More than three quarters (77%) of senior banking executives in a worldwide survey believe artificial intelligence capabilities will increasingly spell the difference between success and being an also-ran.

Of that total figure, 32% strongly agreed with the statement: “Unlocking value from AI will be the key differentiator between winning and losing banks.” 46% agreed with the statement. Belief in AI’s potential was even stronger among North American institutions taking part in the study with 87% in agreement overall and 38% strongly agreeing.

This data comes from a study of C-suite banking executives conducted by The Economist Intelligence Unit on behalf of Temenos, “Forging New Frontiers: Advanced Technologies Will Revolutionize Banking.”

The faith shown in artificial intelligence’s power to determine the fate of financial institutions came in the context of nearly half (45%) of all respondents expressing their intent to transform their existing business models. (This came to just over half (48%) — among North American banks.)

Their goal is to create digital ecosystems. By this, the study indicates, they mean offering bank and non-bank products supplied both by their own organizations as well as third parties, to be sold both to their customers as well as to those of other financial institutions.

Indeed, 83% of institutions agreed or agreed strongly that platformification of products, so that consumers and businesses can obtain numerous financial services through a single source functioning as a market, would be a key strategy in the future. This belief was even stronger in North America, at 87%.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Potential for Artificial Intelligence Ranks Highly

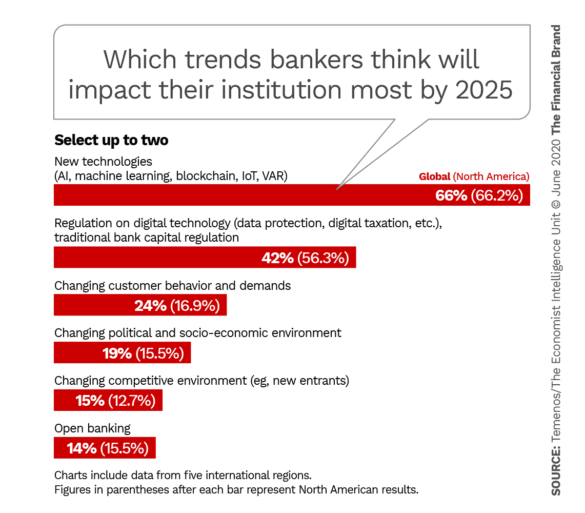

Adoption of new technologies, including AI and the related machine learning, is expected to have the greatest impact, out of multiple current trends, on financial institutions in respondents’ countries by 2025, as shown in the chart below.

The heavy belief in artificial intelligence in the study, while not completely unexpected, is an eye-opener for Alexa Guenoun, President of the Americas and Global Head of Partners for Temenos. Not so long ago a prediction about AI that strong would have come from specialists, she says, but the Temenos/Economist research is conducted among C-suite executives, marketers, retail bankers and others who are not technologists.

“To me, that makes a big difference,” says Guenoun. Part of the impetus for the change, she suggests, is that public-facing AI requires consumers’ willingness to share their data and this seems to be something they have grown somewhat more comfortable with. There seems to be recognition that in order to obtain the hyperpersonalization that more and more consumers expect from financial and nonfinancial providers, AI is needed and AI in turn needs information to extrapolate from.

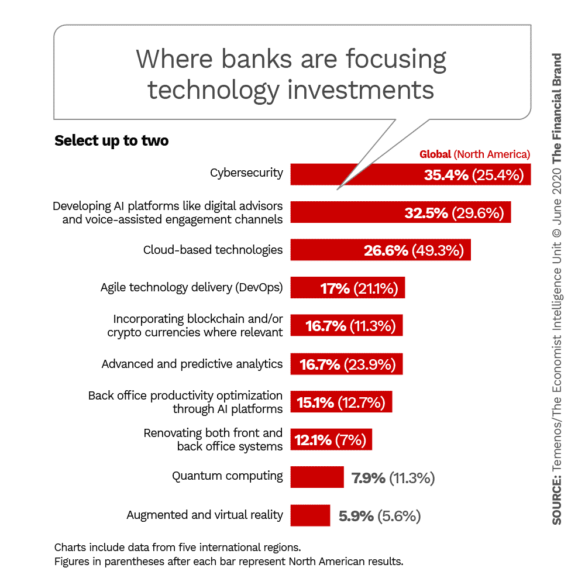

Customer-facing AI ranked as the second-greatest focus for bank tech investment through the entire sample, surpassed only by cybersecurity spending but ahead of cloud-based technologies.

Perhaps the banking industry has an unexpected ally to thank for consumers’ increased comfort with data sharing: Netflix. The streaming service presents suggestions for viewing based on past patterns of interest, Guenoun points out. The service doesn’t nail it 100% of the time — nor does rival Amazon Prime Video — but consumers shrug that off.

“People have spent too much time watching Netflix during the COVID-19 situation,” jokes Guenoun. “But when it picked the wrong movie for them, after five minutes they just switched to another recommendation. It doesn’t matter to them.” This leads to a corollary for financial institutions, according to Guenoun, but let’s dig further into AI first.

