The majority of banks and credit unions across the country are seeking to stem attrition and maintain customer satisfaction by providing consistent, integrated services across all channels and encouraging customers to self-select channels according to personal preference (the concept of omnichannel banking). The result is an environment where consumers have little incentive to choose one channel over another and where banks are faced with increasing complexity and costs. In fact, nearly two-thirds of executives interviewed by CEB TowerGroup agreed that delivering a functionally consistent customer experience across all channels was a priority.

With over 60 percent of multichannel experience customers reporting that both web and branch service offerings were consistent, it seems early efforts are paying off. However, this accomplishment has come at a price: trying to develop an ‘omnichannel’ experience is causing customer preferences to converge and overall transactions to increase, further increasing the complexity of channel maintenance, resulting in higher costs and amplified risks without the customer experience benefits desired.

Growing revenue, reducing costs, and improving customer loyalty demands that retail bank executives consider a more strategic and nuanced approach to multichannel development according to recent research from CEB TowerGroup, entitled “Rethinking Multichannel Strategy: Improve the Customer Experience Through Channel Differentiation and Proactive Guidance‘. The research recommends three steps that bank and credit union executives should take to improve their multichannel strategy:

- Differentiate channel functionality

- Proactively guide consumer’s choice of channels

- Formalize the process of evaluating channel performance

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

The Omnichannel Dilemma

Consumer interest in online and mobile banking has gone unabated for several years now, with digital channel use increasing significantly. As consumers manage their finances in the context of new technology such as smartphones and tablets in conjunction with online banking, branch and ATMs expectations have also increased, requiring banks to provide custom applications and improved service through all channels.

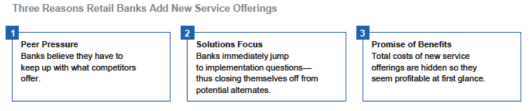

Unfortunately, the increased volume of digital transactions has not resulted in comparable reductions in use of traditional channels or the promised cost savings. Instead, banks and credit unions are adding layers of complexity and costs while trying to maintain a high level of customer service.

Interestingly, according to the research from CEB TowerGroup, while the transaction volumes continue to increase for digital channels, consumers still say they prefer a human touch to their banking which could lead to an even distribution of channel use, making it difficult to please everyone. In addition, as financial organizations monitor customer preferences, consumers tend to ‘want it all’ since there is little financial incentive to differentiate what they ‘want’ from they ‘need’.

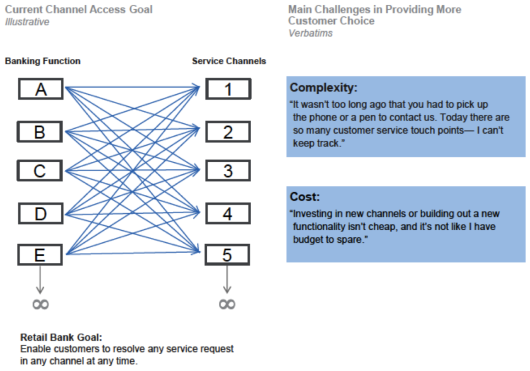

Providing more choice and total functionality across channels increases both cost and complexity as shown below.

Despite functionally consistent offerings across channels, the CEB TowerGroup research also found that technology-focused customers gave lower marks for communication and service, indicating possible confusion on the part of the customer due to this underlying complexity.

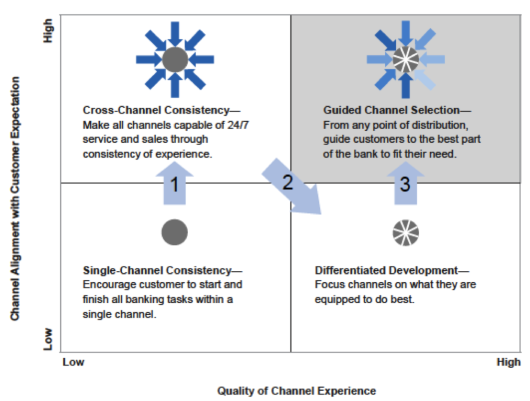

Differentiating Channel Functionality

Instead of trying to make all channels consistent in their capabilities and functionality, CEB TowerGroup recommends building a differentiated functionality for each channel that is consistent with the customer experience strength of the channel. This is required as an interim step towards a process that helps guide the consumer to the best channel for any interaction with the institution as shown below.

