According to the 2014 State of Marketing in Retail Banking study, 59.6% of respondents said that onboarding programs will be a more important strategy in the coming year. This should not be a surprise in an environment where financial institutions are faced with the challenge of growing net new relationships, increasing revenues, optimizing marketing spend and improving cross-sell results.

In the bank and credit union marketer toolbox, there is no more effective strategy than a multichannel new customer onboarding process that says ‘thank you’ and assists the customer in maximizing the value of their new account(s). By communicating with the customer early and often after they open their account, you are more likely to foster a positive customer experience, differentiating your institution and building long lasting loyalty.

A successful onboarding program needs to have a strong underlying strategy that leverages customer insight to build a series of personalized messages. The goal is to show the customer you know them, will look out for them and will ultimately reward them for their business.

As powerful as a good onboarding strategy can be, it can also destroy trust if not done correctly. Your mission is to ensure that all communications with the customer build upon each other, are relevant and reinforce the decision the customer made to open a new account at your institution. Here are five of the most important keys to success for any new customer onboarding program.

1. Communicate Early

As the saying goes, ‘You don’t get a second chance to make a good first impression’. This is especially true with an onboarding program, whether the new account opener is new to the bank or simply opening a new account to expand their current relationship.

The objective is to get out of the starting blocks as quickly as possible so the customer realizes you appreciate their business. The good news is that you have several options available for how to say ‘thanks’ immediately.

Smaller institutions may opt for a personalized note; handwritten and sent to the customer the same day they opened the account. Another option is to leverage the customer’s cell phone number, sending a simple text a few minutes after they have left the office to thank the customer for their business (some banks have even included a coupon for a small gift from a local merchant as a ‘surprise and delight’.

Finally, an email can be generated centrally, personalized with the branch manager’s or online CSR’s name within minutes of opening the account. The benefit of an email is both speed and the ability to provide an embedded link to a personalized new customer introduction microsite or even a welcome video (built for mobile consumption).

The objective is to thank the customer as quickly as possible leveraging a personalized message that will mention the customer’s name, the type of account opened and what the customer may expect next. Obviously, the ability to personalize this message is dependent on the amount of insight collected as part of the new account opening process.

Read More: GoBank Makes Great 1st Impression with Fantastic Onboarding Email

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

2. Communicate Often

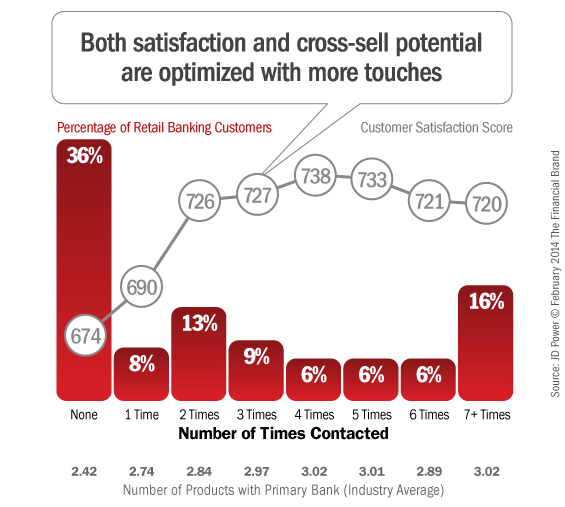

One of the biggest mistakes financial institutions make with an onboarding process is to have only a couple ‘touches’ during the first 60-90 days. According to J.D. Power & Associates, customer satisfaction and cross-sell success both improve as the number of contacts is increased up to 4 times, and is still effective if the customer is communicated with as many as seven times during the first 90 days.

What most banks and credit unions forget is that not every communication intended to be sent to the new customer will be read or even delivered if the message is not pertinent to the individual customer, making the optimal number of messages that should be scheduled even higher than the J.D. Power study suggests.

In my development of onboarding strategies for dozens of financial institutions of all sizes across the country, I have found that the sequence of communications is much like a dating process, starting with a simple ‘thank you’ and proceeding in a non-aggressive manner in stages to encourage a deepening of the relationship. As opposed to moving too fast to cross-selling, the majority of early communication should focus on logical ‘go with’ services, such as direct deposit, bill pay, alert notification selection, online and mobile banking, mobile deposit capture and actual usage of the account. Once trust is established, the relationship can be expanded.