Read More:

- Artificial Intelligence, Algorithms, Big Data & The Future of Banking

- Chatbots to the Rescue: How Conversational AI Will Save Call Centers

Artificial Intelligence Isn’t Just for the Front Shop Anymore

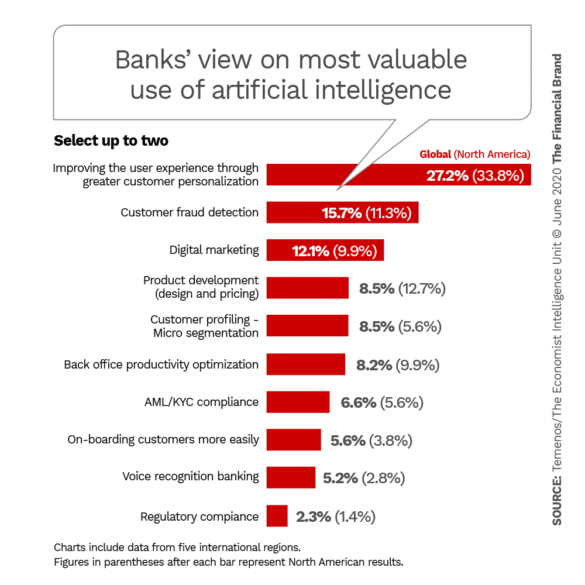

In the chart below, back-office applications for AI rank much lower than customer-facing applications, but Guenoun doesn’t believe this facet of the technology should be minimized. When AI is looked at from the viewpoint of the functions that it performs, it becomes clear that much of what this tech can do for financial institutions begins behind the scenes — even the leading application of using it to increase personalization of services.

States the report: “Banks may be missing a trick by focusing purely on AI’s customer-facing capabilities while downplaying other benefits in the value chain, which focus more on productivity, customer retention and monitoring functions.”

This brings to mind the adoption of actual robots. While science fiction dealt in robots that walked and talked, much of the early adoption of robots involved faceless robotic devices that assembled industrial goods behind the scenes, such as in factories.

The report also points out that while many consumers aren’t worried about their data, that’s not a universal feeling. “There are concerns among customers about how AI technologies will use their data and whether it is safe,” the survey indicates. 40% of the executives surveyed said consumers are unsure about the security of their personal financial information, while 34% of respondents see consumers being concerned about lack of clarity surrounding data use. A similar number (32%) believe consumers don’t fully understand how AI makes decisions, notably in situations where lack of approval could be indicative of potential bias in AI models.

“The algorithm will never get it 100% right. The question will be, are your bankers armed with training to be able to help consumers improve things further?”

— Alexa Guenoun, Temenos

There’s work for bank marketing departments. In fact, many of the functions envisioned for AI by survey respondents are marketing functions, as shown in the chart above. Fraud detection and compliance, notably Know Your Customer anti-money laundering functions, are also growing uses for AI.

In the customer-facing applications, however, Guenoun believes that the human element will come to the forefront in spite of the heavy lifting that the technology will do. She suggests that sometimes human input may help to improve outcomes for consumers — a human can suggest steps to take to improve an application, for example, in a way a consumer will more likely respond to. Guenoun adds that sometimes it will be helpful to have a human on hand to explain how an AI algorithm has come up with the sort of decision it has rendered.

“The algorithm will never get it 100% right,” Guenoun suggests. “The question will be, are your bankers armed with training to be able to help consumers improve things further.”

“They can talk about things in plain, simple English,” says Guenoun. While routine matters can be left to AI, she believes anything that is life-altering, such as obtaining a mortgage, will for many consumers still benefit from a banker’s personal involvement somewhere along the line. For such times, a banker will provide an element of “validation,” according to Guenoun.

Do consumers actually need institutions to obtain services or could they someday have their own AI that searches for and evaluates financial solutions? Guenoun doesn’t think such standalone financial AI will develop, but she does believe that the AI running platforms will need to be absolutely unbiased to remain useful and believable to consumers. (Financial executives might take a lesson from questions that have been raised in investigations by the Wall Street Journal about Amazon’s AI allegedly favoring its own products.)

Cloud Computing Increasingly Becomes Key Banking Element

As noted earlier, cloud computing has become the third-largest area of tech investment among institutions surveyed. Notably, in North America the ranking differs. Currently investment in cloud technology is the leader.

Guenoun credits the U.S. buildup to a thawing of federal regulators’ attitude towards cloud computing for financial institutions. Regulators in other regions regarded cloud more liberally earlier.

“Everybody is realizing that cloud security is better now,” Guenon says, “and that is easing concerns.” The experience for institutions during the COVID-19 pandemic will keep this momentum going, she adds. (The outbreak came halfway through the base research.) Cloud technology helped make remote operations more practical for many institutions.

Read More:

- Run Your Bank in the Cloud: Crazy or Fintech Smart?

- Why Most Digital Banking Transformation Efforts Have Stalled

Keeping an Eye on Tech-Based Competition

The Temenos/Economist research also asked institutions about nontraditional competition. Here is the ranking by the entire sample, with the ranking by the North American subset of the survey in parentheses. The question posed: “Which non-traditional entrants to the banking industry will be your company’s biggest competitors by 2025?”

- Payments players like PayPal, Alipay, Apple Pay, and Square: 50% (51%)

- Technology and ecommerce disruptors like Google, Facebook and Alibaba: 34% (27%)

- Partnerships between tech giants and fintechs: 24% (31%)

- Neo-banks like Volt, Varo, Starling and Monzo: 20% (11%)

- Peer-to-peer lenders and other alternative finance providers: 16% (22.5%)

- Roboadvisors and automated wealth management firms: 13.8% (22%)

- Nonfinancial services firms like retailers, telecomms and accounting software firms: 13% (11%)

The respondents were asked what product areas would be impacted most strongly by new entrants and gave this ranking. Again, North American respondents’ answers are in parentheses.

- Investments, both self-executed and robo-advisory: 31% (41%)

- Payments: 23% (13%)

- Deposits: 23% (17%)

- Retail lending and leasing: 19% (24%)

- Trade finance: 18% (24%)

- International remittances: 17% (11%)

Finally, continuing an ongoing trend, investing in fintechs has become a priority now for many traditional financial institutions. One quarter of all respondents say that investing in fintech startups is an innovation strategy. Further, 12% regard acquiring existing fintechs as a strategy.