As part of the ‘Innovation in Retail Banking Study’ published by Efma and Infosys, it was clear that channel innovation remains the primary focus of banks globally, with 89 percent of banks surveyed saying they were increasing their investment in this category. This was also where financial institutions believed their innovation performance was improving.

![Channel_innovations_bankers_believe _deliver_most_value1[1]](https://thefinancialbrand.com/wp-content/uploads/2014/11/Channel_innovations_bankers_believe-_deliver_most_value11-565x393.png)

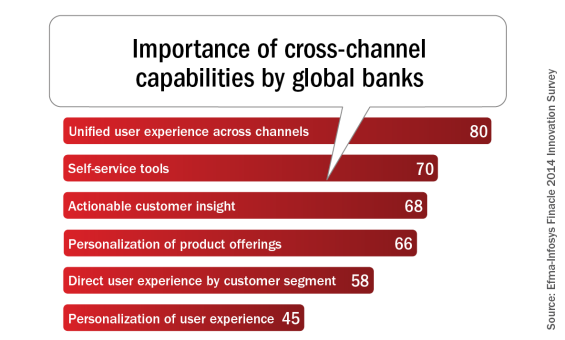

Where organizations differed was which channel(s) should receive the most attention and what the objectives for each channel should be. When asked which cross-channel capabilities would most improve the consumer value proposition, the importance of having a consistent user experience across channels was viewed as the most important, with 80% of the banks rating the importance as ‘high’ or ‘very high,’ according to the study.

“Innovating in one channel without matching that in other channels is unlikely to lead to longer term success,” said the study. ‘Particularly for large banks, cross-channel is a challenge but can have significant benefits.”

It is not surprising that self-service functionality is the second most important cross-channel capability given the trend toward greater use of online and mobile banking by consumers. What shouldn’t be ignored is the trend towards greater self-service functionality in branches as well. Between video tellers, ATMs with increased functionality and even enhanced cash counters in bricks and mortar facilities, teller-less branches are becoming more commonplace.

Finally, the combination of actionable big data insight and more accessible analytical tools is providing banks the opportunity to personalize offers and customer experiences across channels. Once the domain of only the largest banks, organizations of all sizes are increasingly able to leverage CRM skills to improve the cross-channel experience.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Mobile Innovations

The mobile channel is getting the most attention from banks when it comes to innovation. Not hampered by legacy core systems, many mobile-centric financial organizations have been created over the past several years such as Simple, Moven, GoBank, Soon, mBank and Instabank. More recently, the development of mobile-only banks have been announced, such as Atom in the U.K. and BankMobile in the U.S.

This trend in mobile innovation is expected to continue as consumers demand improved ways to leverage technology to access banking accounts. Legacy financial organizations will work to replicate these mobile-centric banks, improving the digital experience through simplification and improved design elements.

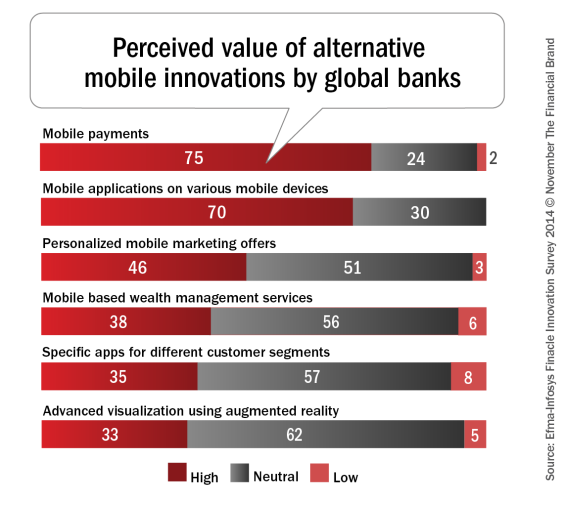

According to the Efma-Infosys study, the primary areas for mobile innovation will be in the categories of payments, multi-device applications and improved personalization of apps and offerings.

