The power of digital communications lies in the ability to provide intelligent experiences in real time. From proactive recommendations to providing product and service alternatives based on activities and behaviors, artificial intelligence (AI) can often simplify the customer journey.

But, the myriad of choices available to today’s consumers, while usually appreciated, can quickly turn communication into noise. Without appropriate assistance and guidance, consumers can begin to feel overwhelmed and unable to make timely decisions.

The question becomes, how can financial institutions best leverage data and insights to attract the right consumers and grow those relationships? In addition, how can institutions balance the use of digital tools and human engagement to reduce friction, personalize and simplify the customer journey and encourage the proper purchases? In other words, what is the best path to intelligent guidance for consumer engagement?

Many brands are finding that the best consumer-centric solutions are actually a blend of digital and human experiences. “Businesses not only have to make interactions with customers faster and more convenient, but also more human-centric, personalized, empathetic and understanding,” says Markus Linder, founder and president of SmartAssistant. “Companies that understand the challenges people face in a digital world and that use this insight to improve their experiences facilitate a mutually beneficial relationship.”

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Consumers Aware of Power of AI

73% of consumers say they are aware of having interactions enabled by artificial intelligence, according to research conducted by Capgemini. Examples include chatbots for customer service, facial recognition for consumer identification, and voice conversation via a smart speaker or a smartphone. More importantly, 69% of these AI-aware consumers were satisfied with their AI-enabled interactions.

In this research, 63% found that AI-assisted engagement gave greater control over their interactions, with the same percentage saying that the 24/7 availability of AI technologies was a benefit. Other benefits included faster response (45%), reduced effort required (35%), increased privacy and security (30%), increased trust (30%) and greater personalization (29%).

Consumers Like ‘Human-Like’ Qualities

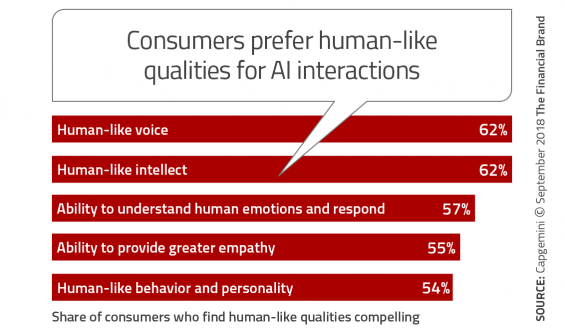

People seem to appreciate it when the AI-assisted engagement is delivered in a more human way. The humanization of the digital process was seen when consumers were asked what human-like attributes were most compelling, In the research done by Capgemini, 64% of consumers want AI to be more human-like, and 62% were more comfortable with human-like voice and intellect, with 57% liking the ability to hold a sensible conversation, respond to follow-up questions, and contribute additional information. Interestingly, consumers also want the interactions to show empathy (55%) and have a “personality” (54%).

While it was found that consumers want AI to be human-like in terms of interaction, they also want to know when they are talking to an AI-enabled system rather than a human. Capgemini found that two-thirds of consumers want to be made aware when companies are enabling interactions via AI, with this level climbing to 71% for the financial services sector.

This consumer desire to know how they are interacting leads to the need for organizations to have transparency with regard to how a person is interacting with their financial institution. Consumers also expect companies to have transparency around the use of data with AI interactions. In other words, consumers want to know their data is being used for recommendations as well as for rewards and offers, etc. Unfortunately, while two-thirds of consumers want greater transparency, only one-third of corporate executives find this to be a need.

This consumer desire to know how they are interacting leads to the need for organizations to have transparency with regard to how a person is interacting with their financial institution. Consumers also expect companies to have transparency around the use of data with AI interactions. In other words, consumers want to know their data is being used for recommendations as well as for rewards and offers, etc. Unfortunately, while two-thirds of consumers want greater transparency, only one-third of corporate executives find this to be a need.

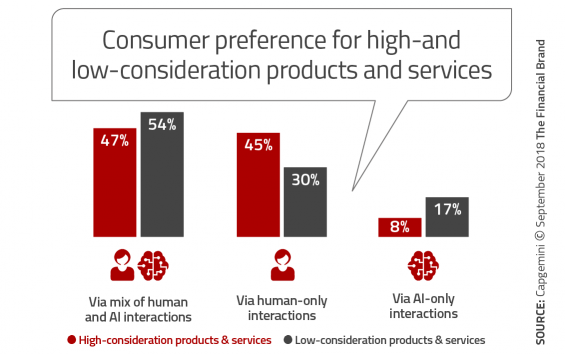

Consumers Want Human Engagement for Bigger Decisions

As would be expected, the level of human engagement desired by consumers is directly correlated to the importance of the decision. The more important the decision (“high-consideration”), the more consumers want humans to be involved.