During the sequence of communications, incentives can be provided to encourage engagement. These incentives should be easy to achieve and can even support other programs at the bank such as a points program. It is important to remember, however, that each communication and offer must reflect the individual’s current relationship with your institution. Nothing is more damaging than to offer a product/service the customer already has opened and/or used. The key is to leverage real-time insight to deliver the right message, to the right customer, at the right time.

3. Leverage Multiple Channels

An effective onboarding program does not need to be expensive. This is because many of the ‘touches’ can be done with channels that are not expensive or are even free.

Leveraging multiple channels (1:1, direct mail, email, phone, SMS, online, mobile banking, digital, video, ATM, social) allows you to appeal to a customer’s channel preferences while delivering a highly personalized message that will positively impact results. Many organizations achieve lift in results of 30 percent to 50 percent when combining multiple channels to reinforce a single message.

For instance, a message encouraging the sign-up for online bill payment on the 15th day after an account was opened could be done with email, online banking banner messages, SMS and can be embedded in the mobile banking application. In addition, each of these messages could be linked to a short personalized online video or an interactive educational microsite for increased effectiveness.

It is important to remember that the ability to use multiple channels is contingent upon an effective new account opening process. If mobile phone numbers and email addresses are not collected, these channels can’t be used. If mobile and online banking is not ‘sold’ during the new account process, these are also channels that can’t be used. In other words, the foundation of an effective (and lower cost) onboarding program is established on day 1 whether the account is opened in a branch or online.

Read More: What Banks & Credit Unions Teach Each Other About Cross-Selling

4. Test, Learn and Measure

There is no ‘one size fits all’ onboarding program for every financial institution. Not only do product sets differ, but so do new account opening processes, the ability to leverage different communication channels, the support team in place, etc. Therefore, it is important to test, learn and measure results for maximum effectiveness and ongoing support of the onboarding initiative.

The good news is that I have never had a financial institution stop an onboarding program once they have initiated the process. This is because the return on investment (even in the worst case scenario) is always positive and many times has a return of 5:1,10:1 and even 20:1 or higher. The key is to test messages, timing, offers and channels to optimize your specific program from both the customer and organization’s perspective. While multivariate testing may seem daunting to many, in most cases I have found that ‘thumbs up’/’thumbs-down’ directional insight many times is a better time/value trade-off. In other words, did adding an email or SMS message to a direct mail communication improve the ROI as opposed to needing to measure the exact degree of improvement.

If you build a robust process of testing new combinations of channels, messages and offers, you may also find ways to improve new account opening processes. For instance, I have had several clients who included questions around 1) services held elsewhere, 2) who was the primary person who will be managing the new account in the household and 3) communication channel preferences which helped build more targeted messaging and improved channel utilization (it should be noted that most banks will still use communication channels not indicated as ‘favorites’ but will simply use them less often).

The beauty of measuring the results of an onboarding process is the ability to share the results with product and segment managers who also have bottom line accountability. By sharing successes (and shortfalls) many marketers I have worked with have seen funding of onboarding increase significantly as product or segment marketing dollars are reallocated or increased for this more effective process.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Read More: 4 Tips for Onboarding Banking Consumers

5. Assign an Owner

Since most banks and credit unions do not have a Directors of Cross-Selling or VP of Retention, it is important to assign the onboarding process to a single person who will ‘own’ the development and impact of the onboarding process. This person should be determined before the onboarding process is developed and kept in place to work with segments, product managers and marketing teams to ensure the success of your program.

Just as importantly, a separate overarching budget needs to be established for the onboarding process that is not allocated by product or service. The problem with dividing the onboarding budget into product or service categories is that the objective of the onboarding process is to build a better experience for the customer as opposed to selling products.

If the onboarding process is done well (from the customer’s perspective), there will be time for cross-selling additional services since trust will be established and you will have set your institution apart from others who only care for the new customer on the day they open their account.

Industry research shows that the rate of attrition and inactivity of new account openers at banks and credit unions often exceeds 25-35% during the first year of a relationship. This high attrition rate is often hidden by future new customer acquisitions or combined with other attriters so the impact seems less.

But, with the cost of a lost retail banking customer approaching $500 and being more than $700 for a small business customer (when acquisition costs and lost relationship revenues are taken into account), the cost of not having an effective onboarding program is unacceptable.

If your institution currently has an onboarding program, do you have enough ‘touches’ and are you leveraging all available channels? If you don’t have a program, there is no better time to build a strategy using the foundation provided here and the learnings of others before you.