Amazon.com didn’t look or function like it does now, when the original online bookstore debuted in 1994. But it’s a dead cinch that if the only thing the fledgling retailer had concentrated on was the site’s online ordering function, Jeff Bezos would still be making his daily personal cargo run to UPS — or maybe working at Walmart. What brought about the Amazon of today was the continual development of the sometimes subtle, sometimes obvious, always active and focused sales efforts that eventually bring billions of consumers to the ordering page.

Many banks and credit unions are building or upgrading digital account opening — a financial website’s equivalent of the Amazon order page — but they appear to treat it as an island unto itself, observes Sam Kilmer, Senior Director at Cornerstone Advisors.

Kilmer says digital account opening should be regarded as part of a digital engagement cycle, not a solitary process. In fact, he adds, account opening shouldn’t even be considered the culmination of the overall digital marketing process because a satisfied consumer should be returning to a bank or credit union for additional products and services. Turned into a graphic, the flow should look like a virtuous circle.

Kilmer says too many institutions are treating digital sales strictly as digital account opening — which he says is the equivalent of just figuring out which paper forms an old-style branch banker should be using to open an account by hand.

Digital sales demands a wide view. “Ask if your institution has what it takes to sell digitally?” says Kilmer. “Are you oriented to putting the right people in the right products at the right time? Are you always clear on how these consumers first engaged with your institution?” Banks and credit unions should be looking at what first brought a consumer into the fold, be it a digital ad, a blog on the institution’s website, or some other outreach.

Ultimately, Kilmer continues, the financial marketer’s sense of the customer journey should venture outside the bank or credit union’s own site or app. “What did the consumer ask Google about when they first began the search that led to you?” says Kilmer.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

In Financial Services, Digital Life has become Real Life

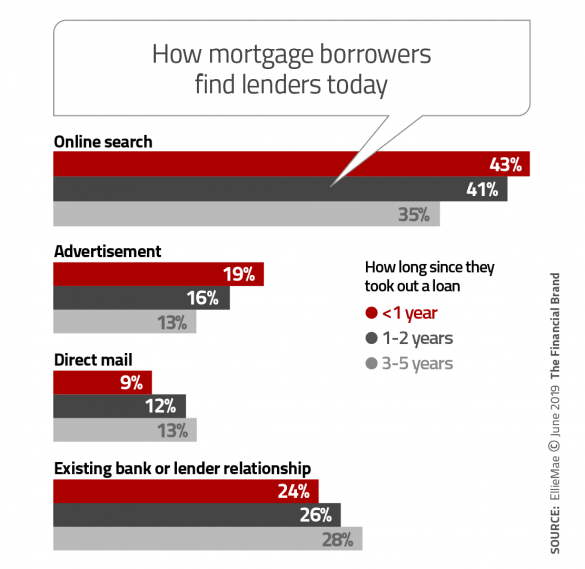

Increasingly, “digital sales” is becoming “sales” in the financial services arena. Kilmer, who recently completed a report on digital sales, points to research by Ellie Mae, the mortgage company, which found that 92% of all homebuyers surveyed start their mortgage borrowing process digitally.

“That’s not just Millennials — that’s everybody,” says Kilmer.

Financial institutions have compartmentalized digital account opening, but “that’s not how consumers and businesses think about the process.” Kilmer says its critical that bank and credit union leaders stop thinking like insiders and start thinking like the people they serve.

The focus on digital account opening blinds executives to the need to think in terms of the broader relationship banking approach that should be making its transition to the digital space. It’s what financial institutions have been claiming to seek and to provide for decades. True believers in this orientation should be considering how to make it work electronically.

“It’s not so much about how I transact with people digitally,” says Kilmer. “It’s about how do I interact with them, engage with them, help them, digitally.” In fact, thinking strictly digitally is a key error here.

Again referring to home lending, Kilmer points to Rocket Mortgage. One of the first personal details Rocket obtains when consumers visit its website, he says, is a phone number. If a consumer abandons the application — in fact, if they even pause for longer than expected — a Rocket representative will make an outbound call to ask if there is anything they can do to help.

By contrast, Kilmer says that when he visits banks and credit unions, he will frequently be brought through the call center at some point. Usually he sees only a handful of representatives on duty. This tells him two things. First, management decided long ago that the call center is just about providing reactive answers to questions and problem solving when people call in. The CEO who wouldn’t flinch at hiring five new lenders will resist adding staff associated with digital sales and marketing. Second, that thinking solidifies the attitude that call centers are a cost center, nothing more.

