Banking today is becoming less and less a place you go, and more something that is hidden from view behind digital banking and commerce apps. Once an account is opened at a bank or credit union, there is less need to stop into a branch, since functions like deposits, borrowing, payments and transfers can be done without personal interaction through online and mobile devices.

According to a new report published by KPMG, “Meet Eva – Your Enlightened Virtual Assistant and the Future Face of the Invisible Bank”, technologies like Apple’s Siri, Amazon’s Alexa or Samsung’s Viv will enable an even greater shift in banks and banking by 2030. Instead of being hidden within apps, banking will become completely invisible to consumers.

Fueled by improvements in advanced data analytics, artificial intelligence (AI), voice-controlled devices, application programming interface (API) and cloud technology, the Invisible Bank will be able to be integrated seamlessly within a consumer’s everyday life. Ultimately being available ‘beyond the device,’ these technologies will allow banking, commerce, daily intelligence and decision making to be available to consumers 24/7/365 as a virtual, e-personal digital concierge.

“Banking in the background is the future,” states Brian Roemmele, founder at Payfinders.com. “The more a personal assistant knows about a consumer and daily ‘life patterns’, the better it can interact with millions of financial (and non-financial) options at any given moment.”

Warren Mead, fintech lead at KPMG UK, said, “Banks are making efforts to improve customer service through use of exciting technologies like robotics, artificial intelligence and blockchain. But, the pace of change is slow and in reality, I’d say banks are only 10% of their way through their digital transformations.”

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences. 83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations. Read More about Navigating the Role of AI in Financial Institutions

Are You Ready for a Digital Transformation?

Navigating the Role of AI in Financial Institutions

Disappearance of Banking as We Know It

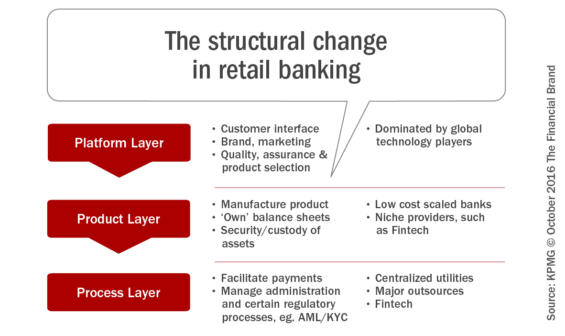

KPMG’s vision for the Invisible Bank of 2030 is a disaggregated industry – with three distinct components.

- The first layer is the platform, leveraging a Siri-like device that combines all of the many other services provided by smart tech with banking

- The second layer is the product, which becomes more flexible and customer-centric

- The third layer is the process layer that brings a new wave of utilities to operate the transactional infrastructure of banking

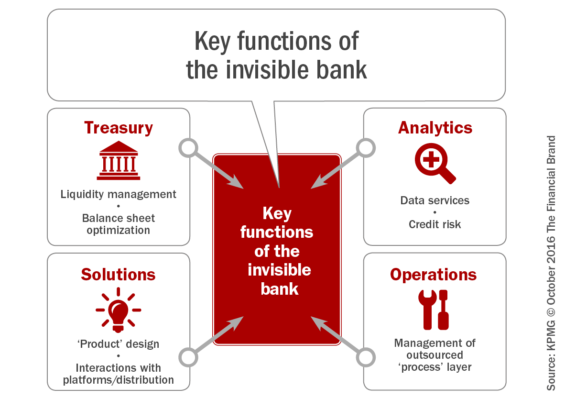

According to the vision presented by KPMG, large parts of the traditional banking organization could disappear. Functions and operations like customer service call centers, branches and sales teams could be a thing of the past. According to KPMG, the winners will be those that are best positioned to utilize their data, drive down costs, build effective partnerships with a broad range of third parties, and drive this new engagement with a robust cybersecurity infrastructure.

“Getting most banks to our vision of 2030 will be painful,” states the report. “Currently, technology firms invest 10-20% of revenues into research and development, for banks it’s just 1-2%. With banks’ return on equity under 5% it’s hard to see that changing significantly in the short to medium term, but if firms want to remain relevant, it has to.”

