefit of a strong digital banking transformation process can become self-funding, reducing costs through efficiency and paying off in improved experiences driven by innovation, personalization, employee satisfaction and growth.

4. Banking-as-a-Service (BaaS) Platforms Went Mainstream

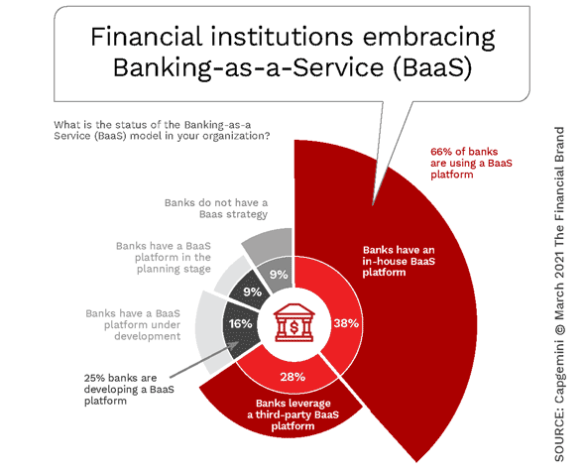

The expansion of the Banking-as-a-Service model across the entire financial services industry in 2021 facilitated value creation as well as value exchange between both financial and non-financial entities, with the consumer being the primary beneficiary. BaaS platforms increasingly democratized the offering and delivery of products and services, accelerated the innovation process, and allowed for faster iterations as consumer behavior changed.

The World Retail Banking Report found that two-thirds of financial institutions were using a BaaS platform, with 25% stating that a BaaS platform is in the planning or development stage. This greatly increased the number of incumbent financial institutions that were collaborating with fintech, big tech and other non-banking entities to increase scale, expand distribution options, create new products/services, reduce costs, diversify revenue streams and gather greater consumer insights.

2022 Action Item: Banks and credit unions must take steps to increase engagement by the customer beyond checking daily balances. This requires that financial institutions move more toward “embedded finance” that is part of a consumer’s everyday life. Combining financial services with social media, retail, transportation, hospitality, investment and advisory services increases the potential to provide incremental value to retail consumer segments or even on an individualized basis.

5. Technology Modernization and Scale Was Not Enough

Investment in new technology, by itself, did not change the underlying challenge at most financial institutions in 2021. The Digital Banking Report did significant research on post-pandemic banking trends, and found that the biggest challenge for most financial institutions was not legacy technology, but legacy leadership.

Similarly, in a competitive environment that favored organizations that could invest more in digital transformation, many organizations looked to increase market share and decrease costs through mergers. In the end, the leadership of any sized financial organization that had not embraced all of the elements requisite of a digital organization would not succeed long-term.

Leadership Level Set:

Leaders need to have the confidence to lay out a hypothesis [for the future] with the humility to expect that some of the predictions will be wrong.

2022 Action Item: There will be an increased contraction in the number of banks in existence in 2022 and beyond due to the costs of doing business, and the changed behaviors that accelerated as a result of the pandemic. The biggest need will be leadership, vision and culture that embraces change, is willing to take risks, and is ready to transform their organizations into something entirely different than they have been since their formation.

Read More: Do Bank Management Training Programs Create ‘Leaders of Yesterday’?

6. Movement to the Cloud Picked Up Steam

According to IBM, the majority of financial services organizations had yet to deploy core systems to the cloud in 2021. The reasons include the perceived amount of complexity and concerns over security, risk, governance and control. In fact, while 91% of financial institutions were actively using cloud services already or plan to in 2022, only 9% of mission-critical regulated banking workloads had shifted to a public cloud environment. In other words, while banks and credit unions of all sizes recognize the need to transition to the cloud, a majority hadn’t started this process.

Key Insight:

Traditional banking systems are outdated and inflexible, making it costly to deploy new solutions or protect against advanced security risks.

To address the need for capacity and speed, banks and credit unions increasingly looked to cloud computing solutions to store data and support applied analytics. The result has been increased customer insights, improved efficiency, enhanced innovation, greater agility, and a reduced risk of security or business continuity breaches. Cloud solutions are also augmenting human productivity, providing insights that can positively impact both front-office and back-office transformation.