Differentiating the channels requires assessing the customer’s channel preferences and aligning these preferences against the best capabilities of a channel, the incremental costs to deliver, usage patterns and the potential for a positive customer experience.

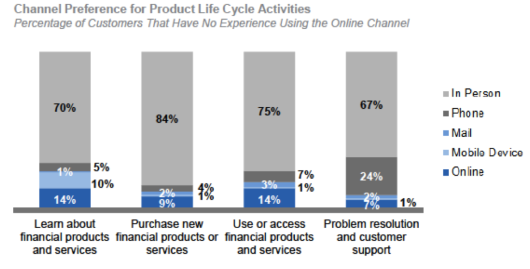

Contrary to what many bankers may think, customers don’t demand a wide range of choice of channel according to the research. Rather, customers are often confused by the increased choice and prefer whichever channel requires the least amount of effort. In other words, customers who demand the ability to do any banking function in the channel of their choice are in the minority.

According to Nicole Surgill, research director of retail banking at CEB TowerGroup, “You have to define what the customer cares about and realize that isn’t the same as what we care about. ‘I want to deposit a check when I want’ or ‘I want to get a loan for a house when I want’ or ‘what is the easiest and most understandable way for me to do that?'”

Implementing a new, simpler process for the customer doesn’t always equate to cost savings for the bank. But we still need to make this experience better or the process better. The challenge is defining what makes the customer experience better and then tying it to reducing attrition and increasing the customer’s willingness to buy more.

Internal capabilities and development costs of different channels are invisible to the customer, so banks and credit unions should determine best-fit channel functionality for each customer need. By simplifying service offerings and tailoring each channel to serve specific customer needs, organizations can limit and specialize channel functionality, reducing costs and complexity and improving the overall customer experience.

We also need consistency in the channels where customers are most likely to CROSS channels.

“Opening a new account or seeking advice on a product or service or trying to resolve a problem – that’s where a customer may start in one channel and finish in another. We need to focus on where customers will cross channels and simplify the transition from those channels, instead of focusing on doing it all in every channel.” – Nicole Sturgill, CEB TowerGroup

Proactively Guiding Choice of Channels

As stated above, customers don’t demand choice of channel. Rather than encouraging customers to select the channel of their choice, the CEB TowerGroup research recommends that retail banks should proactively guide customers to the channel(s) that will enable them to accomplish each task with minimum effort. Done well, the process will guide the customer to the lowest effort channel while still satisfying the customer’s desire for choice.

However, there are two main obstacles to effective guidance – the first is a lack of experience with non-branch channels. This prevents many customers from choosing the best-fit channel for their needs. Secondly, when customers have chosen a channel, they are reluctant to switch even if another channel promises easier resolution. In other words, old habits may be hard to break.

In order to overcome these obstacles, banks should identify common service triggers and step in at these points to preemptively guide customers to the best-fit channel. The goal is to provide a better path for the customer to follow and to avoid customer disengagement as they are served through different, more effective and efficient channels.

One of the most effective ways to preempt channel use that is not best for the customer (or the bank) is through either an immediate event-based email or an SMS message that provides links to the appropriate channel. During this communication, FAQs are very effective at proactively answering the potential questions a customer may have.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Evaluate Channel Performance

Following the first two steps of channel differentiation and customer guidance, banks and credit unions should create a formalized process to evaluate the results. To motivate channel migration, institutions could employ branch interactions to drive selection of online channels, proactively guiding the customer to the best fit channel. An exit survey would then be a good assessment of customer satisfaction with new channel experiences.

The purpose of this measurement process is to continually reassess and improve channel functionality that will lead to reduced costs and duplication of efforts as well as a better customer experience. This will also reduce process abandonment which is one of the ‘silent killers’ of new account opening, cross-sell, increased engagement and retention.

Overall, the goal is to create a multichannel experience that optimizes both the efficiency and effectiveness of each individual channel or group of channels for any specific purpose as opposed to trying to be all things to all people. This reduces redundancy and improves the ability for each bank and credit union to provide the level of service desired by the customer at any touchpoint.

A discussion with Nicole Sturgill, Research Director, Retail Banking at CEB TowerGroup on improving the customer experience in a multichannel banking environment.