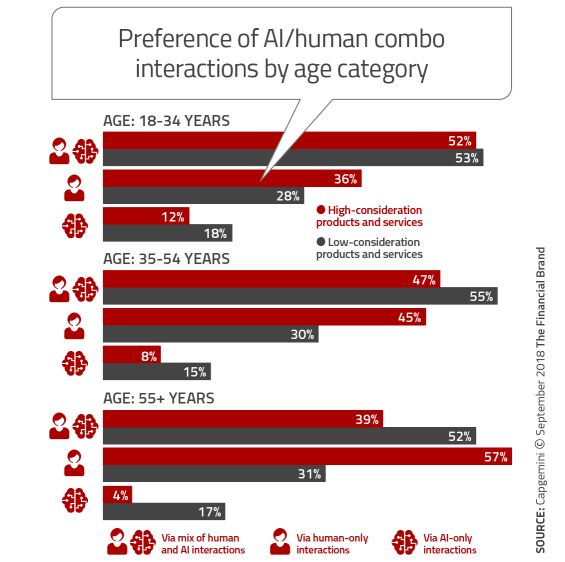

When the need for human involvement was analyzed by age category, all ages showed similar levels of comfort for AI-human engagement for lower-consideration products and services . This supports the idea that these AI-supported interactions for lower level decisions provide a convenience component that senior citizens appreciate, while providing the speed younger consumers desire. For higher-consideration engagement, younger consumers prefer a mix of AI-human interactions, with humans less desired than among any other demographic group.

Organizations Continue to Focus on Costs, Not Experience

As we have found across the industry, while financial institutions talk a lot about the need to improve the customer experience, implementation of AI strategies tends to focus much more on cost reduction. In fact, in the Capgemini research;

- Only 9% of organizations checked on consumer preferences when thinking about AI implementation.

- Many organizations treat AI-enabled implementations as yet another typical technology project.

- 62% of organizations prioritize cost of implementation as a priority.

- 59% of organizations prioritize expected ROI as top priority.

- Only 10% of organizations rated customer experience as a top priority for AI implementation, with 7% mentioning solving customer pain points (the lowest score).

Integrating Human-Centric Digital Experiences

Several research studies have found that the highest value customers to a financial institution also appreciate AI-assisted interactions the most. Therefore, building the best possible digital user experience not only can generate efficiencies and better satisfaction ratings, but a higher ROI as well. However, we have also seen that many organizations risk missing this prize, because their aims and approach are cost- and ROI-focused, as opposed to being focused on the experience.

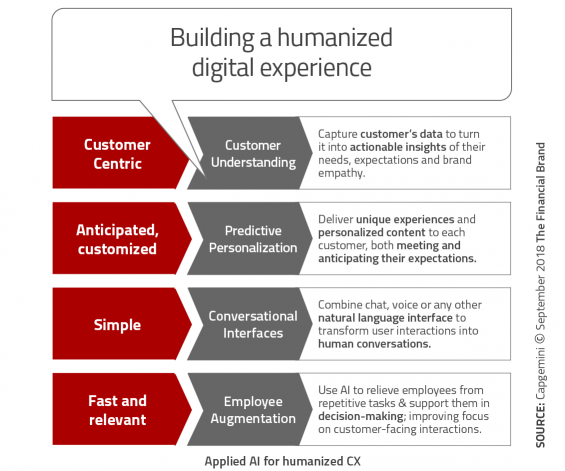

Capgemini says that industry leaders follow a clear formula for digital engagement:

- Prioritize consumer preference and experiences over cost and ROI.

- Take an AI-first approach when making organizational decisions and see AI as a “business” topic rather than a “technical” topic.

- Have scaled AI-enabled interactions across silos to provide insight at all stages of the customer journey.

- Strive to be transparent with consumers when deploying AI-enabled interactions across customer touchpoints.

- Use consumer incentives for use of personal data.

Based on these findings, a framework was developed for integrating AI on a humanized basis across an organization.

It is important for digital solutions to be focused on building great experiences as opposed to simply being used to reduce costs or increase ROI. While consumers are increasingly aware and satisfied by AI-enabled experiences, they also expect a humanized engagement and a human presence to better enable interactions across the entire customer journey.

Successful organizations will realize that digital technologies, without a human “feel” will be seen as technological upgrades by the consumer and will not reach the full potential that is being achieved by many BigTech firms.