Low staffing tells Kilmer that the institution isn’t doing any outbound communicating, independently or in synch with its website and app.

Read More:

- Google Brand Exec: How to Humanize Digital Experiences in Banking

- Prevent Choice Overload in Digital Account Opening Or Lose Business

Content Isn’t Just There to Fill Up Website Pages

Kilmer says a key element of digital selling is website content, something that he says many institutions flunk at.

“Weak content is a really big deal — most of it is awful,” says Kilmer. “On most banking websites , it’s classic, salesy stuff from the 1980s. It’s just the usual ‘Here’s why you should open a checking account with us.’ It’s not interactive.”

“Weak content is a really big deal — most of it is awful.”

— Sam Kilmer, Cornerstone Advisors

Kilmer thinks bank and credit union executives should put on their “consumer head.” Then they should take a cold look at their own websites and ask if they would read them if they didn’t work for the organization.

They should be asking, “Would I want to come bank there?”

So, what does strong digital content look like?

First, it is knowledgeable.

It answers the consumer’s unspoken challenge: “Tell me something I didn’t already know, don’t sell me a checking account.” Content of a quality where people want to come back, perhaps even bookmark the institution’s website, is the standard to aim for. As an example, Kilmer says a blog about the appraisal process, detailing what a hopeful homeowner can expect when approaching that stage, is helpful and not salesy.

“That’s legit,” says Kilmer. “That’s not selling, that’s helping the consumer.” By being helpful digitally, the consumer is being “sold” on the worth of working with that institution.

Second, interactive content can be strong content.

One way that content can be interactive is by being on-demand. A prerecorded webinar or podcast, for example, can be listened to at a consumer’s convenience, perhaps even in “snackable” segments.

Third, strong content is not “bloated.”

Far too much banking website content is just material about the institution, not anything of assistance to consumers.

“Nobody cares about it,” Kilmer says.

The difference between strong content and weak becomes most obvious when you see it done right. Three institutions offering strong content, are NBKC Bank, Tinker Federal Credit Union and Consumers Credit Union (Kalamazoo, Mich.).

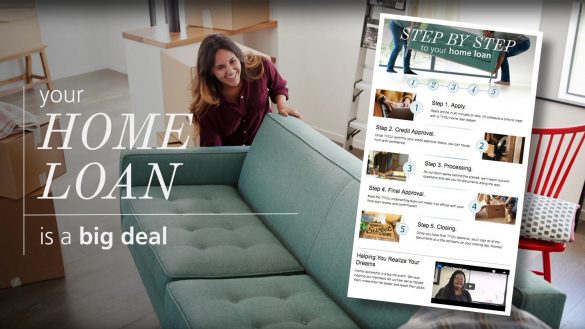

Tinker Federal Credit Union’s mortgage page features videos, infographics, and more to educate visitors about the home buying process without any sales-heavy material.

A factor that impacts institutions’ thinking about content is how closely it impacts consumer behavior. Kilmer says financial marketers should be raising such questions as: “How many people are reading our blog? How many readers become possible onboarding opportunities? And how many potential opportunities lead to closed sales?”

If the content isn’t producing, something needs to be changed.

Read More: 9 Digital Marketing Trends Banks and Credit Unions Can’t Ignore

Fight Abandonment by Updating Thinking

Abandoned shopping carts are the bane of digital sellers. To counteract it, some shopping sites, provided they have the consumer’s email address, will follow up abandoned carts with coupons or other measures to try to get the person to complete the purchase. Clearly, it costs to get a consumer to come in the “door,” so rescuing an “almost” makes a difference.

The problem with rescuing abandoned sales is that it focuses too much on the back end of the process.

“Financial marketers think in terms of applications, and then approvals or denials,” says Kilmer. “But what if the consumer never reached that stage? What if they read your institution’s blog about some financial area and dropped things there? What about the people who abandoned things after Google pointed them to your website?”

This goes back to his feeling that institutions must think in terms of the overall digital sales journey, not just the ultimate destination.

In fact, Kilmer bridles a little at the way the term “abandonment” is used. It almost implies that a consumer somehow tripped up.

It’s the responsibility of the financial institution to follow through and not let business walk out the digital door, Kilmer insists. “They didn’t abandon you, you abandoned them.”

At every stage of the digital sales journey, Kilmer says, a bank or credit union can blow the sale or keep things moving in a positive direction.

“That’s the way that digital commerce works,” says Kilmer.

“It’s not just about making things easy and frictionless. Your financial institution must market itself.”