The “branches aren’t dead” camp has almost made a mantra of the argument that physical facilities won’t go away, but will instead have a new role as places where consumers can obtain professional advice face-to-face. This makes a good argument when debating the “branches are dead” crowd. But research by J.D. Power finds a gap between that goal and the reality, so far, in many institutions.

However, the potential remains strong for the advisory strategy to succeed if financial institutions make more of the opportunity and change their thinking on what “advice” means in retail banking. When advice is done right, according to the research, consumers tend to prefer getting advice face-to-face rather than digitally.

A Plus for Bricks Over Clicks?

Traditional financial institutions should consider this: If they get the advisory function right in their branches, they’ll have an edge over neobanks and fintechs that have no bricks and most likely never will.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Big Hurdle: Consumers Don’t Typically Think of Financial Institutions for Advice

J.D. Power’s research, drawn from its U.S. Retail Banking Advice Satisfaction Study and related work, indicates a relatively low level of consumer interest for getting advice and guidance from banks —19% are very interested in getting help, 47% are somewhat interested, and 33% are not at all interested.

The researchers’ read on this is that “pluralities of customers may not be proactive about going to their banks for advice but are open to it.” A positive note is that of the few who seek advice from banks, 69% who get it act on it, according to the research.

There’s a disconnect here. The industry, especially among community financial institutions, has had the perception for years that they served as people’s trusted advisors. Years ago the American Bankers Association ran national “Full Service Bank” commercials promoting banks as the place to solve financial conundrums. Yet the research suggests that today consumers are more likely to seek financial advice from family and friends plus internet searches, notably using personal finance websites.

Need for Help:

Many consumers clearly have a strong need for advice on one front or more, according to J.D. Power. Less than half — 49% — of the firm’s sample say they are financially healthy. Only 56% say they are satisfied with their current financial circumstances.

Only two consumers out of five could pass a basic financial literacy test, J.D. Power finds.

What Different Kinds of Consumers Want Help With

The research suggests several reasons why the industry’s track record, at least as perceived by consumers overall, has grown sketchy:

- Advice tends to be general, one-size-fits-all help that doesn’t get used because it isn’t all that relevant.

- Much of the “advice” rendered is really guidance about the institution’s products and services and technology. At best this could be called “enhanced sales.” “While this is critical and practical information, it doesn’t move the needle in terms of advice satisfaction,” states a briefing paper from the firm.

- The type of advice each consumer wants differs, often dramatically, depending on their personal financial situation.

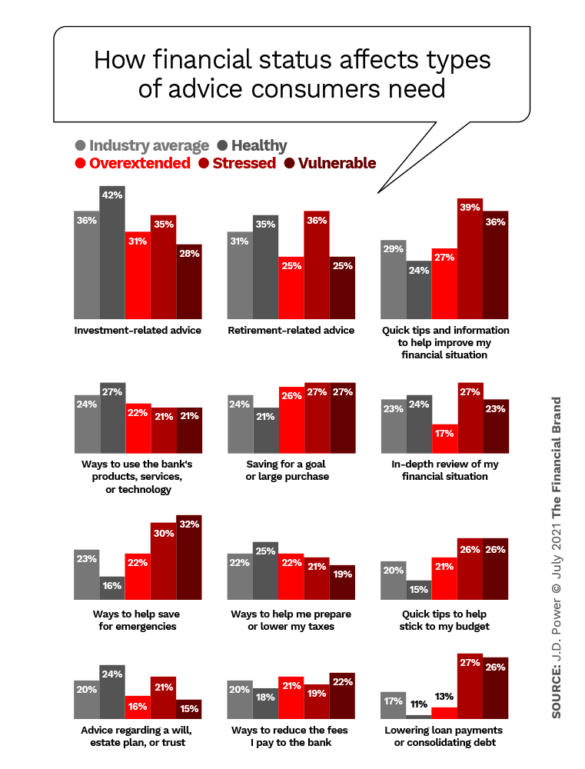

The J.D. Power research demonstrated this last point in detail. In the chart below, the four consumer classifications are as follows:

- Healthy (49% of sample), the oldest, most affluent and most satisfied with current financial status.

- Overextended (11%), youngest, consisting mostly of Millennials. Interestingly, “this segment has high expectations of its bank and is most likely to take advantage of the advice and digital tools that banks supply.”

- Stressed (13%), at risk for savings and financial planning and worried about debt, though they get by day to day.

- Vulnerable (27%), having trouble today, let alone for the future.

Over time consumers can migrate into other categories, such as “graduating” to the healthy segment. While advice needs in the simpler categories, such as savings towards goals, may be stronger among the overextended, stressed and vulnerable categories, at some point, should their lot improve, they may need advice in categories such as investments and retirement planning.

Time to Reconsider What Advice Means

Closing the gap between consumers in need of help and institutions capable of giving it depends in part on an attitude change. As sales thinking permeated many institutions over the years, advice as a mission may have become blurry. Incenting for the product of the day isn’t the best way to focus on the needs of the consumer across the desk.

“A win-win would be shifting institutions’ philosophy a bit to helping customers become better customers by giving them more information and by helping them become and stay financially healthy,” says Paul McAdam, Senior Director of Banking Intelligence at J.D. Power. “The more people earn and spend, the better for banks, the better for the economy, and the better for everyone.”

McAdam says the firm’s research found that assisting consumers with financial health issues “is becoming a competitive differentiator.” Working to understand consumers needs and communicating in a helpful way will not only help them, but ultimately help institutions.

Here’s the Payoff:

J.D. Power’s research suggests that focusing on what consumers need help with is good business. Acting on financial institution advice leads to opening new accounts 48% of the time — an impressive ratio.

Here’s Where the Branch Advantage Can Come In

“Our data definitely shows that customer satisfaction with advice is much higher when it is received from a person,” says McAdam, “whether that person is a specialized representative (such as for investments or insurance), a branch rep or a call center rep.”

McAdam says that satisfaction with advice drops off meaningfully when it is delivered digitally, whether by app, email or other channel.

“That’s not at all saying that providing advice digitally isn’t a positive thing,” says McAdam. “It’s just that the in-person experience trumps it because customers view it as massively more personalized. And it should be, if employees are doing their jobs as they should.”

This is something to remember when traditional institutions consider competing with neobanks and fintechs. Their websites and their entries in the App Store and Google Play marketplaces frequently address the mass market advice needs seen in the earlier chart, versus those that are more mass affluent.

“Consumers act on advice more frequently when it received from an individual, as opposed to a digital source,” says McAdam. “It’s a better experience when it comes to advice. And consumers who receive advice tend to be more engaged.”