2022 Action Item: While there have been reservations in the past around cloud security and regulation, cloud computing solutions will become prevalent in the marketplace for both traditional and non-traditional financial institutions in 2022. Organizations of all sizes must move to the cloud to remain competitive.

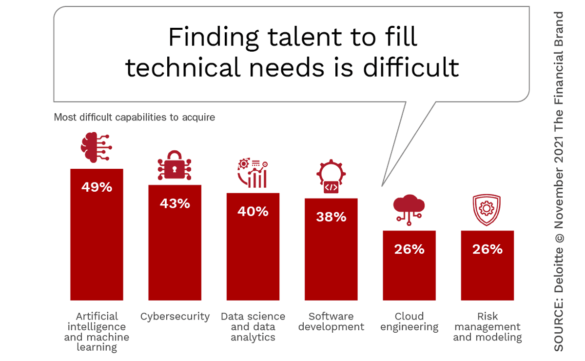

7. Future of Work Included Re-training, Re-skilling and New Hiring

The shift to digital engagement accelerated in 2021 and the expectations around speed, simplicity and empathy replaced physical convenience as a key differentiator. This shift disrupted back-office processes, increased the need for real-time data and applied analytics, and put pressure on leaders and employees ill prepared for this pivot.

The emergence of new jobs created explicitly to support a financial institution’s digital transformation is occurring. In addition to new jobs, many existing jobs have been radically modified as institutions begin to introduce new technology. While some hiring was required to support digital banking transformation, there needed to be a prioritization of employee retention and retraining as well.

2022 Action Item: To be prepared, financial institutions must assess the skills needed in the critical roles of the organization not only for 2022, but looking ahead for the next three to five years. Embracing the change that will be occurring will be the responsibility of every individual, at all levels. In fact, going forward, lifelong learning will become a priority. While the commitment to learning will be a personal responsibility, each bank and credit union must step up to make it possible … at a speed previously thought to be impossible.

Read More: 14 Surprising Predictions on the Future of Banking

8. Outsourced Solutions Provided Gateway to Innovation

In 2021, many financial institutions kept pace with change by collaborating with fintech providers and third-party developers. This provided the benefit of tested solutions and implementation speed that would not be possible if an in-house solution was pursued. This strategy was also used by fintech firms who wanted to expand their product offerings beyond a single solution or wanted to utilize established back-office technology from legacy banking organizations.

Research by the Digital Banking Report found that banks and credit unions looked outside their walls for talent by contracting with both existing (50%) and new (43%) providers to get the skills needed.

“A robust ecosystem of [fintech] partnerships helps banks and credit unions experiment, learn, and, ultimately, import capabilities that are necessary to adapt to acute and chronic disruption,” states MIT Sloan research. “Ecosystems enable organizations to operate more flexibly, providing access to more collaborators and a greater range of potential innovations, thereby increasing the volume, quality, and risk tolerance of experimentation and learning.”

2022 Action Item: When hoping to build an improved process, add a new solution, or completely change existing business models, working with organizations that have already built a viable solution for other institutions should be considered. It allows for focus to be moved to other initiatives that may need greater internal resources, while allowing for solutions built at scale and with speed.

9. ‘Hidden Attrition’ Undermined Customer Loyalty

Fintech firms, big tech companies and the largest financial institutions attacked established customers at traditional banks and credit unions with digital offerings that were both personalized and easy to open more than ever in 2021. Because new accounts can be opened digitally – in an instant – without closing an existing account, traditional banks and credit unions often don’t even know relationships are being undermined.

Hidden Attrition:

Most customers don’t close accounts when they move relationships. Instead, they divert their loyalty to alternative providers that offer more value.

Making matters worse for traditional banks and credit unions, several fintech firms are expanding beyond offering only checking accounts, including payment services, lending, and small business accounts. According to Bain & Company, ‘Most defection in banking consists of people obtaining credit cards, loans, or other products elsewhere, but not closing their original account altogether. Maintaining a healthy base of primary customers may disguise the dire reality of declining share of wallet.”

2022 Action Item: Sophisticated capabilities such as the application of predictive analytics to manage churn must be integrated with other marketing initiatives to stem the flow of customers using alternative providers. Focusing on the improvement of consumer experience will also result in more engagement, increased expansion of relationships and less churn.