Online Innovations

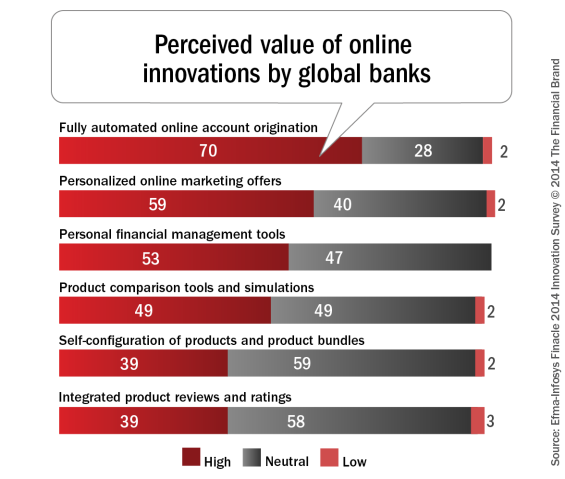

The most important innovations banks are wanting to invest in for the online channel are improved online account origination processes and the ability to deliver personalized offers. These capabilities were followed closely by innovations related to digital money management and interactive comparison tools.

The Efma-Infosys study provided a number of case studies related to innovations in the online channel. One of the most progressive organizations worldwide with their online banking capabilities would be mBank. Introduced in 2012 and launched in 2013, mBank provides a vast variety of innovations including:

- Interactive and functional design

- Google-like transaction search engine

- Redesigned and simplified money transfers

- Social media and text-driven P2P transfers

- Digital money management (PFM)

- Location-based merchant-funded rewards

- Gamification of savings goals

- Real-time offers based on transactional behavior

Branch Innovations

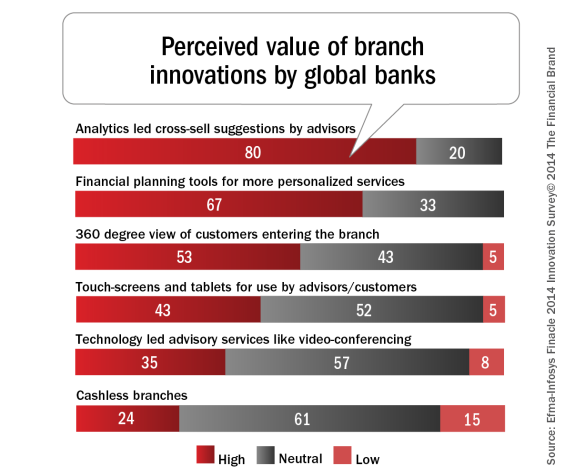

While usually not considered the ‘hotbed’ of innovation, bank branches are being transformed from a human resource intensive delivery channel to a more digitally focused platform. With a smaller footprint and an enhanced sales focus, the ‘branch of the future’ will leverage much of the same big data insights and digital solutions from the online and mobile channels.

At this point, there is no ‘one-size-fits-all’ solution for the perfect branch as banks are testing several different models and technologies. “The innovations which banks identified as the most important were both branch support tools for advisers based in branches – analytics led cross-sell suggestions and financial planning tools,” the Efma-Infosys study said.

Also important was the ability to identify consumers as they entered the branch (possible with a beacon-type device), and digital tools available for customers and advisors in the branch.

Omnichannel Imperative

Banks and credit unions are in an unequalled position to understand consumers. They can see product use, transaction patterns and demographic profiles. By leveraging channel usage insight, they can develop an even more detailed customer profile. Understanding not only what the customer looks like, but also how they conduct their banking can allow for improved product offers using their preferred channel.

The development of strategies to integrate disparate digital and physical channels into a single, seamless experience has to be a priority. By analyzing the activity and preferences of the consumer segments, organizations can tailor offerings to address the priorities of each individual consumer. Mass, low profit segments can be serviced accordingly as can high margin services and clientele.

But organizations can’t stop there. As mentioned by David Gibbard in his blog post, The Flaw in Omni-Channel Banking, Why Bi-Direction Channel Banking is Next,” he accurately points out that omnichannel banking may only be 50% of the solution. A broader view may be needed where consumers and employees have a single user experience (UX) platform so that they can view issues (and solutions) from the same perspective.

Gibbard suggests, “In order to deliver a seamless customer experience credit unions and banks need to deploy technology, re-organization, processes and training that are externally focused while closing the loop so employees and customers are working from the same playbook.”

Streamlined, integrated systems, a single customer view, and an optimal customer experience are all objectives to work towards. Banks and credit unions that focus on these objectives will get the edge over the competition.