During the early stages of the coronavirus crisis, financial institutions of all sizes were in a crisis mode, reacting to the immediate shift to digital banking as consumers could no longer access closed branches or were unwilling to visit those still open. Branch traffic fell by more than 30% in April and May compared to the same period last year, according to financial services research firm Novantas. In addition, up to 40% of consumers expect to visit branches less in the future.

Improving online and mobile banking capabilities is only the tip of the iceberg, however, as most banks and credit unions reassess their entire technology infrastructure in light of COVID-19. After years of relative complacency, financial institutions are being forced beyond their comfort zones, knowing that advanced technology must be embraced across the organization to meet performance objectives in the future.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Banking Industry Facing Financial Uncertainty

While it is impossible to determine what the “new normal” in banking will look like, it will undoubtedly be far different than the past. It is still unknown how the negative financial impact of the pandemic on consumers will impact future banking behavior. While we have seen a spike in digital transactions and in the amount of savings set aside by consumers, it is too early to develop reliable trend lines going forward.

There is little doubt that the banking industry will face a stretch of economic pressure created by delayed loan payments, lower fees, narrow margins and increased risk from credit losses. While government stimulus packages may help, there will still be capital and liquidity challenges.

These financial challenges create a very clear call to action for financial institutions used to doing business the way it has been done for decades. Banks and credit unions must reimagine legacy business models and the technology used to serve the marketplace. Speed of change will determine winners as much as the changes themselves. Being a “fast follower” will no longer be acceptable.

Read More:

- Why Financial Institutions Must Overhaul Their Retail Banking Strategies

- When Opening Accounts in Branches Becomes Impossible

Advanced Technologies: Now More Than Ever

Most financial institutions are aware of the benefits of modern technology as the foundation for digital transformation. Unfortunately, most institutions have embarked on this journey only tentatively up till now for a variety of reasons (funding, culture, talent availability, etc.).

COVID-19 has highlighted that the use of modern technology will be needed more than ever to combine efficiency with effectiveness. The customer experience will need to be improved far beyond what has been done to date, replicating the experiences delivered by technology leaders in other industries.

Sales and service models will also need to be revamped at the same time that employees will need to be retrained for a digital world. Finally, organizations will need to improve detection and intervention in the areas of credit risk and cybercrime. In other words, digital transformation has only just begun.

The pace of change in financial service technology implementation has never been faster – and will never be this slow again. Firms must accelerate their digital banking transformation by becoming digital to the core – operating more like a tech company than a traditional financial institution. In some instances, this will require a change in leadership at the board and C-level.

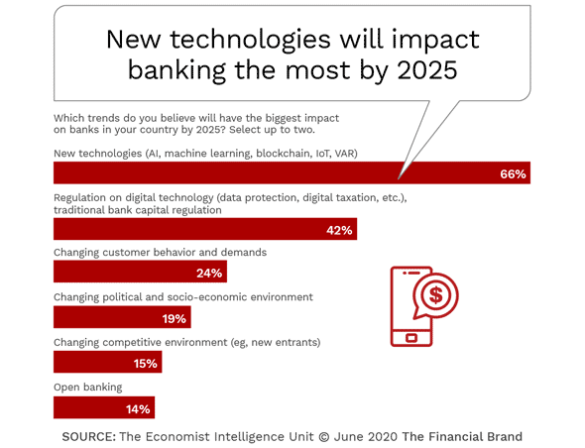

According to research from the Economist Intelligence Unit (EIU) conducted in February and March of this year, a large majority of financial institutions globally (66%) believe modern technologies such as artificial intelligence (AI), machine learning, blockchain and the Internet of Things (IoT) will have a significant impact on the banking sector (this is up from 42% last year). It can be safely assumed that this trend has only increased as a result of the recent pandemic.

Not surprisingly, regulation around privacy and data protection and capital requirements were seen as major trends (42% of respondents mentioned), while the impact of changing consumer demands had shown an ongoing drop for the third consecutive year (24% in 2020). (Note: It is believed this number would be significantly higher if the survey was conducted in May or June as opposed to February and March.)

Banking Focused on Security, AI and Cloud Technologies

Breaking down which technologies are most important to banking, the EIU study found that over one-third of financial institutions focused on cybersecurity (35.4%), highlighting the ongoing concern around data breaches. A slightly lower percentage of banking firms (32.5%) were developing AI platforms that could provide advice or support voice engagement. Finally, more than one-quarter of respondents (26.6%) were focusing their digital efforts on cloud-based technologies.

The importance of cloud technology increases as the focus on efficiency becomes greater. The good news is that technology is available that can allow cloud benefits to reach mid-cap banks. Movement from legacy systems to cloud-based core systems will be required to compete going forward.

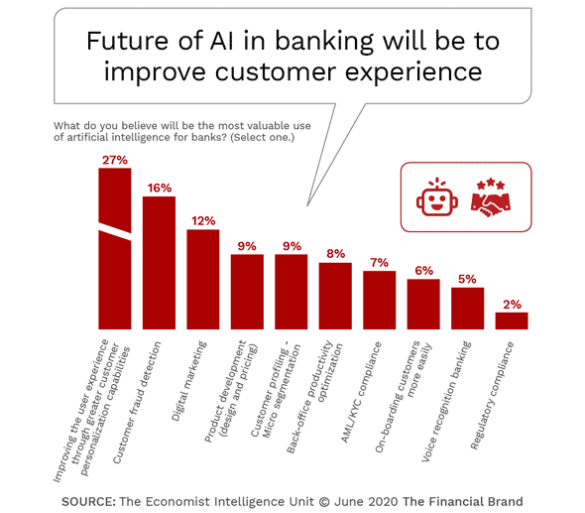

As shown in the chart below, AI will play a pivotal role is the digital transformation efforts of financial institutions. Previously relegated to risk and fraud, AI will be supporting predictive analytics, back-office productivity and all consumer experience efforts. In fact, 77% of the survey respondents stated that extracting value from AI will be a major differentiator between winning and losing in the future.

Leadership Drives Digital Transformation Success

Even before the coronavirus pandemic CEOs were challenged by a expanding list of priorities. While most financial institutions were experiencing unparalleled prosperity, leadership understood the need to digitally transform their organizations with modern technology. The challenge was … few boards or CEOs understood technology.

Now is the time to increase the prominence of the CIO and technology functions to a level requisite for change. No longer simply a support function, there must be integration and collaboration between the technology areas of the financial institution and all other areas and functions of the bank or credit union.

More importantly, financial institutions need to recruit the right talent to support the modern technologies required and retrain existing teams to deploy against the new digital model. These new and retrained teams will also need to have the tools required to deploy results quickly with agile working methods.

According to McKinsey, “The potential for technology to deliver winning business capabilities and change a company’s fortunes is simply too great for CEOs not to lead technology’s integration with the wider business. CEOs who actively influence and shape their companies’ technology functions can position their companies for greater success in an economy where digital savvy is at a premium.”

The question becomes – Which firms are prepared to use modern technology to digitally transform their organizations?