“Banking has not reached the SKU-like level of product and service structure. Amazon is the example of a marketplace where SKU level of product search and recommendation is available at one location. Once Voice Assisted AI and taxonomy identifying all banking functions are available to anyone at any moment, it will move banking into a new realm.” – Brian Roemmele

Banking Driven by a Personal Digital Assistant

The Invisible Bank will be buried within a broader, more digital, connected way of life. Consumers will interact with a personal digital assistant (like Siri or Alexa) that proactively performs daily personal and financial tasks, informed by insights gathered from structured and unstructured data. The role of banking may be as a centralized provider of financial services from a variety of providers, as presented by Ron Shevlin (“The Platformification of Banking). In a worst case scenario banking could become relegated to the position of a white labelled product provider.

To illustrate its vision for banking in 2030, KPMG presented EVA (Enlightened Virtual Assistant), made possible by advanced data analytics, voice authentication, artificial intelligence, connected devices, application programming interface (API) and cloud technology. It was made clear that all of these technologies are available today and merely need to be combined and enhanced to make KPMG’s EVA a reality.

The example of a day with EVA involved the assistant accessing payment data to notice changes in spending patterns (in this case an increase in junk food spending). Using this insight collected over a period of time, EVA suggests a yoga class prior to booking and paying for it. Leveraging social media insight, EVA even suggested friends that might be interested in the same class.

The virtual assistant then recommends buying a gift for a business associate and proactively conducts some basic banking tasks that benefit the user. In this example, EVA shifts savings to get a better interest rate and took action on an unexpected charge by asking for a reversal of the charge with the bank.

With the EVA vision, there is no ‘banking app’ as we know it today. In fact, visiting a bank would be as foreign as using a dial-up modem or landline phone.

Access will be authenticated with biometric voice recognition, with banking insights being integrated with health, diary, social and other parts of the consumer’s daily life. The potential to integrate with IoT innovations is also endless.

According to KPMG, this platform layer will probably be provided by global technology players like Amazon, Google, Apple and/or Facebook. This is because technology hardware is hardly the core business of banks today who are focused on maintaining costly and outdated legacy infrastructure.

Progressive banks will want to own the product layer, however. This includes today’s traditional products, the consumer’s account behavior, custody of assets, and security function in addition to being the provider of outside products and services provided by fintech and non-financial technology providers.

The biggest banks will also want to retain the transactional (process layer) infrastructure, but again will look to be the centralized utility for fintech and technology providers. Competition will remain intense, according to KPMG, especially for payments, settlements, core platforms, client onboarding, know your customer (KYC) etc.

Regulatory Impact

The report emphasizes that there are regulatory challenges, since this model of banking does not fit or comply with much of the current regulatory requirements. This could be one of several roadblocks to advancement of the Invisible Bank concept.

For instance, in the platform layer component, there is the potential for systemic risk if the algorithms driving the decision-making process are wrong, resulting in wrong recommendations. To date, regulators have been reluctant to have a comfort level with the use of artificial intelligence.

In the product and process layers, there could be the integration of dozens of new entrants, some of whom may not be directly monitored by existing regulation. If traditional banking organizations provide these services within the Invisible Bank framework, who manages the regulatory risk?

Preparing to Become the Invisible Bank of the Future

The Invisible Bank is just one possible future of how banking’s transformational journey will play out, with voice assisted AI being one of the many opportunities that may result. According to Roemmele, “The first transition to this world for a bank is to present uniformly the exact taxonomy of services rendered and the exact benefits available. Once established, voice-assisted AI via personal digital assistants, will cull from ontologies to find perfect recommendations and financial solutions in real time.”

The technology required to build the Invisible Bank already exists today. Components such as APIs, cloud-based services, artificial intelligence and mass personalization are already becoming the foundation for the future at many financial institutions. But, in most cases, these technologies are being used in the peripheral systems rather than the core.

According to Brett King, founder and CEO of Moven and author of the book Augmented: Life in the Smart Lane, “Banking is becoming embedded in our life through a set of distinct experiences, whether that be access to credit in a store, a voice agent that can act as a money coach and tell us if we can afford to go out for dinner and then can reserve and pay for a restaurant booking, or an algorithm that will manage our portfolio. As banking becomes a set of embedded technology-based experiences, the artifacts associated with the bank disappear.”

“A real shift in banking would require building out core platforms from scratch – and few banking CEOs have the risk appetite for that,” states KPMG. “The winners will be those that are able to utilize their data, drive down costs, build effective partnerships with a broad range of third parties, and of course, those with robust cyber security.”